Door Has Opened For Deeper 2nd Wave

With the market breaking lower today, the larger 2nd wave pullback potential has significantly increased in probability. Yet, I cannot yet tell just how high those probabilities have risen. Allow me to explain.

Normally, when we get a c-wave down, the structure of that move takes shape as a standard 5-wave Fibonacci Pinball structure. But, I simply cannot come up with a clear 5-wave downside structure based upon the initial manner in which we began this decline. So, it leaves me wondering whether it will take shape as an ending diagonal.

So, on July 26th, I strongly urged all our members in an update sent out before the Fed announcement to lighten up their long positions, especially the ones that are more short-term in nature. The main reason was that if the market would have provided us with a higher high to complete 5-waves off the recent low, you would still have likely seen a corrective pullback in a 2nd wave to re-enter at lower prices. So, there was not a lot of risk to lightening your load on the long side of the market. And, I hope many of heeded my suggestion.

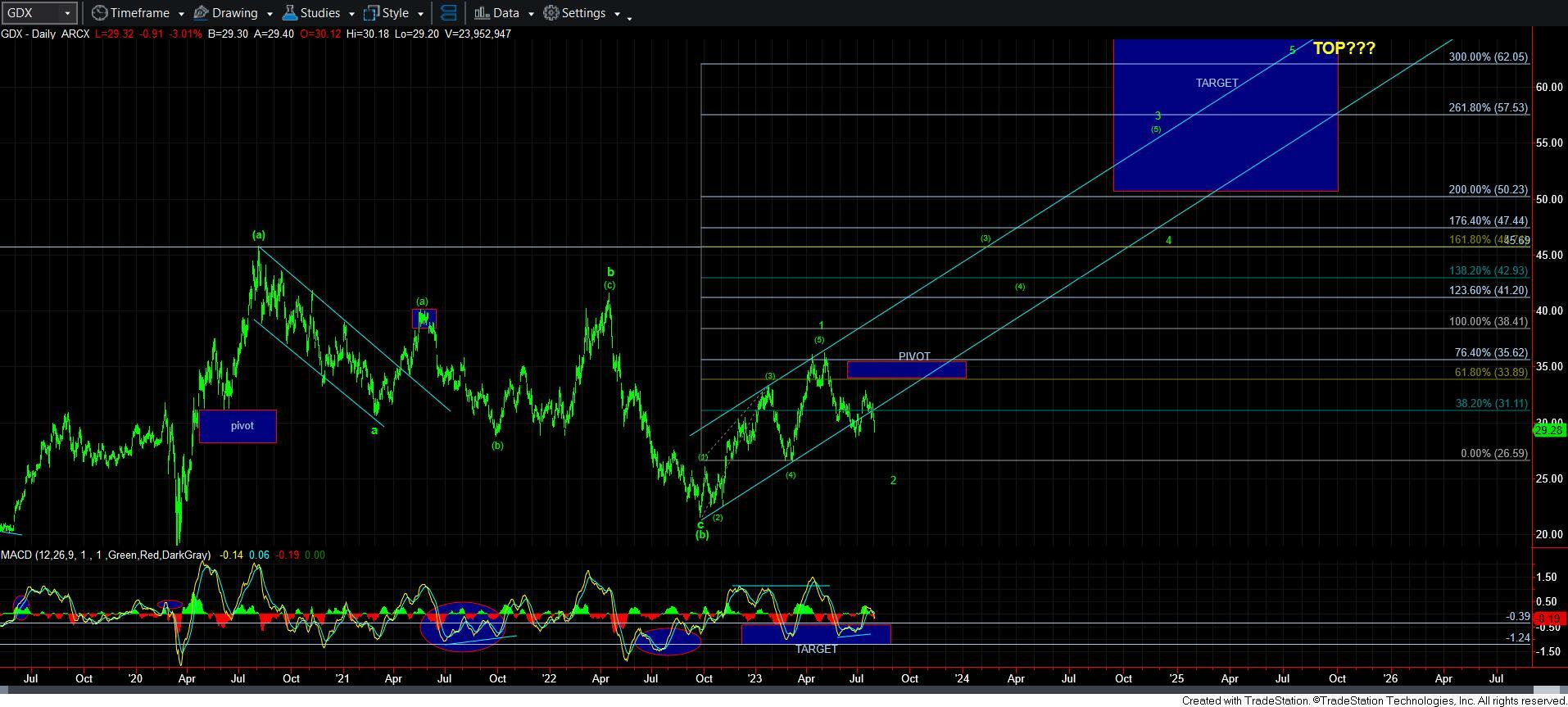

In the meantime, it would seem that the market is going to attempt a deeper 2nd wave pullback as we have been outlining as our alternative count. And, until I see a 5-wave structure that breaks back over the high seen last week, I think I am going to maintain this as my expectation, even though I do not have a solid micro count upon which I can yet rely.

Yet, I do want to note some potential for silver to prove us with more of a leading diagonal assuming we can still see a rally take hold in the coming days. Clearly, I do not rely upon leading diagonals until they prove a lot more of their structure to me. Yet, it is something I am watching based upon the silver chart, as it is hard to count the decline as a standard 5-wave structure. So, obviously, this is not something I am suggesting to anyone to trade to the long side at this time.

And, interestingly, I can see the same potential in GLD. Yet, I cannot say this is a reasonable option in GDX. Therefore, I am not suggesting anyone be trading for this potential at this time. I think it is more reasonable to be protective at this point in time.

Now, in the bigger picture, I am still very much expecting a rally to take hold, potentially in the fall, that can take us through 2024. This would be the 3rd wave that I still am expecting. So, in the bigger picture, nothing has really changed, other than providing for us a larger 2nd wave pullback. And, once we do confirm where this 2nd wave completes, I will set up our respective pivots as our targets and resistance for the next 5-wave rally we would expect off those lows.