Exciting Action, But No Bottom Confirmed

While the action was quite exciting today in the GDX, and I am sure it got many of your bullish juices flowing, I cannot confidently proclaim that a bottom has been struck. While I will view the potential that a wave (ii) may have been struck, I am going to maintain my primary count as looking lower unless the market is able to move through the 22.85 level, as I noted so many times today.

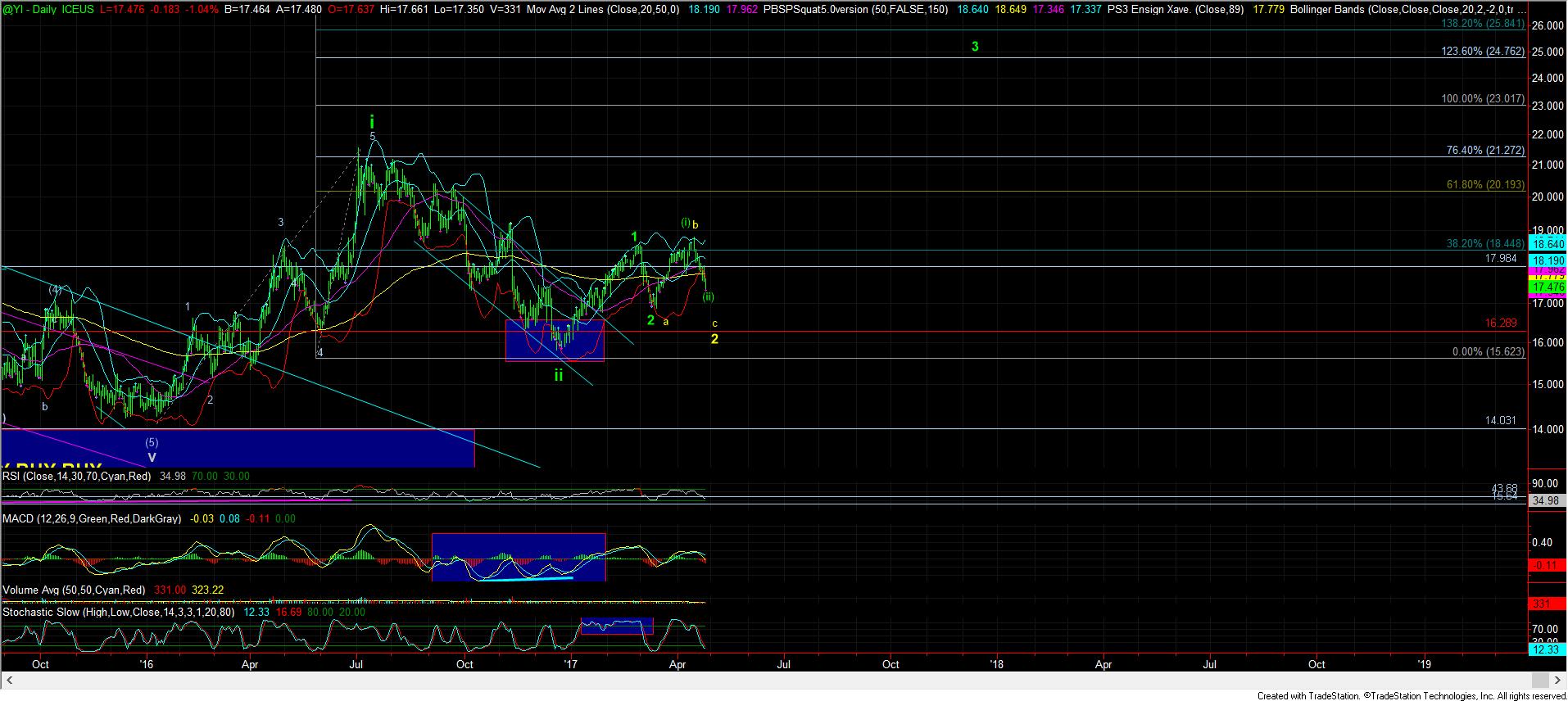

As we see on the 8-minute GDX chart, I am primarily counting today’s rally as a c-wave in an expanded wave iv of 3. As long as we hold below our resistance region, I am looking for resolution lower in this set up to complete all 5 waves down in a c-wave of wave (2), as outlined on the chart.

However, should we see the market impulsively break out through our resistance region, I will be more amenable to the more immediate bullish count on the charts. In fact, we can count a 3 wave decline wherein the last wave down is equal to the 1.382 times the size of the first wave down, which makes it a reasonable point to bottom in a wave (ii). But, again, this is only my alternative count until it proves itself.

The issue I am having with accepting this as a wave (ii) bottom in silver is that I just don’t have the usual positive divergent bottom I would expect in a c-wave of a wave (ii) in silver on my 144-minute chart. That is not necessary for the market to have bottomed, but it certainly provides that indication to me more often than not.

As far as GLD is concerned, I am just waiting patiently as it completes its corrective pullback, and will be on the look-out for our first true impulsive move off a low.

So, for now, pressure still remains down in the complex, but I am clearly on high alert for a potential bottoming.