DXYZ: When Structure Leads the Story

Markets tend to reward narratives — until price tells a different story. Over time, structure asserts itself, separating what merely captures attention from what is actually taking shape beneath the surface. That separation matters most when a stock begins to organize before a widely accepted narrative catches up.

DXYZ appears to be entering one of those phases.

Rather than advancing on headlines or speculation, the stock has been moving in a way that suggests something more deliberate is unfolding. Price surged, corrected in an orderly fashion, and has since begun to stabilize and push higher again. That sequence is not random; it reflects a shift in participation — from reaction to organization.

What stands out is not just the recent movement, but what preceded it. Before the current advance began, DXYZ completed a larger impulsive move followed by a controlled, three-wave pullback. That correction did not erase the prior progress. Instead, it reset conditions and allowed price to begin rebuilding from a more stable foundation.

When markets behave this way, it often signals that sentiment has not broken — it has regrouped.

From a structural perspective, DXYZ now appears to be in the early stages of a new advance, with the initial phases already in place. This does not guarantee continuation, nor does it require belief in a long-term story. What it offers instead is something far more useful: a clearly defined framework for evaluating probability, risk, and potential reward.

That framework does not rely on optimism. It relies on structure.

To understand whether this emerging move has substance — or whether it fails before it matures — we turn to the only thing that consistently records market intent.

We let sentiment speak through price.

⸻

Sentiment Speaks

When markets are healthy, price doesn’t move randomly — it moves in recognizable phases. Advances tend to unfold in stages, pauses follow progress, and corrections often retrace in ways that prepare the ground for the next move. This rhythm isn’t driven by news flow; it’s driven by participation. And participation is sentiment in motion.

In DXYZ, that rhythm is beginning to stand out.

The stock first experienced a strong advance, followed by a controlled pullback rather than a collapse. That pullback did not erase the prior progress — instead, it relieved excess enthusiasm. When markets correct in this manner, it often signals digestion rather than failure. Buyers stepped back, sellers failed to take control, and price stabilized.

What followed is the more important development.

Price has begun to move higher again — not explosively, but methodically. It advances, pauses, and attempts to continue. This behavior suggests rebuilding participation rather than speculative chasing. Each pause tests whether buyers are still willing to engage at higher levels. So far, that willingness appears intact.

This is how durable trends often begin. Not with excitement — but with organization.

Structurally, DXYZ is no longer behaving like a stock searching for direction. It is behaving like one attempting to establish it. Whether that attempt succeeds will be determined not by conviction, but by whether price continues to respect its internal structure as it unfolds.

That brings us to risk.

⸻

Risk / Reward — Defined, Not Assumed

This setup does not require belief. It requires discipline.

The bullish scenario remains valid only as long as price holds above the prior key low near $20.47. That level is not symbolic — it is structural. A sustained move back below it would indicate that the attempted advance has failed.

As long as that level holds, the structure allows for continued upside progression, with a next meaningful target near $58, and a broader potential path extending toward the $75 area over the coming months.

If price moves below $20.47, the scenario is invalidated — not delayed, not weakened, but wrong.

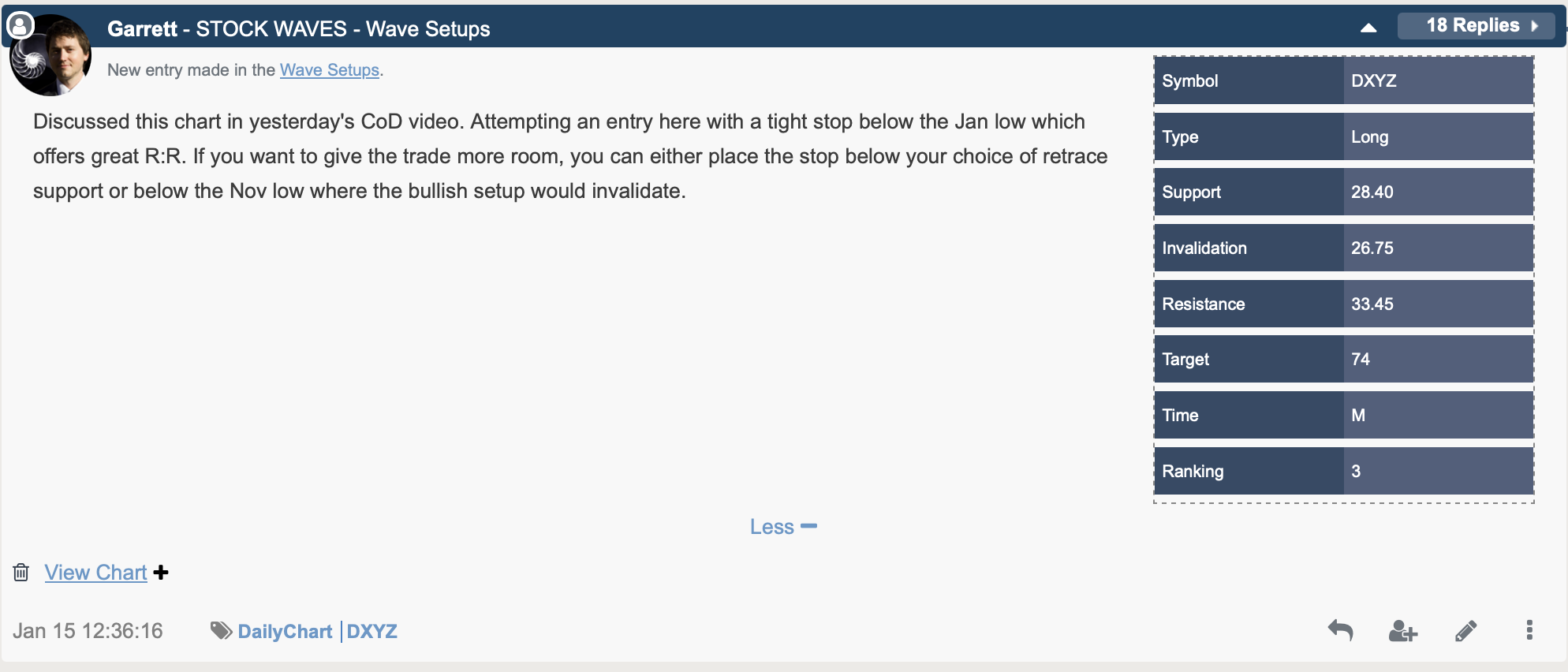

We can even tighten this structure further. Garrett Patten shared this update just a few days back:

That clarity is the advantage of approaching markets through structure rather than story:

• Risk is explicit

• Upside is proportional

• Bias is conditional

DXYZ does not need a perfect narrative to move higher. It simply needs price to continue doing what structure already suggests it may be capable of doing. If it does, the opportunity unfolds naturally. If it doesn’t, the market has already told us to step aside.

No hype required — just respect for what price is willing to confirm.

Final Thoughts

DXYZ does not need certainty to be tradable — it needs structure to remain intact. As long as price continues to respect its key levels, the market is offering a defined framework for participation with measurable risk.

If that structure holds, higher prices remain a reasonable outcome. If it fails, the signal is equally clear. In markets driven by sentiment, the goal is not to predict — it is to listen, respond, and remain aligned with what price is willing to sustain.