Downside Setup Still Developing In Metals

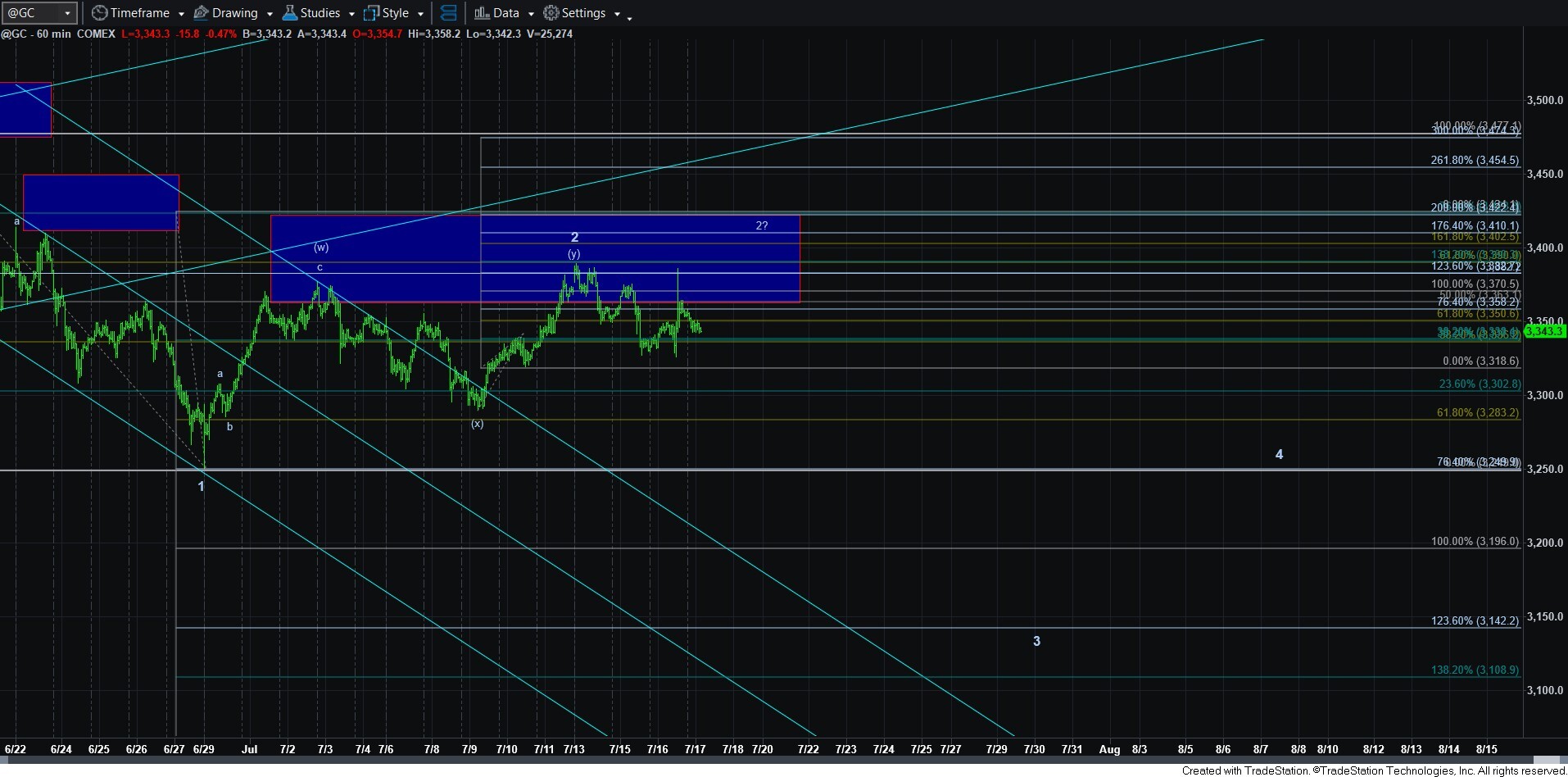

For those that have been following my analysis, you would know that I have been expecting a downside move to complete this correction in the metals before the next and likely final rally completes this long-term bullish cycle.

In both gold and GDX, I have been tracking a 1-2 downside structure for their respective c-waves to complete a larger degree 4th wave. However, this 2nd waves I have been tracking has become quite unreliable, as it now relies on more of a w-x-y pattern than a standard a-b-c for a wave 2. While I can technically maintain an a-b-c for wave 2 in GDX, I cannot say it is highly reliable since the top of its potential wave 2 last week.

In gold, if wave 2 is done, then it has done so with a w-x-y, which, again, is not the most reliable of set ups. Moreover, there is still potential it may want to spike higher one more time in a more complex ED for the [c] wave of 2. And, if we fail to see a downside move develop as a wave 3 in its bigger ending diagonal lower, then I will likely have to more strongly consider a bigger b-wave triangle as continuing to develop, which may even take us another few weeks before it completes.

So, in the near term, while there is a reasonable structure in place to consider that we see a downside follow through, I cannot say that I am highly confident in that follow through right now due to the unreliable structure which has developed. But, as long as GDX remains below the 54 region and gold remains below the 3430, I have to continue to look lower.

In silver, while it is unorthodox to see a large expanded b-wave structure as I currently have it counted, it would be a bullish indication for silver. But, it still leaves me wanting for a c-wave decline. And since c-waves are most often standard 5-wave structures, that is how I am presenting the current count with the completed wave 1 of that c-wave being struck at the low on the 15th, with the rest of the action since also providing us with an expanded b-wave flat. However, I am now considering that the expanded b-wave flat was merely part of a larger a-wave, since the a-wave of a wave 2 usually attempts to target the .382 retracement of the wave 1. That means that I am still reasonably seeking one more push higher to the target/resistance box noted on the 8-minute chart. So, for now, this seems to be the most likely scenario playing out in silver.

That means that as long as silver remains below the 39.20 region, I am going to be looking down for a c-wave follow through, as outlined on the 144-minute chart.

I want to stress again that this is not the most reliable of downside structures that I am presenting. Therefore, most of you should not be aggressively shorting for downside follow through. Rather, your focus should be in buying the completion of any c-wave decline we may see in the coming weeks.

Lastly, the next time we break the lows struck this week, I have to assume we are in a 3rd wave decline. If we see indications that this potential 3rd wave is not going to follow through, I will then begin to present the alternative potential b-wave triangles.