Eyeing Low 320's In SPY

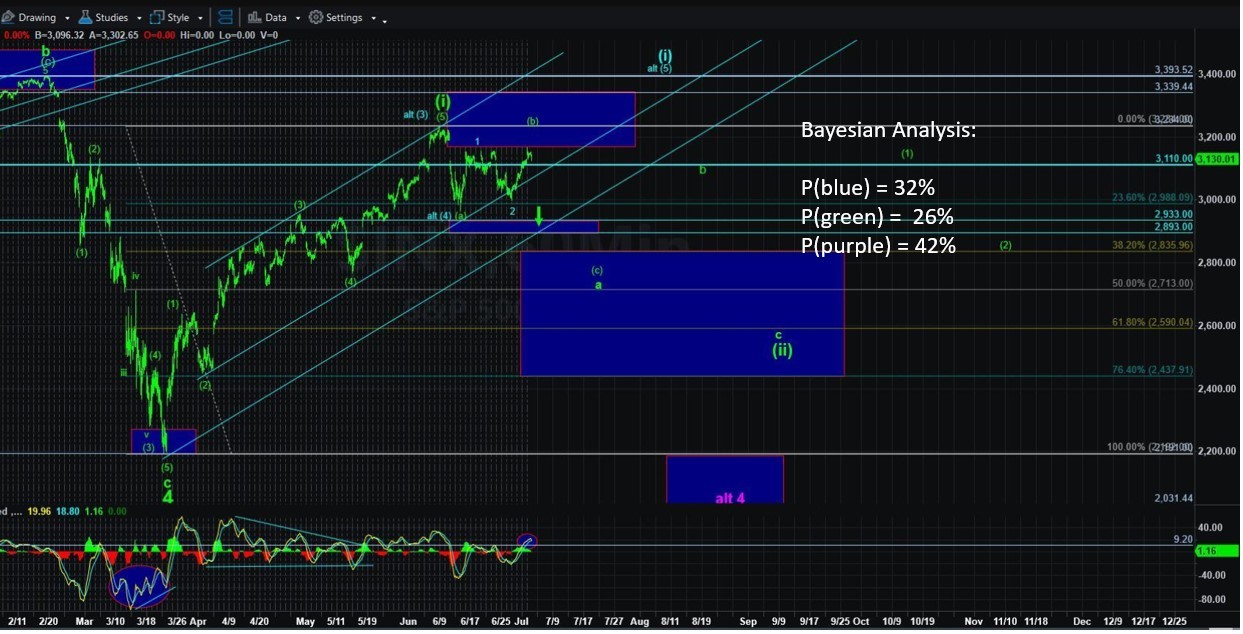

The Bayesian Timing System (BTS) is back to being a bull for a swing trade and sees targets in the low 320s for starters from here in the SPDR S&P 500 ETF (SPY). Once this grinding to a slightly higher path runs its course, a $30+ pullback is still most likely, and the BTS will continue to run its probabilities to ascertain a price level to attempt another short.

From an intermediate price perspective, here are paths to consider: (1) [P=22%] SPY sub-320 slows this bull train down, (2) [P=39%] SPY 320-325 slows this train down, and (3) [P=39%] SPY sees above 330 to ATHs on this leg.

Bottom line: A $30 move lower is still on the table and odds point to at least from the low 320s.

Longer-term long positions comment: Believe it or not, things are actually shaping up to be “easier” for longer-term positioning. Basically, wait for the next $25-$35 and begin to position long and wait for the BIINND that may come from that level. If the correction is greater than $45 from that recent high, then longer-term long bets will be questioned.

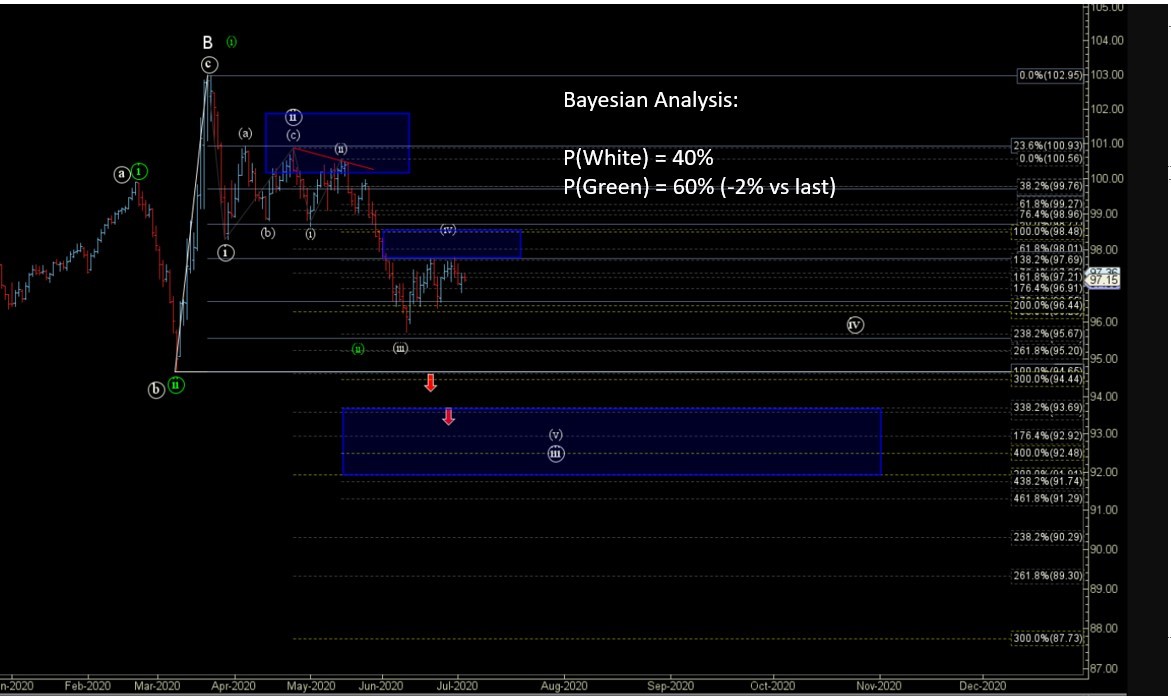

In metals with the 38 level in the Gold Miners ETF (GDX) still a ceiling to this multi-week corrective retrace higher, members are cautioned to protect gains if long or at least not get FOMO. Bayesian probabilities still point to much lower before a sustained break higher:

(1) [P=67%] GDX stalled early the week of 5/18 and pulls back to at least 26-28 (23-25 can’t be ruled out), and (2) [P=33%] GDX continues its bullish advance that targets 40.