ES Trend Change Battle, NQ & RTY Remain Weak

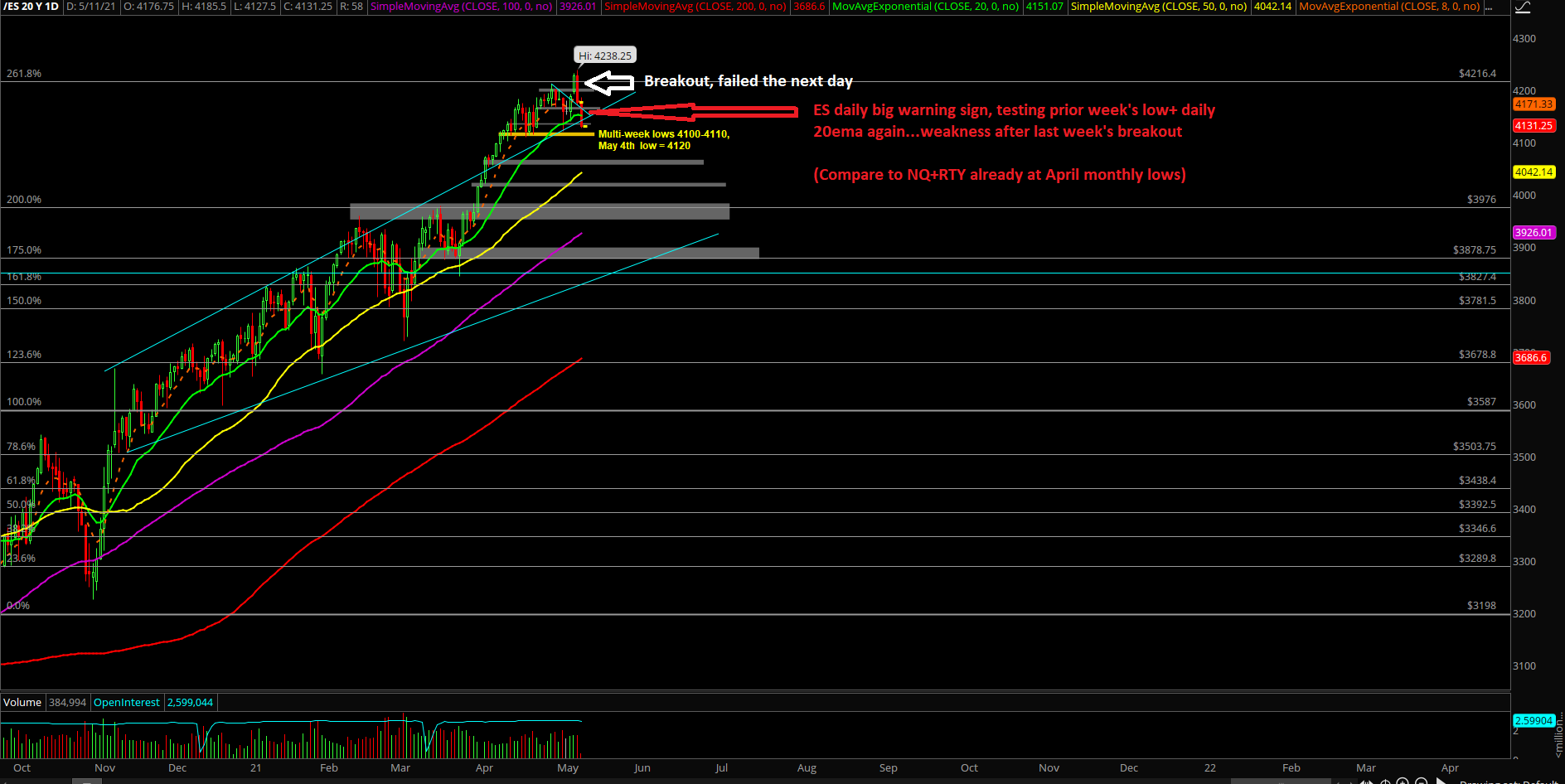

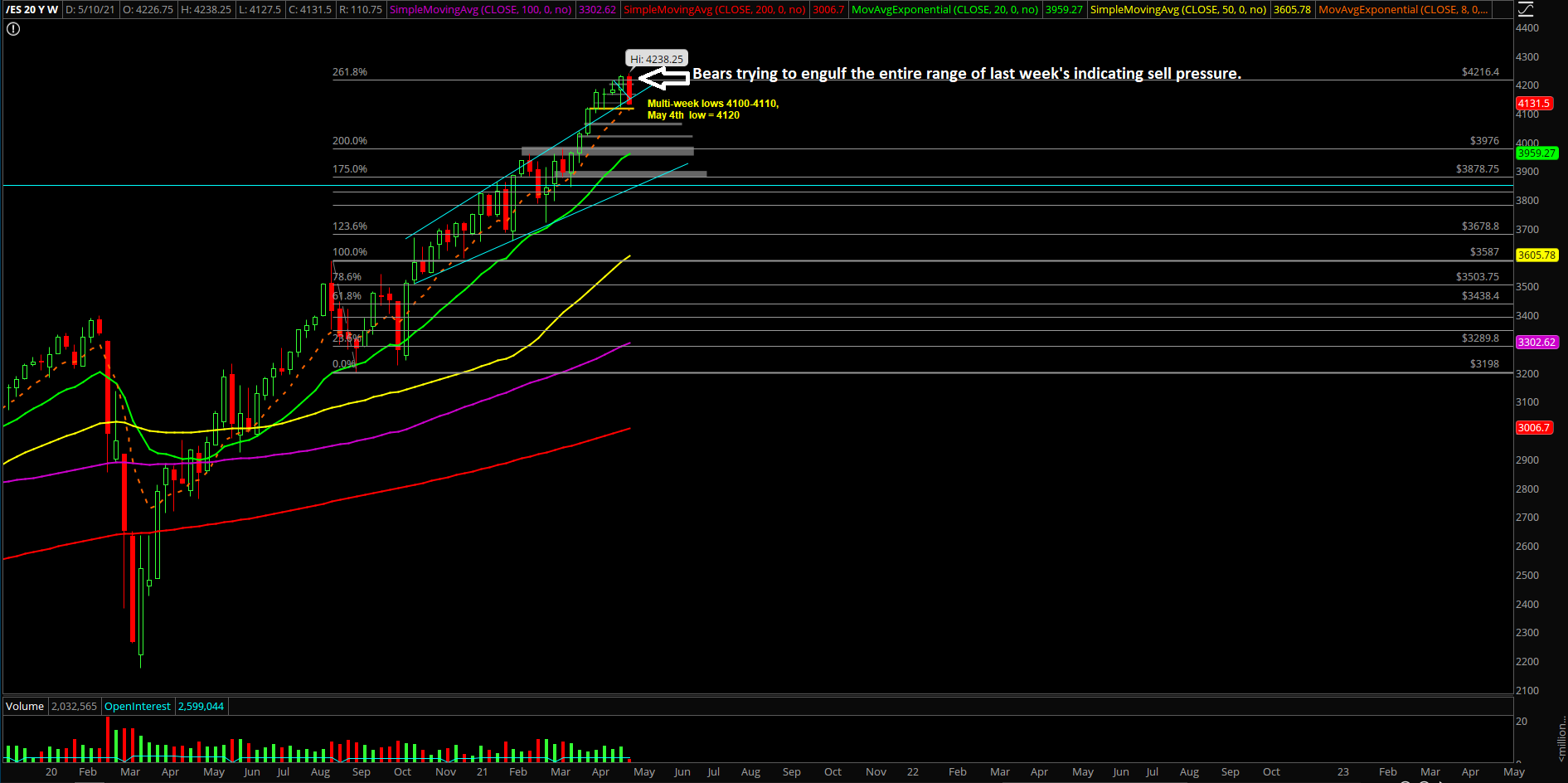

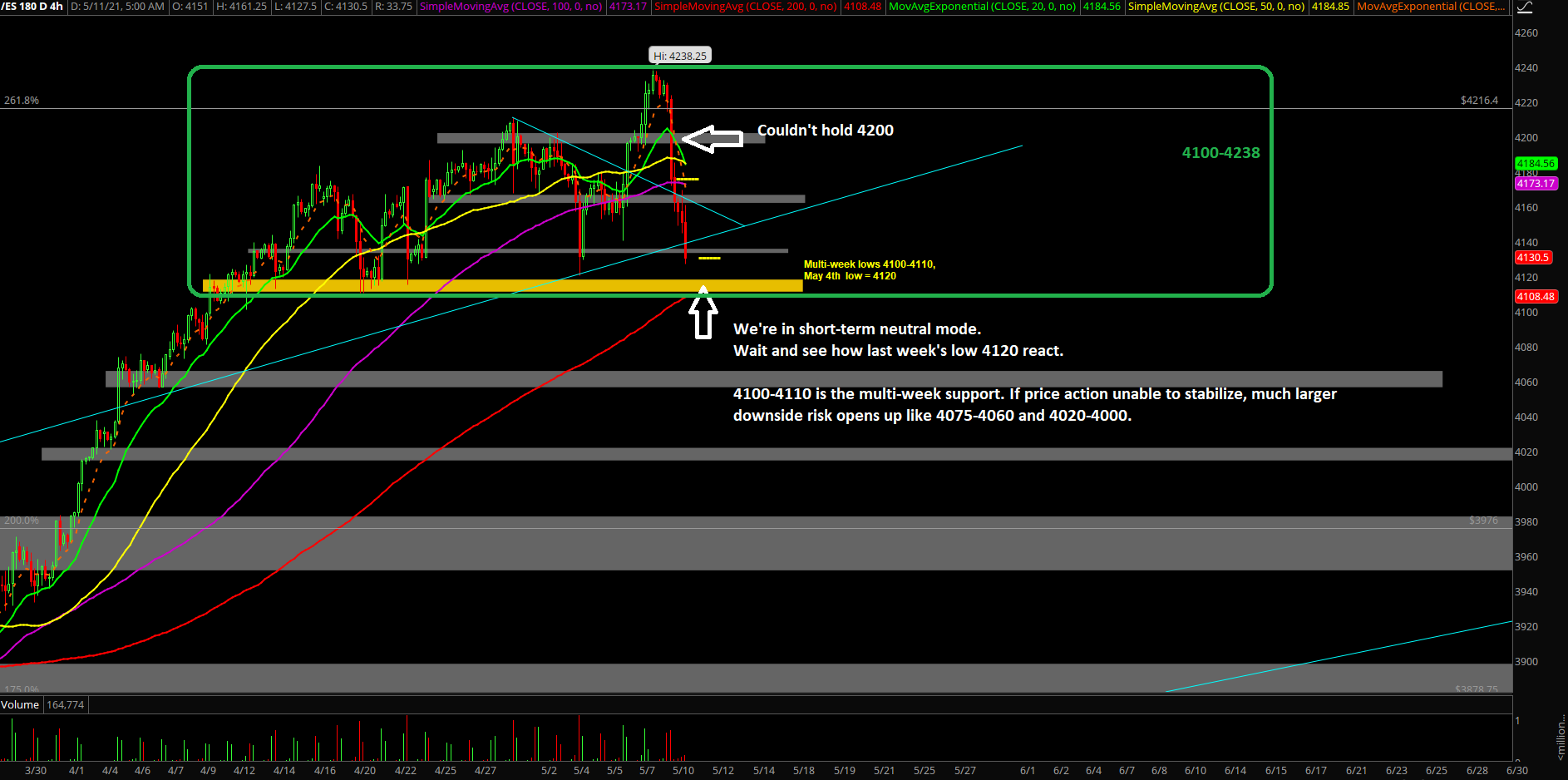

Monday closed at 4175.75 on the Emini S&P 500 (ES) as a trend day down and sustained below key 4215/4200 support levels. We’re back to short-term neutral mode as last week’s breakout has been unable to sustain above 4200.

There is short-term downside at risk again due to last week’s 4120 being backtested here and the weakness being spilled across the indices. (ES relatively strong for now, but could change quickly.)

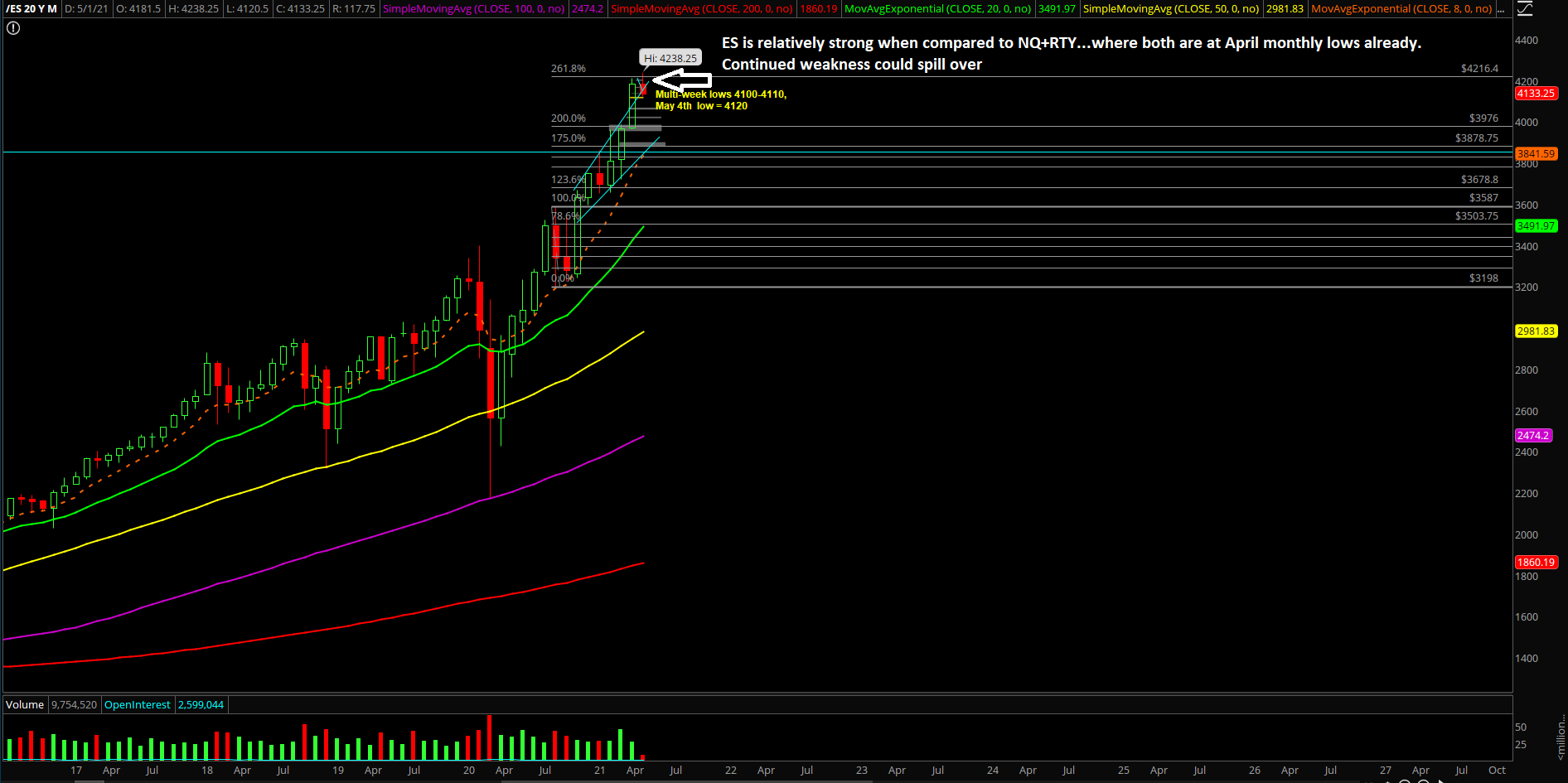

For reference, the Nasdaq and Russell 2000 futures (NQ and RTY) are hovering at April monthly lows as of this morning and they are in short-term bearish mode given yesterday’s breakdown.

Let's wait and see how last week’s 4120 low in the ES reacts. Does it stabilize or does it slice through? For reference, the multi-week range low from April is 4110-4100, so it’s a key confluence area.

We may change to short-term ES bear mode quickly if sellers sustain below 4120 to open up the downside range.

4075-4060, 4025-4000 are the next risk zones if price slices through current supports.

Bulls would need to reclaim 4185 to stabilize this on a daily chart timeframe.