Downside Being Seen, But, Weaker Than Expected

I was unable to write an update as I was at doctor appointments this morning. So, I am going to outline what I am seeing so you can understand my conclusions.

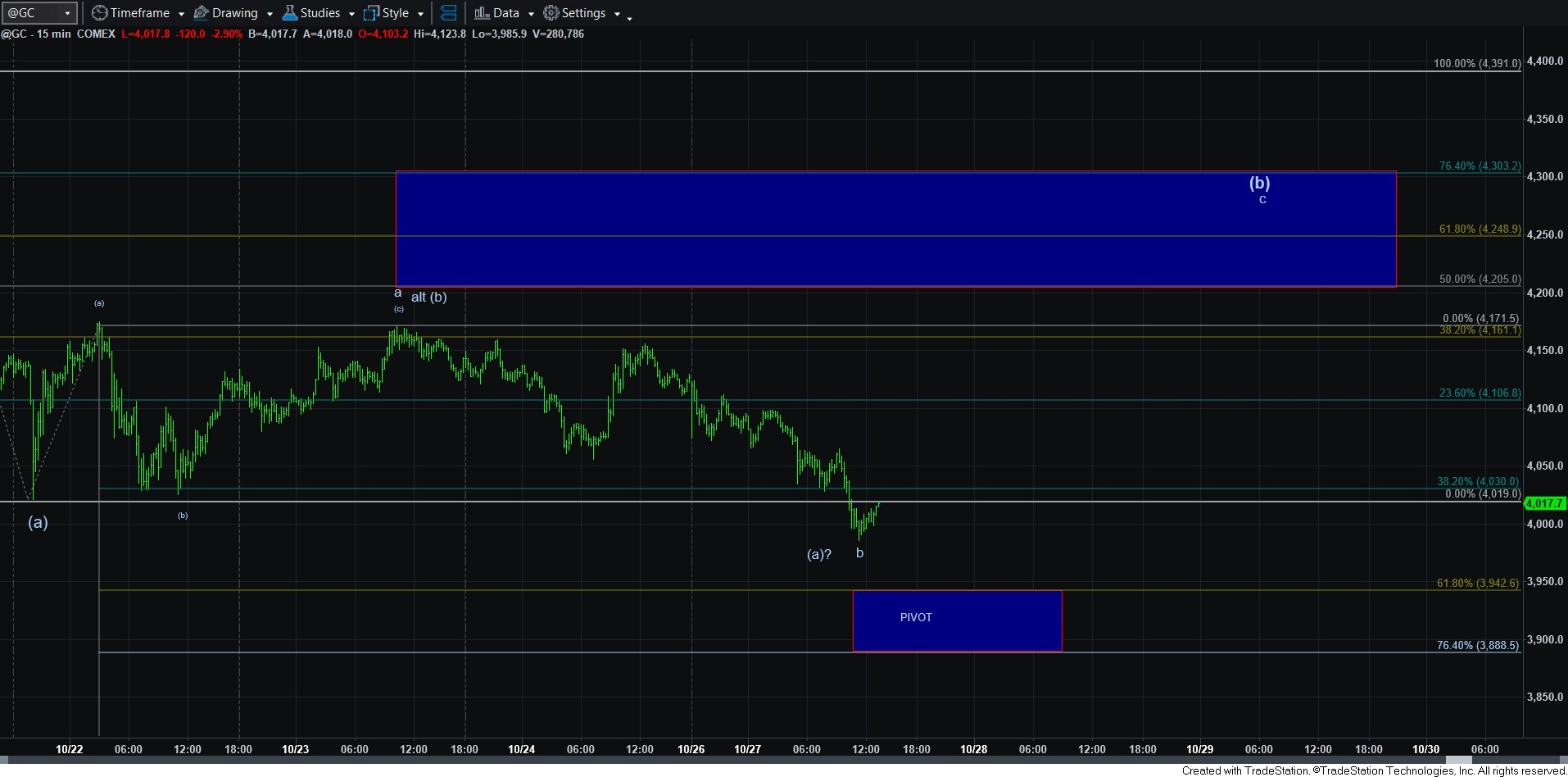

While we did see a “bounce” last week, that bounce only went to the .382 retracement of the prior decline. While it is “possible” that this was all the (b) wave we are going to get, as shown by the alt (b) noted on the charts, this is clearly not my primary expectation. In fact, I still think it is reasonable to expect more of a bounce. Let me explain.

To see a (b) wave that only retraces .382 of the (a) wave decline (with GDX not even reaching that point) is not terribly common. So, I have two other options to consider: Either the bounce was a 4th wave in a 5-wave (a) wave decline, or we are seeing an expanded b-wave structure, with this lower low being the b-wave of the bigger (b) wave.

At this time, I like the expanded b-wave a bit better than a 5-wave decline for the (a) wave for several reasons. First, the 5-wave structure would only be a diagonal, which I really do not trust. And, to be honest, it really does not count well as a diagonal. So, I may even lean more towards this already being the (c) wave decline more so than a diagonal at this point in time. So, again, it leaves the best option being this is an expanded b-wave structure.

In fact, GDX counts best as an a-b-c decline with the c-wave being a rather clean 5-wave structure. I would need to see the GDX break the 64.50 region to assume that this is already the c-wave down.

Silver is the most unclear of the various charts, but it too counts best as an expanded b-wave for right now. I am really not sure how to count it otherwise.

In Gold, I have added a pivot and as long as we remain over it, I have to assume either the expanded b-wave is taking shape, or even a bigger (a) wave decline.

For now, I still think it is reasonable to expect more of a “bounce” in the metals market before the expected c-wave decline takes hold. But, the market is much weaker than I initially expected at this point, so we at least have to entertain the alternatives that the c-wave has potentially begun. For now, that still remains my alternative.