Extension or Misdirection?

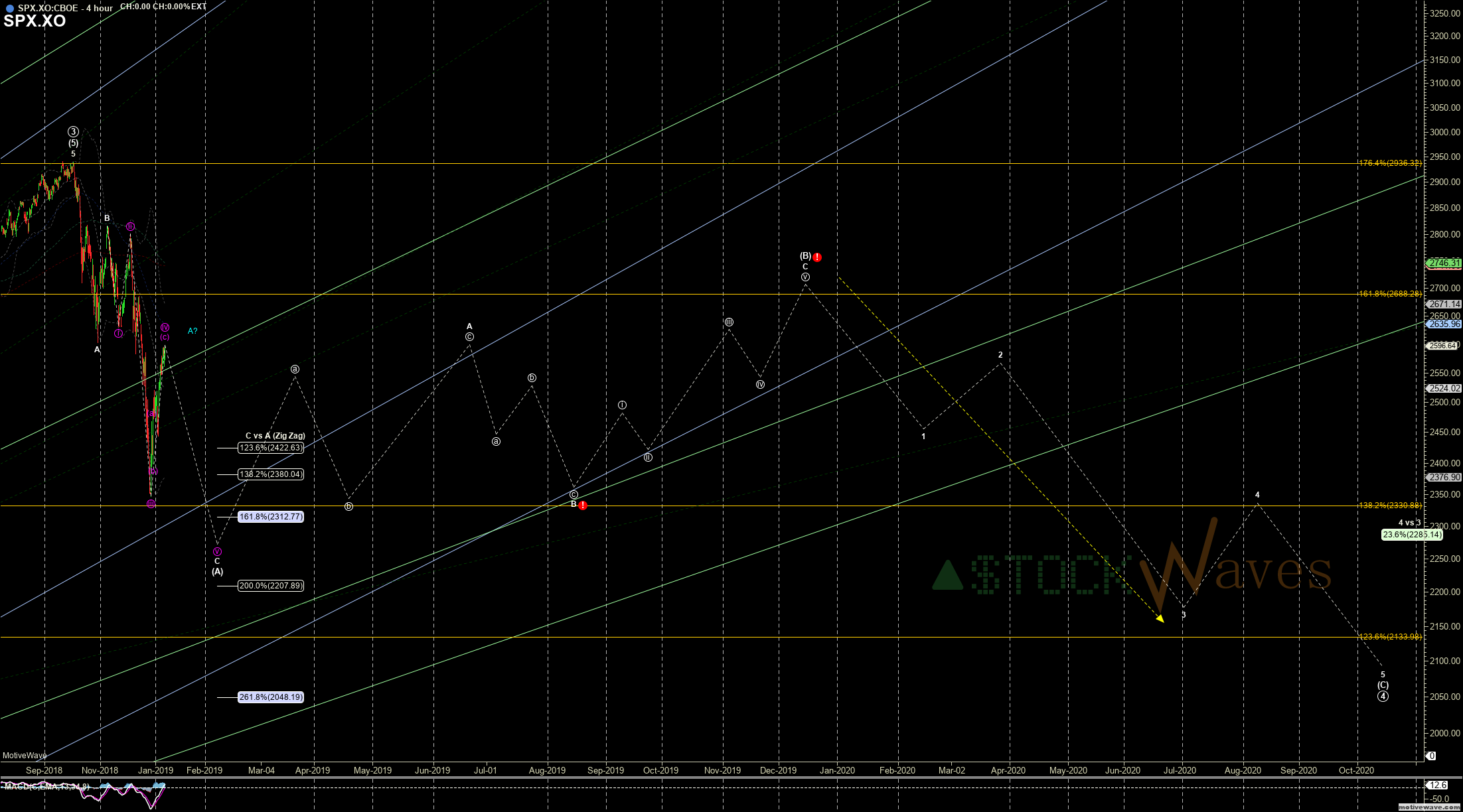

The green path allows for extension of the (c)/"c" toward 2630+ (5min).

It needs to turn up sharply right here or risks failure, SPX's pattern really should have seen it set to open ~2609 if it was getting this extension...

A break of 2575 followed by 2562 (ES) will be the first indications of a "local top".

IF we do get the extension, while technically still valid as a ivth of an ED C wave it will be more likely the A of (B) (blue) at that point. However it is possible that it is b of Y of (A) and still drops to a nominal new low and then restarts the (B) wave, there is also a risk that it is ALL of (B).

In any case I do not see the larger P.4 complete. Capital preservation is key. I see a decent pullback ~5% at a minimum here, and I also see potential risk of some more "sudden" drops.