GDX Is Still Such A Problem

If you listened to my live video this morning (or even a recording of it), you would have heard my in depth view of the various charts we have been tracking, including NEM and GDXJ. And, the ultimate conclusion remains that I still cannot get a strong bullish indication from GDX or GDXJ.

In truth, GDXJ would really need one more high to fill in a more likely 5-wave rally, and even that would be as a leading diagonal now due to the overlap in waves 1 and 4. But, unless GDX is tracing out a 1-2, i-ii off the low, I really have no bullish structure to which I can immediately point. And, even the 1-2, i-ii potential is unlikely in my eyes, since neither of the two rallies off the lows which would comprise that 1-2, i-ii is a clear impulsive structure. But, if we are to take just a simple look at GDX, it is a rather clear corrective rally thus far. So, it still leaves the door wide open for a lower low in GDX, and potentially even in GDXJ. But, please do remember, this is not a shorting opportunity but more of a buying opportunity if we do indeed get that lower low.

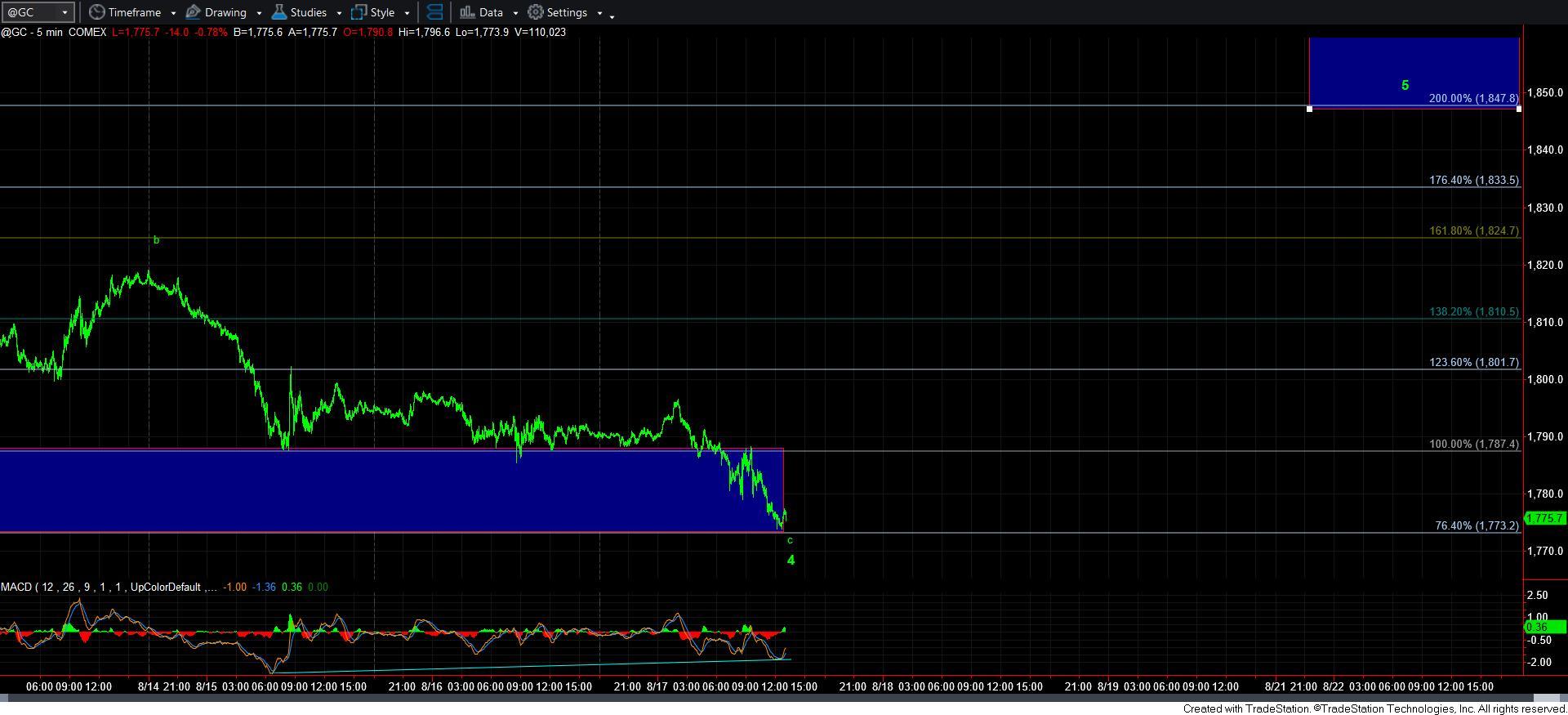

While GC has certainly not been ideal in its extensions struck on this rally, as also discussed in my video this morning, it is just barely holding on to a potential impulsive structure. And, I can make out a reasonable 5-wave rally off today’s low. But, I cannot say that is wholly reliable at that degree.

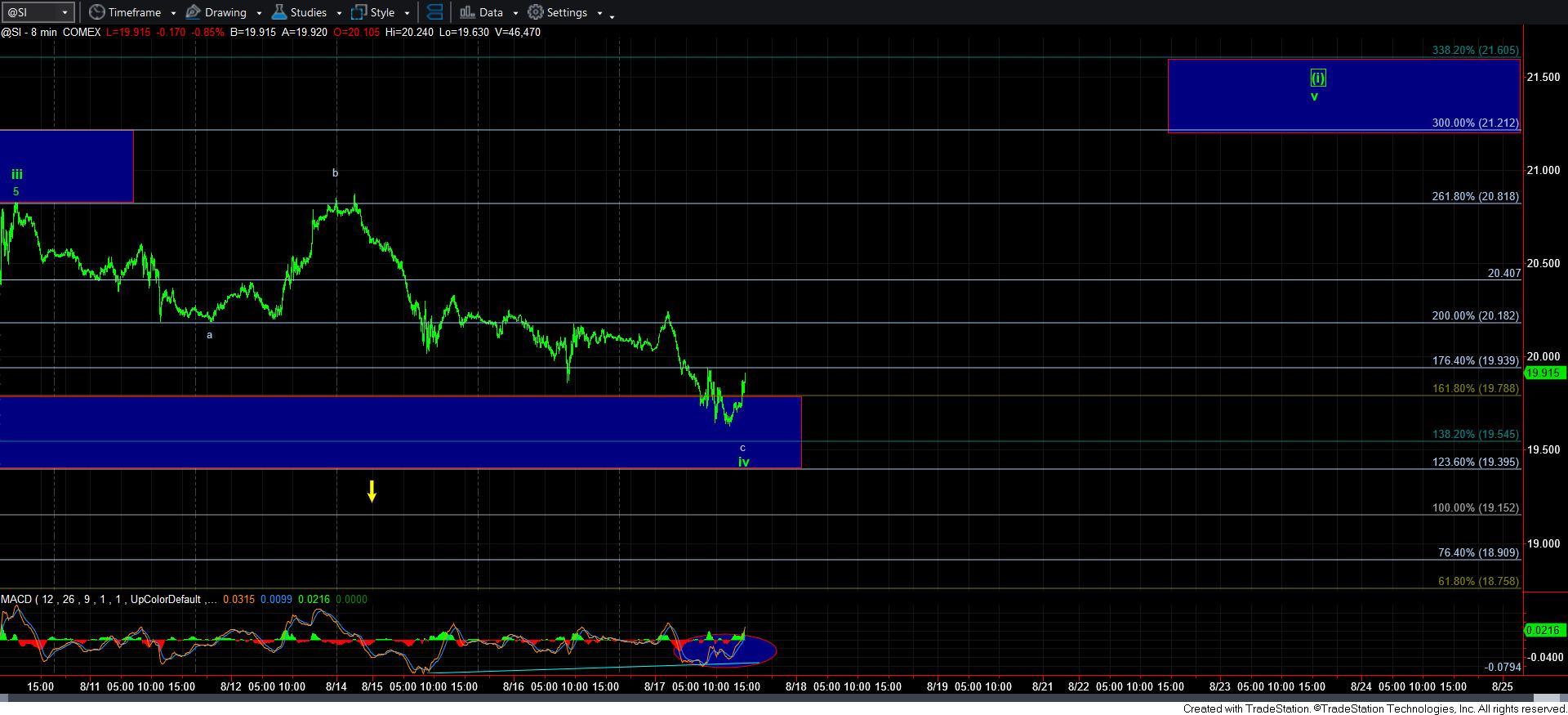

As far as silver is concerned, it is still playing along better than any other chart. So, as long as it holds today’s low, I would like to see us heading up to the 5th wave target over the coming days.

Remember, for us to turn aggressively bullish in the complex, I really want to see a fuller 5-wave structure off a major low point. And, in order to get that in silver and GC, I would much prefer to see a higher high in the coming days. Until that happens, I simply remain cautiously optimistic.