Downside Patterns Have Completed

With the drop today in silver, we have enough waves in place to consider that the c-wave of 2 of iii has completed.

Moreover, we have a potential bottom in the GDX in wave 2, with a possible 1-2, (i)(ii) off that low – noted in green. However, the market has not yet invalidated a setup to drop towards the 21 region in the GDX until it breaks out over 23.10.

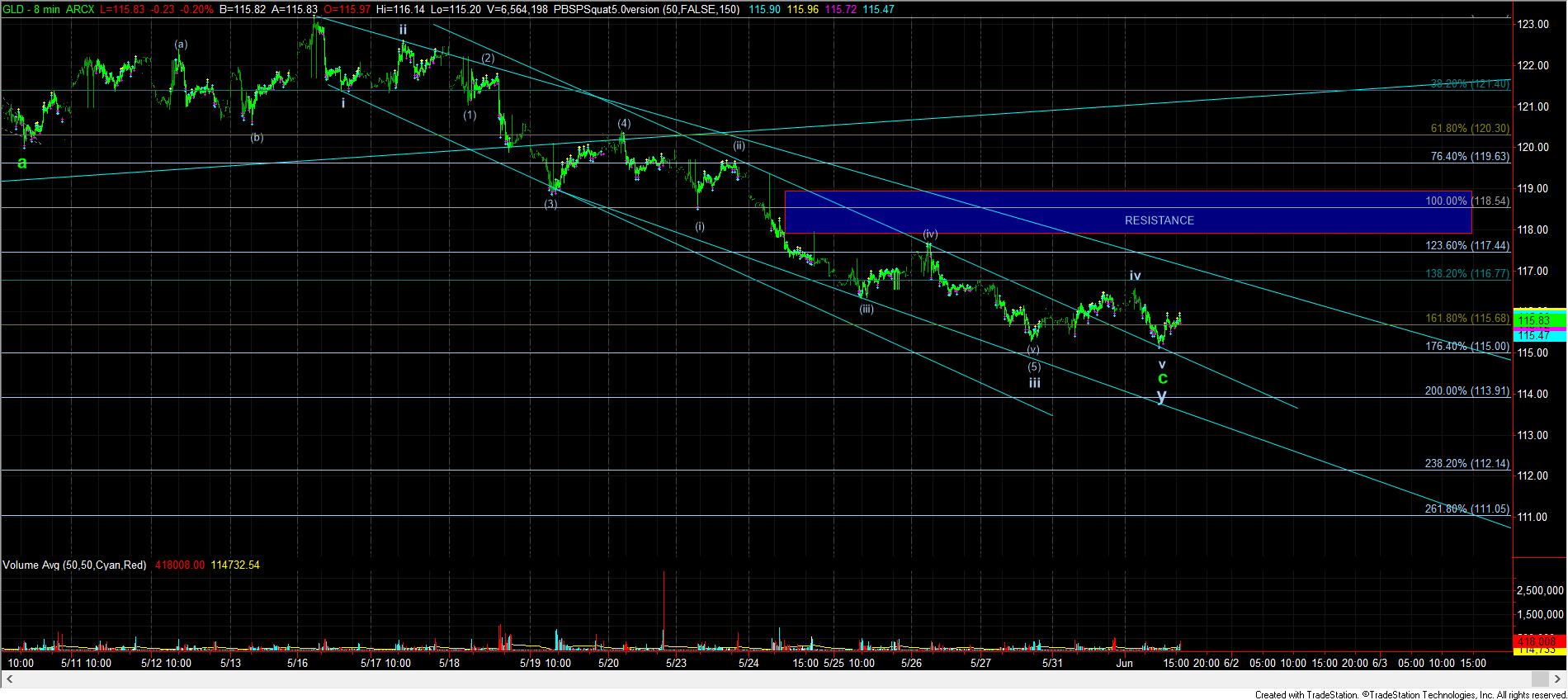

In GLD, while we have not quite struck the 113-113.50 region, we do have enough waves in place to consider this correction for wave ii as now completed.

But, it is one thing to have enough waves in place to consider a correction complete, and another thing to have our confirmed uptrend back in gear. So, in order to begin to confirm the uptrend is back, silver and GLD must take out their resistance regions, and GDX must break out strongly through 23.10, with follow through over 24.25. In fact, the next degree wave (i) of 3 of iii should be targeting the 25.85 region, which is the main break out region for GDX.

So, as we stand at the time of my writing this update, while I want to be very bullish, all we have a set up for a bottom, but we need a follow through to begin to confirm that the heart of a 3rd wave up is taking hold.