Expecting Some Digestion After New All-Time Highs

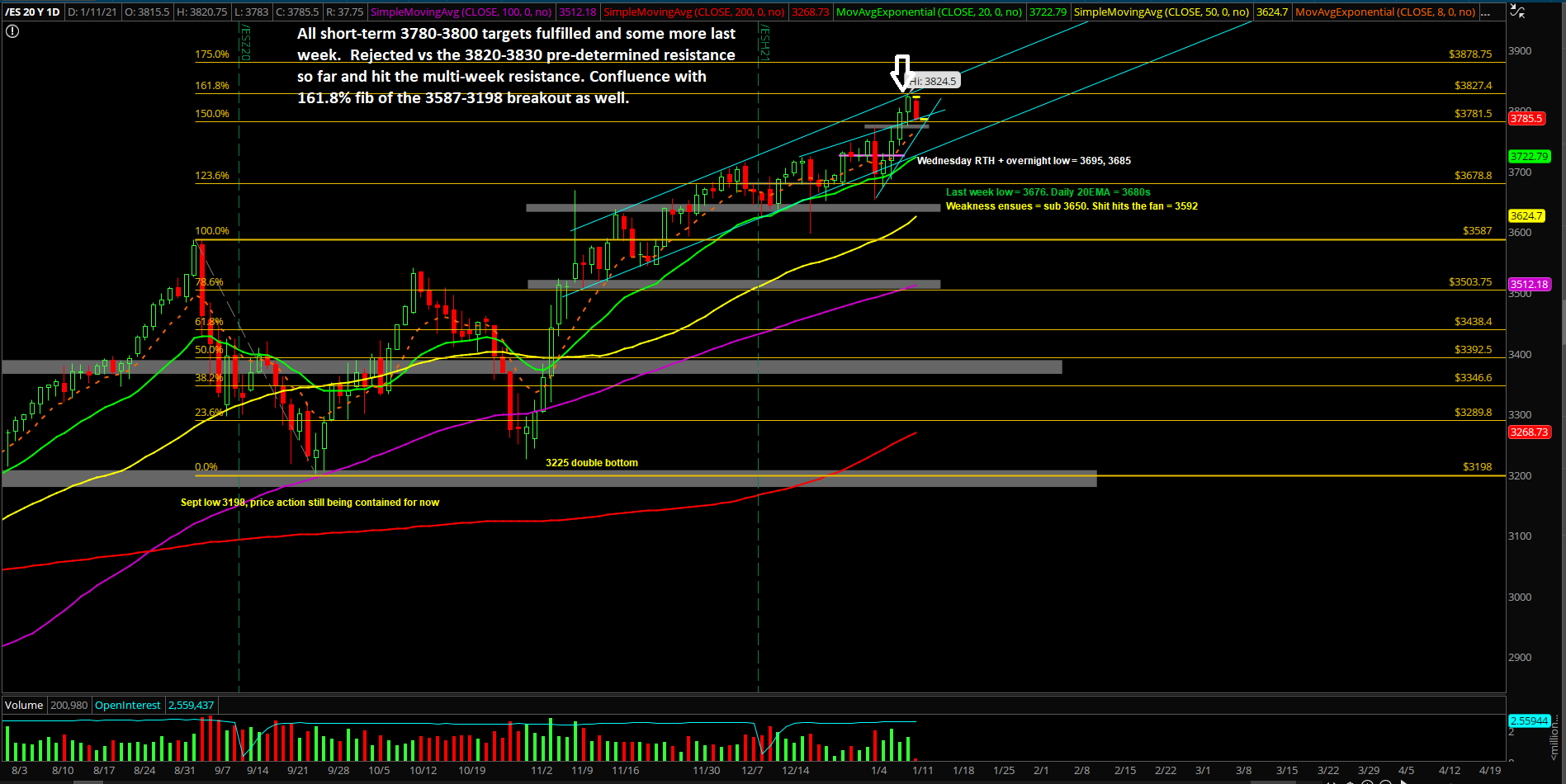

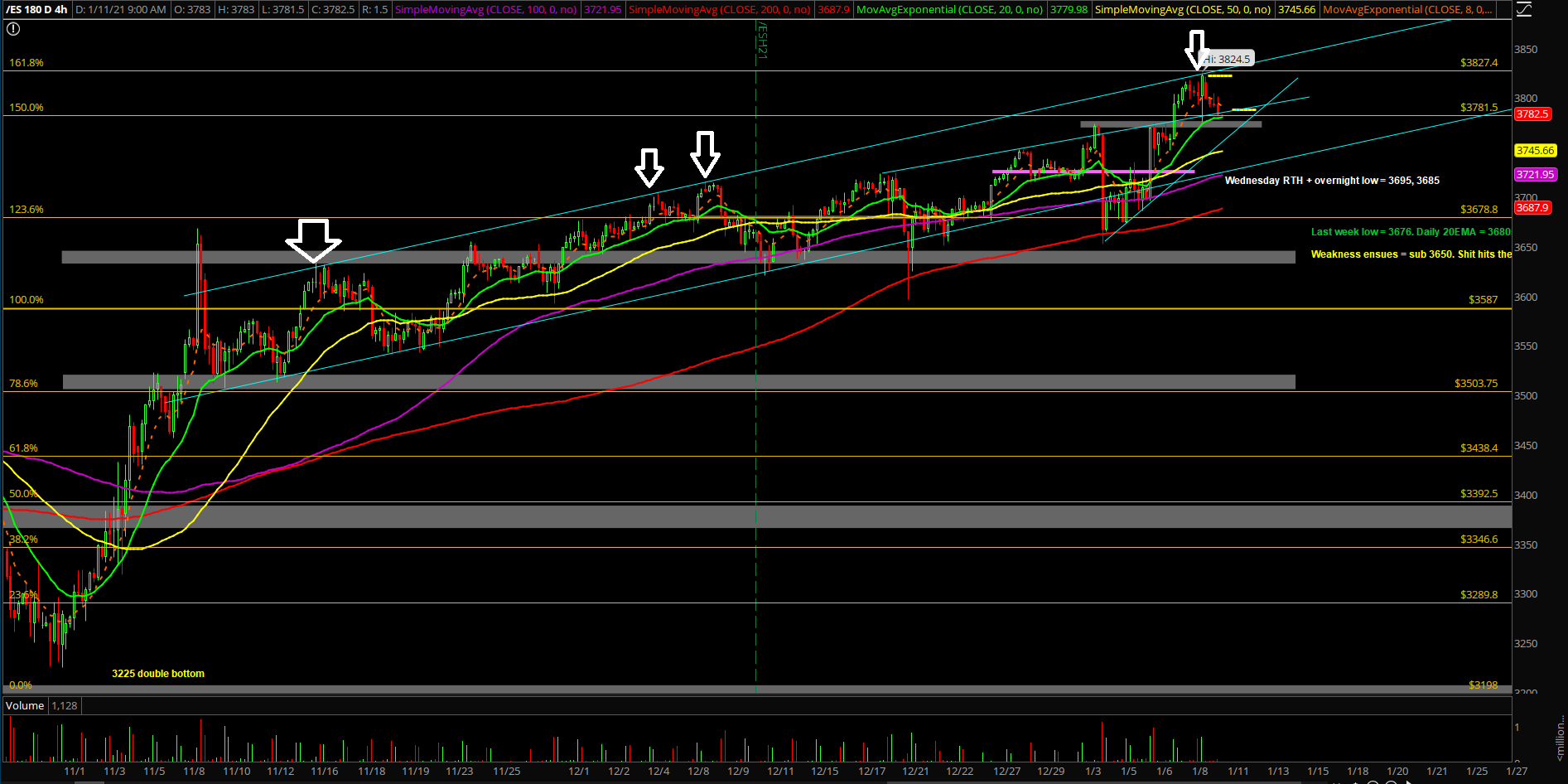

The first week of January played out mostly according to expectations as the only surprise was on Monday. If you recall, price action dropped from the 3773 new all-time high on the Emini S&P 500 (ES) into a low of 3652.50, and the rest of the week was spent grinding out higher lows and higher highs into another new all time highs. Our scenario 1 was discussed in real-time during Monday’s backtest into significant support as we expected price action to hold versus the support confluence area of daily 20EMA+December breakout backtest. The rest is history as price action played out as a methodical V-shape recovery into new all-time highs for the rest of the week.

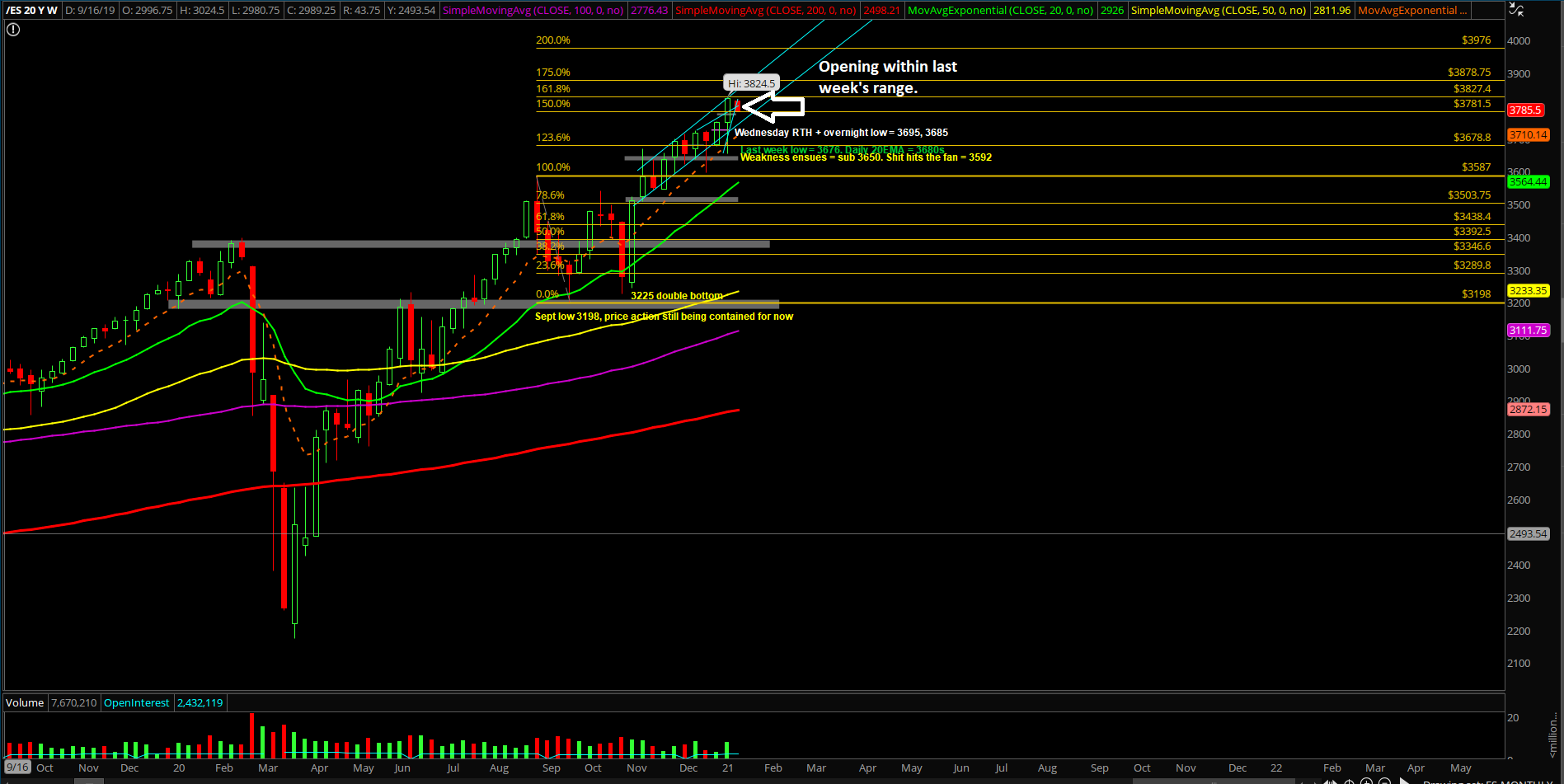

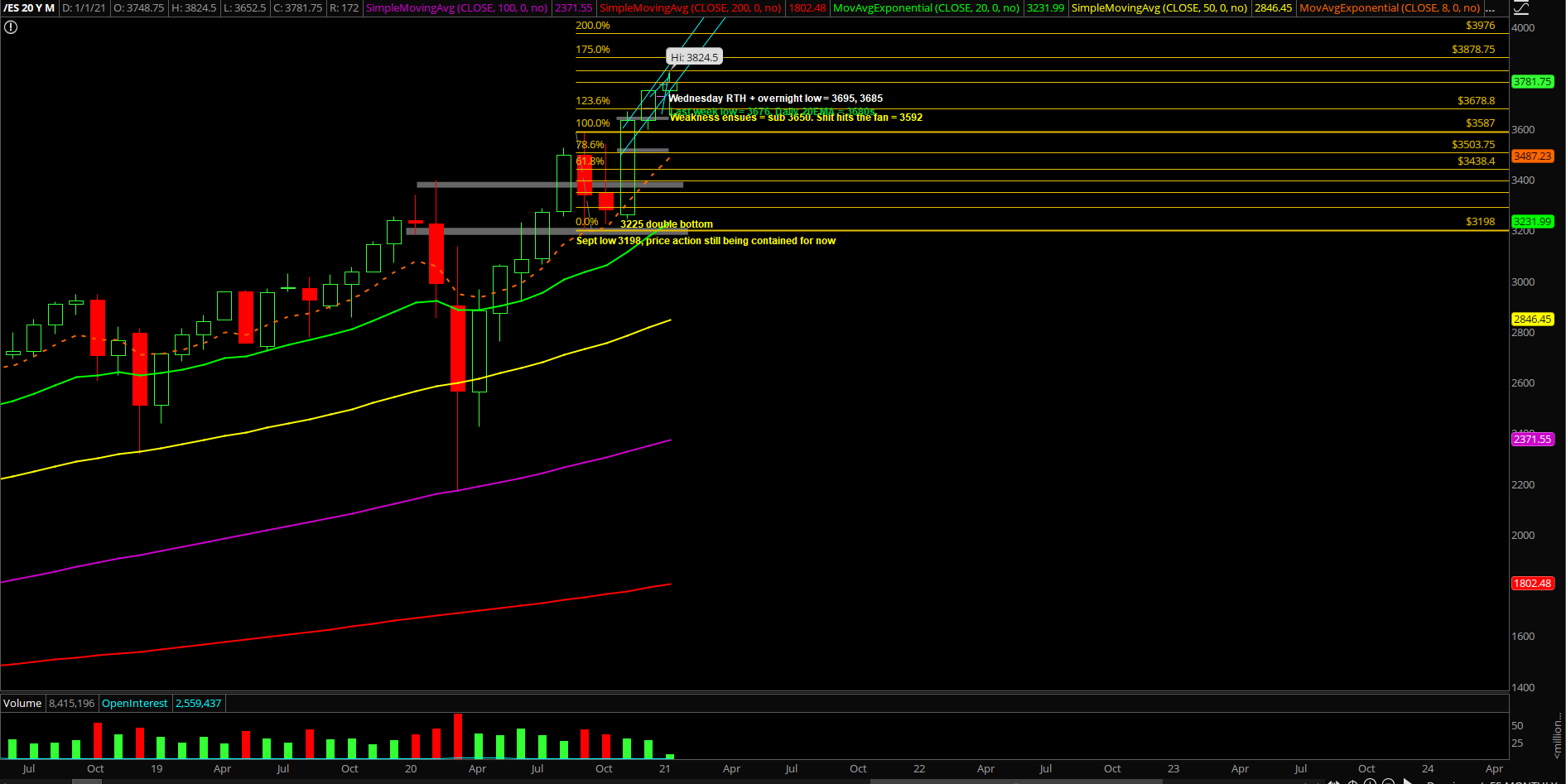

The main takeaway remains the roughly the same. Price action has demonstrated that it is following our expectations (Scenario 1 from Monday), where it’s just a bottoming setup versus the daily 20EMA + support confluence area. Bulls confirmed momentum on Friday with a new all-time high closing print on ES WEEKLY chart. All short-term targets have been fulfilled and now price action is likely doing a healthy consolidation/rotation game as we begin this new week.

What’s next?

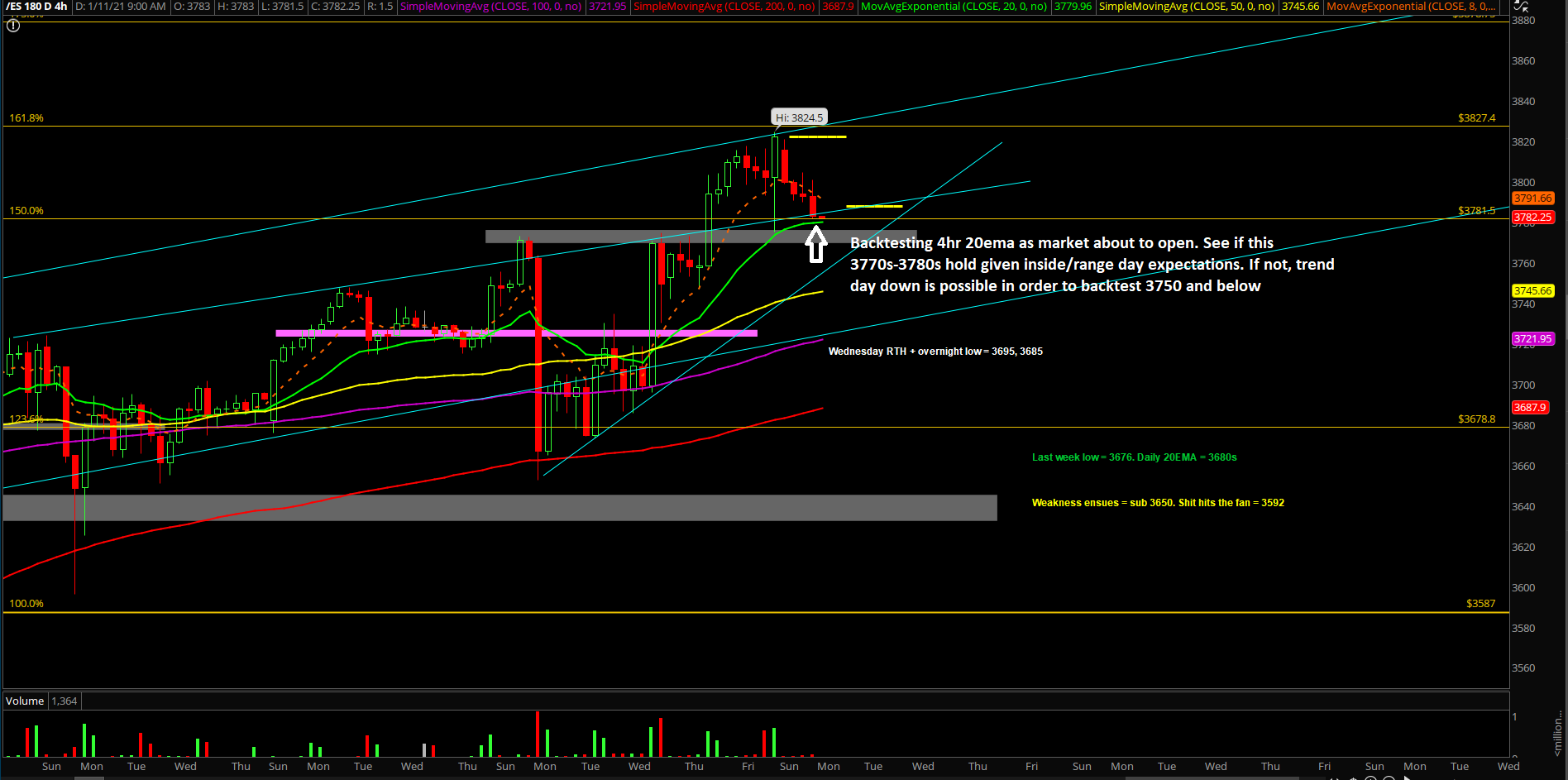

Friday closed at 3822 on the ES as price action wrapped up at the multi-week uptrend channel resistance. We’re expecting some healthy digestion/consolidation for today and maybe extend into tomorrow dependent on how the backtest structure goes vs 3770s-3780s support. Adapt accordingly.

Summary of our game plan:

- All immediate targets have been fulfilled as last week played out accordingly into the 3780-3800 target/all time highs and then some more as price action hit the multi-week channel resistance

- The context is that it’s been 4 days straight up since the daily 20EMA backtest into new all time highs (3650s->3820s which is about +4.6%).

- Price action going to open as a gap down on for RTH, price is also within Friday’s range for now. Meaning our expectation of inside/range day has merits as price action consolidates.

- We’re going to utilize rangebound strategies to capture a few points here and there vs key levels.

- Immediate key supports are located at 3785 and 3775 where the latter was the low of Friday+prior all time highs breakout area from last week (3770s).

- For educational purposes, an inside/range day would be constructive and healthy after 4 consecutive days of higher lows and higher higher. Price action is letting internals and rotation do its thing. Just do mindful of key momentum levels such as 4hr 20ema as price is backtesting.

- No new immediate targets at this time given the structure on the short-term charts. Level by level approach and know your timeframes here. You must adapt your opinion and expectations with the ever changing market.