Day #2 Success, Bulls Showing Commitment

Context Section:

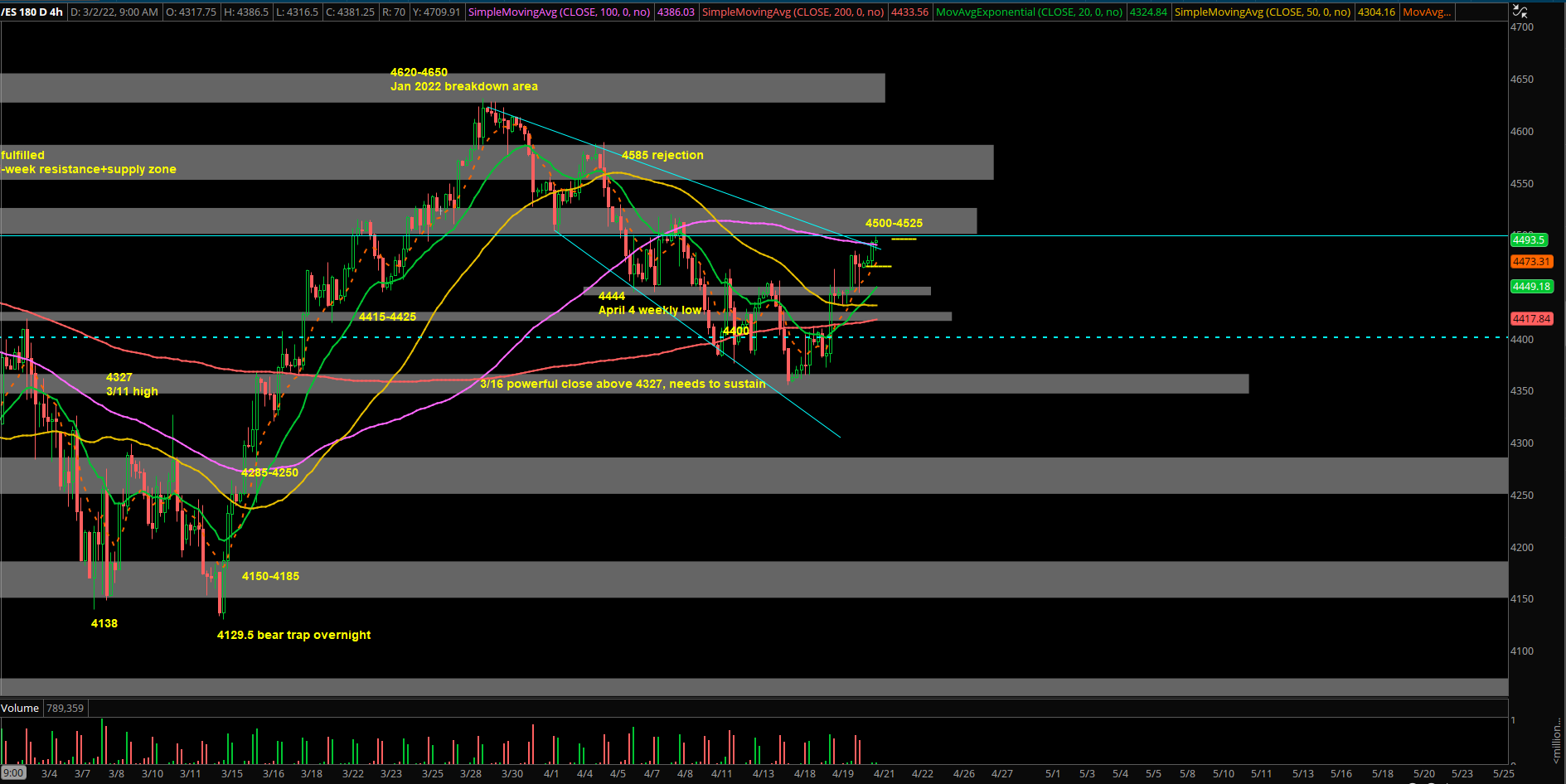

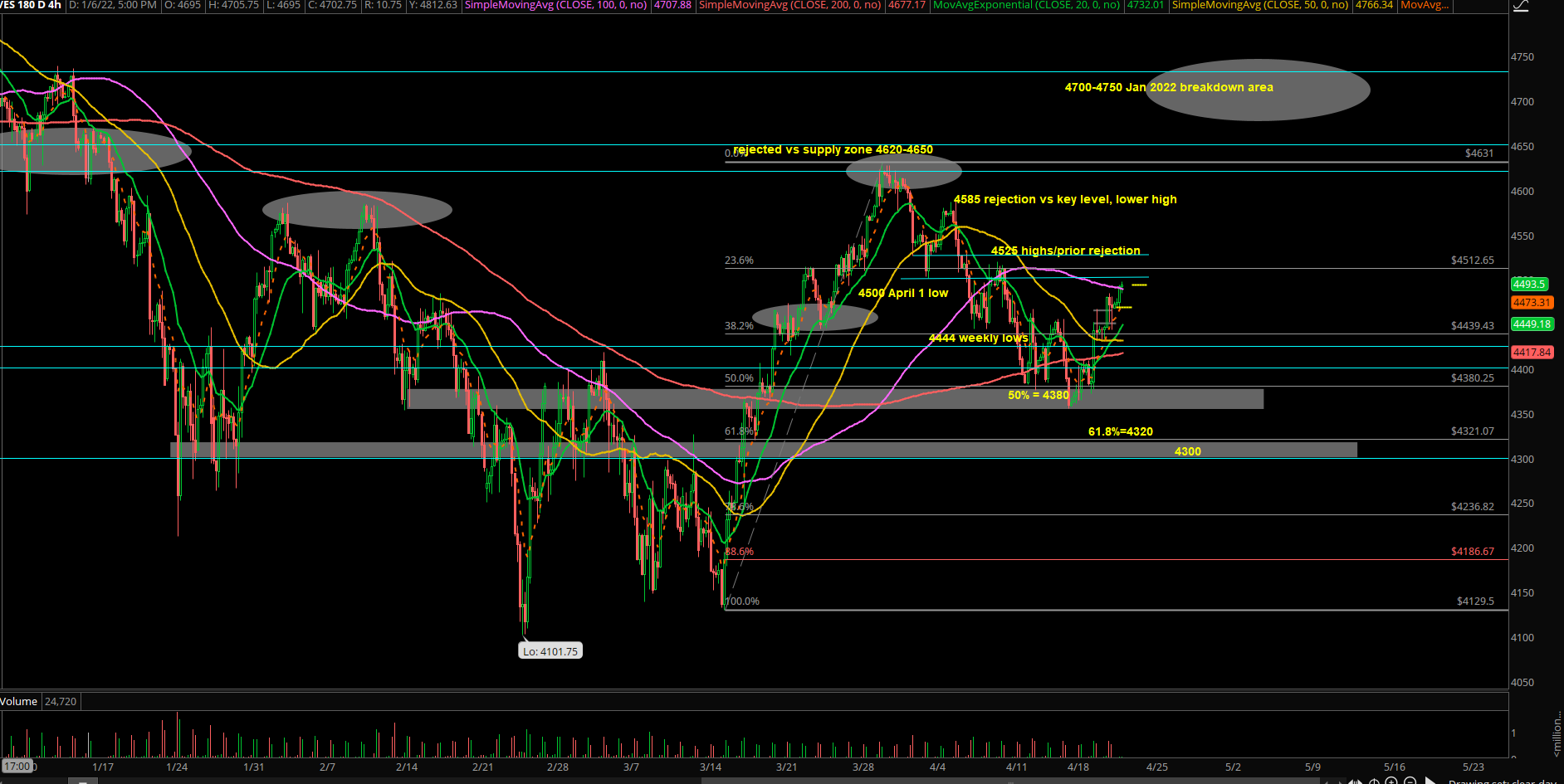

Starting from mid Jan 2022, since the decisive breakdown below the trending daily 20EMA + 4650s area, the market has continued trading in a massive sideways range of 4630s-4100s on the Emini S&P 500 (ES). And within this period the majority of time has been spent between 4585-4250.

In addition, no short-term directional trend that has outlasted more than 2 weeks before it reversed into the other side testing extremes. Whipsaw environment.

- Feb’s monthly range = 4586-4101.75

- March’s monthly range = 4631-4129.5

- Ongoing April month range = 4588-4355.5

April’s monthly price action continue to be trading entirely within the previous month indicating indecision and consolidation before the next decisive monthly move (eventually outside the range)

Zooming in: If you recall, last week’s expected initial range was 4525-4400 since the Monday April 11th report. In reality, the weekly range played out as 4491-4375.

For the most part, all dips into 4380s-4400s were bought throughout the shortened holiday week. However, by end of the week price confirmed that bears were in full control with the short-term downtrend with Thursday closing around the week’s low.

As of 4/19 EOD close, price action recaptured above DAILY 20EMA (main trend), a shift of momentum change.

4/20 EOD closed at 4455, confirming a day#2 above our key levels of 4425/4444. If you recall, 4425/4444 were critical levels for earlier this week. This indicated that bulls were ready to attack 4500-4525 range high area into end of week as bears failed their shot at lower lows.

4/21 as of writing, ES at 4498~, hitting the lower end of our target zone.

Current parameters:

- Overnight range = 4498-4467, current price = 4498. Market about to open as +0.9% gap UP vs yesterday’s close. Strong trend continuation (NQ +1.3% gap up, playing catch up).

- 4490s also represent last week’s WEEKLY highs, watch if FOMO or an initial fade that gets bought. Ongoing massive weekly ES bull engulf, NQ still lagging at the moment.

- Momentum news: TSLA premarket +7.4%, risk-on market. See if it sustains after RTH open. We want to see $1150-1200 (10% away) in next few sessions if so. Now, $1050

- Similar stance as yesterday, short-term bull remain in favour due to 4/19 DAILY 20EMA trend change + 4/20 day#2 confirmation.

ES main scenario for today, trend day continuation model:

- Immediate supports are ES 4473/4465/4455, look for higher lows to buy dips against for a chance for 4500-4525 range high towards end of week.

- Note: ES risk vs reward is lower now that the bulk of move has played out. (NQ trying to play catch up, shared bonuses in Ricky’s service)

- At this point if price goes below 4444 then things become wishy washy due to the momentum. Below 4444 opens 4425/4400 for immediate downside risk/backtest.