Digging For Value: Agnico Eagle Mines

Contributed by Mark Malinowski, produced with Avi Gilburt

Inflation has pushed up the price of everything is what the Fed and mainstream media has been is telling us every single day for the past two years. So what happens when the Fed says inflation is under control, and they plan to cut the cost of borrowing money? Historically, when the Fed begins reducing the cost of borrowing, it has shown to be a great time to invest in precious metals and precious metals miners. Now is that time.

The traditional view to finding value would be looking at the cash cost of production of a gold equivalent ounce, GEO. However, the all-in sustaining cost, AISC, includes sustainable production costs. AISC includes all the varying costs incurred in gold production over the mine's lifecycle. In other words, what does it actually cost the company to produce that ounce of gold and sustain that level of production over time.

What are these companies? What do we like about their fundamentals?

Agnico Eagle Mines

Agnico Eagle Mines (NYSE:AEM) is a top tier global precious metals mining company, with more than 65 years of operating experience. The majority of its operating assets are in Canada, but also in northwestern Mexico, Australia, and Finland. Approximately half of these assets resulted from an all share merger with Kirkland Lake Gold in February 2022. At the time the merger closed, the combined company had a valuation of 22.4 billion USD. Today it trades slightly higher than that at a 26.3 billion USD valuation. In a higher interest rate environment, not only did the merger add zero debt to the company, but what I find most interesting is that it trades at a P/E ratio of ~ 10x, where many precious metals companies in much riskier locations trade in the 16 to 20x range. The low end of that target would place the individual share price at ~ 83 USD (~112 CAD). The average precious metal mining is currently over 35x. Agnico Eagle reported an AISC of $1162/oz year-to-date at the Scotiabank Mining conference. Another way of looking at precious metals miners that our resident Fundamentals Analyst, Lyn Alden Schwarter, prefers is operating cash flow, and she sees “AEM is one of the better risk-adjusted looking miners on a fundamental basis.”

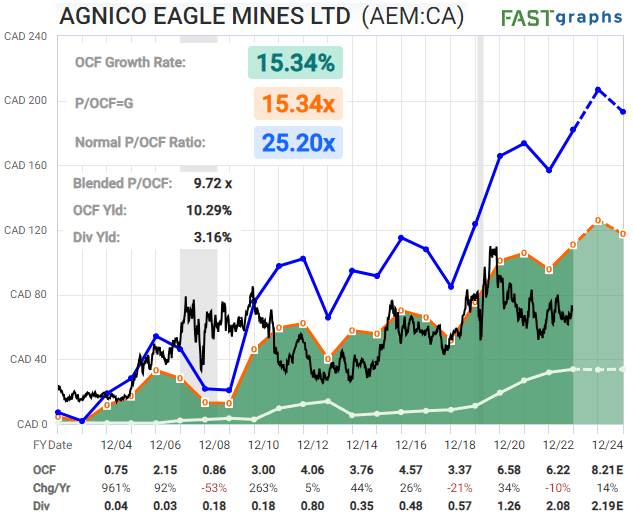

FAST Graph on AEM (Lyn Alden)

Stocks camped out deep in the shaded green region of Lyn's FAST graphs with solid EW setups have done very well in the past, demonstrating the synergy of "where fundamentals meet technicals."

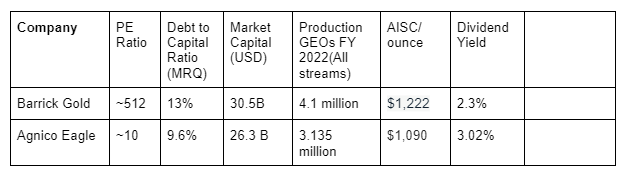

Fundamental comparison

Let’s compare Agnico Eagle with one of the big boys, Barrick Gold (GOLD). While Barrick Gold did not have a great year in 2022, which affected earnings in a significant way, and therefore, the PE Ratio, let’s leave that aside for the moment. What I want to bring to your attention is the efficiency of the Agnico Eagle assets when they can earn more than $130 more per oz than Barrick on a sustained basis. They pay a higher dividend yield and have less debt.

Table comparing data on AEM & GOLD (Mark M)

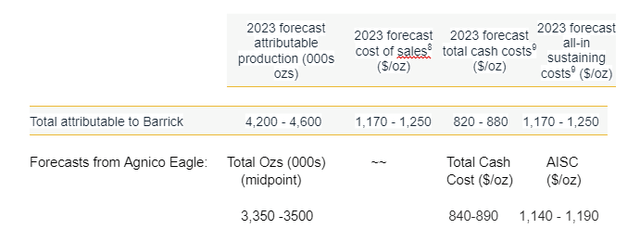

When we start looking at 2023, Barrick’s 2022 shareholder report, their 2023 forecasts were:

Table on GOLD vs AEM (Mark M)

While inflation may have closed that gap this year, the advantage is still in AEM’s court as the price of gold increases while they operate in a very stable environment.

How about a value development miner?

Osisko Mining

Osisko Mining (OTCPK:OBNNF)/ (OSK:CA) is another Canada-focused precious metals exploration company with a mid-tier market value of 1.1 B CAD. It has a 50% interest in three properties, the Windfall gold deposit, the Quevillon property and the Urban Barry property, all located in Quebec. All of these projects are under the banner of the Windfall Mining Group, which is a partnership with Gold Fields. In the last quarterly report it had an EPS of 0.56 CAD, but what would be more interesting in this case is not a peer comparison, but rather one of value based on extractable assets.

Osisko has performed surveys, engineering and analysis for seven years on various sites, but their Windfall gold deposit has the most physical work into it. This year they will continue with excavation, having signed a power line agreement for construction of a dedicated 69 kV line and execution on further development of their mine plan from the 2022 Feasibility plan. They have many more details in the September 2023 presentation, but one of the key ones is 4.1 MM oz of gold measured and indicated based on 1600 USD gold that gives a net present value of 1.2 B CAD from 2022 and the market cap is 1.0 B as of writing. What’s with the mismatch? That's the fundamentals knocking on the door, given the price of gold (~2000 USD) and the further progress in the development of their mine, there seems to be some good reasons for upside. I also see the investment by Gold Fields as an important step not to take on debt and continue to develop and enhance their existing and future operations sites.

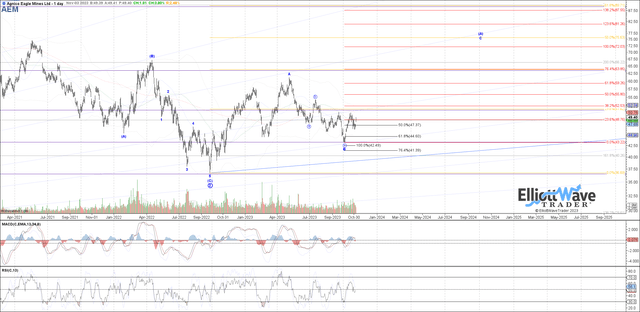

Elliott Wave Analysis: Agnico Eagle Mines

The most recent Wave Setup is still active, posted on Nov 3rd, by Garrett Patten (another of our team leaders) was:

"Previous wave setup got stopped when the June low broke, but with a new 5 up from the October low, looks like a decent opportunity to reattempt." Garrett’s price target for this setup is in the 70s with a stop less than 10% resulting in a better than 1 to 4 risk vs reward.

AEM chart by Garrett from Nov 3 (EWT)

This setup also was "officially" updated by Zac on Nov. 28 when it hit the first resistance level in Garrett's Nov. 3 post. It also has been covered in three videos and more than a dozen chart updates since that time frame. Zac’s recent chart on Dec. 8 gave members clear parameters for a near-term target and support.

AEM chart from Zac on Dec 8 (EWT)

Since that time, AEM has put in a strong reversal, closing up more than 7% from the low on the morning of Dec. 11. Where will it go from here? Great question, but with clearly defined stops and fundamentals in alignment, this setup is in the money. While this could be topping in a local high soon, the key question about where is ideal support for further upside will be based on ideal Fibonacci ratios between 38.2% and 61.8% off the move off the October low.

Osisko Mining

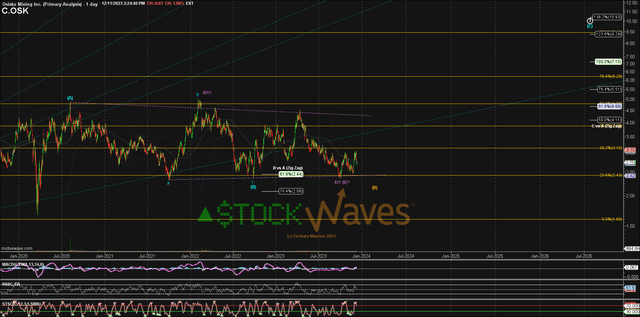

On Dec. 11 Zac Mannes posted the following chart, sharing that:

“2.50s could certainly hold as the start of the (C) wave up from a 2x bottom for (B) as either E of a triangle or Y of a complex combination, but with only 3up so far there is still a risk of one more low toward the 76.4% Fib at 2.08.”

Chart on OSK:CA from Dec 11 by Zac (EWT)

So while the fundamentals of this company make sense, the chart is not as clear at this time. We made the first steps Garrett wanted to see on Dec. 1, when he commented: “Needs to get back above the October high as the next step toward confirming a bottom.” However, I'm in more of a wait and see for the chart to clarify, but that doesn’t mean it isn’t a potentially bullish setup.

Lyn says that, with regard to mining companies, management decisions are important, but the direction of gold is also of key importance.

“I view gold as building a pretty good long-term base ever since it began consolidating in mid-2020. The Fed's ongoing tightening is putting some pressure on it, but that can only go on for so long, and so as we look out in the years ahead, I think gold is rather well positioned for an upside breakout.

Higher interest rates by the Fed can slow down private sector lending, but increases interest on public debt and therefore increases fiscal deficits, which are a source of new money creation. The 2020s decade is likely to be defined by varying levels of fiscal-driven inflation, and if this starts to be seen by market participants as a longer-term problem, then gold is likely to be among the major beneficiaries.” -Lyn Alden

What do we look for in a setup?

We want companies with strong balance sheets and strong operations in safe operating environments, like Canada and the US. The stability in government and regulatory requirements creates clear conditions for investment decisions.

When we compared Agnico Eagle and Osisko Mines, these two companies are undervalued when compared with the price of metals and when compared with peers. While Agnico Eagle has a much more clear pattern with which one can make decisions based on price and pattern, there's a lack of clarity on the chart at this time in Osisko Mining Inc. but in the bigger picture looks like there will be a time to shine.

Both of these stocks are displaying price action behaviors that are associated with diagonal patterns rather than standard Impulsive moves. Many traders find the “choppy” structure inside diagonals challenging patterns to navigate. However, when the path is laid out clearly, there are actually many more trade opportunities over a longer period of time, and therefore it can actually be more rewarding.

There continues to be a near-term opportunity for AEM to be forming a local top in the near term, but subsequent support levels will provide another great opportunity to add or start a position based on Fibonacci retracement levels. We will continue to track this stock on a regular basis.

We see the price of gold and silver significantly higher over the next two years and as Avi Gilburt posted a public target for Gold on January 17, 2023, this aligns well with the increased profit potential for these two growing companies over the next few years.

Longer term, there's a very bullish view of metals in the coming years. But how should one take advantage of that opportunity? The ideal way is to continue to be patient and not chase, but instead find miners that sit at the intersection of good fundamentals and reliable sentiment, as identified by Elliott Wave structure and Fibonacci support levels. When these principles intersect with high reward, low risk setups, we have mining waves.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.