Cautiously Bullish As Everyone Forced Into Chasing

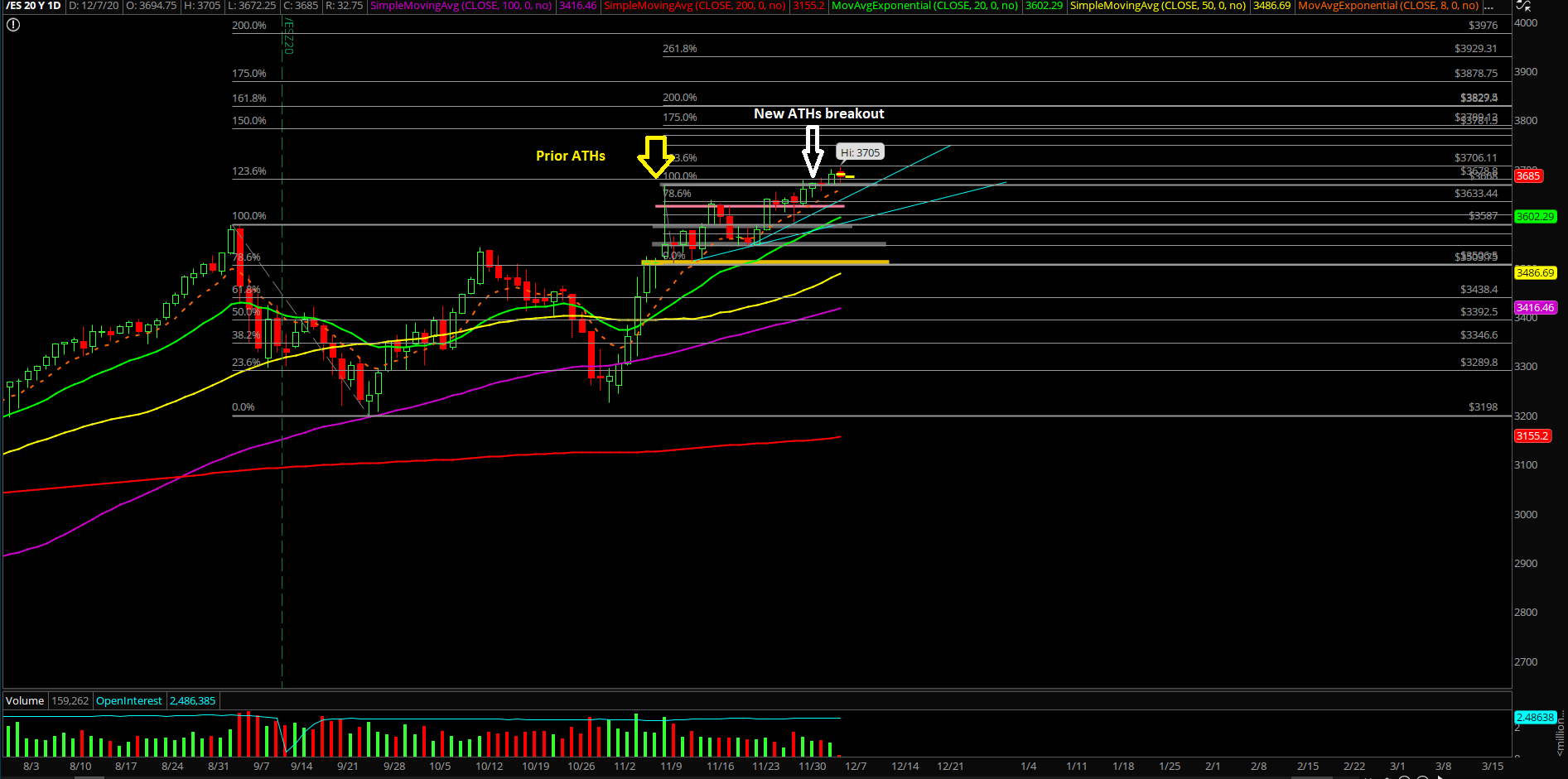

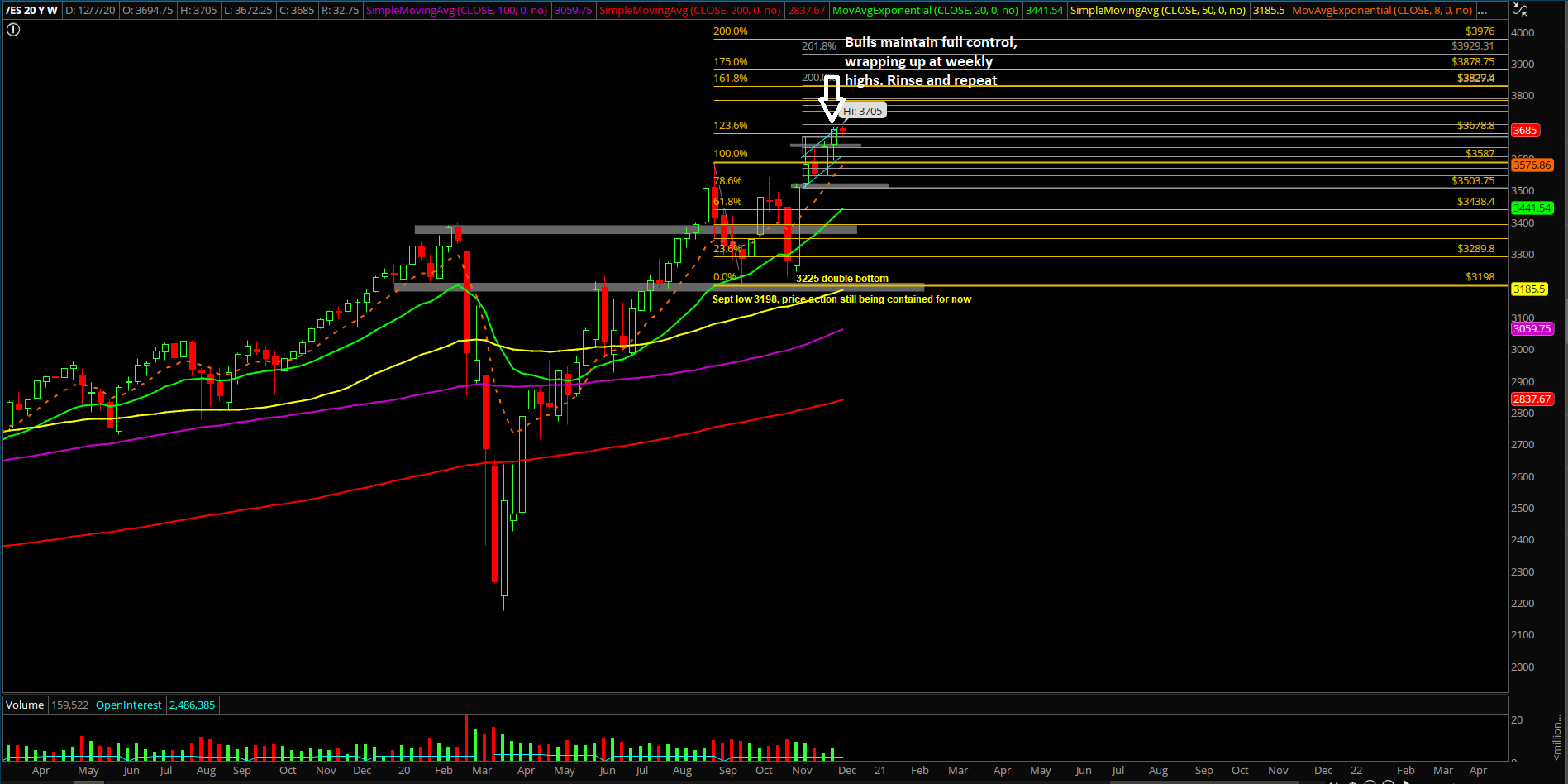

The first week of December played out as a trend continuation to the upside. If you recall, November was the largest monthly gainer this year, and the ongoing momentum remains bullish moving forward as price action keeps rotating higher.

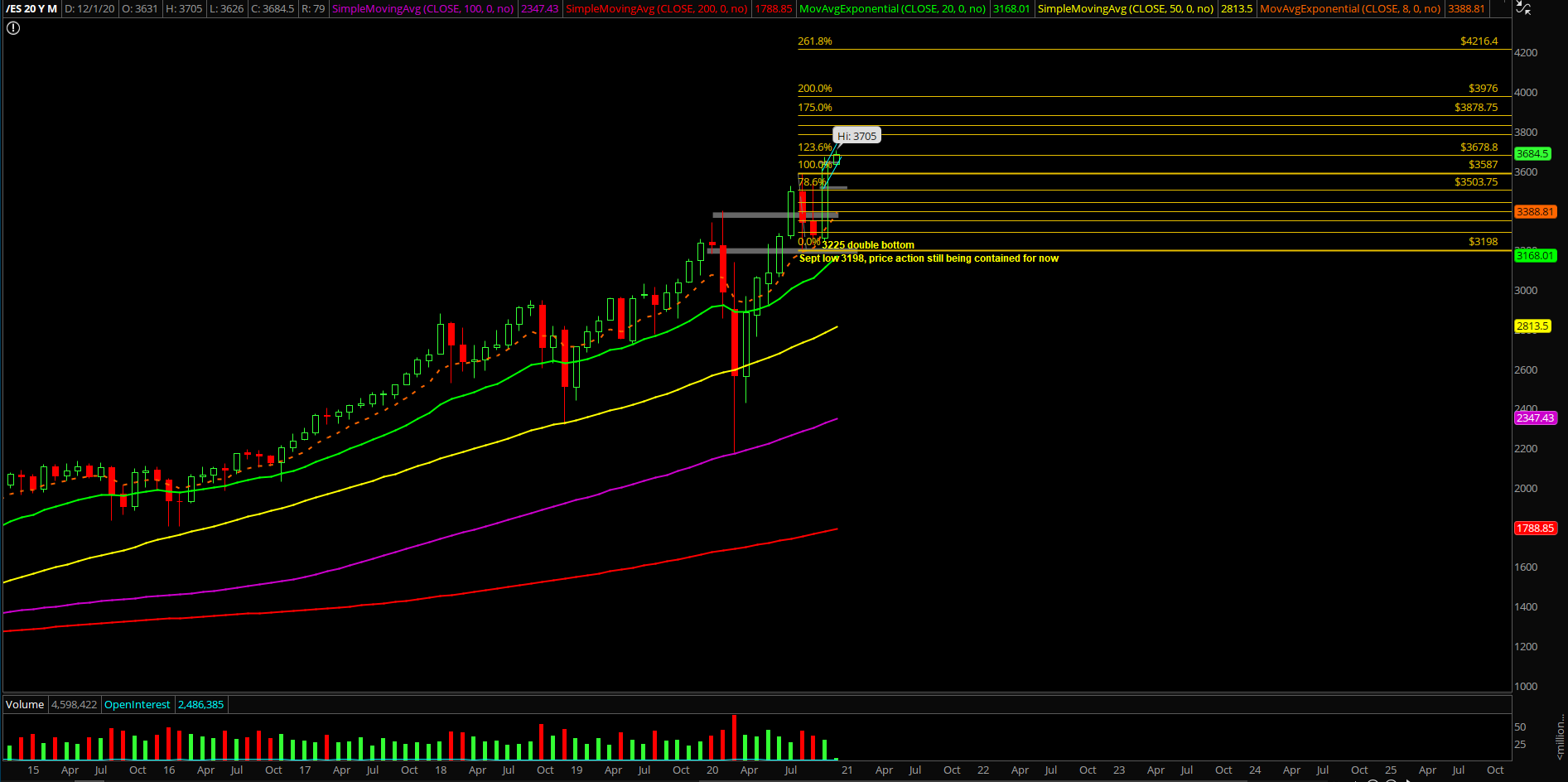

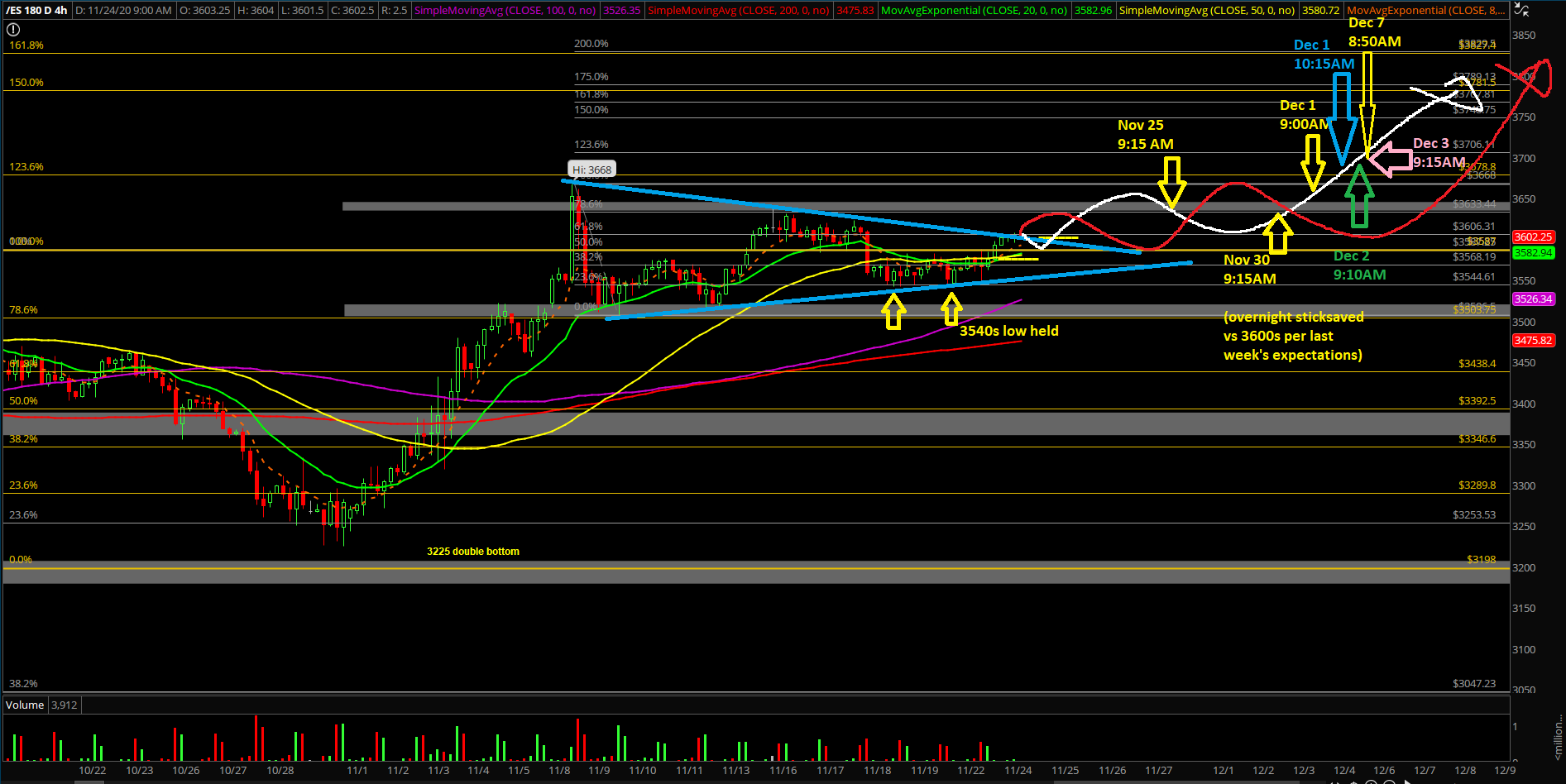

The main takeaway remains the same: Bears had lost many crucial fights during the past few days/weeks/months as they just lack follow through and momentum on their side. If you recall, all backtests into the daily 8/20EMA have held and there were no sustained breakdowns ever since the April V-shape recovery. The market is trying its hardest to wrap up this year at the highs or stabilize at the highs in order to enhance the momentum for year 2021. When price action is hovering at new all time highs, it means that the upside is unchartered territory and could extend to unimaginable lengths (theoretically unlimited). Pair this with the fact that NQ/tech getting super coiled in a bull flag/pennant…you have the perfect recipe of a squeeze when above support. As we head into year end, price action is hovering at highs as expected and we’re still expecting a high year-end close as we’ve been saying since April-May 2020 reports. (This doesn’t mean the market cannot pullback in between, you must understand and know your timeframes because now we have proprietary signals giving us a warning near the end of last week.)

What’s next?

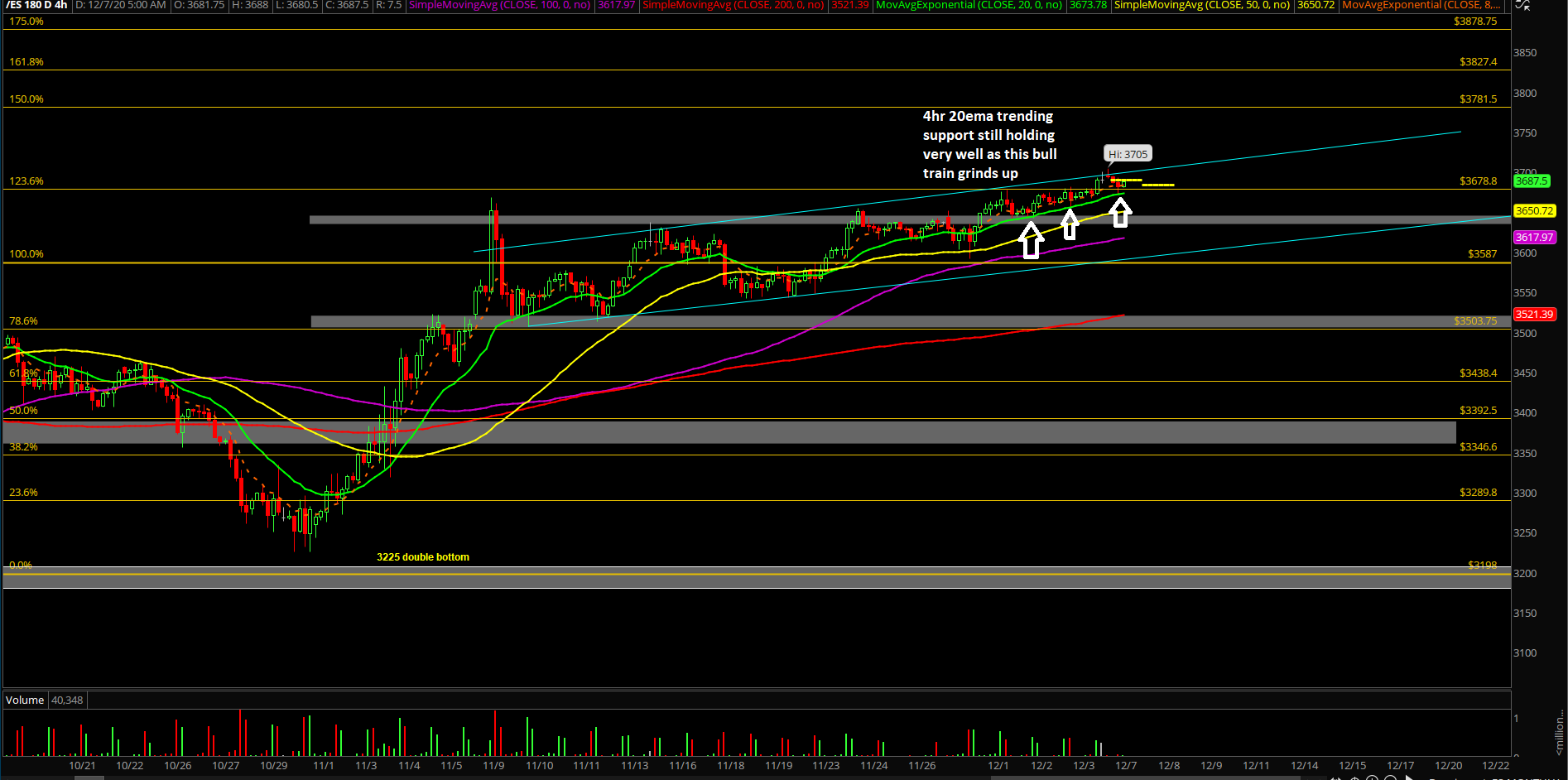

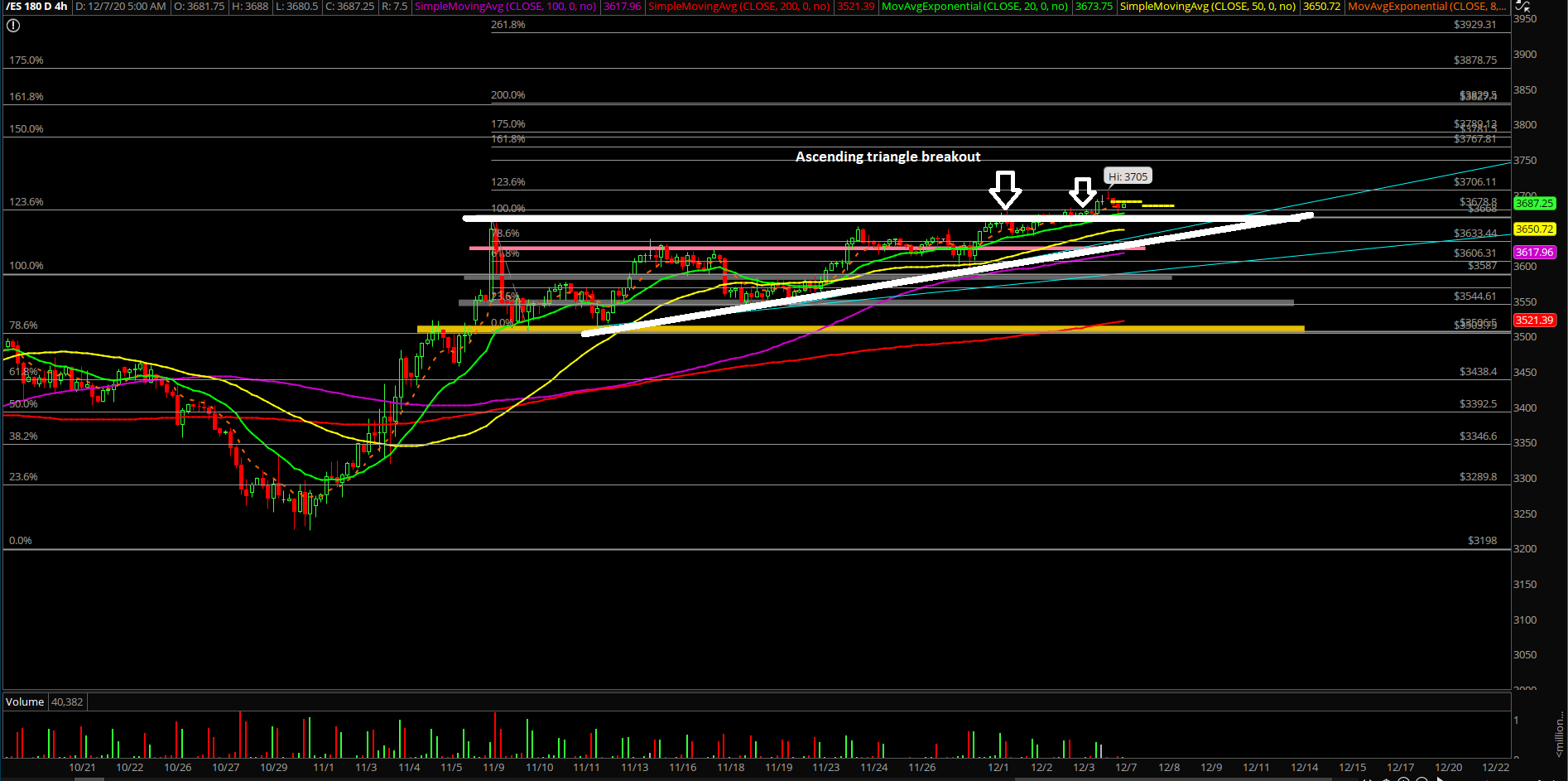

Friday closed at 3690.25 on the Emini S&P 500 (ES) around the highs of the week as price action cemented another upside continuation follow through. Expect more of the same slow grind up when trending above 4hr 20ema.

Summary of our game plan:

- Last week’s price action showcased an immediate trend continuation towards the upside meaning that the bulls remain in full control as support keeps rotating higher along with price.

- The first week of December week gained 53.25 points or +1.46% over the prior week.

- We still have to be cautious about the false breakout scenario with a swift mean reversion as we warned last week in regards to some of our proprietary signals indications. If the action changes quickly, be adaptable. As of writing, price = 3688~.

- For today, it is imperative for short-term bulls to keep the pressure up. Overnight low = 3672.25 which aligns with key support at 3668, focus on dip buying opportunity when above this key zone. For reference, 4hr 20ema trending support = 3673 as of writing.

- Failing this feat, 3655/3642 comes to mind swiftly which would then threaten much lower levels.

- A break above 3705 would confirm that bulls are ready for new immediate all time highs and go towards the 3780-3800 next immediate target levels.

- At minimum, a daily closing print below 3575 is needed in order to confirm a temp top.

- Our no shorting rule for the past few weeks remain valid until further notice; bull train mode.

- Price action is still following our 4hr white line projection since Nov 25th, adapt if changes.