Existing Bull Train Given Another Chance

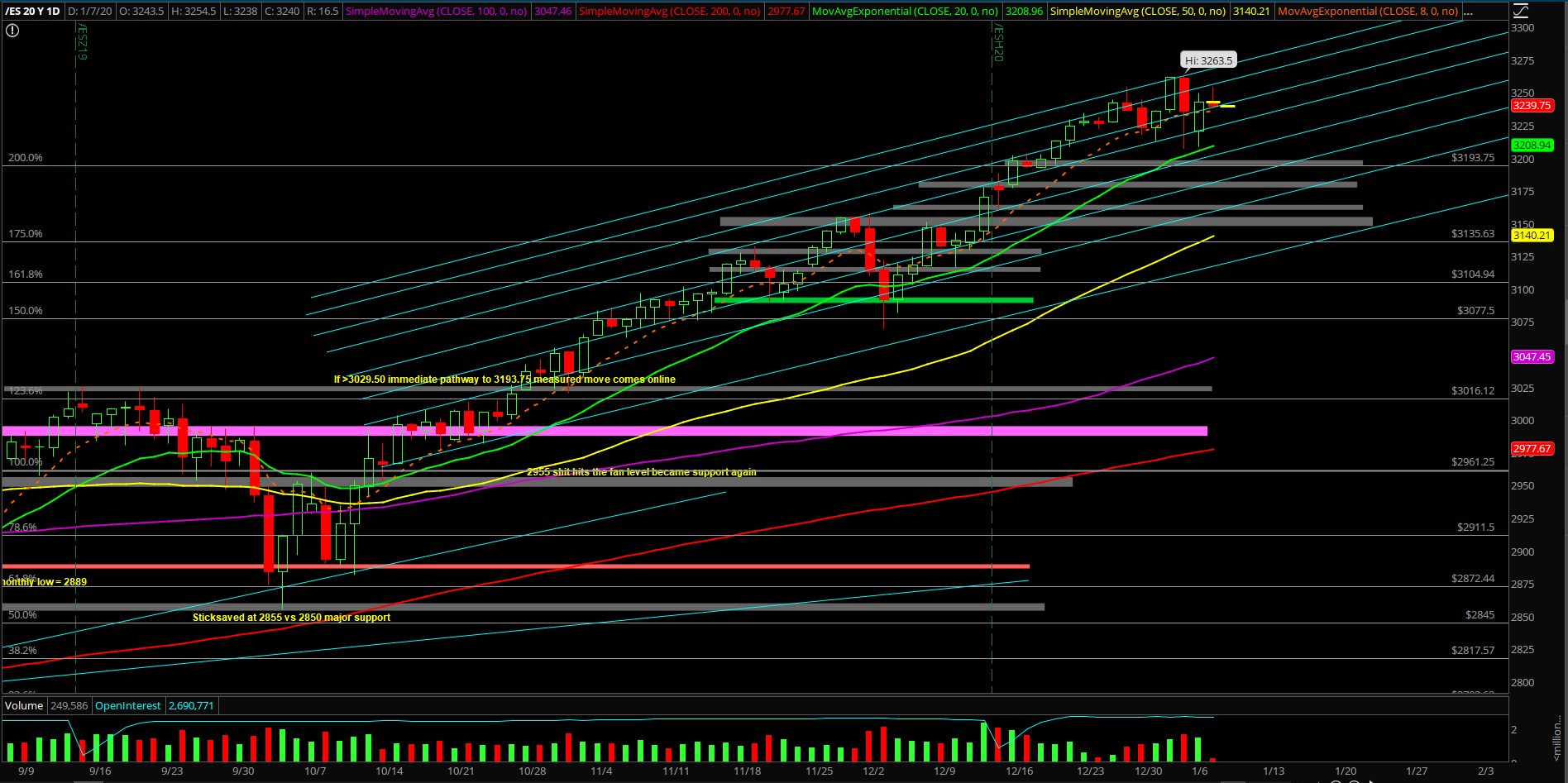

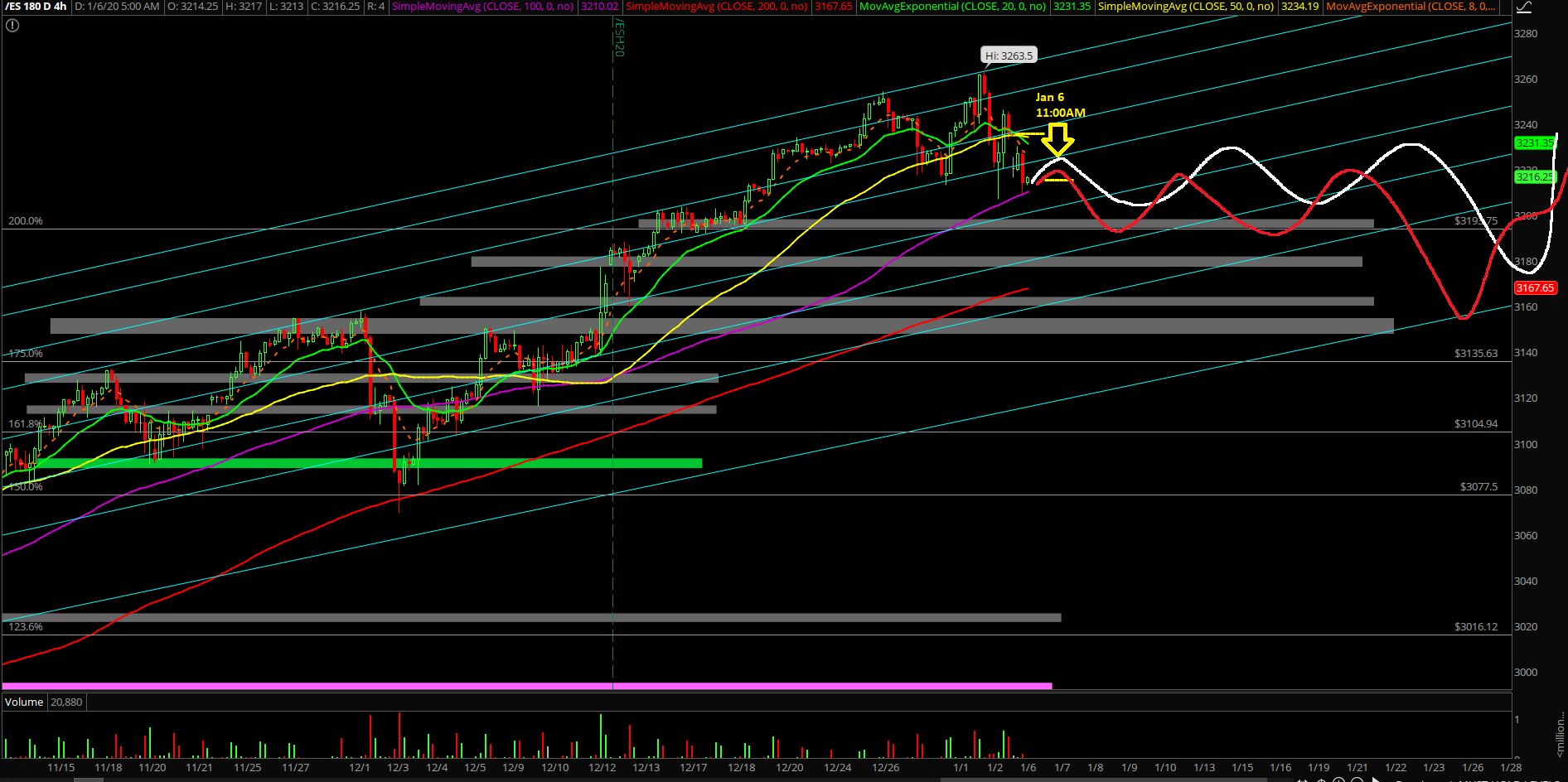

Monday played out as a rangebound session that overshot into the resistance levels by a little as it reclaimed the 3225/3235 pivots on the Emini S&P 500 (ES) and then eventually gunned for the 78.6% retracement around 3250. Basically, it was just an inside day within Friday’s large range session that traded between 3263.5-3206.75. In other words, the "shakefest" is continuing.

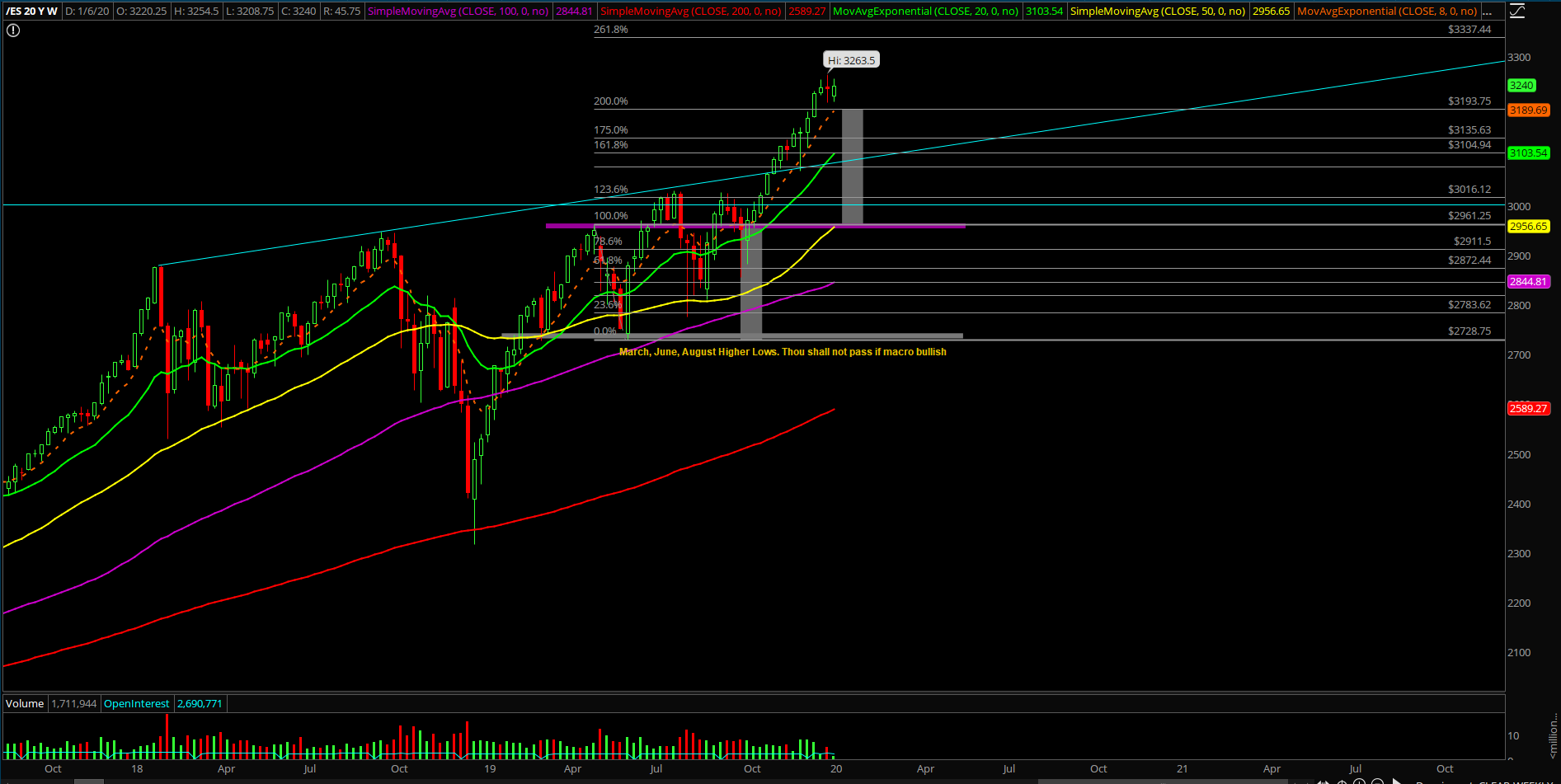

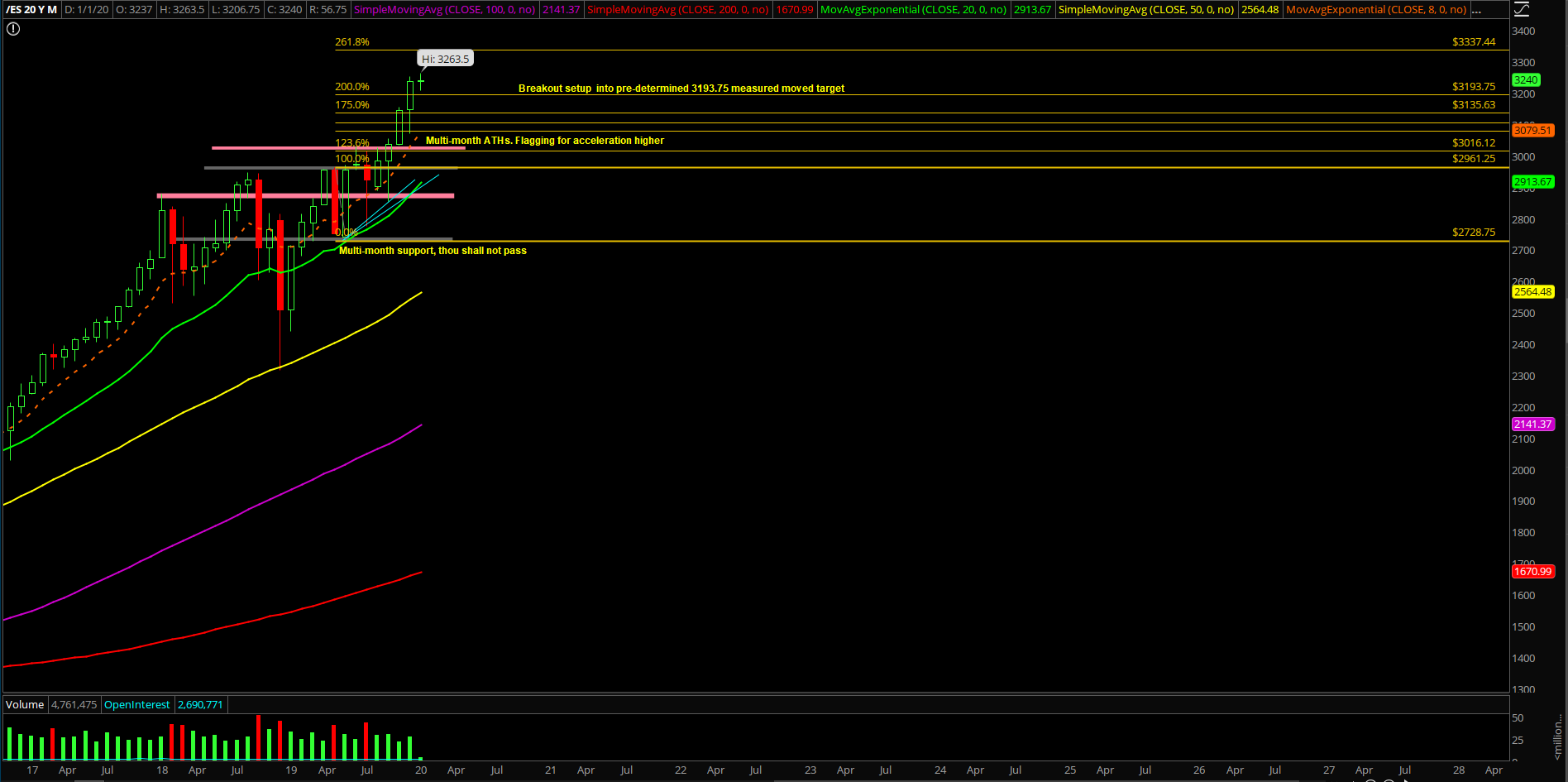

The main takeaway from this session is that the bears/mythical creatures were not able to confirm things by closing below daily 20EMA 3200~ and that it is allowing the existing bull train another chance to play this out as another high-level consolidation structure due to the nature of the formation. We still think there’s more downside pressure and potential than upside at the moment, but things could change rather quickly if price action proves us as dead wrong.

What’s next?

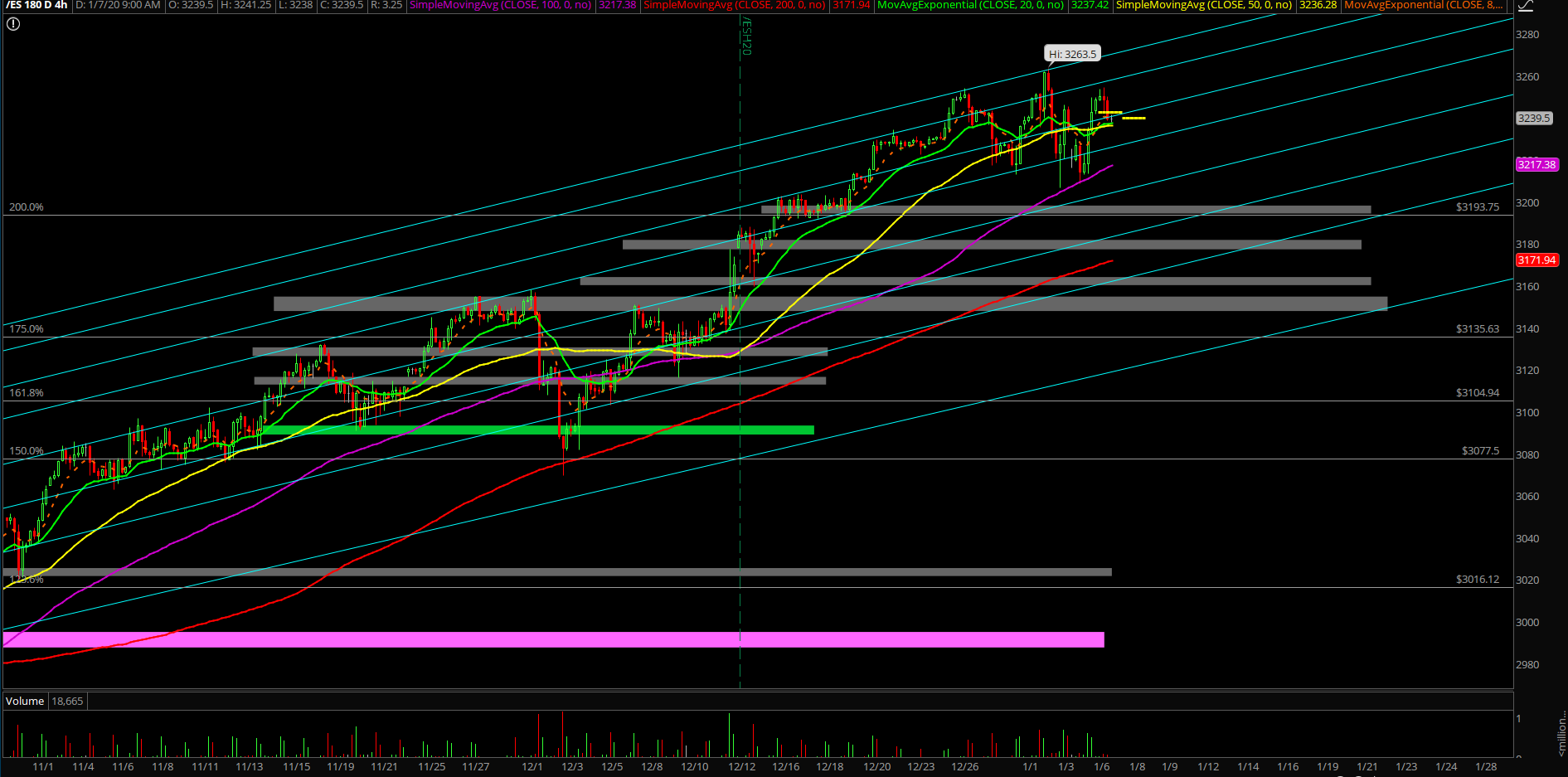

Monday closed at 3242.5 on the ES as price action held the daily 20EMA for another day alongside being an inside day within Friday’s unsustainable bottom wick candle. Again, this week in general will be all about whether the ES closes above or below daily 20EMA to prove that it’s time for mean reversion for the bears/mythical creatures or the existing bull train continues like clockwork.

Here's a section from our premarket ES game-plan report:

- Based on current assessment, rest of January’s pre-determined range is 3263.5-3155 until further notice or new clues. There is a little more downside risk than upside risk at the moment

- This means that traders should go back to the drawing board and be careful of utilizing aggressive BTFD strategies that have been working resiliently for the past few months printing ‘easy money’

- This is likely the time to utilize rangebound strategies where bi-directional trades work well in a pre-determined rangebound setting against the key levels instead of just the one directional bull train trade setups

- 3190-3200 will be the temporary floor on micro for now alongside with 3177 as the next key support/ confirmation level given that it’s going to be a consolidation month for the time being

- 4hr white line and red line projections showcase our primary and alternative scenarios for rest of this week and into next week, at least until they invalidate or the odds change

- However, if we’re dead wrong and things keep stabilizing above 3225/3235 for next few sessions and then go for another higher high breakout above 3265 then you know this bull train is not slowing down for anybody

What are the key levels to be aware of?

- Resistances 3245, 3250, 3265, 3280, 3300

- Supports 3235, 3228, 3225, 3215,3208,3200,3190 ,3177, 3172,3165,3158, 3150, 3140,3135, 3125, 3120, 3117, 3112, 3107, 3100, 3095, 3082, 3074, 3063, 3050, 3035, 3030, 3016, 3000

Trend day vs. range day?

- Likely another range day as price is just overshooting the 3235 pivot by a little but remains in a confined range of Friday’s large range session 3263.5-3206.75

- Close above/below 3235 is the first key hint because that is the midpoint of the Friday range, then we can establish more clues from above or below daily 20EMA that hovers around 3200~.