GDX Is At The Goal-Line

As I noted in the trading room, while NEM and GOLD – the two largest holdings within the GDX – broke through their respective 1.00 extensions off the 2015 lows already, the GDX has not yet. And, as I write this, we are sitting just cents below it.

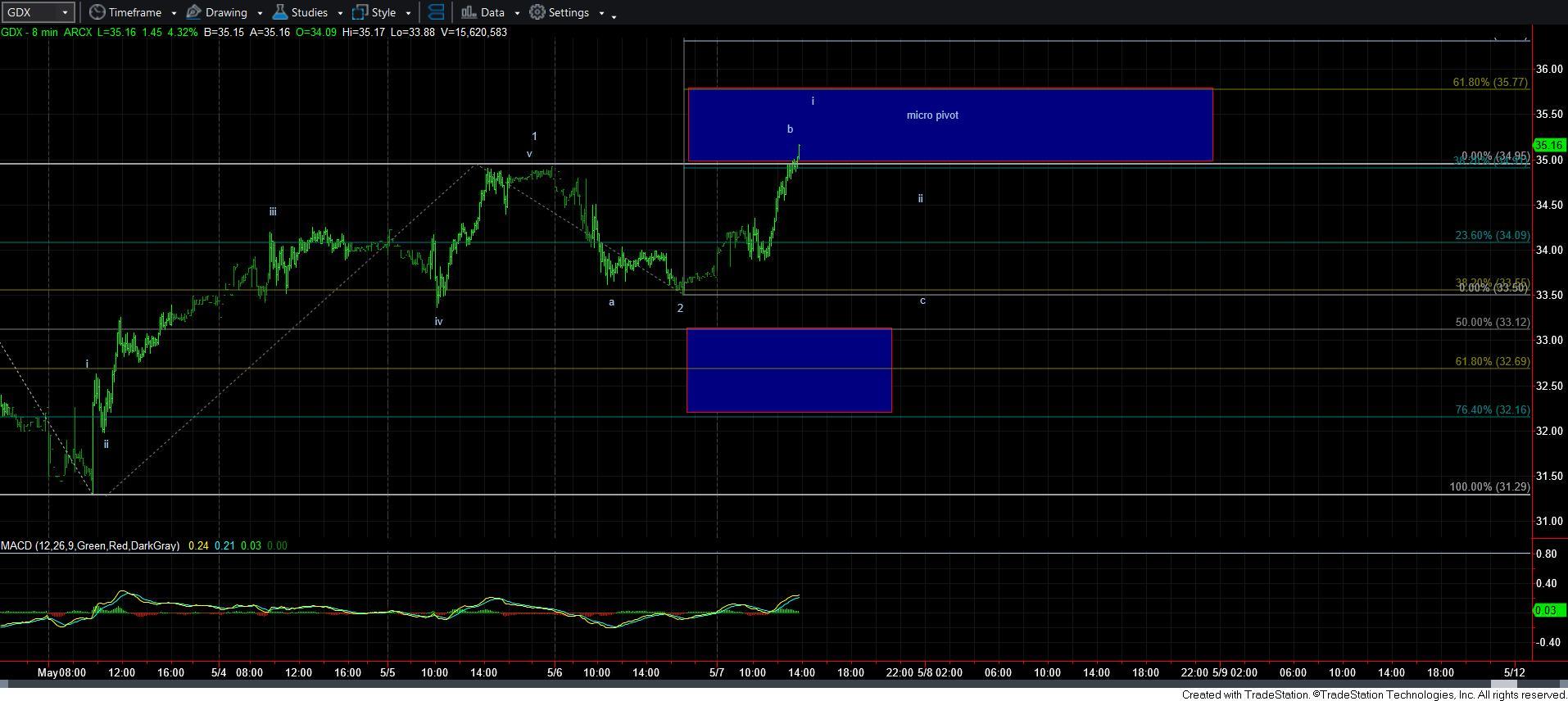

When I view the micro structure, we seem to have completed 5-waves up off last week’s corrective pullback low. And, yesterday, we seem to have completed a corrective pullback to only the .382 retracement of the prior 5 wave rally. That is considered a very shallow 2nd wave pullback. But, it does happen in the metals complex when it is very bullish.

At this point in time, I am looking for a bit higher in the GDX towards the 35.75 region to complete wave i of wave 3 off last week’s low. And, once that occurs, 33.50 becomes our solid support, and all pullbacks should not break down below that level if pressure if going to remain to the upside to our next target in the 40-43 region in the coming weeks.

But, what the next i-ii set up and break out over the top of wave i suggests is that GDX has now followed its brethren and is likely going to continue to climb over the coming year or two to ideally complete a much larger 5-wave structure off the 2015 lows. It would also mean that all correctives pullbacks can be bought with much greater confidence, and one can treat this chart as being in the heart of a 3rd wave from a trading standpoint.

Moreover, a break out through that 36 region will also likely suggest that the laggard miners within the GDX will begin to catch up, whereas the likes of GOLD and NEM may begin to slow a bit more. So, once we see a break out through he 36 region, and you see GOLD and NEM begin to approach their next larger degree targets, you can consider rotating into the laggard mining stocks which will likely catch up and drive the GDX higher in the coming year.

So, I want to conclude this additional update with a bit of a risk management warning. While we are sitting on the cusp of what we have been looking forward to for quite some time, we have still not gotten over the goal line in GDX. Yes, I know other charts have well gone over their respective goal line, but we need to see GDX follow through as well. So, right now, 33.50 is upper support, with 32 below that. Do not throw risk management to the wayside simply because it “looks” good on the long side. That is specifically the time you need to focus on your risk management plan when your emotions begin to take hold and have you “hopeful.” And, should we break out, we will continually raise those supports.

The next week is going to be a major week for the GDX one way or another.