GDX's Failure To Launch

When the market rallies off a low, and provides us with a 1-2 set up off that low, and then rallies off the wave 2 low to the 1.00 extension of waves 1 and 2, if we pullback off that 1.00 extension and break down below the .618 extension it often tells us that we have a failure to launch. That is what just happened in the GDX.

While I can certainly come up with bullish counts, I do not think that I would be benefiting you by doing so. The market has not held its standard set up, and will now have to PROVE to me that any alternative immediate bullish count is reasonable.

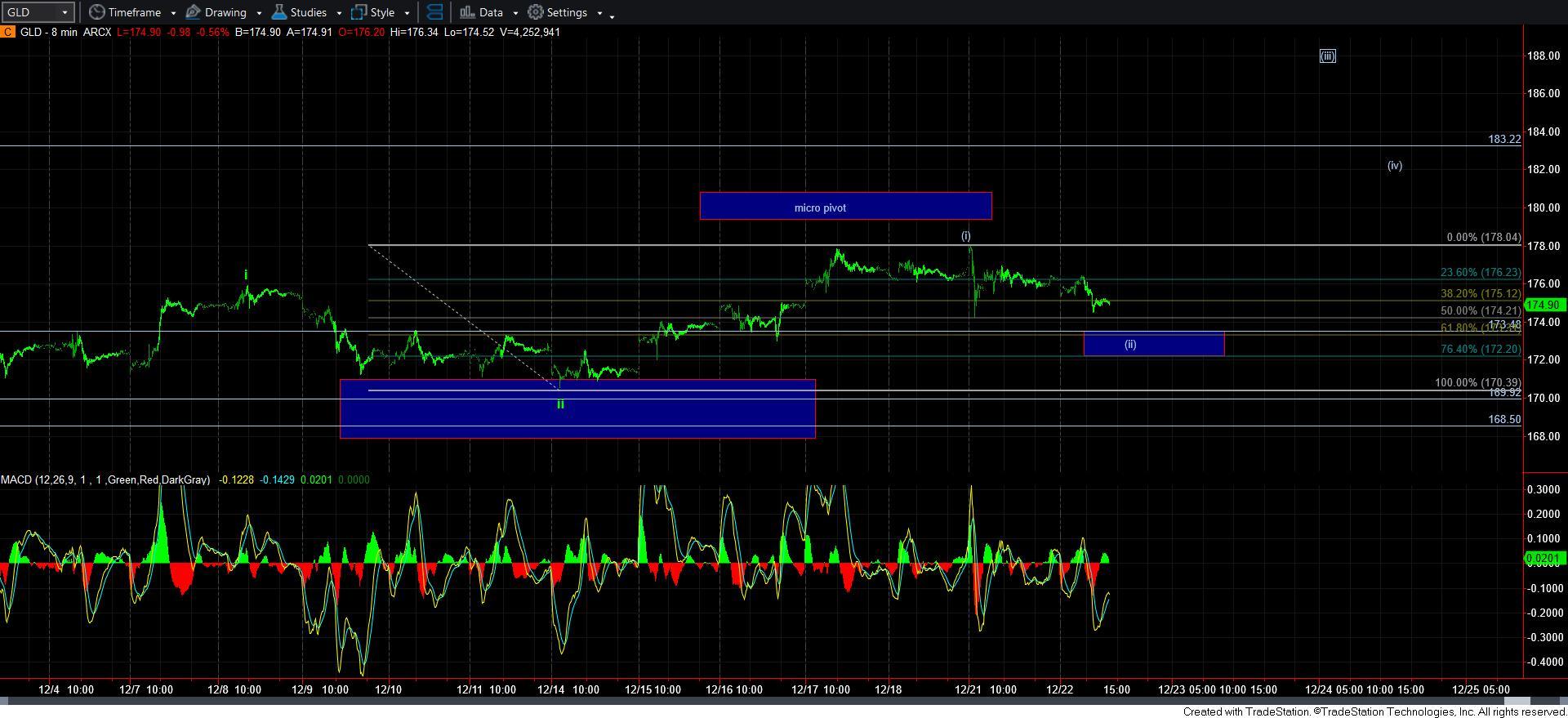

To understand how complex this correction has become, one simply has to look at the 60-minute GLD chart. I have modified the count to show how we get to a lower low, with this being the 4th wave bounce in an ending diagonal for the [c] wave. So, not only did we see an a-b-c within the [a] wave which had a complex b-wave triangle, we seem to be setting up a potential ending diagonal for the [c] wave as well. They do not come much more complex than this.

But, there is one caveat: GLD still needs to break down below 172 to suggest this to be the case. Both silver and GLD have retained a bullish 1-2,i-ii off the recent lows, so until I see a break down below 172 in GLD, I cannot assume we have a high probability of dropping down to complete the ending diagonal.

As far as silver is concerned, it is really hard for me to come up with a bearish count into the recent high. It just does not look terribly complete however you attempt to count it. So, as long as we hold the 24.25-24.75 support region, I can still maintain a near term bullish count on that as well.

The issue with which we have been grappling with for months now is that we have not had a completed wave structure to the downside in GLD and GDX that has provided us with a positive divergent low. I have outlined this issue many, many times in my updates. And, with GDX being unable to hold its standard Fib Pinball structure, I would have to say that the probabilities have begun to shift towards the potential for the lower low in at least the GDX. Silver and gold will have to break down below their upper supports to make it a greater probability in those charts, as they still retain bullish count at this point in time.

And, should GDX be able to resurrect, there is still plenty of room to 55+ in the coming year. But, for now, this break down below the pivot has made me much more concerned about a lower low before wave [4] completes. And, it will likely take a bit more time until I am able to identify an accurate micro count in GDX, as the overlap has left too many possibilities on the table, so I would rather wait for clarity, and just assume we are targeting the 31/32 region for as long as we remain below the high struck last week.