First 5 Waves Up Are Still Incomplete

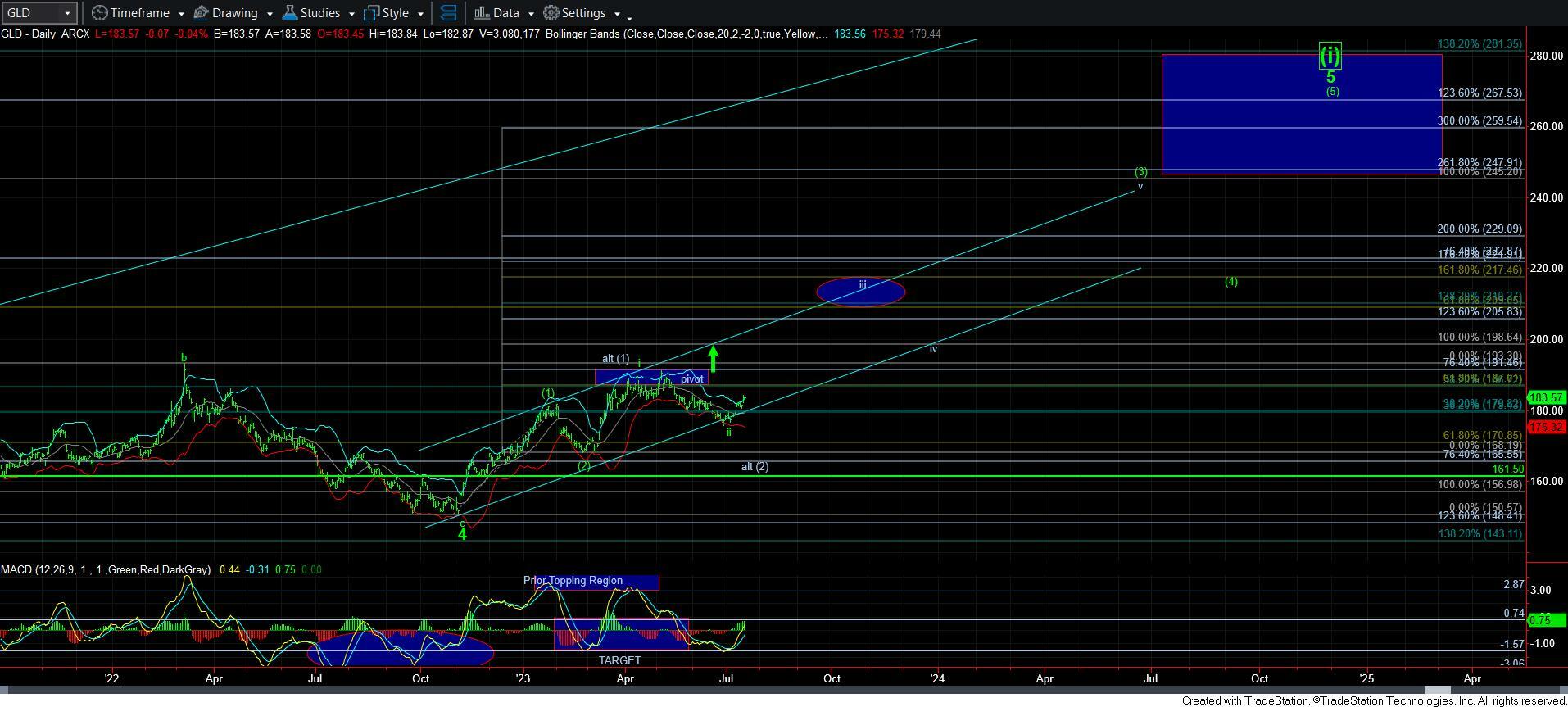

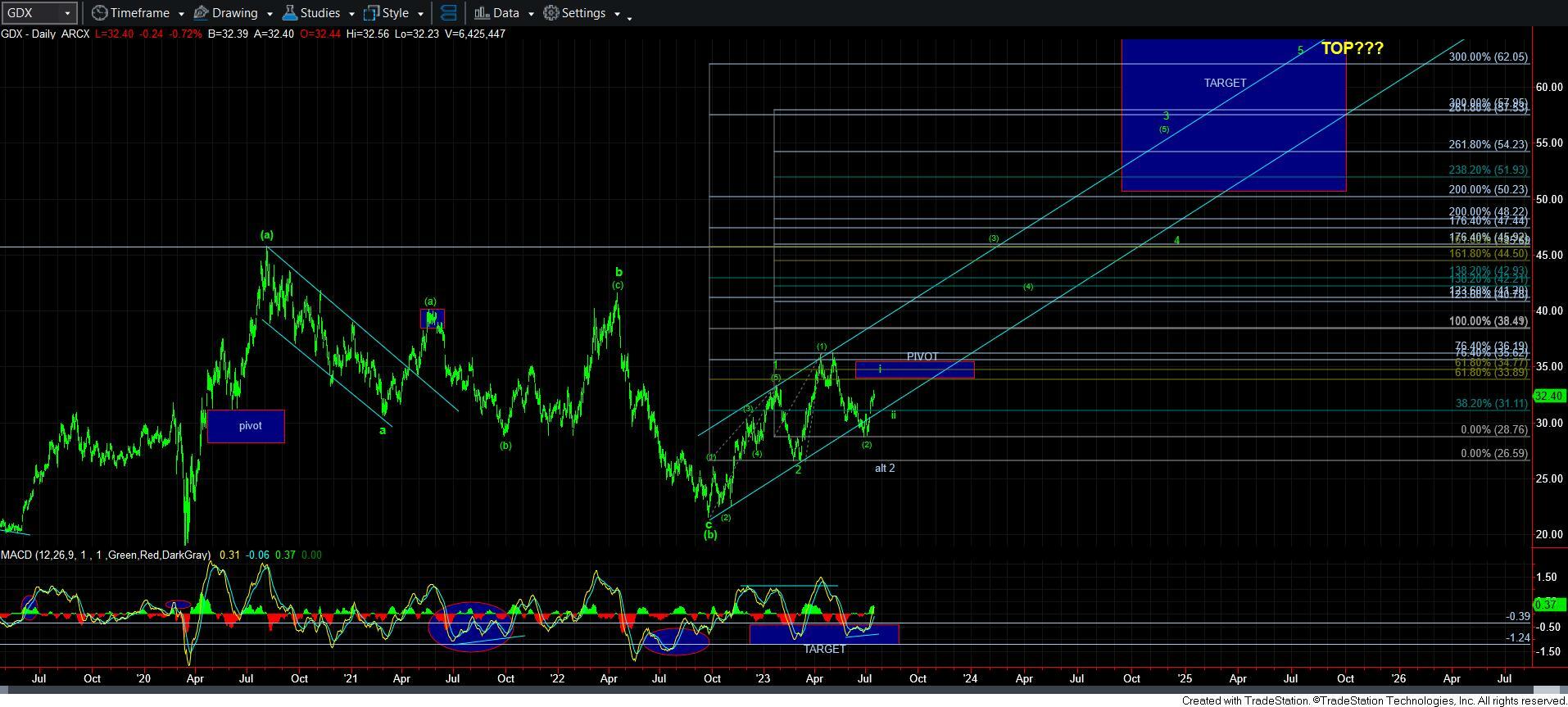

While the market certainly took its sweet time in bottoming out during the last pullback, we have rallied quite nicely so far in GDX and silver. While gold is still bringing up the rear, I am going to consider it as following through as the other charts for now.

As I highlighted over the weekend, silver was strongly suggestive of still being in the wave iii off the recent lows. And, as I posted earlier today, this 5th wave of iii seems to be taking shape as an ending diagonal. But, keep in mind, diagonals and triangles may go on for longer than we initially expect. So, while getting one more high can provide us with a minimally completed diagonal structure, we would need to break down below the trend channel to signal that it has potentially completed. And, a break of the 25 region would make it likely that we are in wave iv (again, assuming the market is going to complete all 5 waves up off the recent low).

As far as gold is concerned, I really do not have a highly reliable count off the low, and am going to assume that it is tracing out a leading diagonal for now.

And, in GDX, as I outlined over the weekend, it too seems to best count as completing its 3rd wave off the low, and should see a 4th and 5th wave, ultimately taking it towards the 34 region, as I have explained in prior updates and the member-wide morning video.

So, nothing has really changed. I think we will likely begin a smaller degree 4th wave pullback in the near term, which if it holds support, and then we see a 5th wave higher high, we will then be watching the ensuing pullback to make sure it is clearly corrective. If so, then we will have another buying opportunity before the break out and melt-up beings likely some time at the end of the summer or in the fall.