Could Be Stuck Between Resistance And Support For A Little Bit

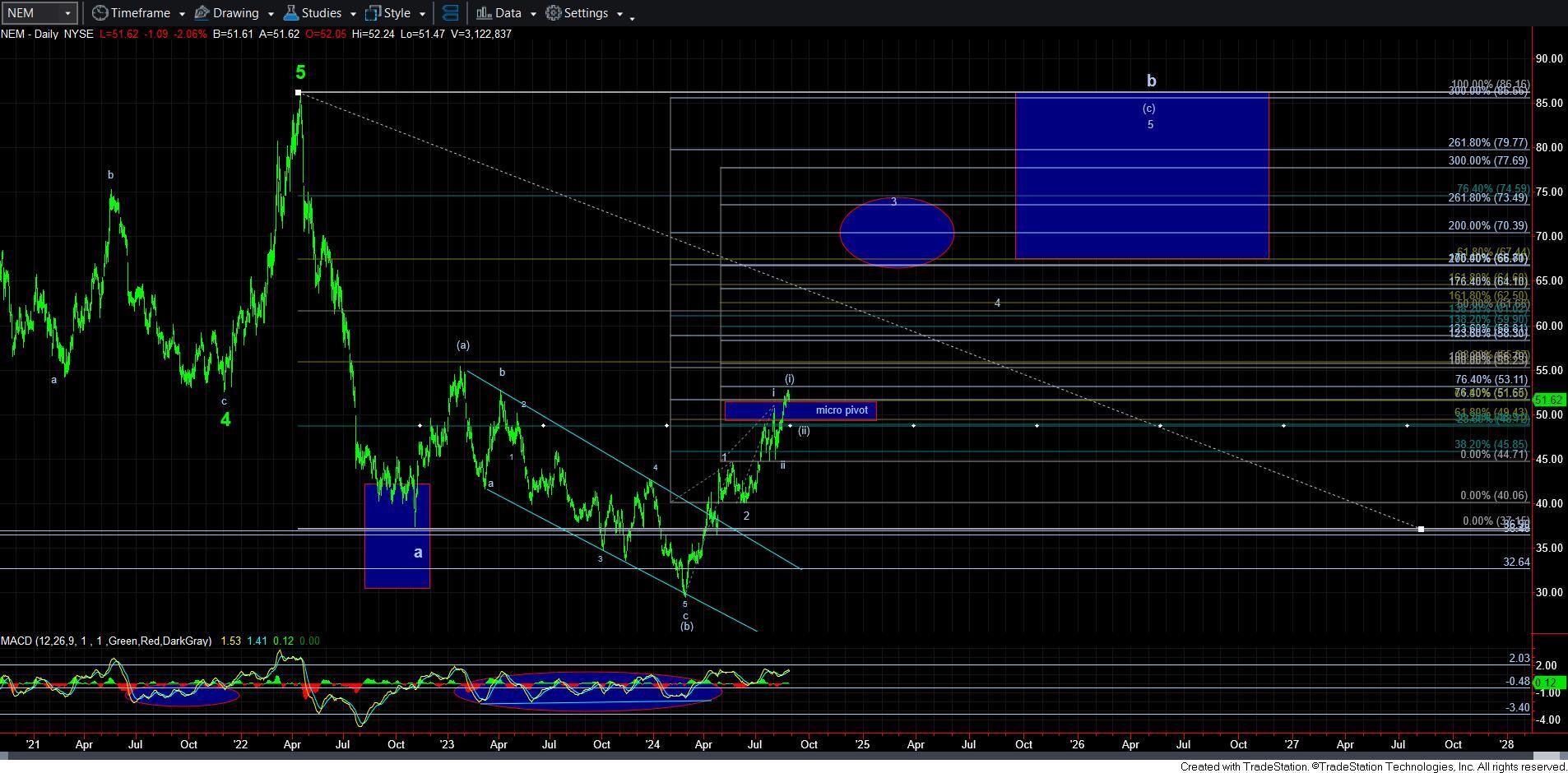

First, I want to state affirmatively that there is nothing I am seeing at this time that changes my bigger picture as we look to the end of 2024.

With that being said, I am going to note that the pictures on the micro-structure for GDX, NEM, silver and gold are slightly different but can begin to align in the coming week or two. So, let’s discuss each individually.

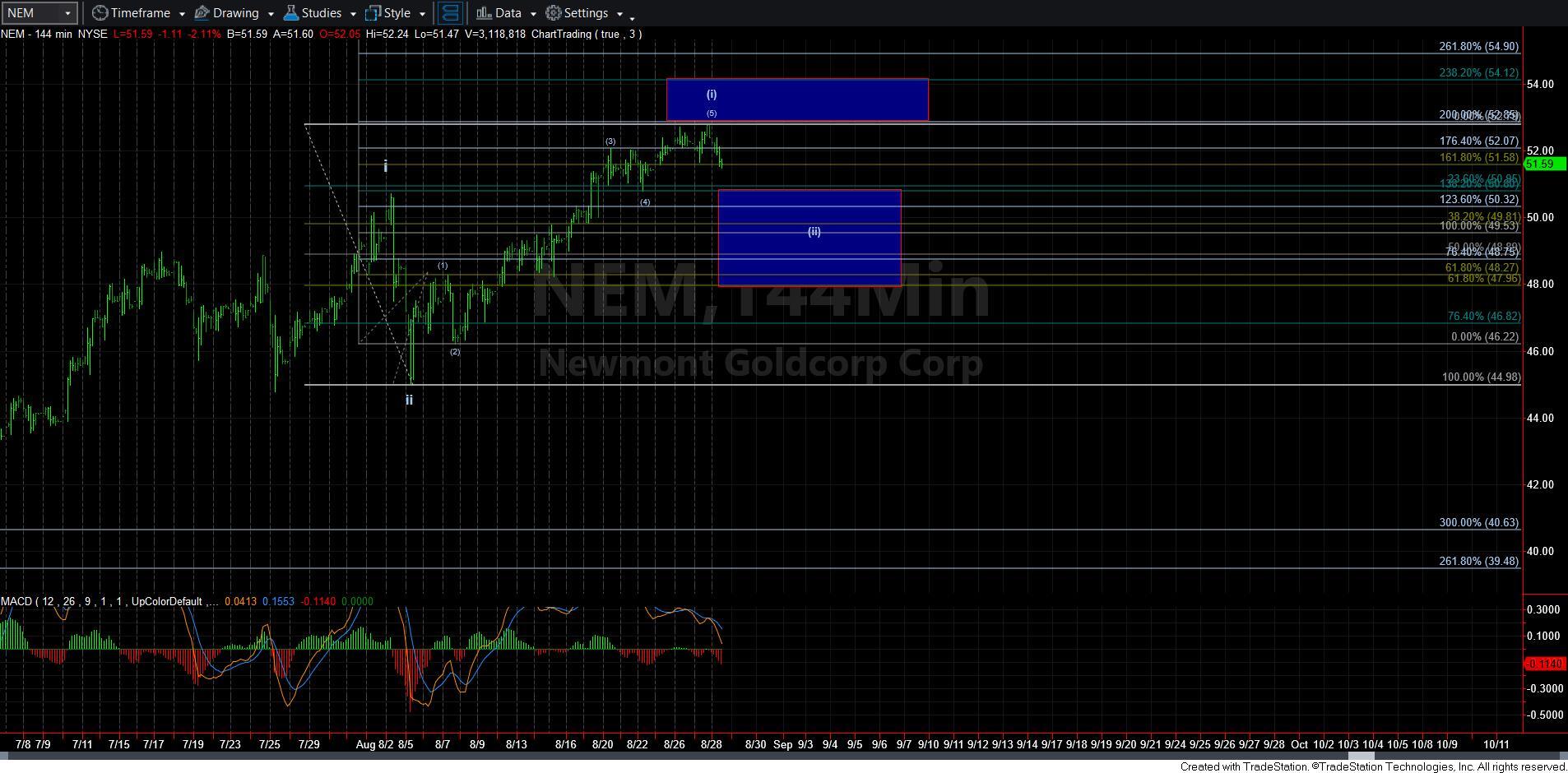

Let’s start with NEM. With the higher high struck yesterday, I can now count a completed 5 waves for wave [i] of iii of 3. This means that the next time we take out this week’s high, it “could” be the start of wave [iii] of iii of 3. But, ideally, I would prefer to see more of a pullback in wave [ii]. Now, of course, should we rally over this week’s high sooner rather than later, I may have to revise my view that wave [5] of [i] is still in progress. But, should we break out through the noted resistance, I likely would not be able to retain such a view.

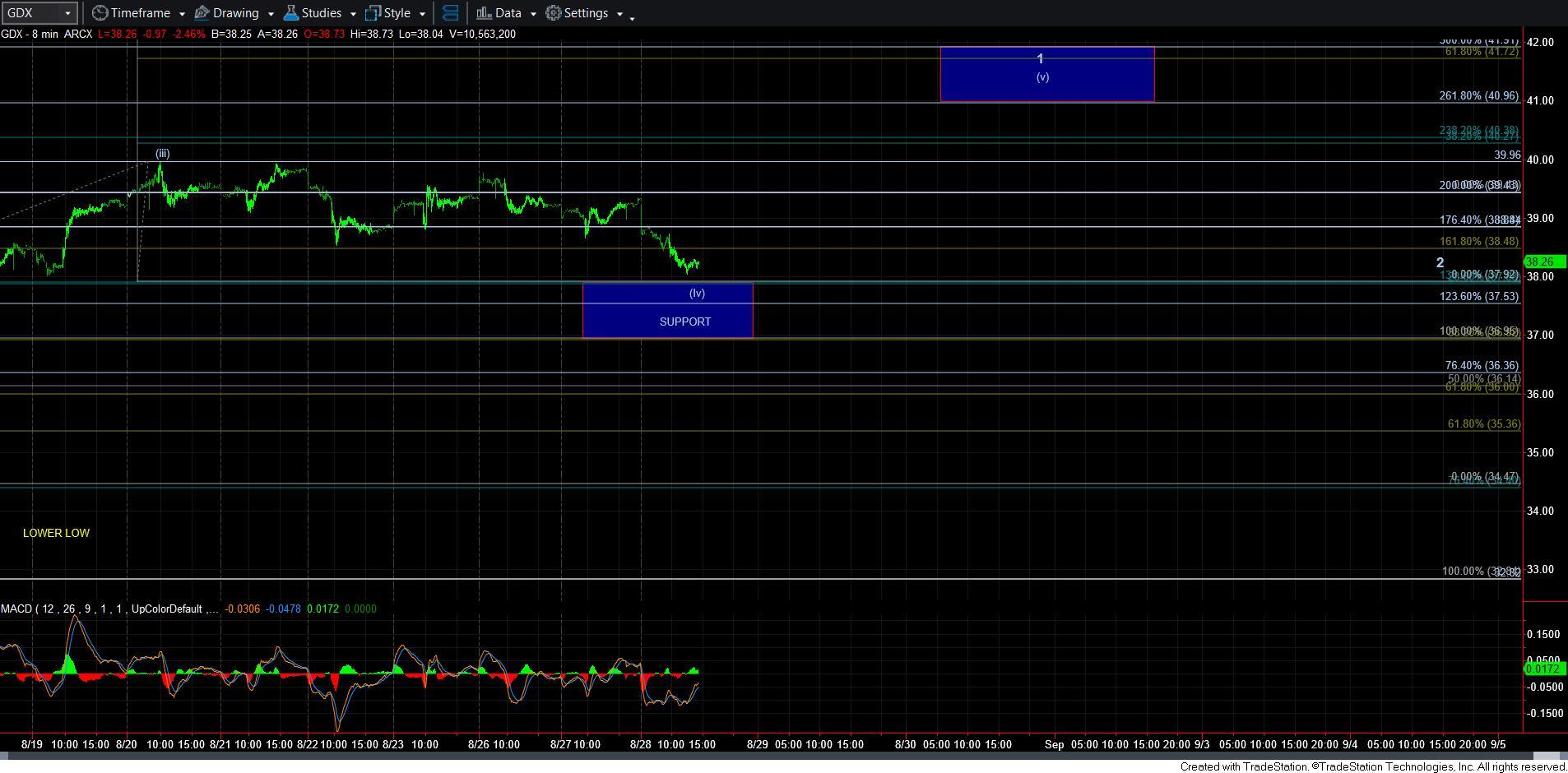

In the meantime, GDX looks a bit different, as it should ideally see one more rally to complete 5 waves up. This is why I may give a bit more room to NEM, as noted above. And, as long as the resistance box on the GDX holds as resistance, then I am still going to expect one more pullback in wave 2 before the heart of the 3rd takes hold.

In silver, while I can also count the bare minimum now in place for 5 waves up, I do like the more expanded wave [4] as presented in blue. The only reason I am counting it as an alternative at this time is because we have enough 1’s and 2’s in place for the 3rd wave to take hold at any point in time now. So, I want to make sure you are prepared for that potential, but to keep your eyes open to this alternative, as it is a very reasonable alternative in my eyes, and even one I like more so than the direct break out. But, should we break out through that resistance box, then I am going to move into the heart of the 3rd wave count.

Gold looks a bit similar to silver in that this could have been a a-b-c consolidation over the last seven trading days, but in gold it would represent a [b] wave within a b-wave. So, similar to silver, I am looking for a potential rally to begin, but that rally may only be a [c] wave of a b-wave, and maintain within the resistance box. This will set up one more decline in the c-wave of a 2nd wave, which would be the last segment of the 2nd wave of this degree before the heart of a 3rd wave takes hold. But, just like with the other charts, should the market break out through resistance, then I am clearly going to move into the heart of 3rd wave count.

In summary, I want to make it clear that we have enough 1’s and 2’s in place across the complex for the heart of a 3rd wave to take hold at any time now. However, those that follow me know that I am a stickler for detail and ideal structures. So, I do still see potential for one more rally which is followed by one more pullback before the heart of a 3rd wave takes hold across the complex. Yet, I will not stand on ceremony should resistance begin to break over the coming week or so. In the end, I don’t think this is a time to get cute with your positions. Jesse Livermore’s wisdom should be resounding in your minds by now.

NOTE: I AM NOW ON DECEMBER FUTURES