FCX: Learning Opportunity Regarding Fibonacci Pinball

I do not often discuss individual stocks, but this one has presented a wonderful learning opportunity, so I decided to do a write up. In fact, I have been tracking this in my live video presentations daily for quite some time, and I told our members of that service when I was buying around the 35/36 region, and then when I went overweight the stock in the 39 region on the wave (2) pullback. But, I am seeing something a bit troubling.

As you may know, our Fibonacci Pinball structure is set up once waves 1 and 2 are in place. And, then we often see waves (1) of 3 taking us towards the .618 extension of waves 1-2, with wave (3) of 3 taking us to the 1.00-1.236 extension of waves 1-2. And, when the market does something unusual within this framework, it is often a warning to us that the standard structure may not play out. In the current case, there could be a warning that this rally is corrective in nature. Allow me to explain.

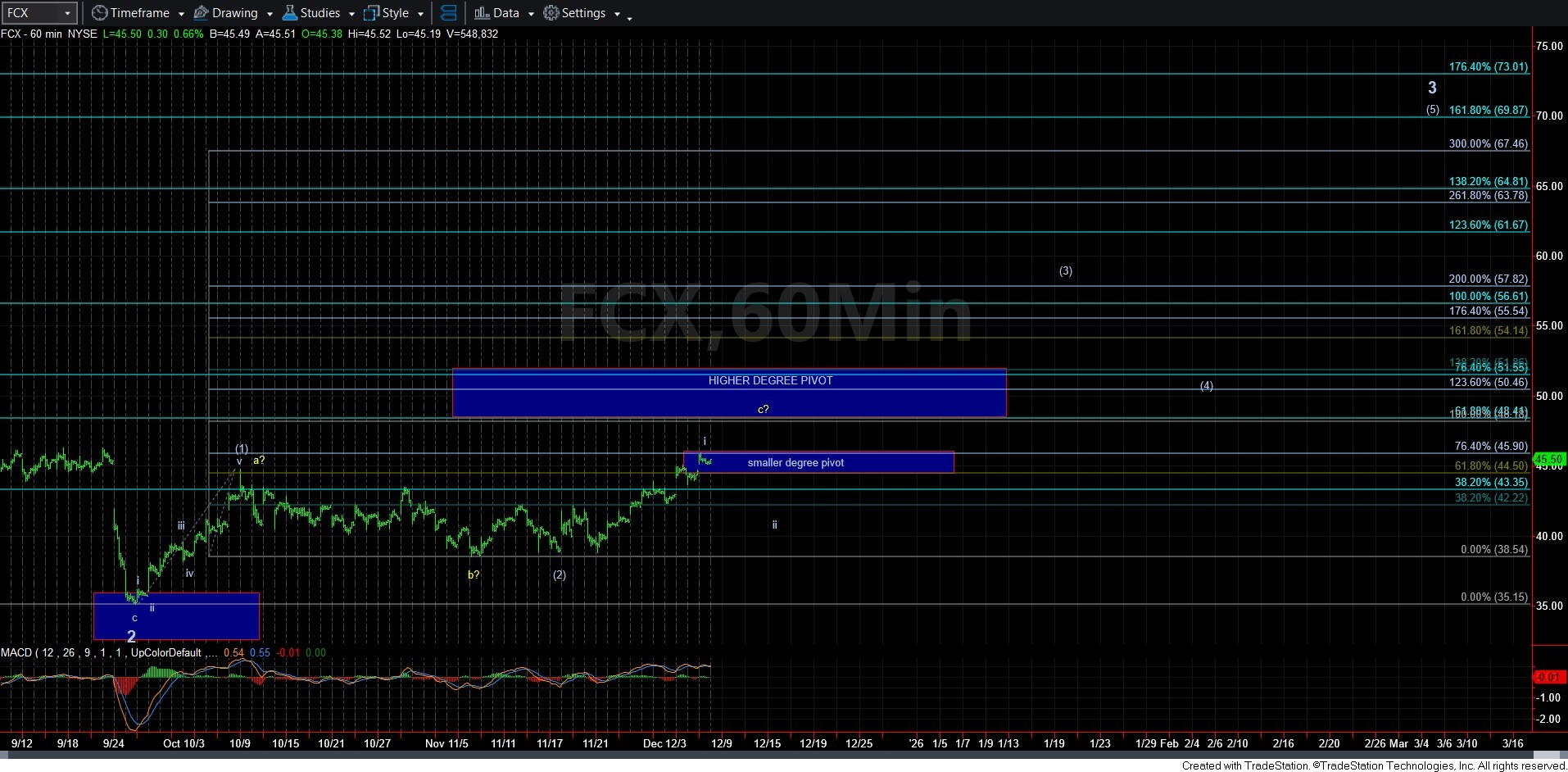

As you can see, I have the wave 2 labeled on this picture (as wave 1 is off the chart to the left), and the larger degree fib extensions are now being presented in light blue. The reason I did that is because there is also a smaller degree (1)(2) on the chart (which should be the start of wave 3, and those fib extensions are presented as they are normally on my charts.

So, this chart presents two wave degree of Fibonacci Pinball extensions. I have also labeled the smaller degree pivot as well as the higher wave degree pivot.

As you can see, we are now at the top of the smaller degree wave pivot, which is the .764 extension of waves (1)(2). If this is indeed wave i of wave (3), we SHOULD see a wave ii pullback begin here. And, that would keep the bigger picture well on track regarding a standard Fibonacci Pinball structure.

However, should we move beyond the .764 extension of waves (1)(2), and move directly to the 1.00 extension, there is an interpretation that can be made that this is simply an a-b-c corrective rally. And, should the market head directly there, then I would personally not want to be overweight this stock due to the concern of this being a corrective rally. Should the market prove otherwise, I can always choose to buy back what I would sell.

This was something interesting that I have been tracking of late, and thought it may be a good opportunity to explain why tracking multiple waves degrees is important when we do our analysis, and why wave slapping will never allow you see issues like this that could come up.