GDX Still Weak - Market Analysis for Dec 26th, 2018

While we have been tracking a c-wave rally in a bigger 4th in GDX, this last segment of that rally has certainly become quite sloppy.

If you remember, we noted that the minimum target we had for this 4th wave is the 21.50 region in GDX. Last week, we hit that target within 3 cents, and dropped straight down to the 19.90 support we noted, and held that to the penny. But, we still have not completed 5 waves up to complete the c-wave of wave iv in the GDX.

As you can see, I have outlined this 5th wave as a potential expanding ending diagonal. While they are not terribly common, I at least have to note the potential, especially as long as we hold today’s low. However, should today’s low break, it opens the door to the potential of the wave iv flat, as noted by the “alt 4” count. Support still remains in the 19.90 region.

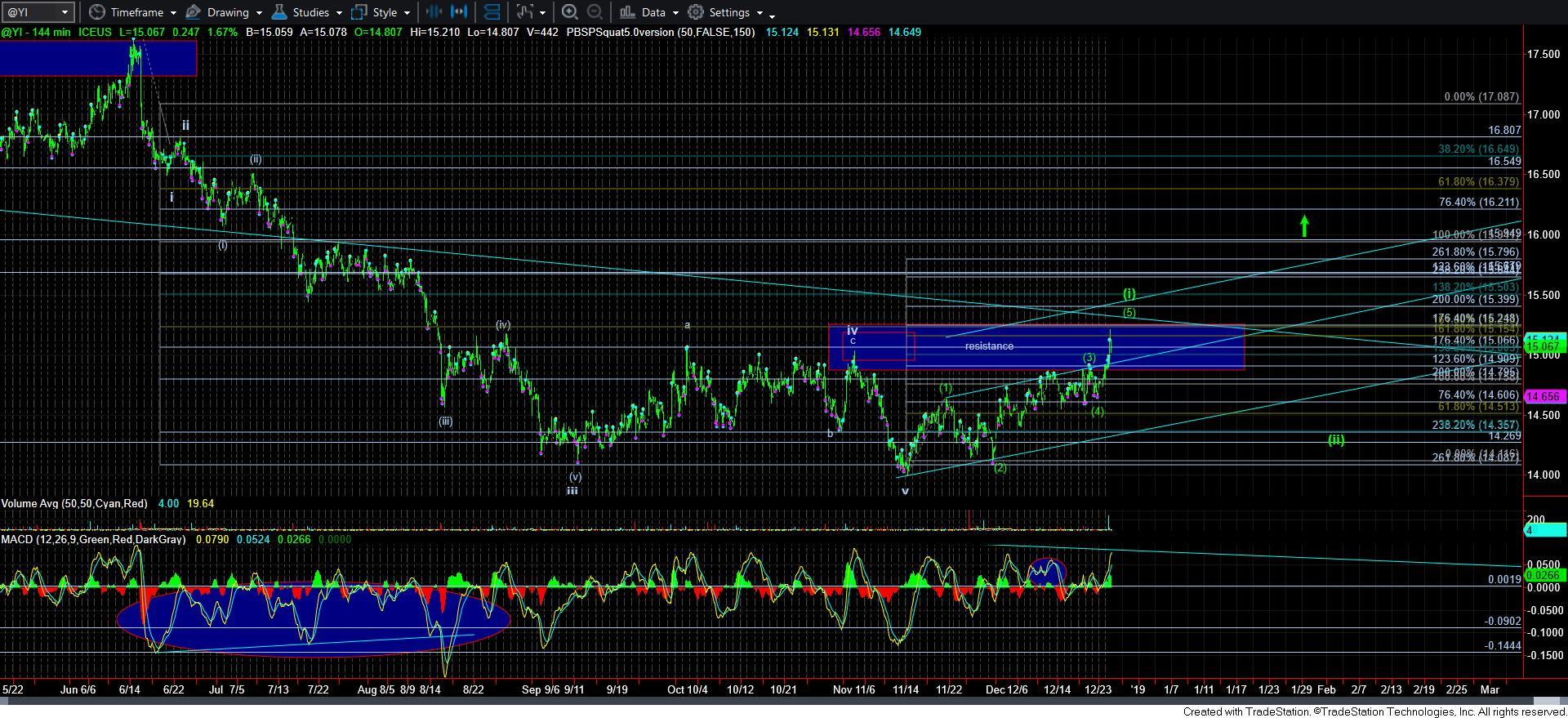

With silver finally getting a bit more bullish, we now have a minimal 5 wave structure off a full count low, as we discussed in the weekend updates. While this 5 waves is only as a leading diagonal, and not the most reliable of signals, I have to give it the benefit of the doubt for now.

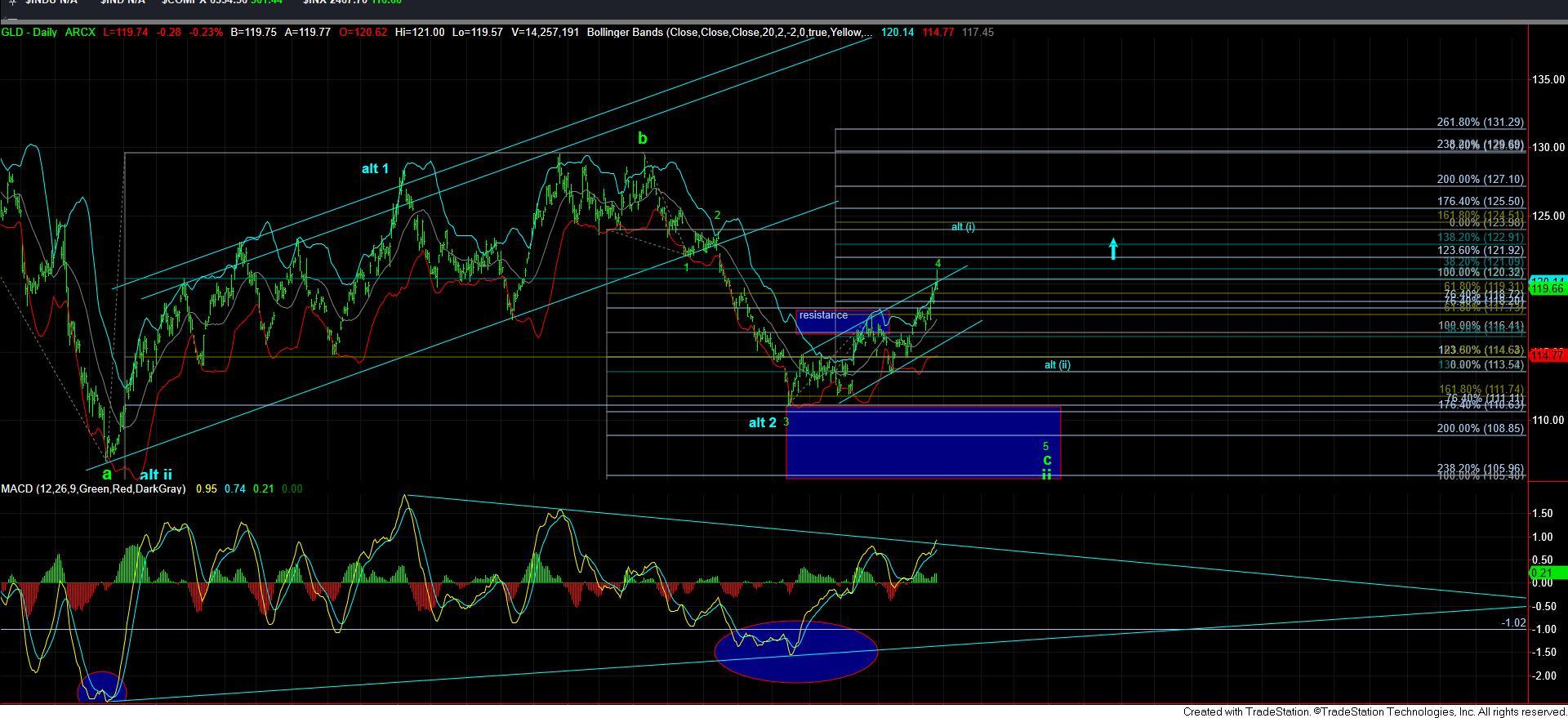

As far as GLD is concerned, it still makes me question whether a lower low is sitting out there. Unfortunately, I am still not convinced that GLD has its bottom in place for wave ii, but it is not a chart I would aggressively short due to my questions about the pattern. If I should see an impulsive decline take us below 117, I may consider adding to my hedges with a GLD put position. For now, I will stay clear of this chart.

Most specifically, the NEM is still displaying bearish indications, and seems to be completing its c-wave of wave iv. And, the ABX still seems to be attempting one more push higher as well to complete its wave (i), but it may not exceed 14.50 when this wave (i) finally tops out.

Overall, I still see the market as quite bifurcated, and would only use specific charts for hedging purposes. Our expectation remains that the market is in a bottoming stage, and another decline will likely take hold. During that decline, some charts will see a higher low, whereas others will see lower lows. For this reason, I am not willing to get aggressive on the long side of the market just yet and am looking to protect my portfolio, especially as long as GDX remains below 22.30.