Dance Into Year End

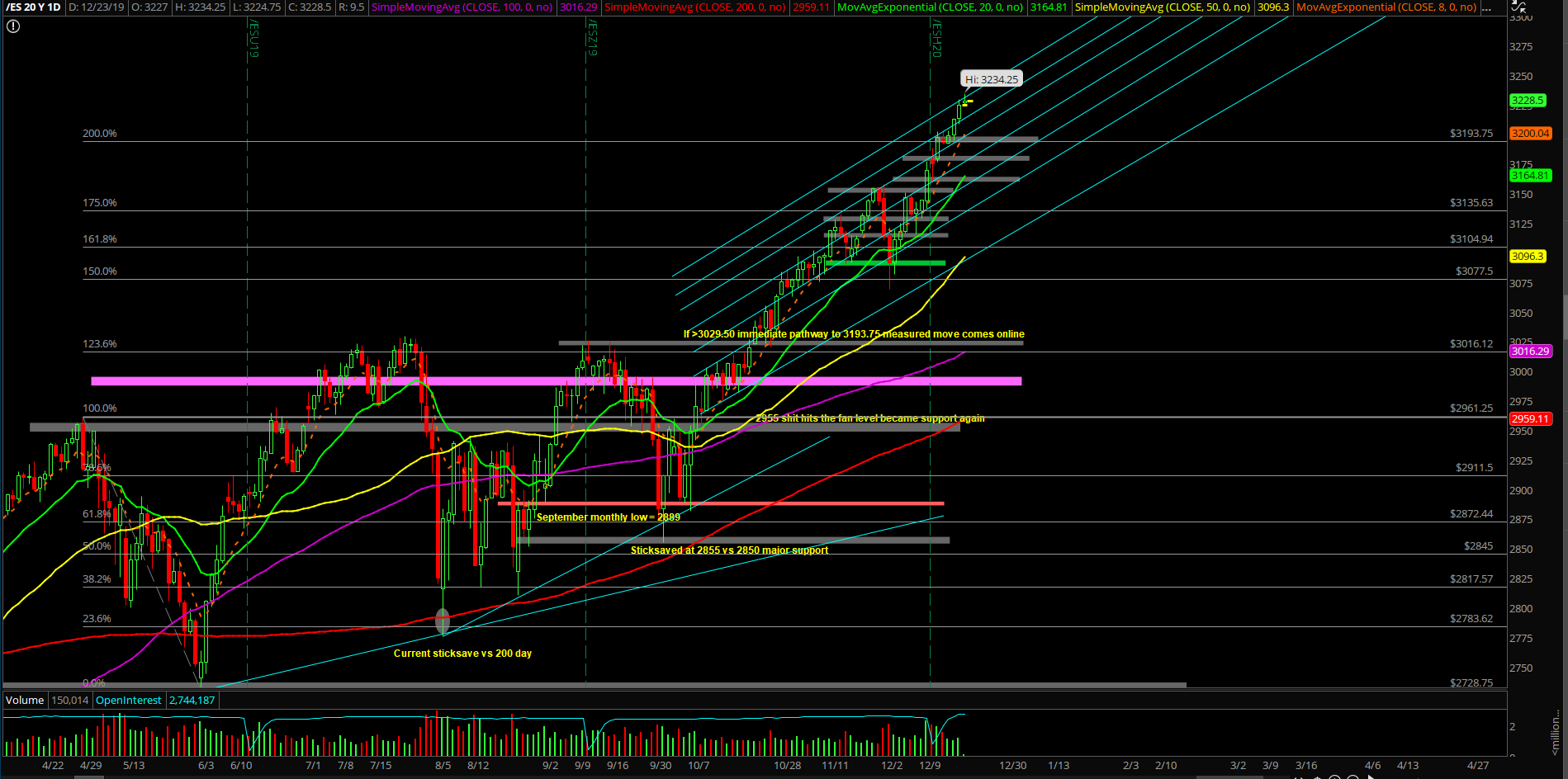

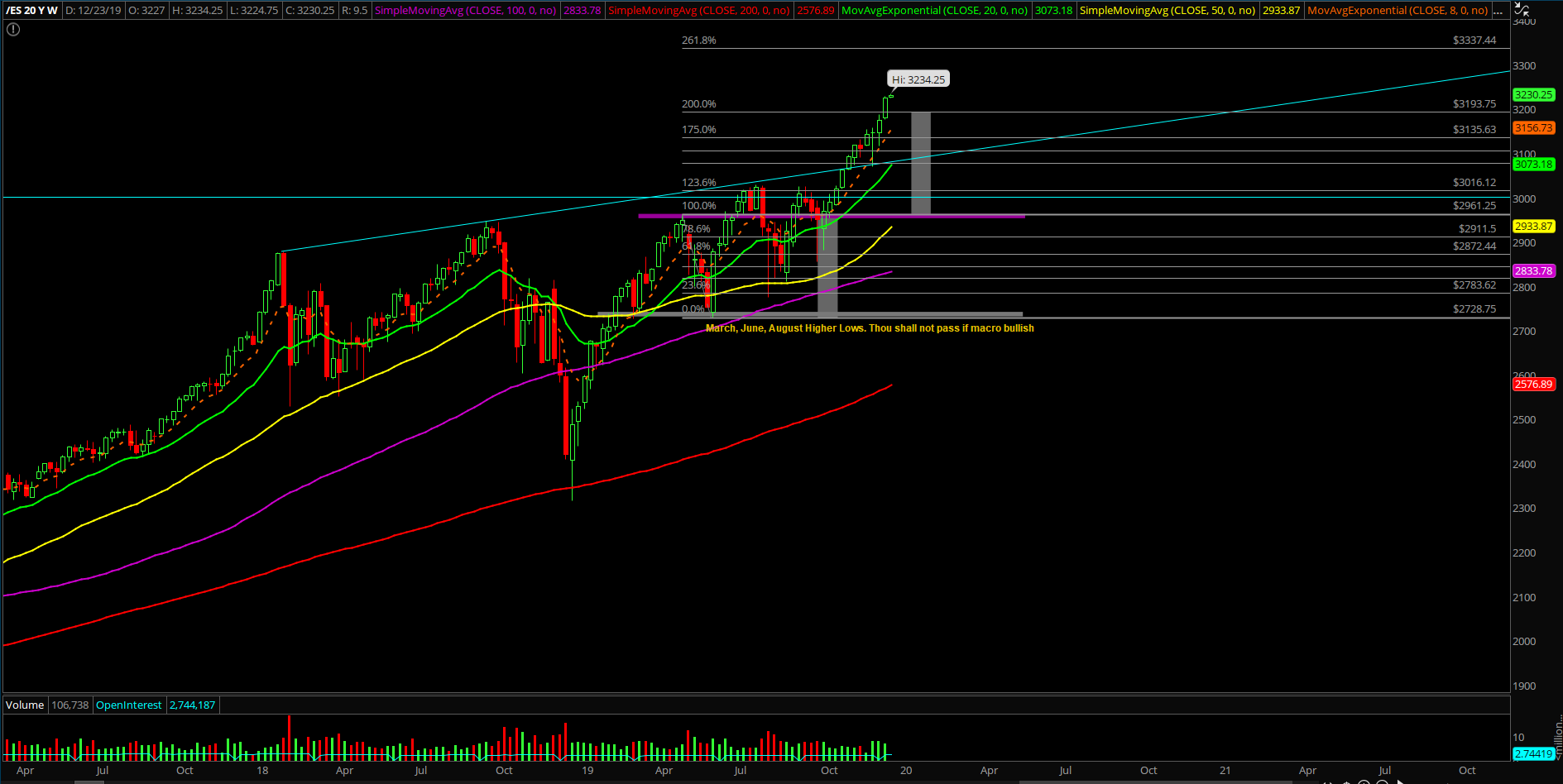

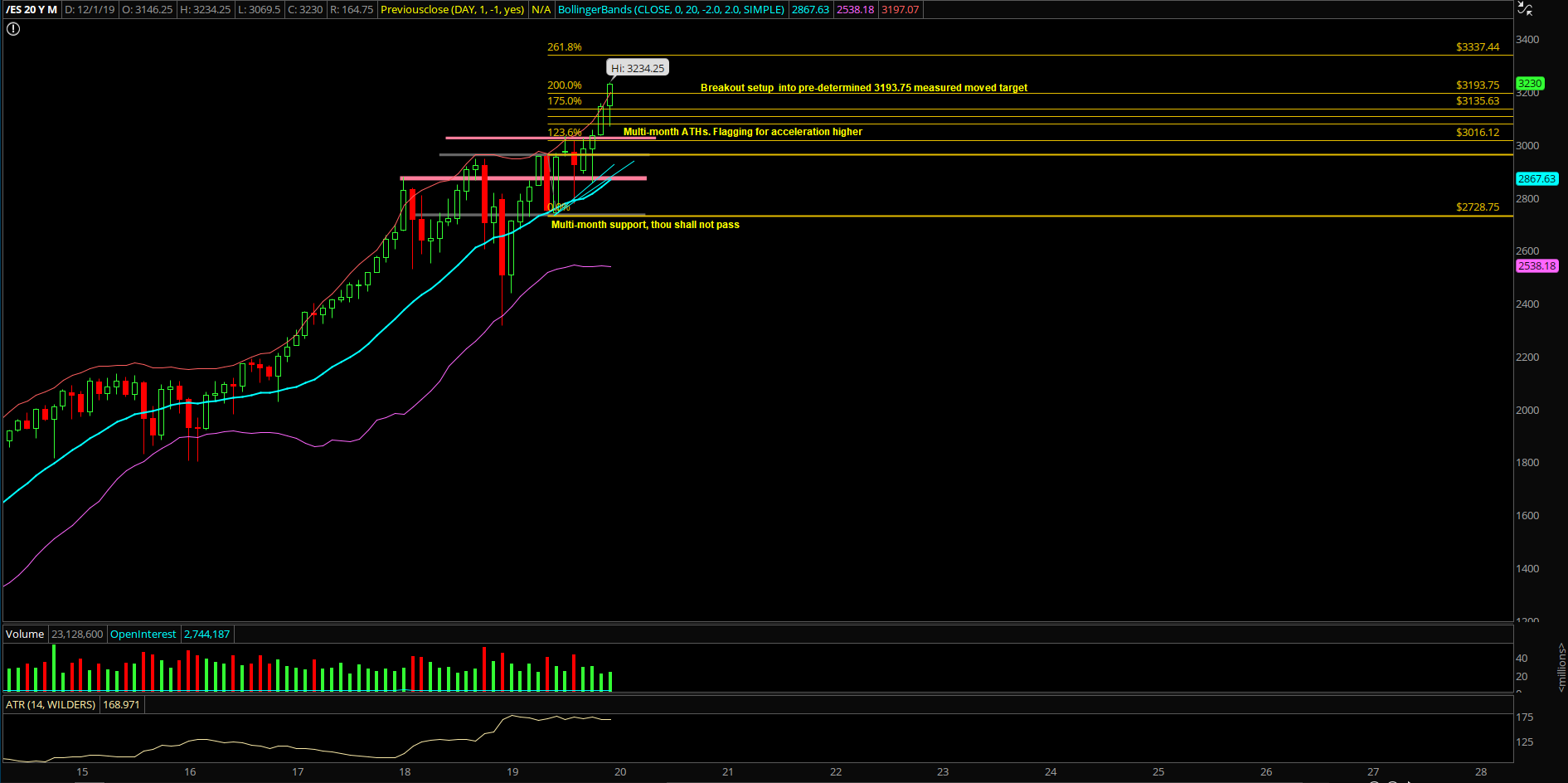

Third week of December pretty much went as expected as the price action took a breather during the early week to regroup and trap in another round of shorts and wrap up the weekly closing print at the highs. Essentially, it’s been the same old higher high followed by a high-level consolidation and eventual breakout pattern that has been playing out religiously for the past few months.

The main takeaway from the third week of December is that absolutely nothing has changed in terms of the bull train and its ultimate goal. By now, everybody and their mother should know that the bulls are trying to wrap up the year-end closing print at the dead highs/around the highs as we’ve discussed numerous times. It seems like it’s just going to be semantics at this point given the odds are so stacked in favor of the prevailing trend. We’ll see.

What’s next?

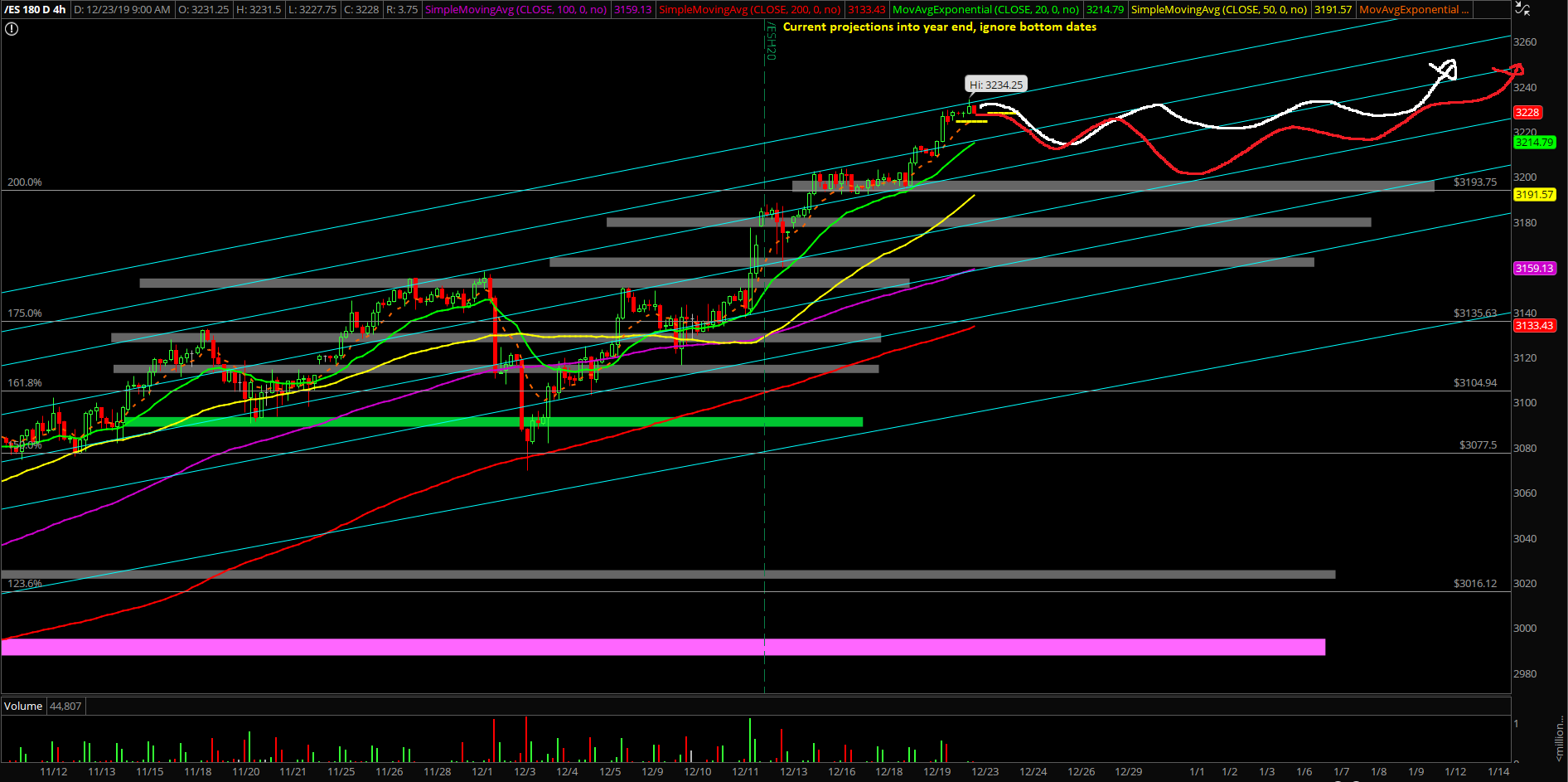

Friday closed at 3224.5 on the Emini S&P 500 (ES), just above the pre-determined 3215-3220 zone per calculations, so the bulls remain fairly resilient and powerful. In short:

- Based on current calculations, the price action attempting to wrap up at 3245-3250 for year end when above last week’s 3200 acceleration trigger (or just stabilize horizontally around the highs)

- Immediate trending supports have moved up to 3200 and 3208 where all intraday dips continue to be bought when the train reminds riding the textbook 1hr 8/20emaema acceleration grind up

- This week is very similar to last week as it’s mainly about not being a piggie because targets across the board (indices+important stocks that we trade had fulfilled or more than fulfilled their respective targets into year end already as it’s been a spectacular outperformance year to say the least)

- In essence, it’s likely about realizing short-term gains and hedging the long term portfolio properly for those with the same timeframes in mind. Very crucial to know when to be scaling out/taking profits/rotations for a lot of short-term positions going into Christmas/year end if haven’t already because the December contract expires this Friday and we’re going to be trading the March 2020 contract from now on

- Lots of rotations in the portfolio approach with tax selling strategies to gear up for the new year

- Seasonality argues that the last 5 sessions of the year + 2 first two sessions of the new year will be heavily favored towards the bulls after this week’s likely rangebound grind