Ceiling to Bullish Leg Higher Appears Imminent

The SPDR S&P 500 ETF (SPY) still has that shot to see one more high into the 308-310s that has the potential to be the 2019 high. Further, the indices continue to chop marginally higher into the resistance band, and a mini-blow off top can’t be ruled out into this week’s vibration window*.

For perspective, SPY is 1-2% above its all-time highs, so there doesn’t (yet) appear to be any bullish momentum over last week’s highs. As such, a ceiling to this bullish leg higher still presents as imminent. SPY has tripped an "on the clock (OTC)," which is a higher probability vibration window with important volatility and turn implications.

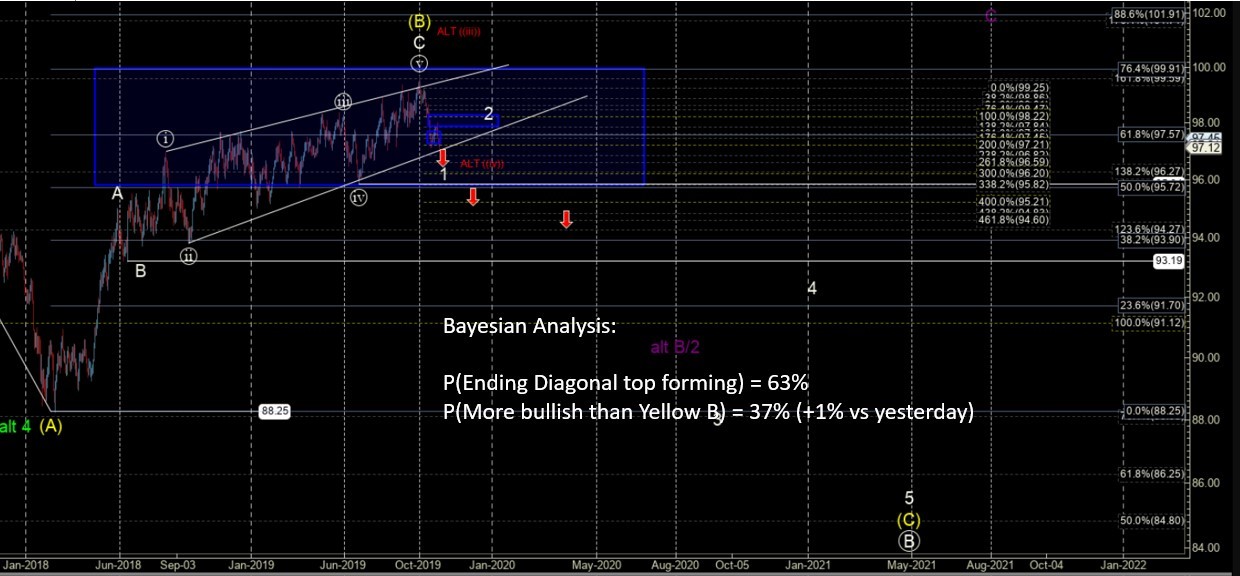

The OTC extends over the previously identified vibration window and lasts 2-3 trading days –- so anywhere between Nov 4 and Nov 6. At a minimum, our Bayesian Timing System sees a pullback to 300-303 before any longer-term bullish leg can develop. The timing for a minimum 300-303 is within 2-3 weeks and has a probability of 75%.

*A Bayesian vibration window is a moment in time that serves as resistance or support in price, usually manifesting as a relative high or low in price.