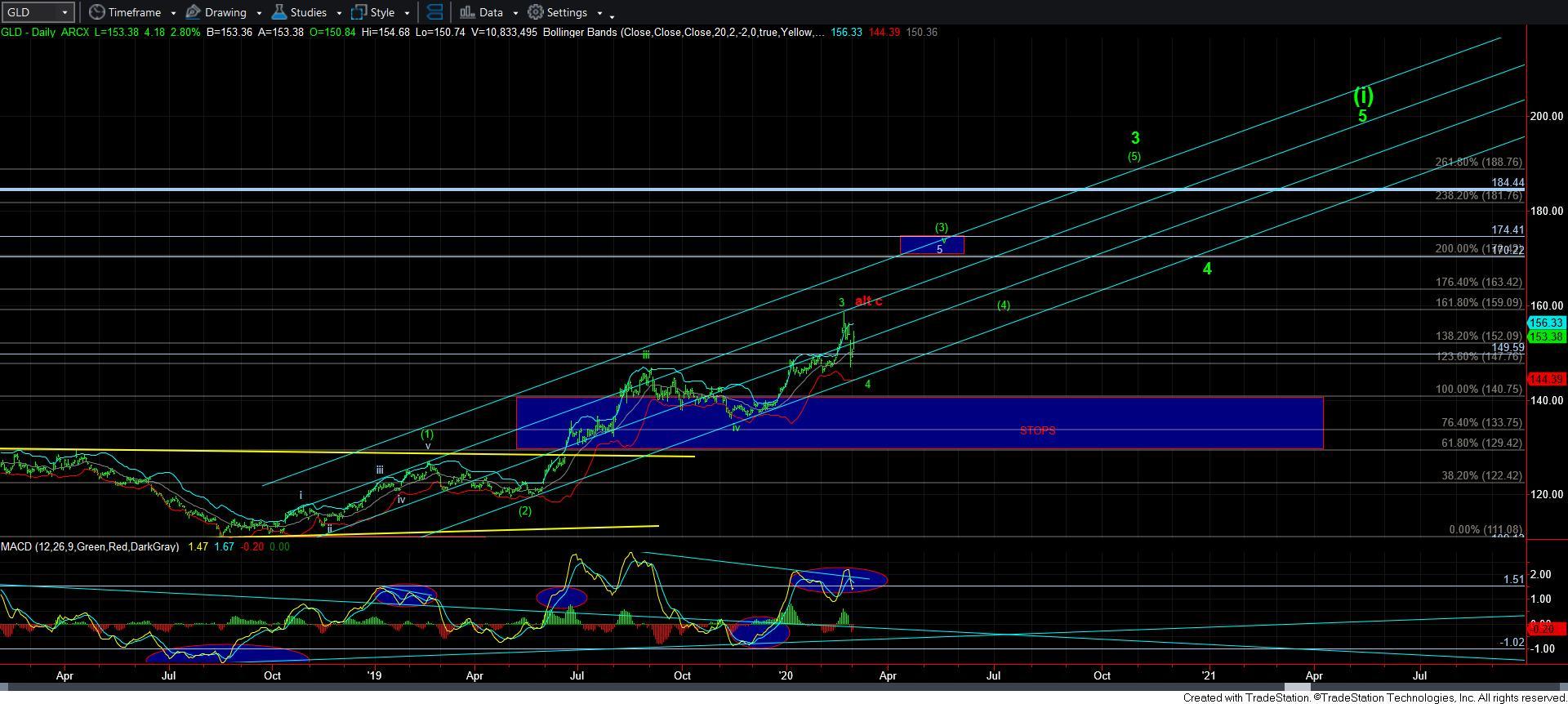

GLD Remaining Corrective - Market Analysis for Mar 3rd, 2020

It seems a number of people are getting confused in GLD. So, let's all take a deep breathe and read this carefully.

Over the weekend, I noted that IF . . again, IF we got a full 5-waves down in GLD, I would be on notice for a POSSIBLE major top in the market. At this time, the market has made it clear that it has not provided us with a 5-wave decline . .. as the decline off last week's high was 3-waves which is corrective.

The question now is if all of the wave 4 I am tracking has completed, and we are heading to 170-174, or if the bottom was only the a-wave of the wave 4.

Right now, I think the bottom was only the a-wave of wave 4, because the rally looks question corrective off the lows. So, that means that as long as we remain below 157, I am expecting a c-wave down for this a-b-c pullback in GLD, looking towards the 140-144 region to complete what I am counting as a wave 4.

However, if the market does make it through 157, then the odds begin to shift that we are completing 5-waves up off the recent lows, and a corrective pullback from whatever high we strike over 157 would suggest we are getting set for the rally to 170-174.

So, we need a bit more patience until this region shakes over over the next few days.

The micro chart shows my ideal path for this (c) wave rally of the b-wave. But, overall, if the market continues to remain as corrective as it is now looking, then we are likely going to see higher levels later this year. . . . and maybe even sooner than later. Need a bit more patience. For now, I think we have potential for one more loop lower as long as below 157.