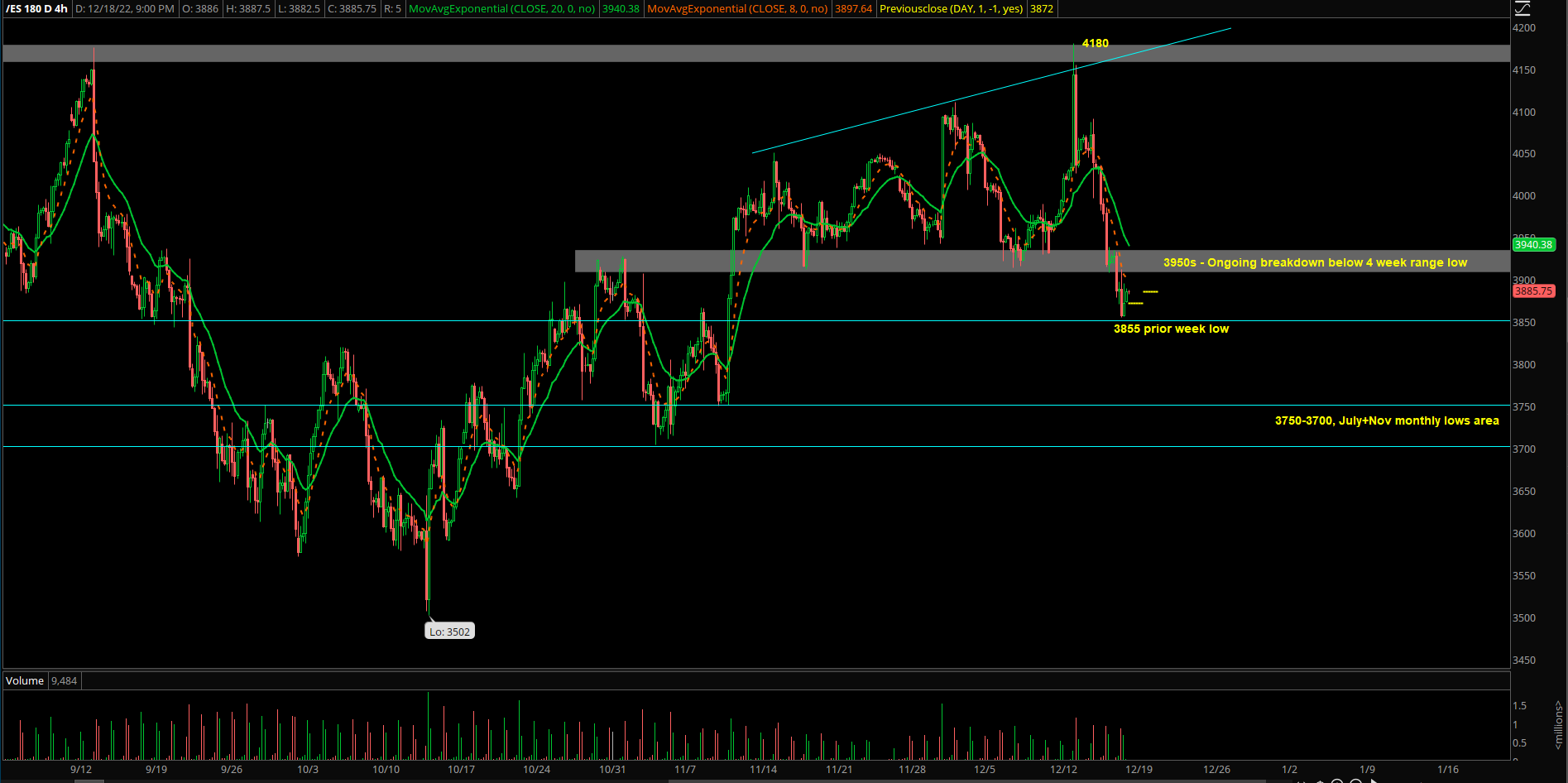

Decisive Breakdown Below 3950 As Markets Heads Into Santa Rally Bullish Seasonality

The most significant things that occurred last week were the Emini S&P 500 (ES)'s massive rejection at 4180 after the CPI report, followed by the breakdown continuation below the 3950s 4-week low. Then, price was able to close near the weekly lows in the 3870s to cement a -1.47% trend week down. Overall, it was a massive weekly range 4180-3855 (worth 7.8% and 325 points).

Key ideas going into next few sessions:

- Typical bullish seasonality starts ramping during Dec 22-23 into 2/3rd day of the New Year, according to stats (an average of ~1.5% gain during that period). Keep this in your back pocket when trading if setups accompany this bullish seasonality.

- Price is currently hovering in the 3880s, which is below the previous 4-week balance of 3950-4150, indicating short-term sellers remain favorable as trapped longs got liquidated.

- Main expectations/bias going into this week is that if sellers retain momentum by disallowing daily closes above 3950, then further selloff could escalate into the 3750-3700 area for continuation.

- Conversely, if buyers sticksave this by breaking and holding above 3950 on a daily close, and then make consecutive daily closes above it, this opens a scenario for another retest into 4100/4150/4180.

- Basically, 3950 will be the most pivotal point of battle for the incoming sessions given the context of the breakdown structure below the 4-week low.

Intraday trading parameters:

- Almost all of our short-term downside targets have been considered fulfilled from the prior report. Per Dec 16th report: looking for another test into 3912-3920, 3900, 3885/3850/3830 as continuation targets.

- As of writing, need to be aware that Monday most likely going be an inside/range day balancing between Friday’s range of 3930s-3850s.

- Look to buy vs. potential range low if 3850/3865 hold with the corresponding setup after RTH open tomorrow.

- Look to short vs. potential range high if price backtests into 3912/3920/3930 resistances.

- A break and hold below 3850 would immediately open up bigger trend towards 3750-3700 zone.

- Let’s see where we open for RTH as our parameters could change, utilize the additional key levels at the end of our ES game plan report (in room).