Eye SPY Long - Market Analysis for Aug 16th, 2019

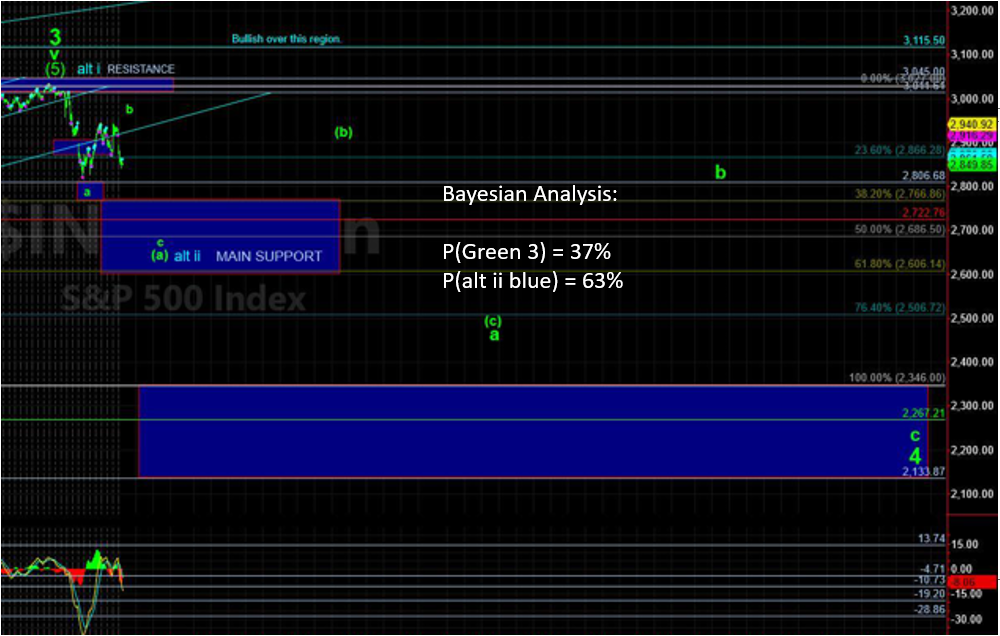

With the SPDR S&P 500 ETF(SPY) spiking down to the pivotal 184-185 level on August 14, the Bayesian Timing System (BTS) determined the risk-reward set up was there for a long signal. If this general area holds, then odds support a multi-week to multi-month rally to new ATHs.

SPY levels to keep an eye on, and please note this is a potential strong basing area so volatility will prevail: SPY support down to 278-279 and resistance at 287-290, which we are approaching.

In metals, the Gold Miners ETF (GDX) resistance is in the 29s. It feels more like the index is topping or at a last gasp at the moment. Risk return doesn’t justify a position presently. On the downside there is the support at 27 and then 23-24.

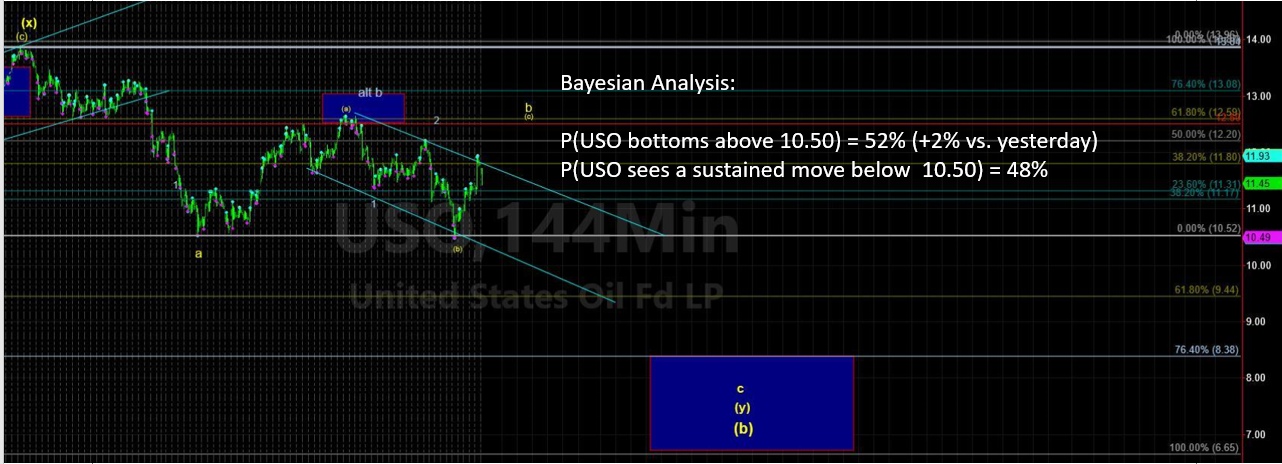

In oil, the United States Oil Fund (USO) low at 10.50 from August 7 is showing more support that you’d expect. And similar to indices, if this is basing above 10.50 then expect a lot of volatility (already getting that) and a chance to get long for a longer term hold sooner than later. Support 11.10, resistance at 11.75.

In the dollar, our multi-week view is bearish. The US Dollar Index Fund (UUP) needs to get back below 26.10 for more immediate downside. It was drawn towards 26.50-ish and has been there for quite some time without breaking through.