Easy Trading To End Soon

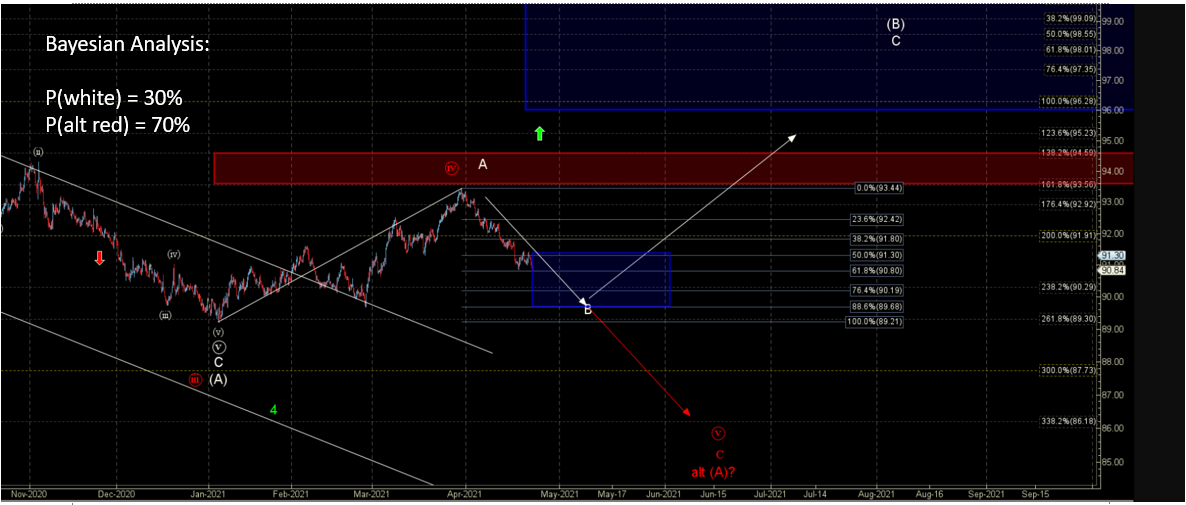

The SPDR S&P 500 ETF (SPY) got caught in the 414-418 resistance band for nearly two weeks, as expected. Bayesian Probabilities indicated the break would be lower out of this band, but premarket action on 4/29 indicates the 32% path higher was selected (vs. the 68% of a move lower).

That’s how probabilities work; net net on average they keep you on the right side of the trade, but lower BP will happen. Action over the next several days (or even hours) will dictate whether we get in or not now on the long side.

As May approaches, another bullish leg is expected, but from what I am seeing the easy trading is coming to an end soon. Nothing in my longer-term work is pointing to this bull market making past the summer of this year. In the future, I will do my best to explain what the BTS is seeing 2H 2021.

From before: Given the nature of the divergences between stock sector ETFs and various other things, Bayesian work is pointing to this melt up ending this summer (if it even makes it to early summer). And my longer-term Bayesian work remains consistent in calling for at least several quarters of grinding to down price action that could extend into 2022 (and beyond) once a peak is found in the next 1-3 months. At a minimum, I’d expect trending moves to be difficult to come by in the 2H of this year (bullish and even bearish, as bearish paths are notoriously tricky to short).

Longer-term note: My Bayesian work sees a blow off top (of which is now setting up more as a blow off fizzle) into the summer of this year and then things get tricky; as preliminary work points to at least a several quarter (if not a generational top). Thus, BPs continue to indicate SPY has entered a multi-quarter topping region with downside targets lower in the 2H 2021 vs highs hit in 1H 2021. Can this change? Of course ... but given I remain fully long with longer-term funds, it really doesn’t matter in the present. It will be this summer when we will need to make important longer-term decisions. Stay tuned.