Eyeing Path Lower in SPY

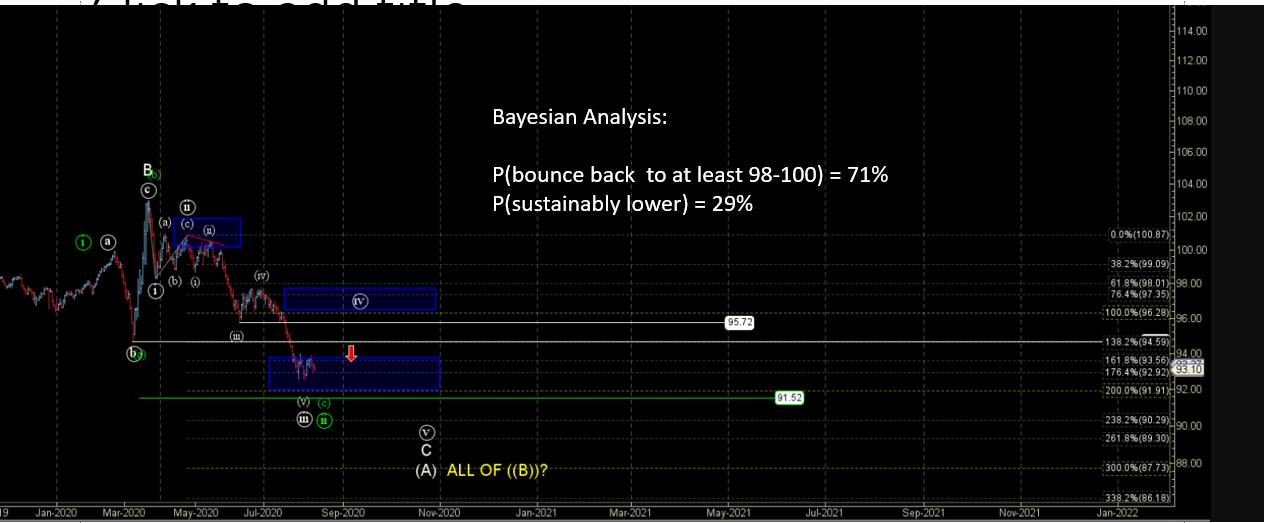

With the SPDR S&P 500 ETF (SPY) at the upper end of its consolidation range for nearly two weeks now (between SPY 335-340), there really isn’t much to add. Targets on the first move down should see the mid-320s. Below that is the 305 region, and below that is the 280s.

Here are the paths: (1) [Probability=79%] SPY begins a sustainable path lower targeting the price points itemized above, and (2) [P=21%] SPY continues a sustainable bullish path targeting as high as the 350s.

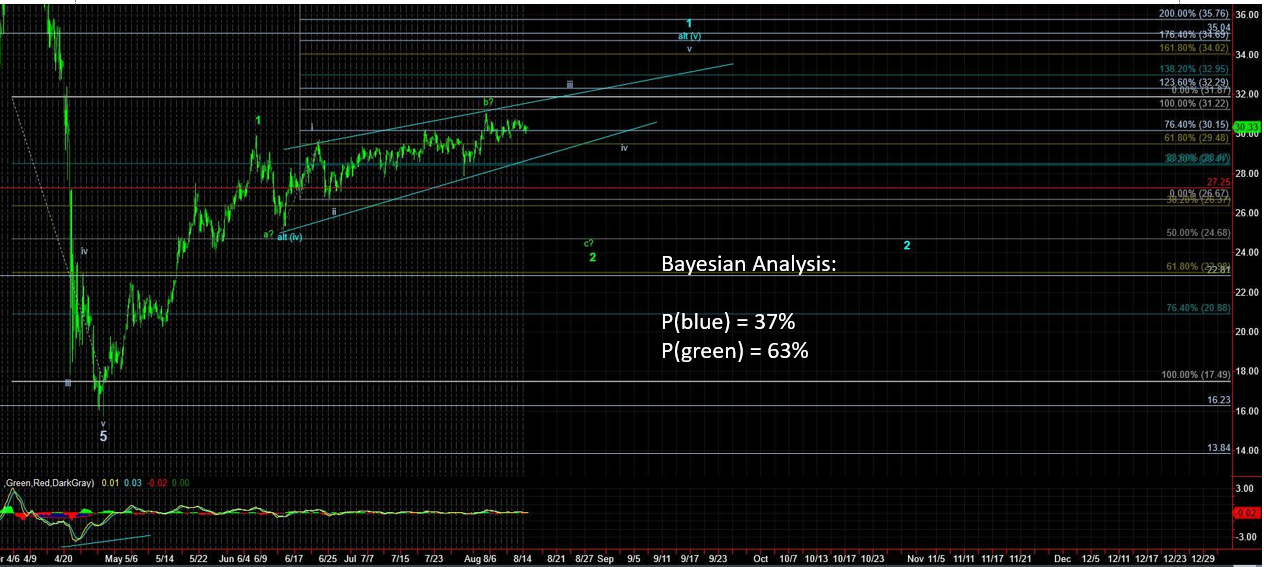

In metals, the Gold Miners ETF (GDX) is back touching the important 39-41s region. Below 39 opens up the low 30s. Also, the SPDR Gold Shares (GLD) has a tradable shot of seeing the 150s again before the next sustainable uptrend is seen in metals.

Here are the paths: (1) [P=76%] GDX stalls into the vibration window late July/early Aug with a spike as high as the 45s and pulls back to at least the 36-38 region, which occurred on 8/11, although lower targets remain on the table, and (2) [P=24%] GDX continues its bullish advance sustainably above the 45s.