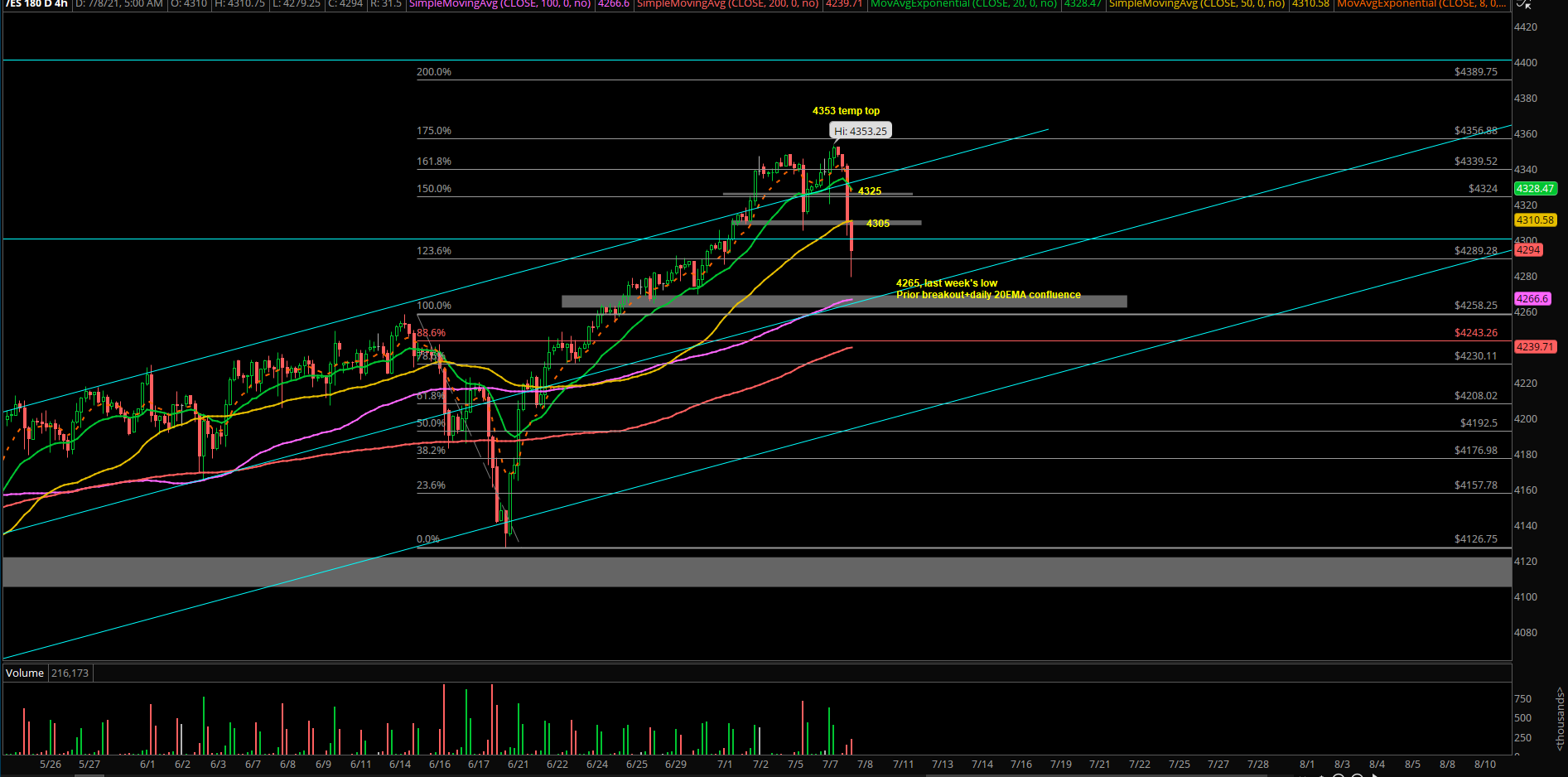

Decent Start To A Quick Reset.

As we had discussed with members yesterday, the biggest short-term risk is a quick -1.5-2% reset on ES and 2-3% for NQ. With today’s gap down open for both indices, this is a decent start to a quick reset.

If you recall, the overnight market broke decisively below key levels such as ES 4325 and 4305 (week’s low) and opened up the downside to our 4280-4265 key zone. Same with NQ as it broke below the 14750 key level and then 14625.

Current overnight ES low is 4279.25, with no concrete signs of a stabilization event yet, so don’t get too antsy here for a daily dip buy yet. Let it stabilize first because it’s a large gap down.

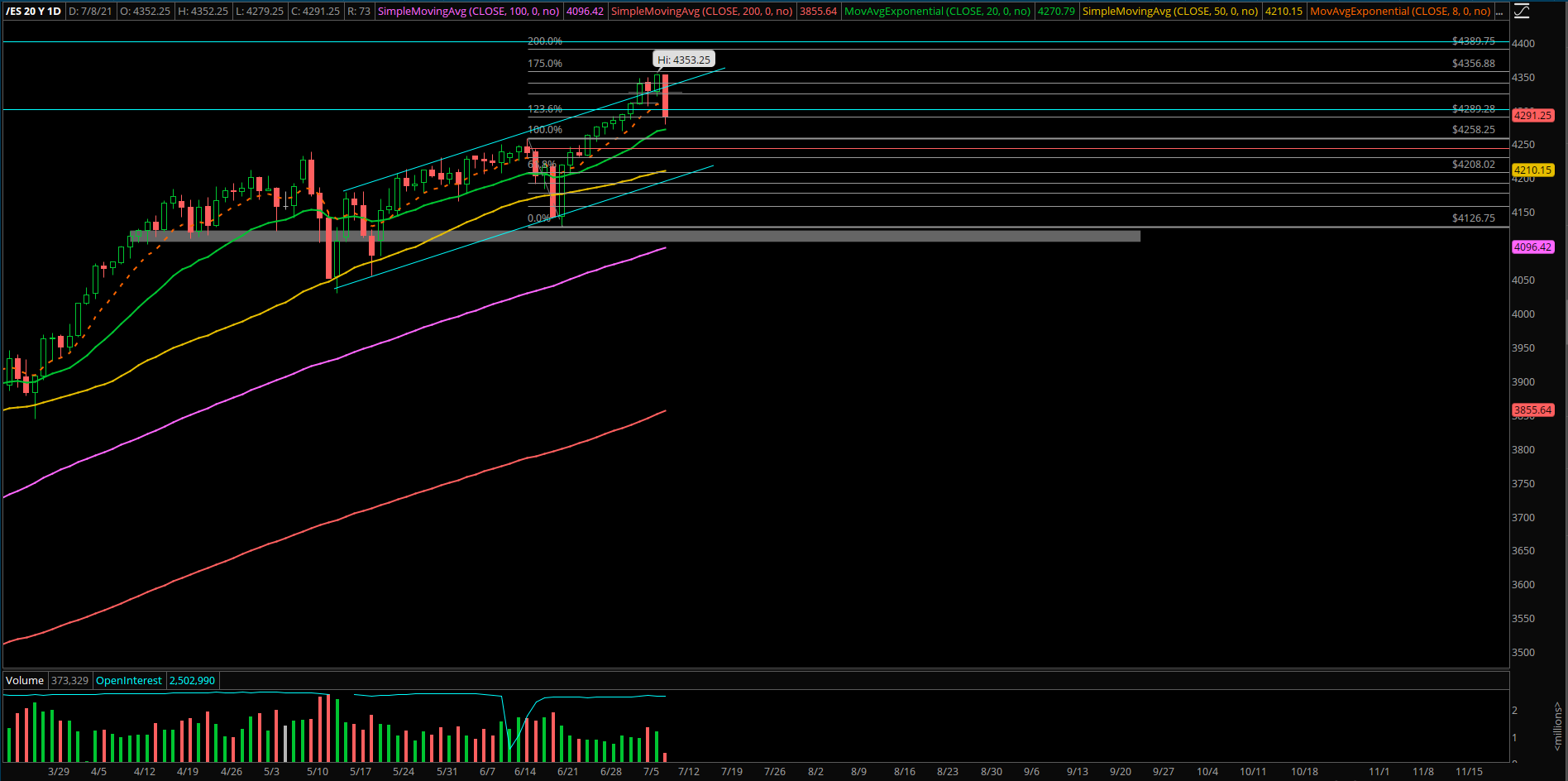

We're watching as the key confluence zone of 4265-4280 (last week’s low) and daily 20EMA intersect to try and hold as the next basing pattern on the daily timeframe.

If below 4260, price action opens more downside risk into 4225-4200, but overall we’re expecting this to be a 2-3 day dip event to become buyable again.

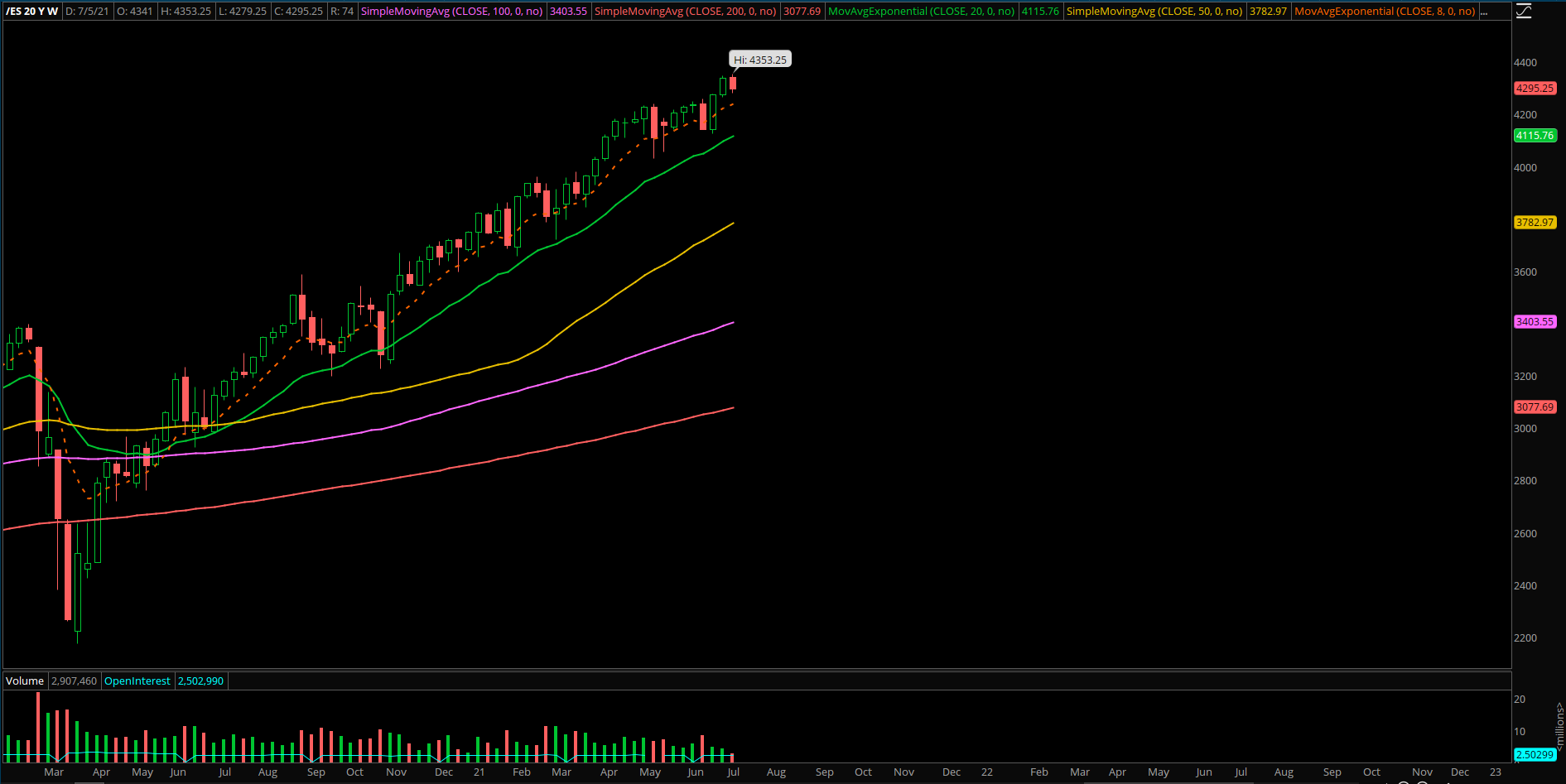

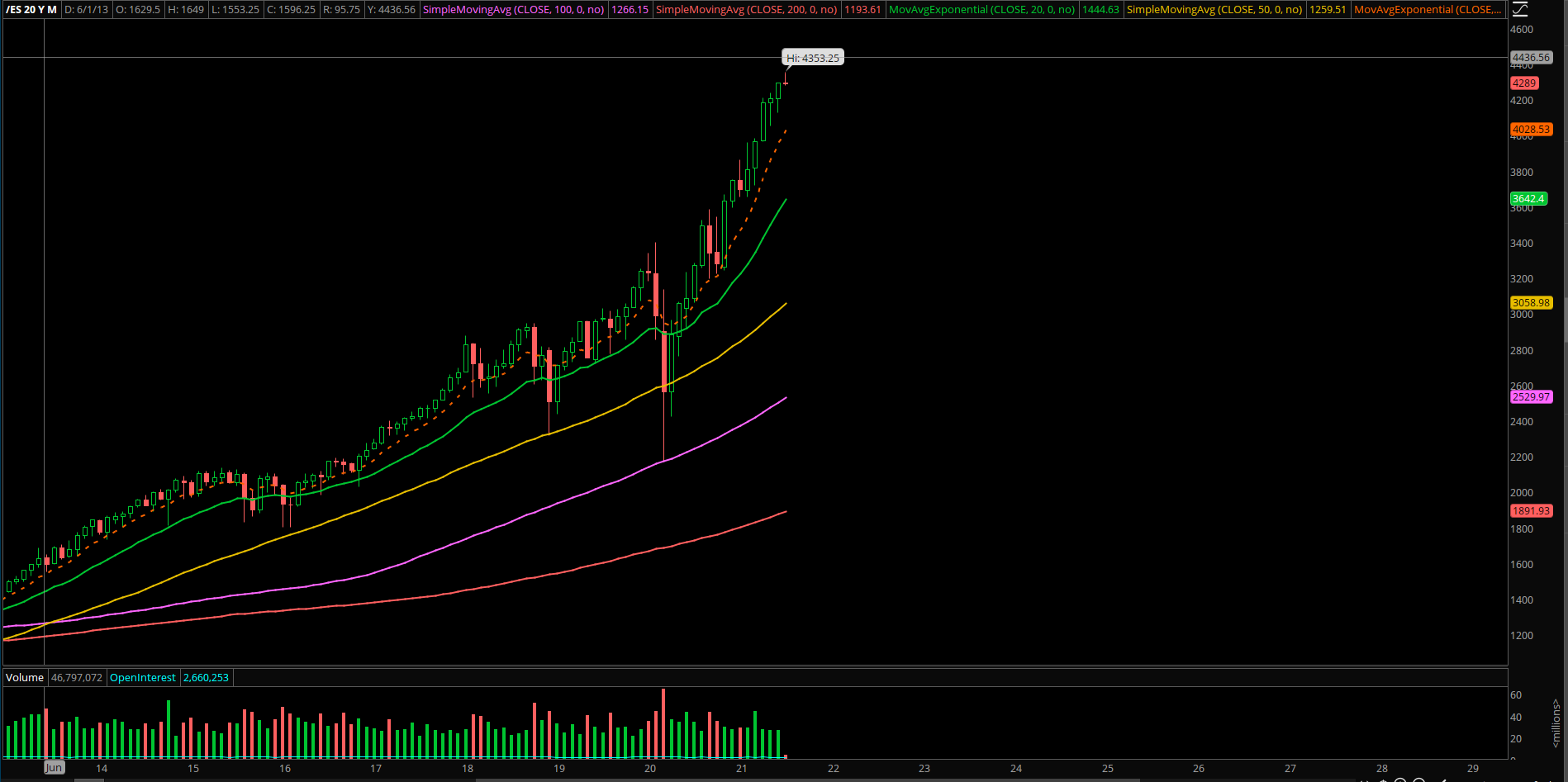

Our general theme (unchanged past few days) is that July is the 3rd strongest month based on returns via past 20 year S&P 500 data. We’re expecting more of the same grind up structure; market is a launch pad towards 4300 and 4400.