Costing into the Fed

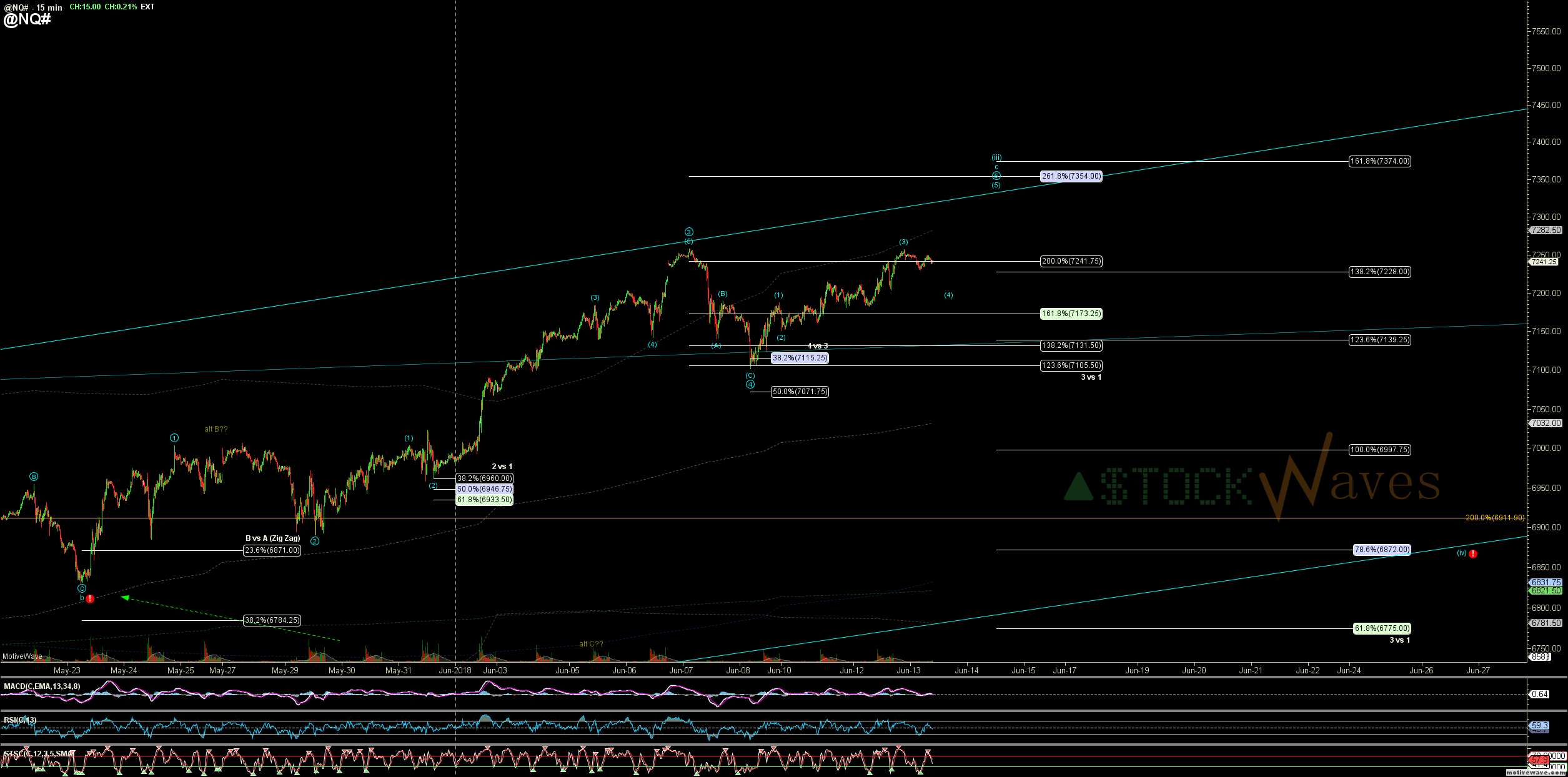

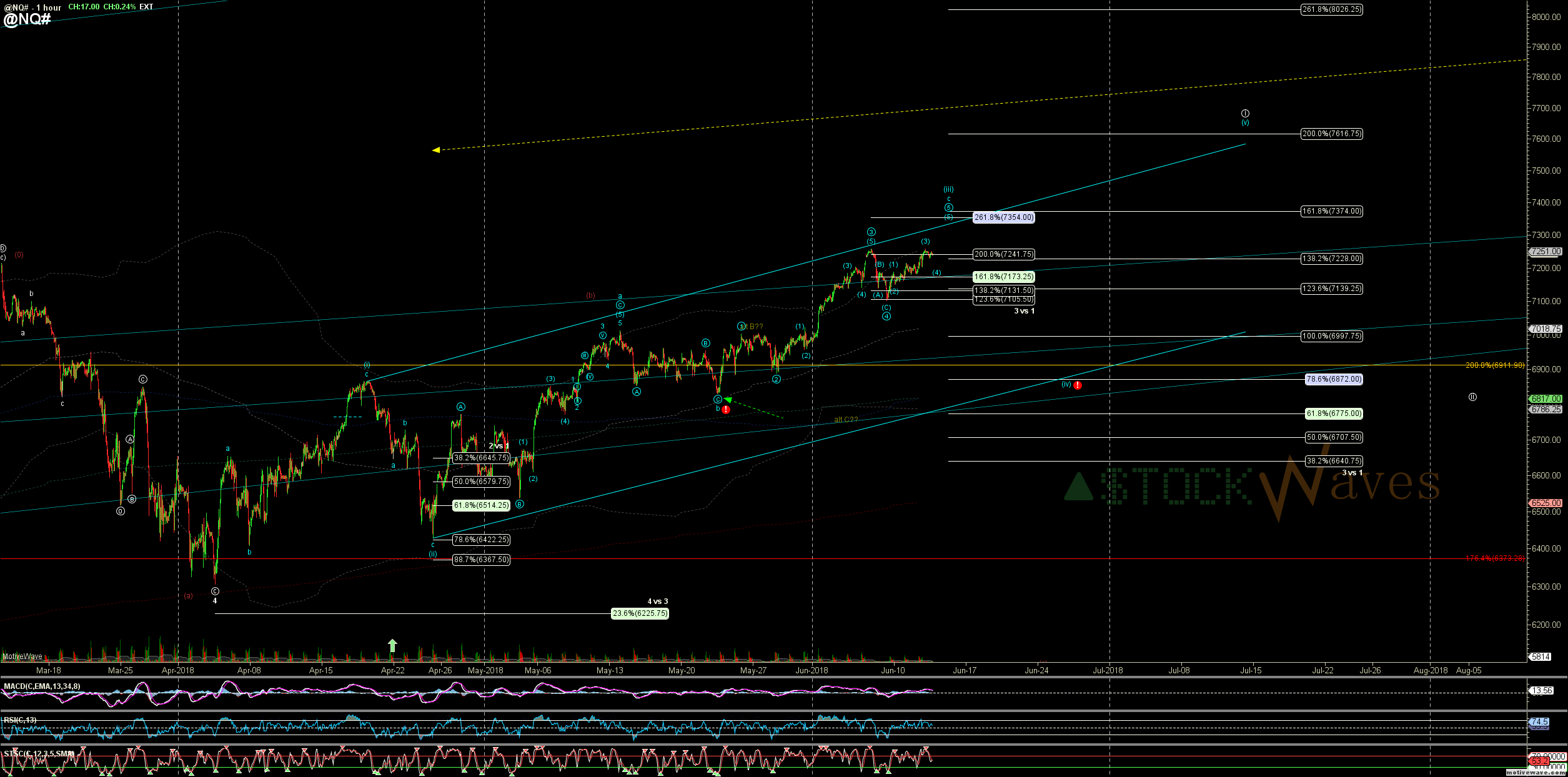

I think we are still grasping for ever so slightly higher into today's Main Event... DJI can easily count as the top of (iii) of the LD I am tracking in place as can ES/SPX though slightly higher to ~2805 is still more ideal. And then there is NQ which has not yet made a nominal new high for micro 5 in its' c of (iii)... (though it has exceeded Fib targets for c and (iii) both).

R:R is now skewed in favor of a retrace. I think that retrace should be a (iv) of the LD for circle i in the start of our larger Minor 5th. Target support regions are 2725-2690 in ES/SPX, 6900-6775 in NQ/NDX, and 24,725-24,450 in DJI.

Because there is potential for this to be a wave two in something a bit more immediately bullish trading for upside in the "b" of a "(iv)" is worth an attempt.