Dollar (DXY) Still Pressing Higher in b-Wave

When I learned Elliott Wave analysis, one of the aspects of it that I appreciated is the fractal nature of the market. That meant that if a substructure within the market was not developing appropriately, it usually provides us early warning that the structure we are tracking will likely invalidate.

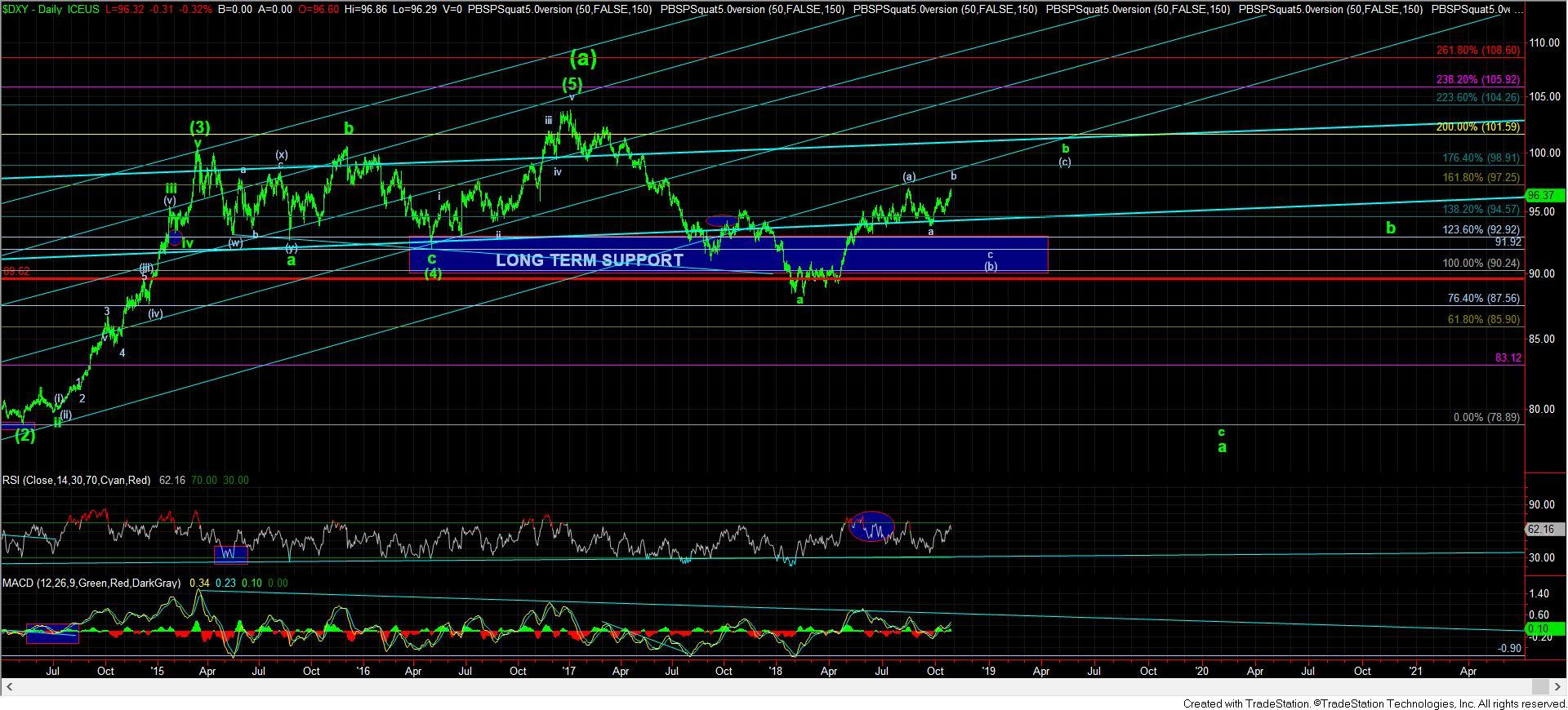

This is what happened over the last few weeks in the U.S. Dollar Index (DXY). While my expectation remains that we are going to complete a b-wave rally in the DXY and then see a c-wave drop, the market provided us warning signs that the c-wave decline may not yet be ready. Over the last few weeks, I presented these issues to you in my analysis, and warned that one should not look to the short side for a c-wave lower until the appropriate set-up developed. Yet, at the same time, it was hard for me to accept the risks of the long side, since going long for the final squiggles of a b-wave has not been something that has been profitable in my experience.

So, with the market providing me clues that the c-wave down may not follow through, this past week, it invalidated that immediate downside set up, and told us that the b-wave rally was going to push higher, and potentially up as high as the 98-99 region.

This past week, the market continued up to the point where we struck the (a)=(c) point within this b-wave rally on the daily chart. But, the (c) wave within that rally is not clearly a 5-wave structure. Therefore, until I see a break down below the 95.45 level in impulsive fashion, I have to at least recognize the potential of the DXY to extend up as high as the 98/99 region.

One of the other benefits of Elliott Wave analysis is that it provides you an understanding of where you reside within the general trend. When the market is within an impulsive structure, you know you can trade that aggressively with the trend. However, when the market is in a clear corrective structure, you know that caution is the perspective you must take. Currently, the DXY is within a b-wave within a larger degree b-wave, based upon my wave count. That means we are within a corrective structure, and they are the most variable form of wave structures within the Elliott Wave patterns. So, until we see strong cues of this b-wave ending, I will continue to suggest caution on the long side, at least until the c-wave down shows strong evidence of following through.