Feed Back Loop Time?

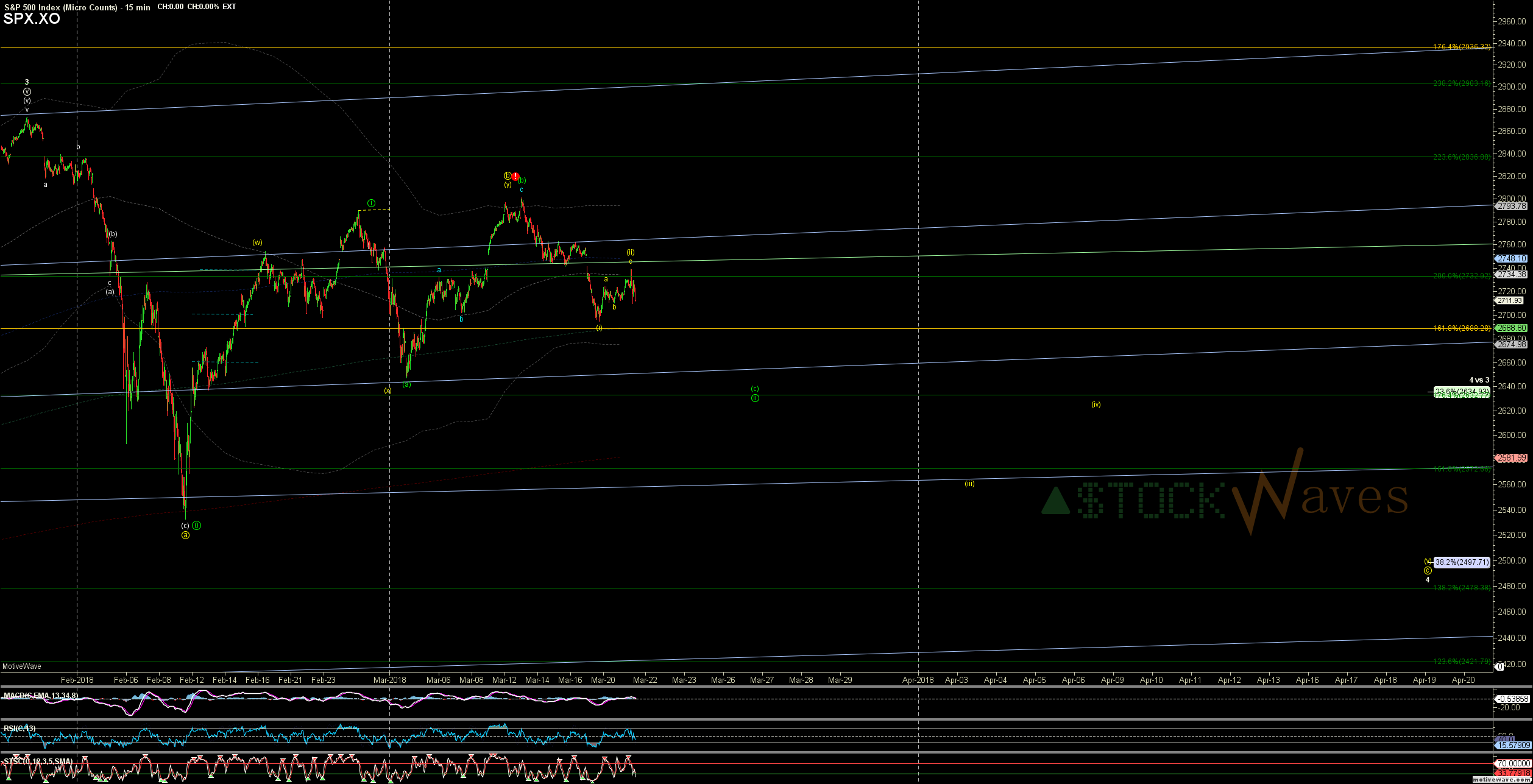

Yesterday's FOMC action allow the c wave up to 2744 we were looking for to complete and then promptly reversed, and HARD.

ES futures extended that reversal down into this morning.

So far though it has only nominally broken the Mar 19 low... it is possible to count a micro WXY off 2744 ES as an alt b allowing for an ATTEMPT up toward 2740s again IF 2695 region holds. However many stocks and sectors are just now "waking up" to a RED morning and could start the negative feed back loops that can accelerate our pattern in the (iii) of circle c down.

24,500-24,250 is the region that needs to break in the DJI to REALLY start the waterfall.

I continue to watch the individual sectors and some key stocks in StockWaves both to look for "clues" to where the weakness will come from and which names will "out-perform" (to the downside in this case).

This is still part of a HEALTHY correction as Minor 4 firmly inside our larger bull trend, we are setting up for a very nice rally as 5 of (5) to complete P.3 over the next ~year toward 3369.