Captain Obvious - Market Analysis for Mar 8th, 2023

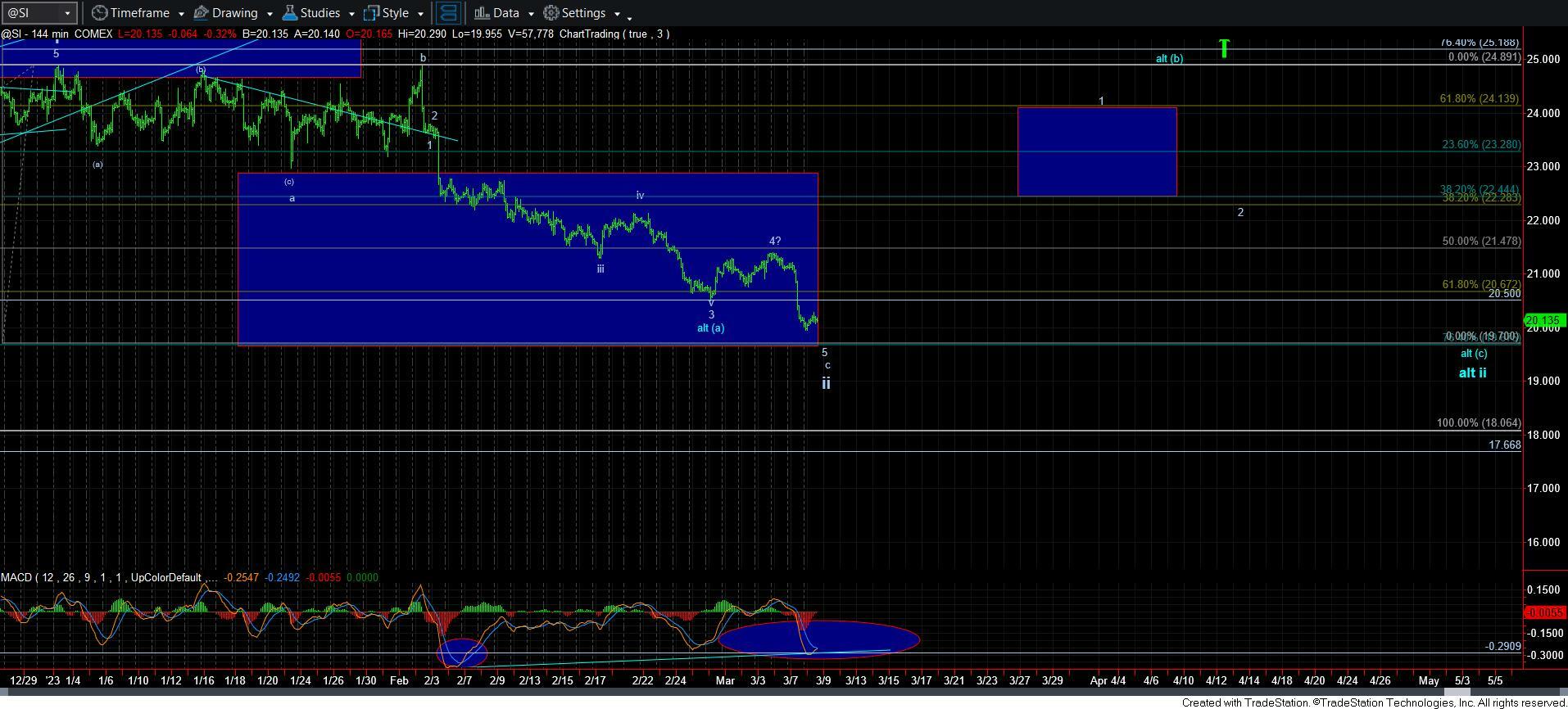

I think it is quite obvious to anyone looking at a silver chart over the last 24 hours that it broke its immediate [i][ii][1][2] structure, and it has dropped to a lower low in what I am still counting as the c-wave of wave ii. Unfortunately, it was not able to capitalize on the upside set up, and it ultimately broke down.

As it stands now, I have outlined the resistance region for a wave iv bounce, and as long as we remain below that resistance, I think we can get a 5th wave lower low in silver, which can target the 19.75-19.85 region, which is where the next set of Fib levels within this decline reside.

As far as gold and GDX are concerned, they have not yet broken below their prior lows, but I would assume they will if silver does drop in a wave v of 5.

But, what this highlights is what I tried to warn in my last update about getting too aggressive too early. We still need the larger degree 5-wave structure to take us to the highs struck back in January. Once we get that type of 5-wave structure, then we can consider getting more aggressive on the long side during a 2nd wave pullback. Until then, the market has a lot of promise, but it has yet to provide to us the ideal set up.

This leaves with our need to see a CLEAR 5-wave rally off a low in silver to make sure that we are going to attempt a larger degree 5-wave structure to the target box on the 144-minute chart. Remember, the .382-.618 extensions is the general target region for a first wave in a 3rd wave. And, that is for what we need to wait.

So, my apologies if the recent wave action has frustrated you. Unfortunately, the market did not give us a clear indication of the potential to drop to levels this deep, as the initial structure pulling back off Friday’s high was corrective in nature, and can only be counted as a leading diagonal. My apologizes for not preparing you for this decline, as the structure looked like a run of the mill corrective structure, making me assume we were simply pulling back in a 2nd wave until we actually broke support.

So, it again has me warning you to not become overly aggressive until the market actually provides us with the higher degree 5-wave structure to set us up for a break-out. That is still going to take a bit of time.

Lastly, I do want to point out that silver is again providing us with a positive divergence bottoming set up with the MACD on the 144-minute chart. While it is not going to tell us the nature of the next rally, it certainly does well in providing us with an early warning sign of an imminent reversal once it begins to cross positively in this type of set up.