Continuing To Lean Bearish on SPY

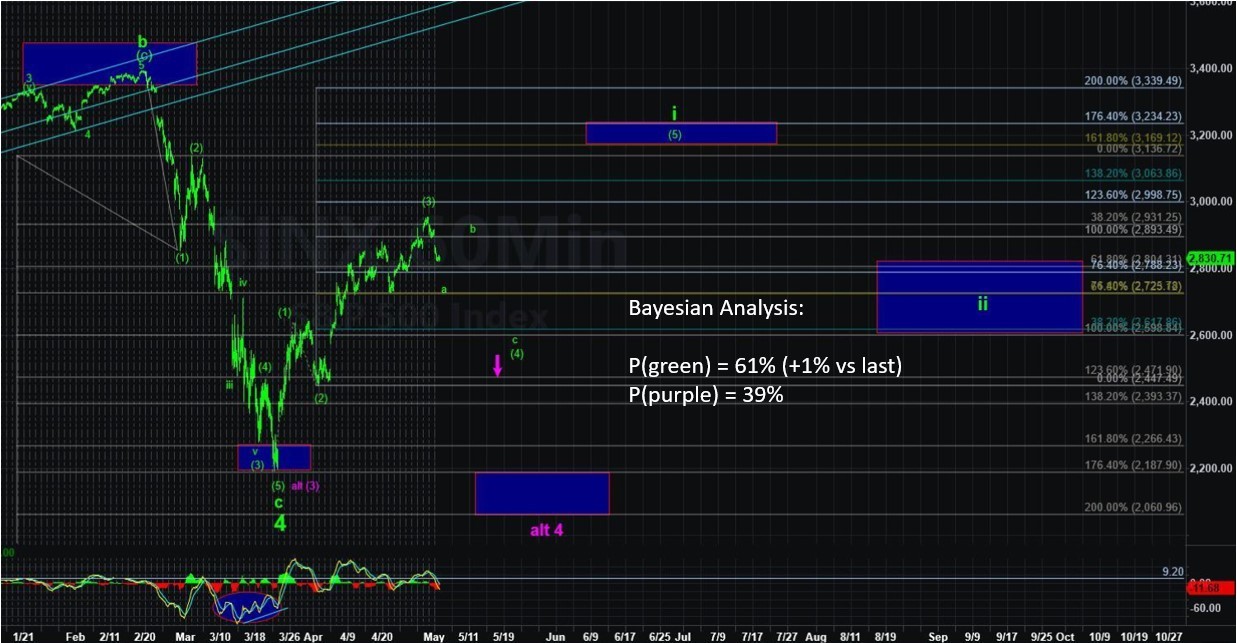

With SPDR S&P 500 ETF (SPY) in a vibration window and still struggling to get thru 286-289 resistance, our Bayesian Probabilities (BP) continue to lean bearish.

And extrapolating from current price action and vibration window activity, will we see a vw high and vw low across this week into next week? As a reminder, a vibration window is a moment in time that serves as resistance or support in price, usually manifesting as a relative high or low in price.

Here are the updated paths: (1) [P=74%] SPY continues to stall beneath the low 290s and begins a descent back to at least the low 270s, with the low 260s under that, and (2) [P=26%] The bullish leg begins more imminently with targets back towards 295ish, for starters.

At the micro BP support level there is 280-283 that was hit on 5/4 and has produced a muted bounce – back below 280ish and the low 270s should be seen quickly.

Longer-term long positions comment: In the SPY 240s a month ago, I pounded the table to “buy it if it’s not nailed down (BIIINND)” for those positioning further out. On 4/27-4/30, I sold/hedged some of my longer-term long positions. With that said, there does appear to be another BIIINND potential for us on the horizon – not necessarily during this swing cycle, but not long after.

In metals, the recent action in metals still presents as precariously bullish, with not much else changing as GDX struggles with the 33-34's resistance region. It does appear the early May time frame is serving up a vibration window high opportunity with projections for a deep selloff over the next month or more.

Our Bayesian Timing System remains comfortably short (even more so with the weak price action in GLD and SLV). A few paths: (1) [P=74%] GDX stalls in the 34-35 region and pulls back to at least 28 (but 23-25 can’t be ruled out), and (2) [P=26%] GDX continues its bullish advance that targets 38-40.