Eyeing SPY Bottoming Action

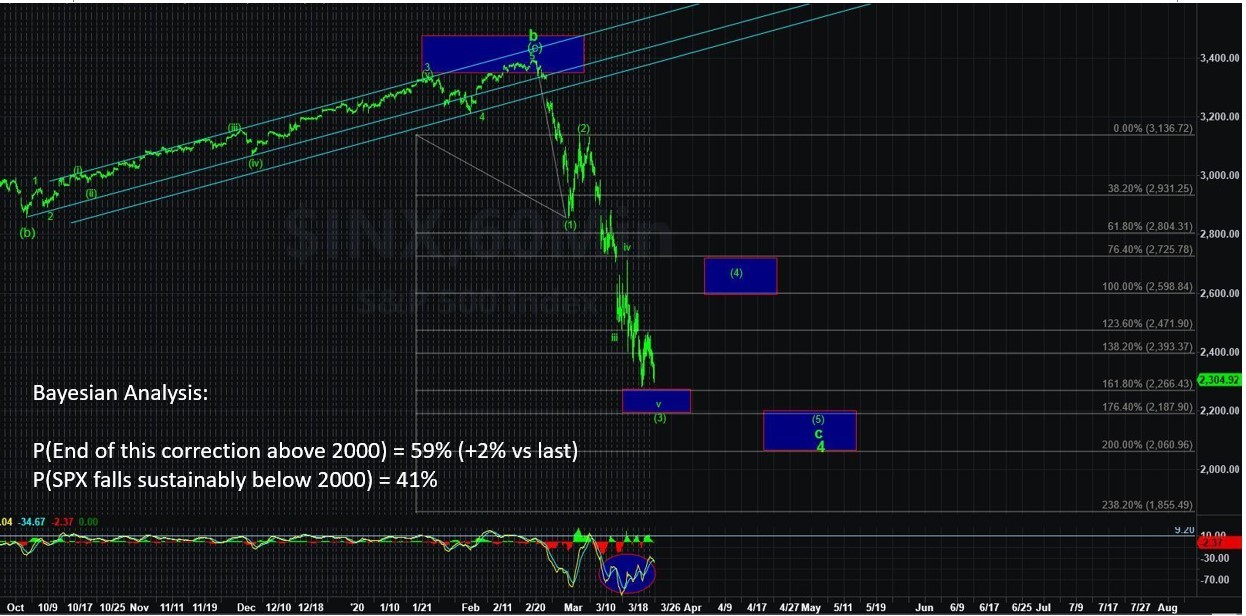

The SPDR S&P 500 ETF (SPY) did hit nearly smack dab in the middle of the SPY 215-220 support region and did modestly bounce yesterday. Our Bayesian Timing System is keenly watching this bottoming action, as an ability to base above 210 could very well be "the bottom." If the 200s let go, then look for the 160-170s to be the next stop. Note the vibration window (a moment in time that serves as resistance or support in price) is showing up for this week.

The Gold Miners ETF (GDX) has entered a very choppy trading range of 10% daily moves. Tough to get an angle in action like this long or short. For now, we watch potential basing action, but objectively speaking GDX action has presented more corrective in nature, while the iShares Silver Trust (SLV) can’t get off the mat, and SPDR Gold Shares (GLD) is doing its own bullish dance. With a vibration window coming up, let’s hope we get more clarity and soon.

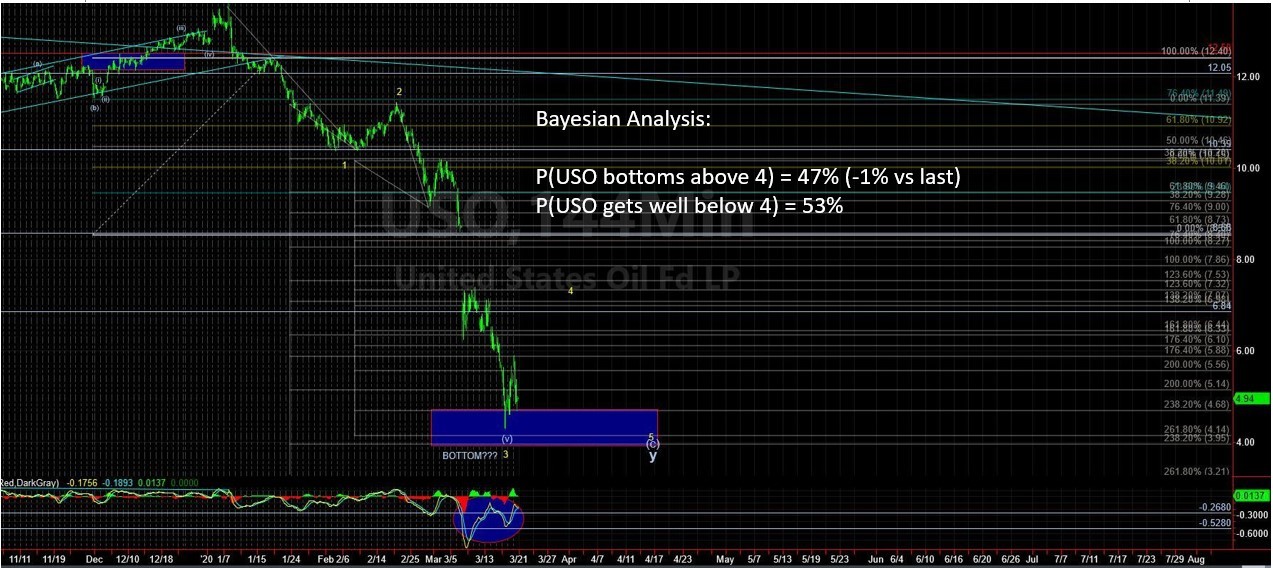

The US Oil Fund ETF (USO) is struggling to base in the 4s. The intraday volatility is making USO very difficult to find a tradable set up. I will copy this down from above -- "I was asked in room recently the low-end target for longer-term using Bayesian – I have USO 2s showing up if all hell breaks loose. That would be approx. $8-12 oil."

The Invesco DB US Dollar Index Bullish Fund (UUP) has clearly broken above 27 and has a target of 30 in mind. If, however, UUP fails to reach 30 and closes back below 26.50, then a false break higher begins to be triggered. This scenario would most likely have important ramifications for asset classes the world over.