Eyeing Path Lower in April

Once the SPDR S&P 500 ETF (SPY) got above the cluster in the 282's, the 285's did seem the most probable outcome. Regarding micro paths, the 286 level will decide if we turn down from here or need to see the path to the 289s first.

Regardless, our Bayesian Timing System (BTS) still believes the path lower will begin in April and most likely a top is seen before the end of next week (most likely this week if we didn’t already see it on 4/1).

In metals, as expected, a strong reversal from the 23.50-ish level in the Gold Miners ETF (GDX) kicked in high gear on 3/28 and from here the BTS is expecting choppy to down action for another week or two. Hang in there, though, as the GDX could rally to 25-27 by this summer.

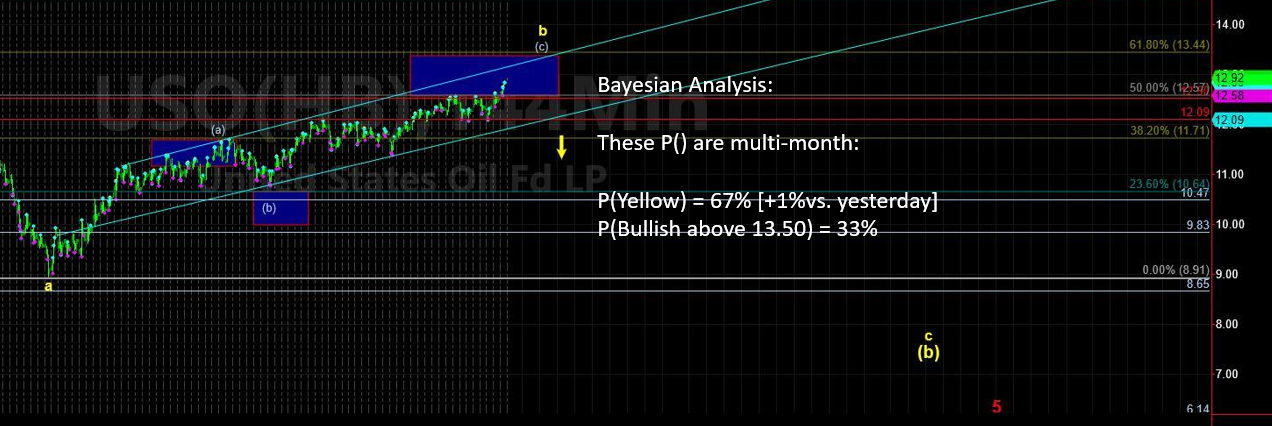

In oil, after the US Oil Fund (USO) bounced between 12.15 and 12.50s, the bulls finally won the battle and pushed up towards 13-ish. Looks more like a last gasp than the beginning of something larger.

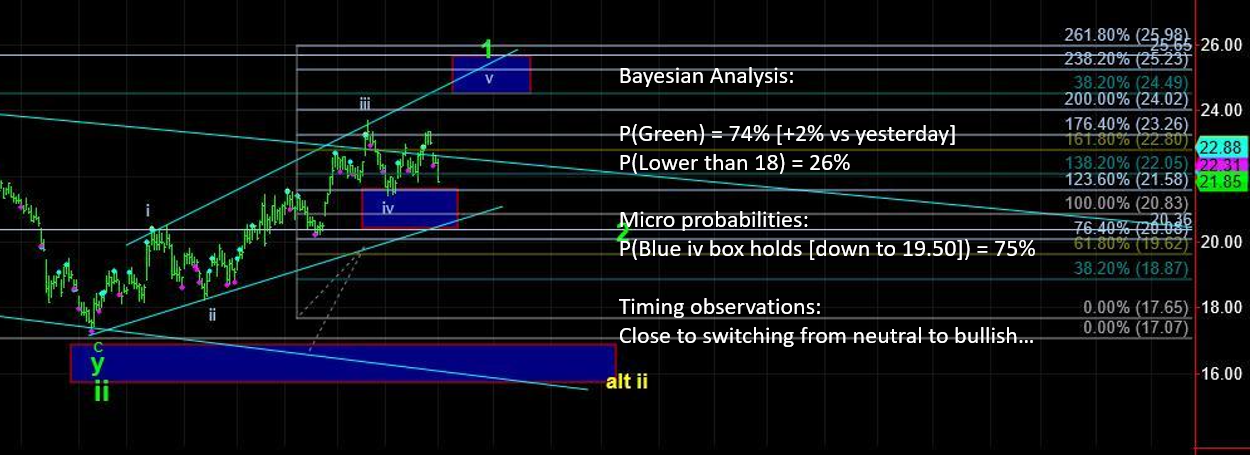

In the dollar, the Invesco DB US Dollar Index Bullish Fund (UUP) met resistance in the 25.90-26.10 range, as the BTS expected. And the move stopped nearly exactly at the support level of 25.55. As such, UUP continues in its sloppy range.