Developing Bullish Set Up?

With the action we have been seeing of late, there is growing potential that the metals may be trying to push higher sooner rather than later.

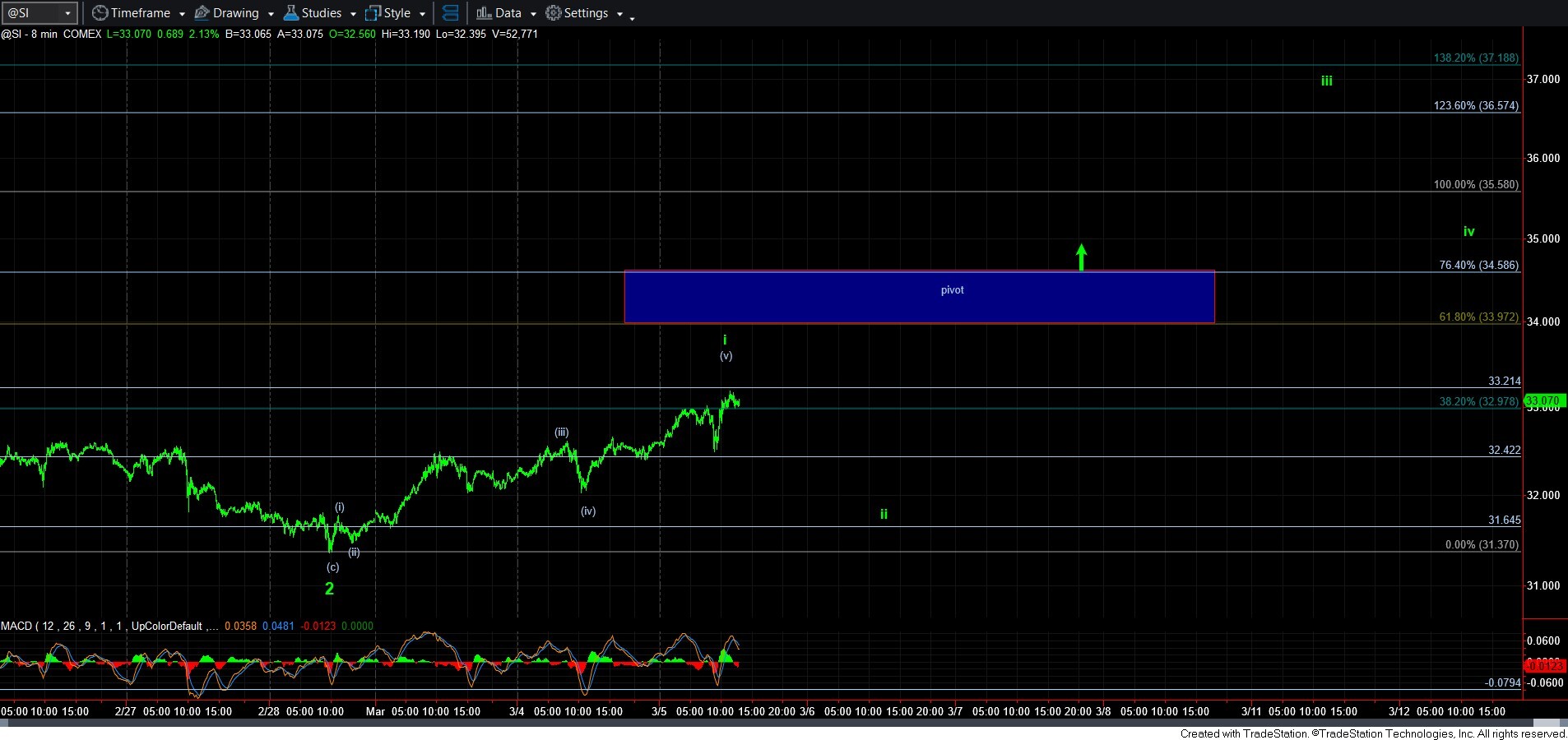

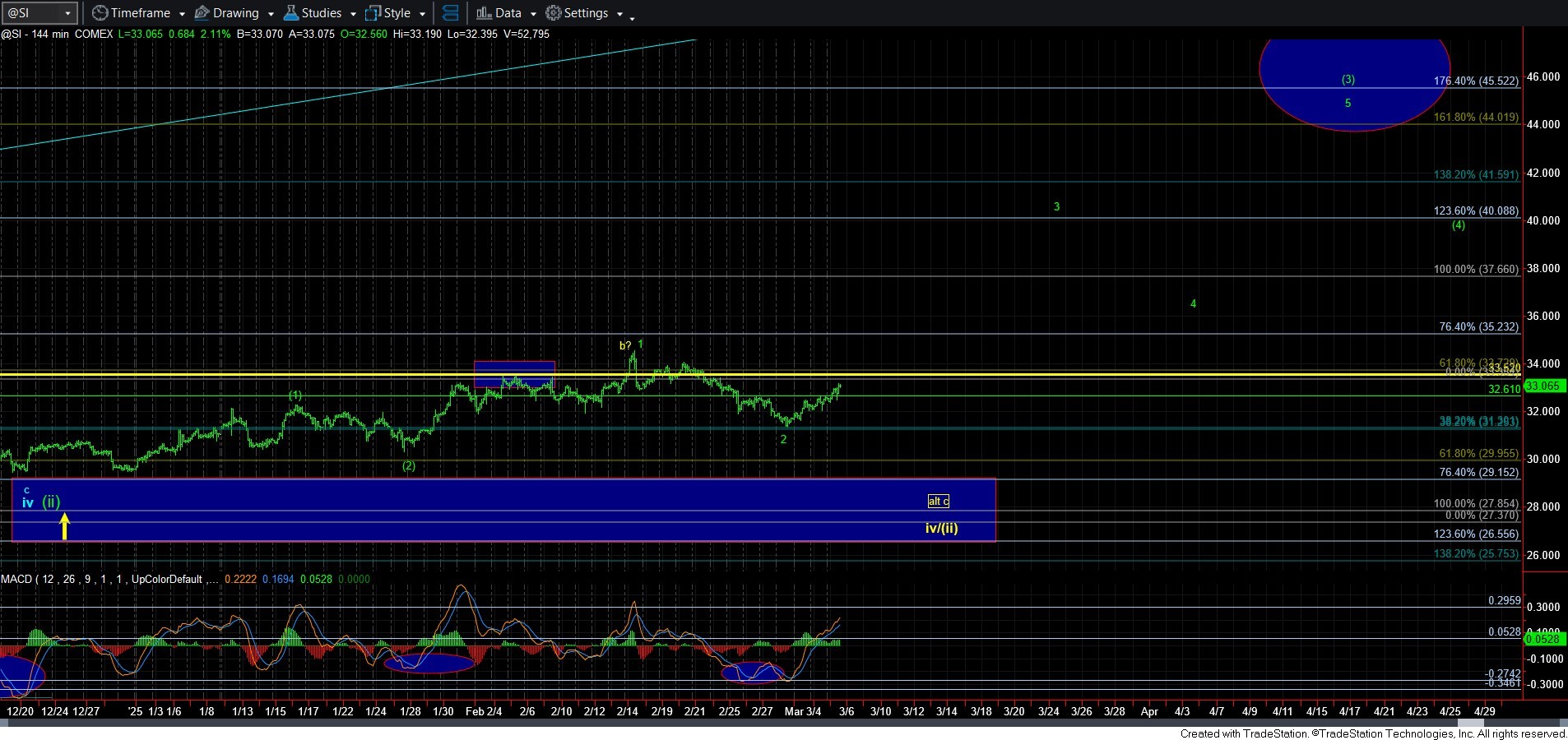

In silver, I outlined in my last updates that as long as we hold the 31.30 region, we can develop a break out set up. And, at this time, there is a reasonable 5-wave rally that is completing off the latest pullback low of 31.37. This now sets us up for a series of 1’s and 2’s, which can trigger if we see a corrective pullback, followed by a rally over the wave i high on the 8-minute chart. And, should that occur, then moving through the pivot noted on the 8-minute chart “should” signal we are finally in the heart of a 3rd wave in silver, ultimately pointing us well into the 40’s over the coming months.

Alternatively, a break below 31.37 would invalidate this set up, and move us back into the yellow count.

GDX has a similar potential set up, but it can also be viewed as a wave 2 in yellow (after a leading diagonal wave 1 down), as shown on the attached 8-minute GDX chart. Moreover, I have a pivot box on that chart as well, so breaking out through that pivot makes the next rally phase a much higher probability, and we can then set stops below the pivot for a continuation run that seems to project to the 57-60 region. So, ideally, GDX should remain over 39.50. And, should we take out 42.83, then we would invalidate the yellow count as shown.

Alternatively, a break-down below 39.50, which follows through below 38.58 opens the big downside door in the yellow count.

While I had the blue count stay on the chart as an alternative, and even though we did break below upper support of 264 in GLD, this action really makes that much more likely. So, as long as the next pullback is corrective, and we then rally over the high we strike in the current move, I will be adopting the blue count as my primary. But, I think it is reasonable to expect it to begin to lag GDX and silver should all three break out together.

So, for now, I am going to retain my “insurance” protective puts, until I see a clearly corrective pullback. I will then probably sell half and hold the rest as remaining insurance, and sell those should we break back over the highs we strike in this rally. However, if we begin to break supports, I will likely add back some more insurance. Moreover, should we begin to see upside follow through develops, I will consider adding long-side options positions to take advantage of the break out.