Expanded 2nd Wave - Market Analysis for Aug 9th, 2023

For those following me through the years, you would know that if the market provides us with a potential bullish count, that is going to be my primary. And, the main reason is because if the market takes off, and we are not ready for it, it is VERY hard to find an entry. However, if the market only meanders to the upside in that structure, we can then lighten up, or also stop out on a break of support, only to re-enter at a lower price. So, as I will continue to handle the metals market as I have in the past.

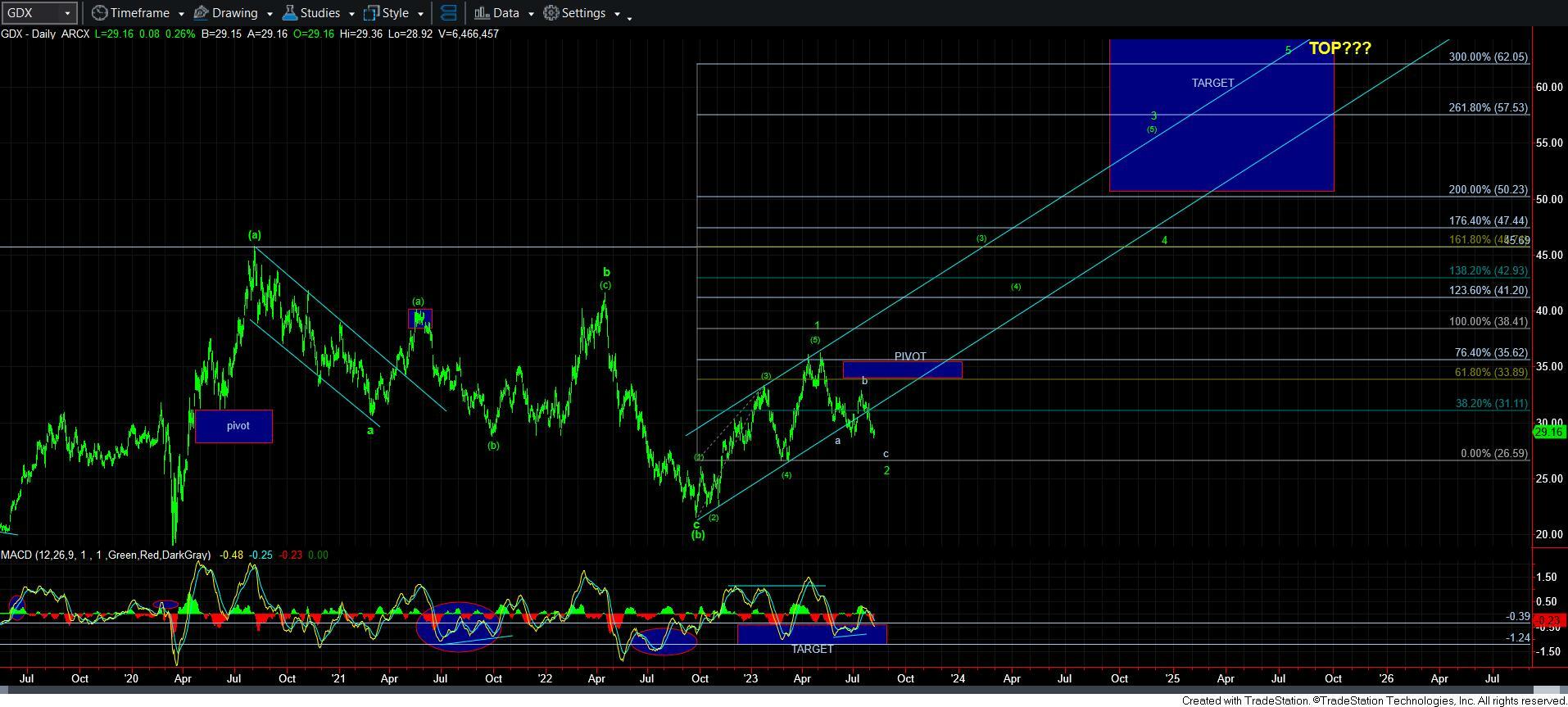

As I reminded you in my live video this morning, when the market rallied into the high struck the day before the last Fed meeting, I suggested that there was really no downside to lightening up in your long positions. I surmised that we were close enough to a potential 5th wave higher high that we would likely be able to buy back the positions at lower prices during a 2nd wave pullback. And, if the market was not going to get a higher high, and provide us with a deeper wave 2, well, then it clearly was a good opportunity to lighten up. I really did not see much downside to that call at the time. And, we can see it has paid off.

For now, it does look like the NEM has been the ‘tell,’ as the direct move lower seems to be the markets plan. And, the clearest path to that is presented on the 144-minute silver chart.

As you can see, in the purest form of EW, I am viewing this low that I think we are trying to develop as wave iii of [iii] within the [c] wave of the 2nd wave. That means that I am still expecting 2 more lower lows after this wave iii completes. And, we are also seeing the positive divergences on the MACD that we like to see as we are setting up for a bottom.

Of course, alternatively, we can always bottom after one series of a 4th and 5th wave. Yet, if one does not have appropriate positions already in place, or if you want to redeploy some of the capital you raised near the high, the next lower low may be a good spot.

When I look at GDX, I have issues with the proportions of the c-wave relative to the a-wave. But, when I take note of NEM, it really does make sense to me. Yet, even NEM needs AT LEAST one more 4th wave bounce and a lower low thereafter. And, to be honest, it would be quite perfect if it followed the silver fuller 5-wave count as well.

Gold is one I am having a hard time figuring out. I even tried to review a 60-minute chart of GLD to see if there was further information I could glean. And, there is a potential 5 waves up, from which we are trying to see a corrective pullback. I really do not have a lot of confident in this structure just yet. But, it is something I am going to watch.

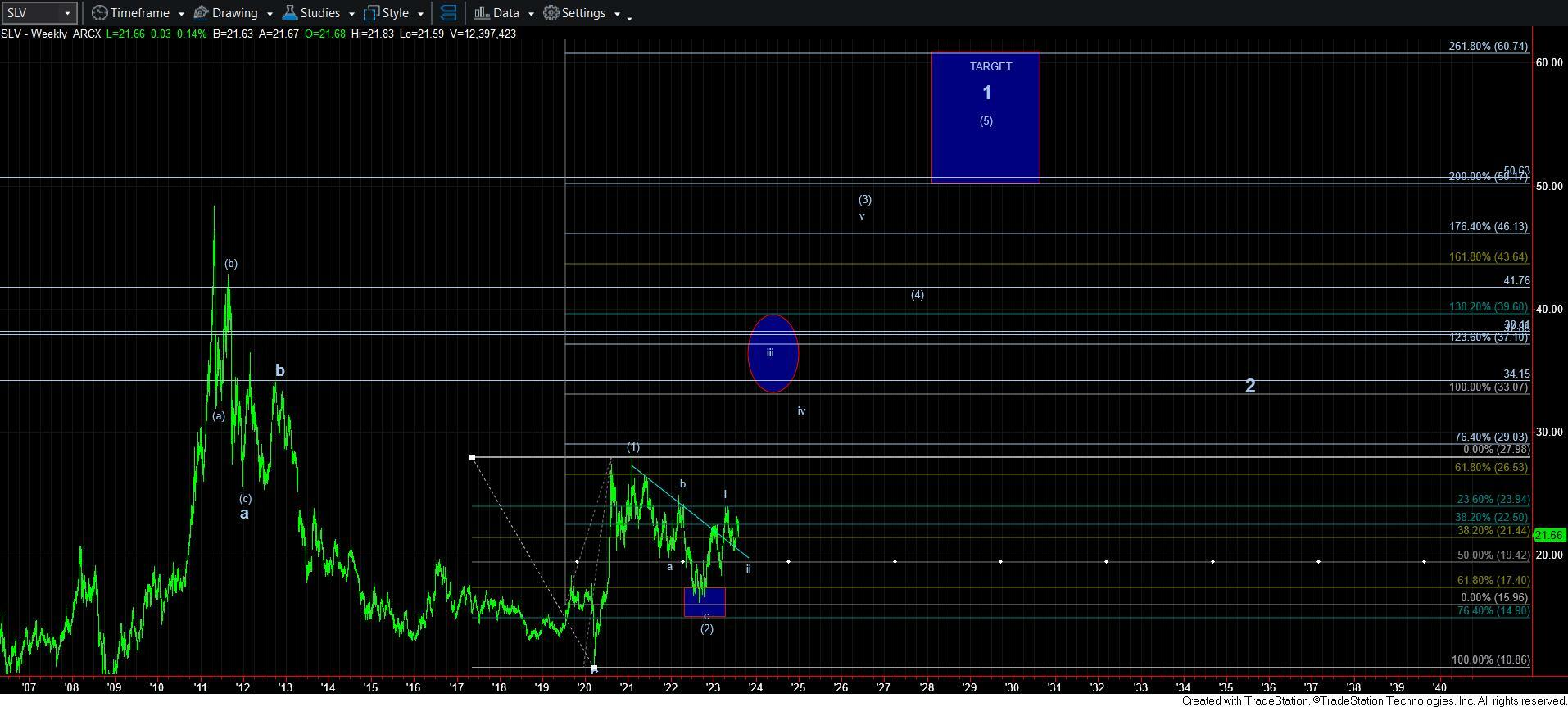

Overall, when we zoom out, as you can see from the SLV weekly chart, we are still very much setting up for a larger rally over the coming year or two. While it has certainly taken a lot longer than I had expected for this to set up, we seem to be bottoming in a larger 2nd wave. So, the bigger picture has not at all changed.

Yet, I am still waiting for the next [i][ii] structure off a low we create in the coming weeks to make me consider adding further aggressive long positions. In the meantime, I am going to follow the silver chart, and if it completes the full 5-waves down as outlined, then I may be adding more aggressive long positions based upon that full c-wave structure.