Favorable Setup Into Friday

Thursday played out as a range day as the CPI reaction gave traders a clear reference point from the established high and low. If you recall, a minute before CPI event the market topped at 4019.5 on the Emini S&P 500 (ES) and then spiked lower into 3954. By 9am, price was retesting into 4020s, and regular trading hours opened around 3990s, which is yesterday’s closing print.

Immediately after the RTH open, price tanked and backtested into the CPI lows of 3950s and gave us a double bottom/higher lows setup. We took that express train and captured a few points and we were basically done the trading day by 10:15AM.

Ultimately, there were a few tradable setups for traders if you utilized the key levels and what the price action provided you with the reactionary setups. No need to predict, just need to react fast enough with real-time execution as we noted in yesterday’s report. As you could see from the chart, all predictions or projections went out the window when news hit the wire; it’s all about price discovery and how buyers+sellers interact around our key levels.

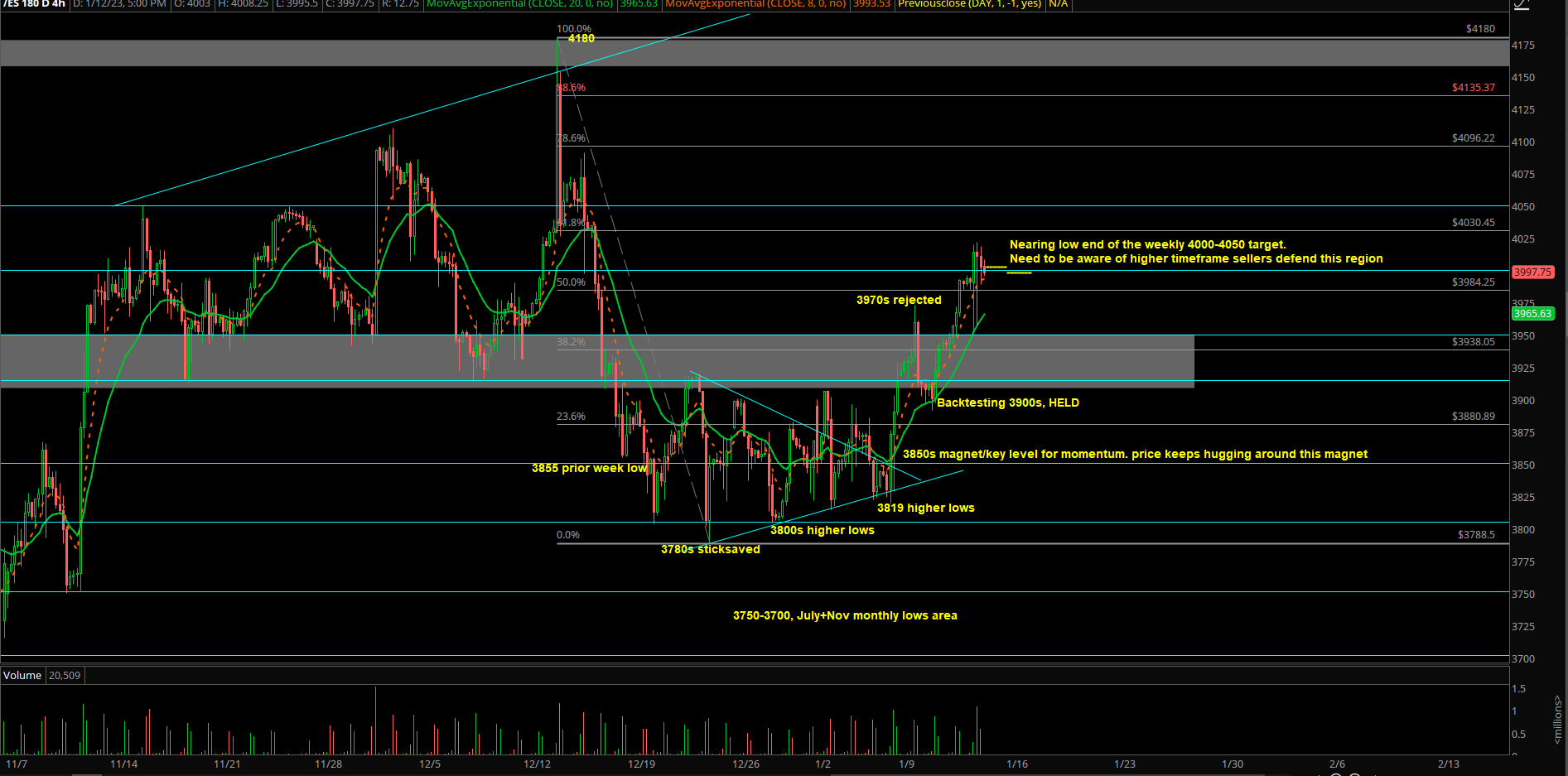

Key weekly parameters remain the same from weekend report (copied and pasted):

- Heavy events week with Powell speech on Tuesday, China CPI Weds, US CPI on Thursday and Friday US Michigan Consumer Sentiment

- Need to keep an eye on whether buyers are able to retain strength on a weekly breakout formation as there’s a lot of trapped inventories for the past 3 weeks

- It could open a multi-day ramp back into 4000-4050 which means a +2-3.5% worth of range

- Keep tabs on tech/mega-caps as a quick 2-3 day worth of relief rally could easily pump out a double digit % gainers when looking at the daily+weekly charts

- Failing back into ES 3850 would be considered as a complete failure/massive rejection

Intraday trading parameters:

As of writing, it’s a trend week up context from Monday Jan 9th into Thursday Jan 12th, which means that buyers have a favorable setup going into tomorrow. Statistically speaking, when Monday-Thursday operates in a one directional trend, then Friday is typically a climax of said action, traders can look for on-trend setups when applicable.

- We’ll utilize 3980/4000 as immediate trending support to see if there’s buyable dip tomorrow into 4020/4030/4050 targets

- If RTH open is above 4020 (today’s high area), then it’s possible for a direct trend day into 4030/4050 targets

- If RTH opens below 3950, be very careful of recent buyers being all trapped and there’s a lot of trapped inventory to unload/get liquidated (this scenario is unlikely at the moment, but best to be prepared for anything)

- Slightly bigger picture wise, as we noted in last night’s report, we’ve been expecting higher timeframe sellers to defend this 4000-4050 region going into next week/long weekend. Need to be mindful of the different timeframe battles here. A daily close below 3950 would be your first hint of sellers flipping the short-term momentum

- Let’s see where we open or RTH as our parameters could change tomorrow morning based on the overnight price action development, utilize the additional key levels at the end of Ricky’s ES gameplan report (available in ES room)

- We as traders must know our timeframes, risk parameters and game plan

- Key levels are static, context is dynamic, real-time execution is fluid

- We utilize a level by level approach, let the price action dictate our actions