Déjà vu or False Hope?

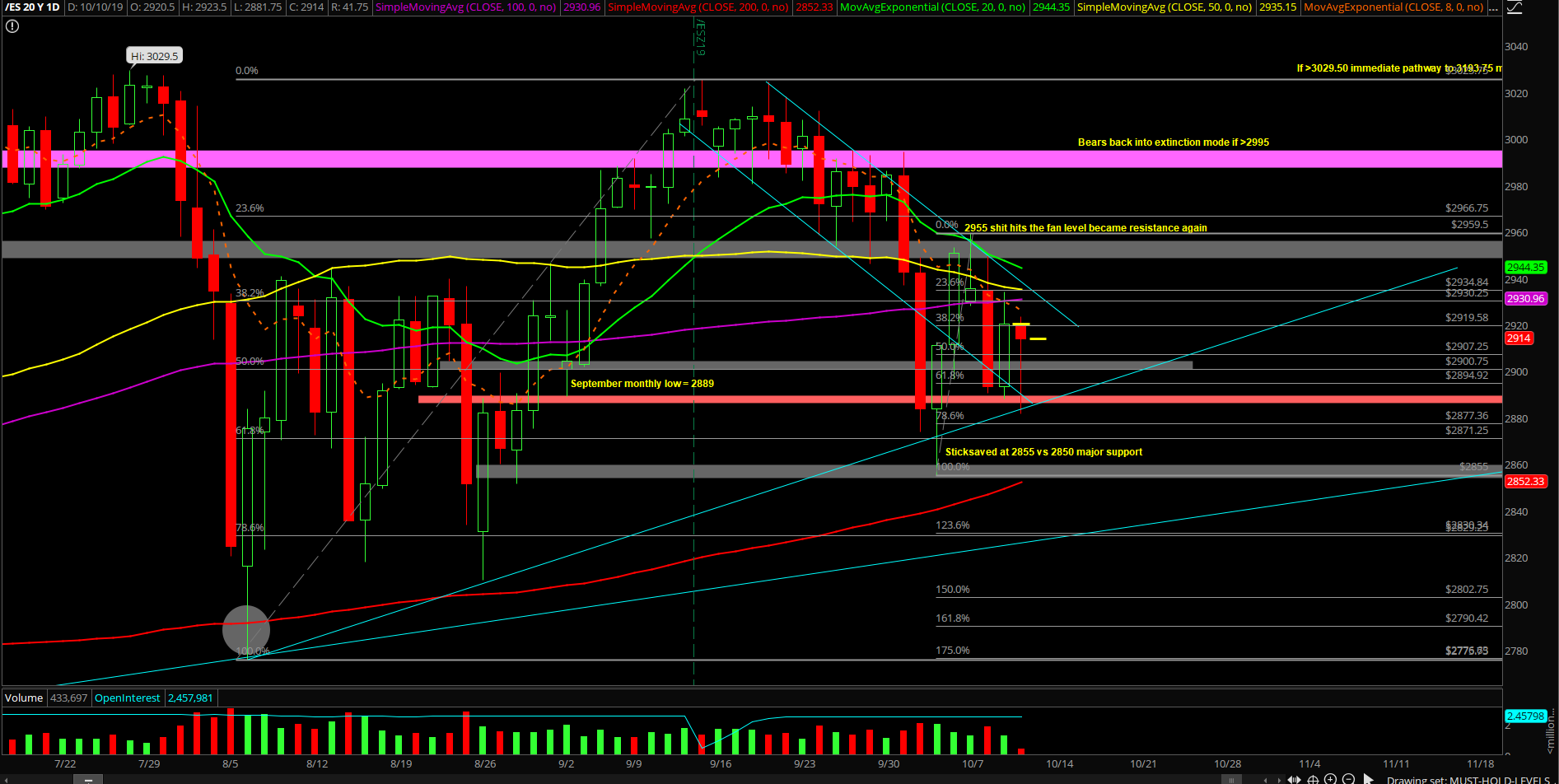

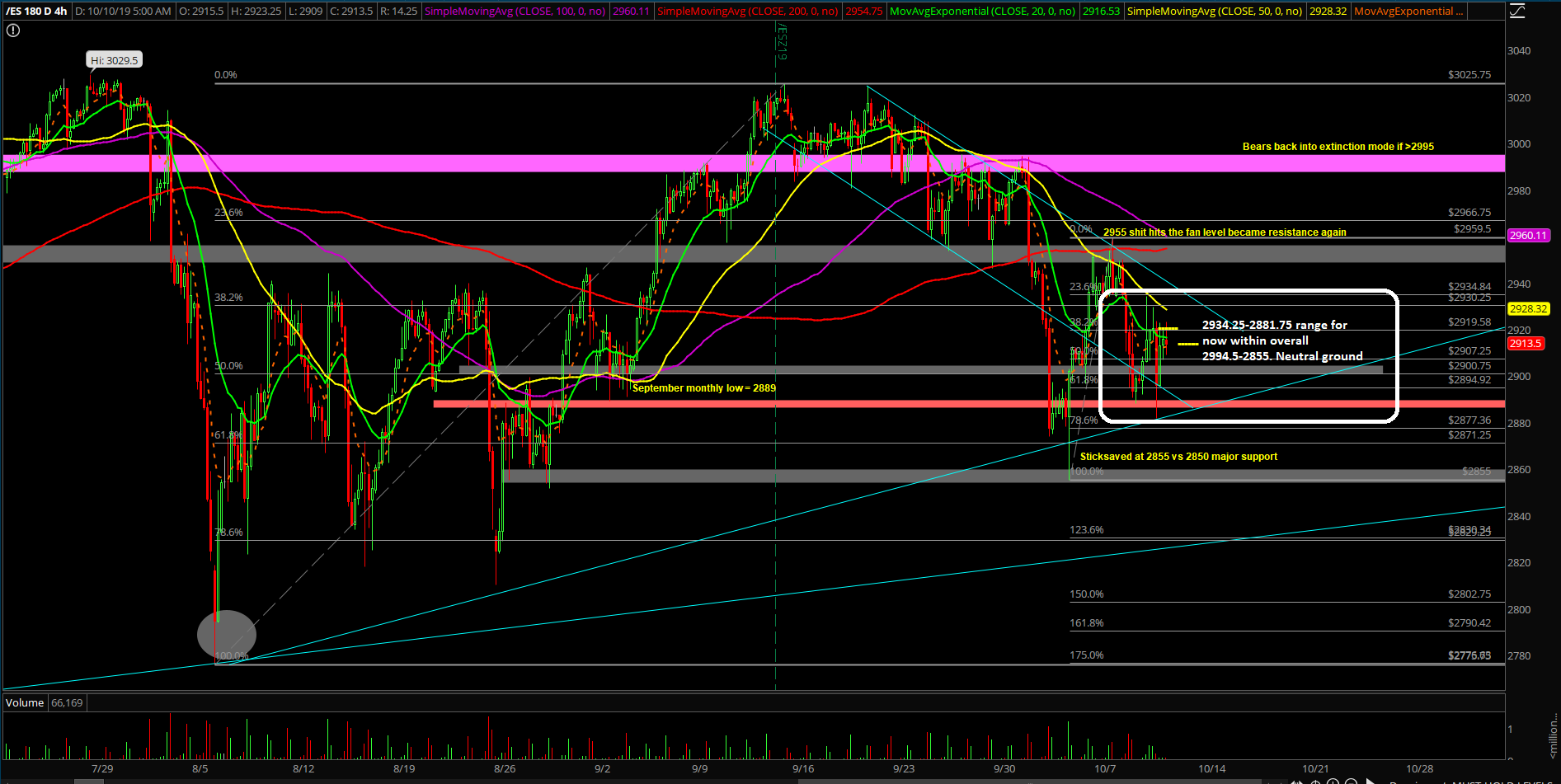

Wednesday’s session showcased a textbook 61.8% retracement of this week’s range thus far as the bears lost the immediate battle on continuing lower given Tuesday’s perfect trend day setup. Essentially, the bears had a chance to flush out a lot of stops and push the market into a mini liquidation event into our next 2850-2860 target on the Emini S&P 500 (ES), but bulls were just too great at defense for the time being. Tuesday night held the September monthly lows area 2890s and proceeded to V-shape up and the RTH opened as a +0.70% gap up at 2913 from the prior day’s close of 2892. The rest of the day during RTH was spent in a slow and methodical grind up with higher lows and higher highs.

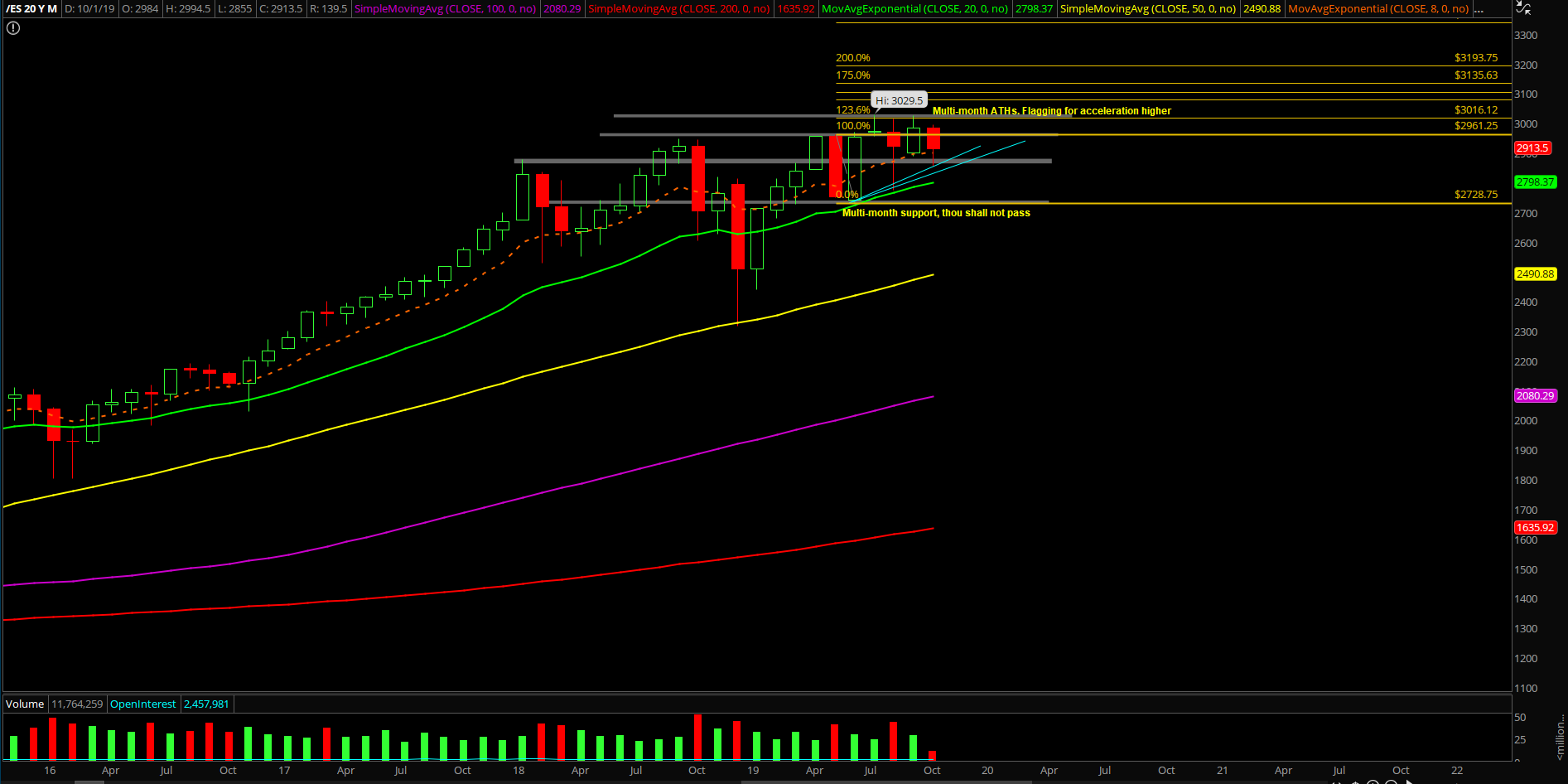

The main takeaway from this session is that we’ve discussed that the odds have shifted and it’s more of an established range now especially after seeing the Wednesday overnight action. Basically, the bears had two legitimate chances to breakdown the 2880-2890s area in a decisive manner, but they failed to capitalize on these perfect setups thus far.

What’s next?

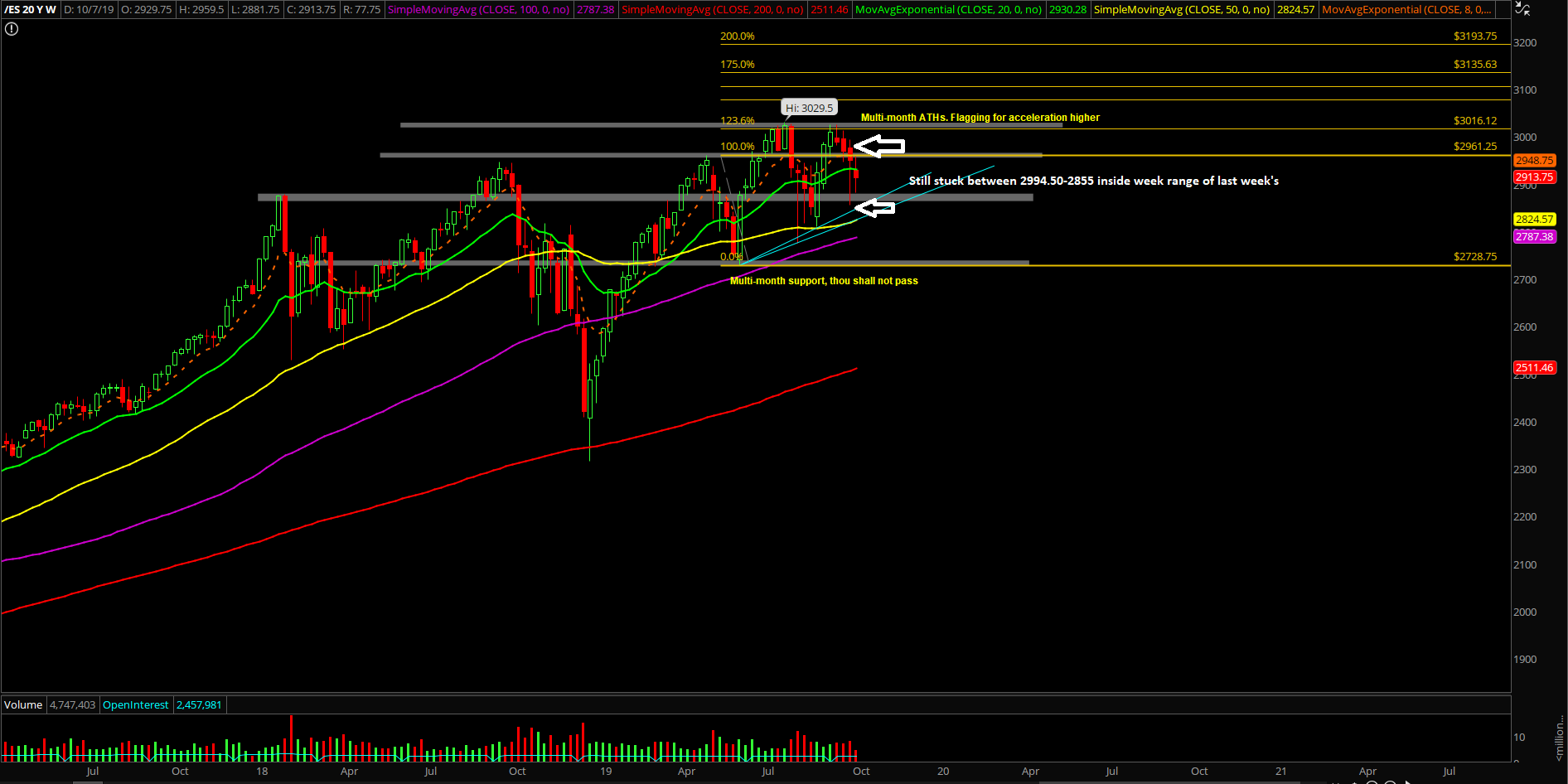

Wednesday closed at 2920.5 on the ES as a retracement candlestick of Tuesday’s trend day down signifying some sort of intra-week range within the overall inside week range of last week. For short-term, we’re in neutral mode for now until our key levels tell us momentum is back and odds are favorable for a single direction. This is just a "shake and bake" inside week combined with news driven events.

Key takeaway points:

- It is still an inside week; this week’s range = 2881.75-2959.50 within last week’s overall 2994.50-2855 week range.

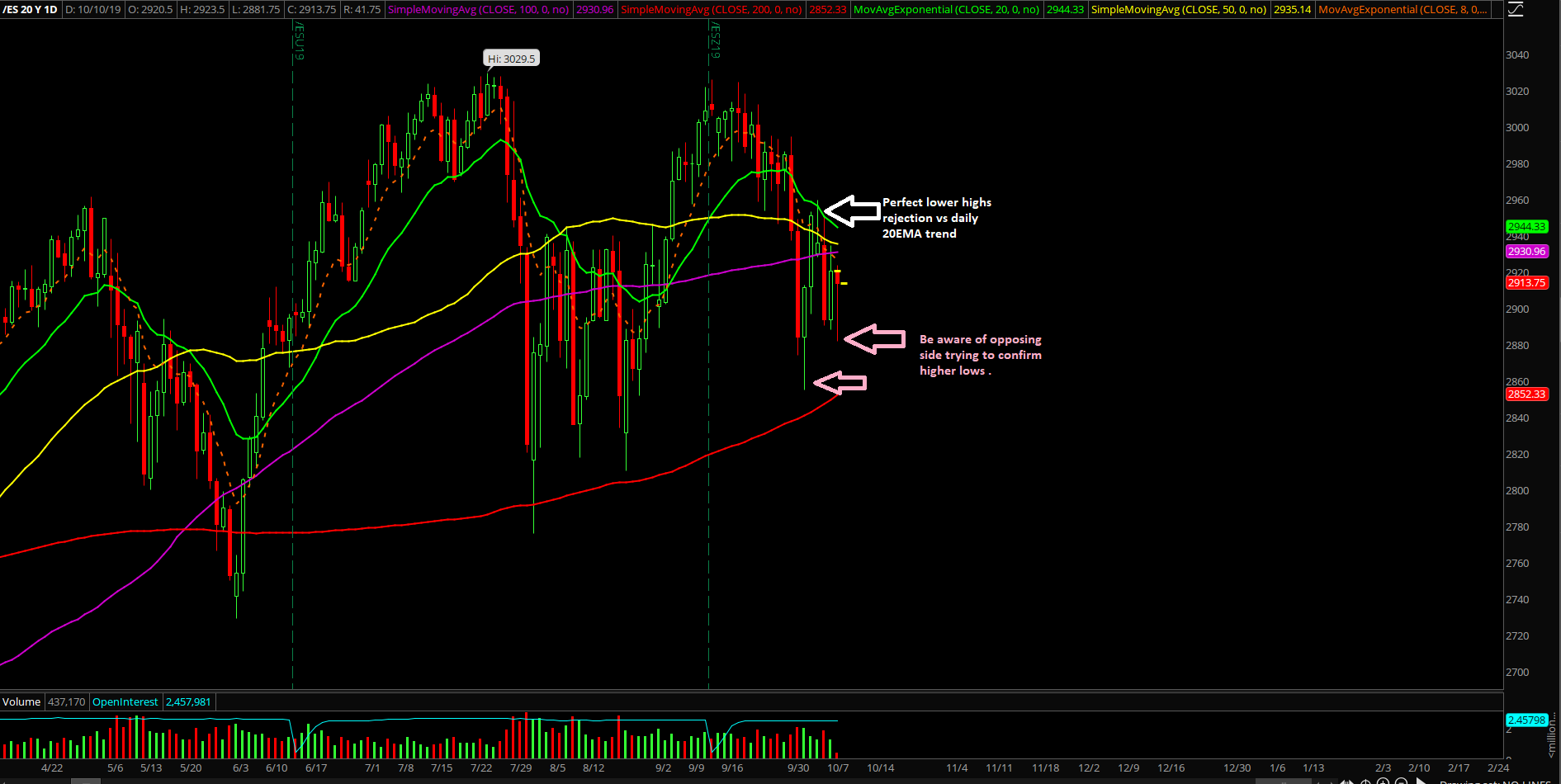

- Intraday neutral mode heading into today/rest of week, price is still below our key 2955/2950 levels and the daily 20EMA showcasing the lower high rejection/inside week setup.

- Above 2923.50 overnight high would favor bulls for a squeeze attempt into yesterday’s 2934.25 high and beyond.

- Below Tuesday’s low 2888.25 and last night’s 2881.75 would position bears for the immediate acceleration attempt into 2850-2860s.

- There are no 4hr price projections at this time, but last week’s daily white line projection into 2850-2860s is still technically valid given the daily 20EMA lower highs setup.