GDX Has Narrowed The Playing Field

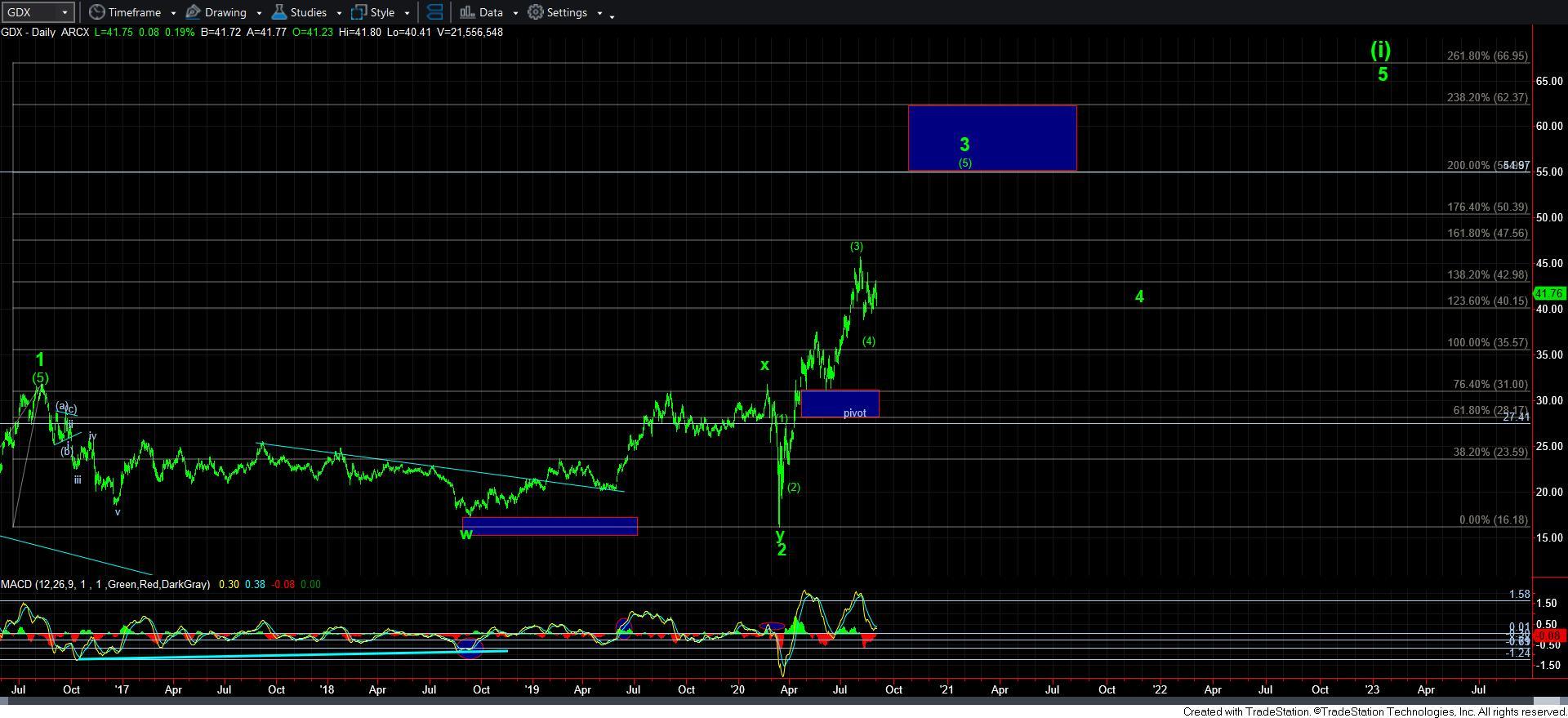

I am going to start this update again with the GDX, as it provides the clearest levels upon which we can base our actions.

You see, we have been tracking a potential 4th wave triangle for the last two weeks in the GDX. And, if this is the correct count, then the GDX has potentially completed wave [4] today. But, please forgive me if I remain skeptical until the market truly proves this to us.

First, I want to note that earlier today I took the green alt-b count off the chart, since it has dropped to a probability that I do not think is worth discussing at this point in time.

Second, we have enough waves in place to consider the e-wave of wave [4] as completed today. But, I warned that I would need to see a CLEAR 5-wave rally off that low to make that count a much higher probability.

You see, 4th waves are known for many twists and turns. And, just when you think they have completed, they can often offer yet one more twist to the count. So, I am trying to be a bit more cautious, at least from an analytical perspective.

The rally off today’s low was – at best – only a leading diagonal. And, as many of you know, I do not trust leading diagonals, especially in this type of circumstance.

Yet, the structure within the GDX right now has provided us with some very strong levels to focus upon. Our main resistance region is highlighted on the 8-minute SPX chart, and it tops out in the 44 region. That means that wave i of wave [5] of 3 in the GDX should take us through the 44 region to set up a rally to the 55+ region in the coming months.

Moreover, the 39.59 level is the must hold support right now if the market has truly bottomed. Any break down below that level will likely open the door back down to at least the 37 region. And, we can get there in several ways.

At this point in time, I want to note something that Frost & Prechtor warn about triangles: They often take longer than we initially think. For this reason, as long as we remain below the 44 level, I can view a rally up into the box again as a continuation of the d-wave, still needing the e-wave pullback to complete. That would ideally target the 43.90 region.

Alternatively, this current move off today’s low may even be he [e] wave of the yellow b-wave triangle, which I have discussed in detail in prior updates.

So, with the uncertainty we still retain due to the structure off today’s low, I am setting down these two levels as rather determinative as to how this will play out in the coming week – 44 resistance/39.59 support. Those two levels will now tell us all we really need to know regarding how soon we begin that rally I expect to 55+.

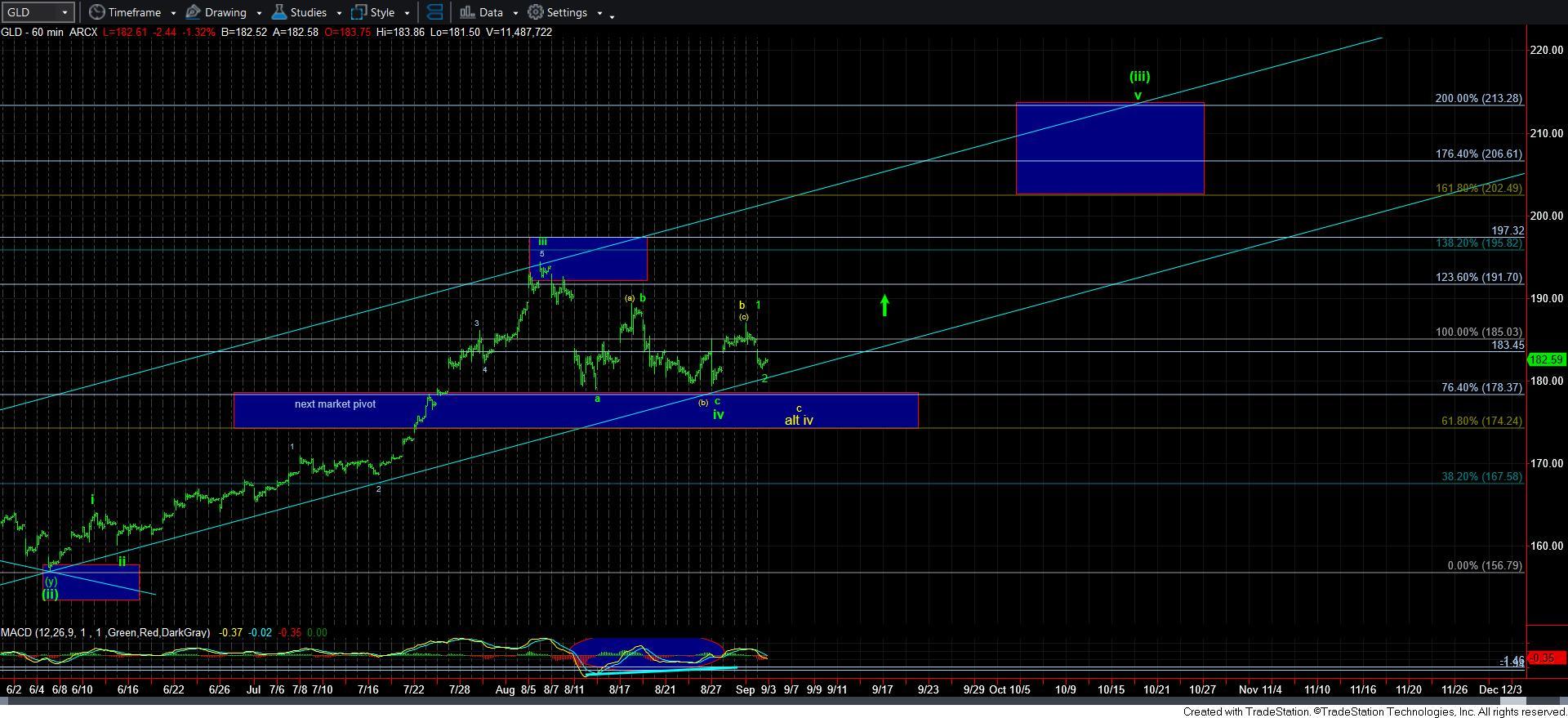

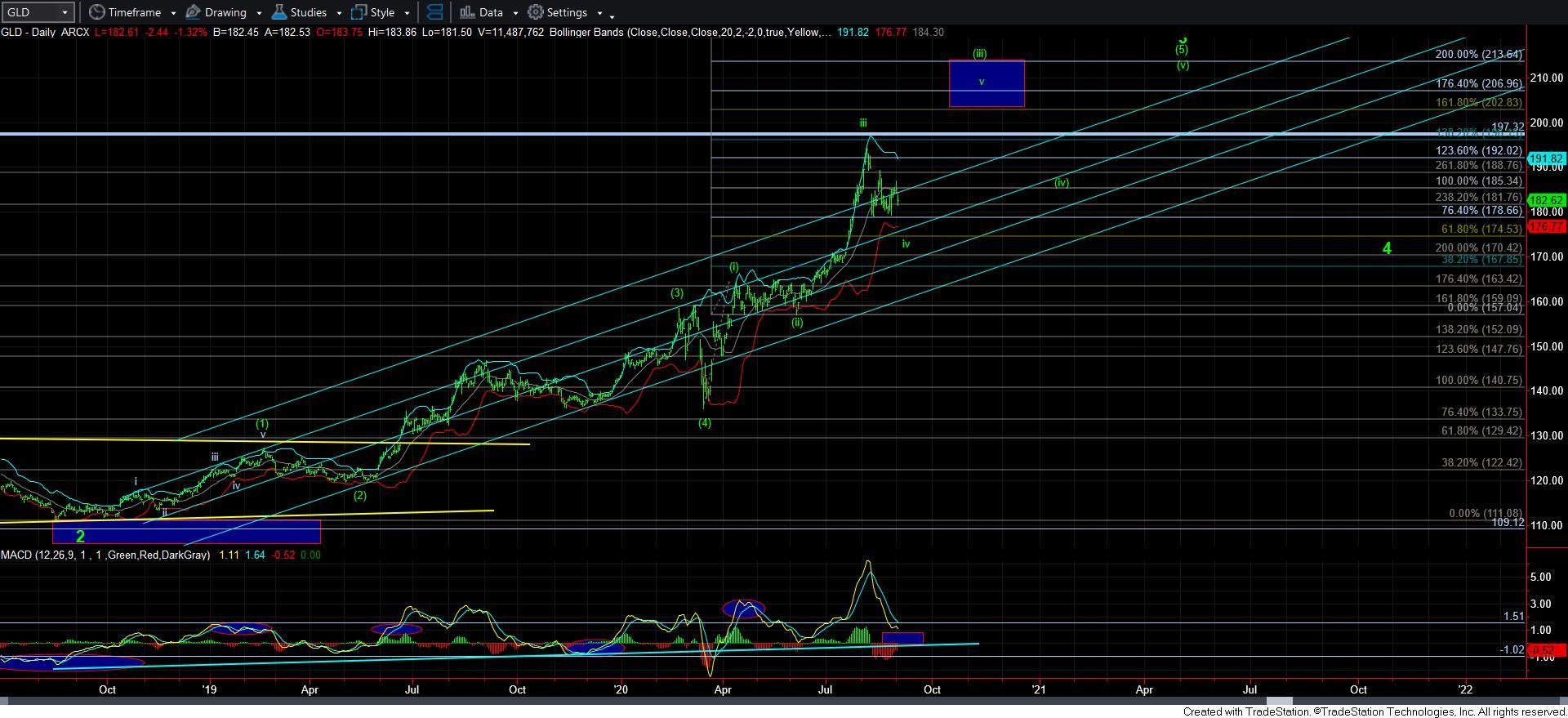

In moving over to the GLD, while I can view the current set up as a 1-2 structure pointing us higher in expectations of a 3rd wave, I have a hard time adopting that count with a full heart. The 5-wave structure would – AT BEST – be a leading diagonal, and as noted so many times before, I have a hard time relying upon such structures as a reliable trading cue. So, this leaves me quite skeptical about assuming that the wave iv pullback has yet run its course.

When it comes to silver, I have been trying to give it the benefit of the doubt, since it has been retaining its immediately bullish 1-2 structure . . . until the last two days. It had the opportunity to break out over the market pivot I provided yesterday, but has rolled over in what seems to be only a 3-wave rally completed of the low struck on the 26th. So, the most bullish case scenario right now is that we have a larger wave 2 pullback taking shape, as shown on the 144-minute chart.

As I noted yesterday, we would still have to break out over that pivot to suggest that we have begun a un to 36+. And, thus far, we have been turned down just pennies below that resistance.

I will be on the lookout for the next micro i-ii set up for wave 3, but until such time as the market makes that clear, I am still going to view the structure with the same skepticism I hold for GLD and GDX at this point in time.

In summary, please do not take this update to assume that I am not looking higher over the coming months. Indeed, I still think we will see much higher levels in the complex. The only issue with which I am currently grappling is if we are ready TODAY to begin that rally in earnest, or if this market has some further twists and turns that we often see in 4th waves before the 5th wave begins in earnest.

I hope this update has provided you with enough understanding of my thoughts and expectations to consider in your positioning over the coming months.