Capitalizing On Correction ... What's Next?

We were net short from early-January 2022 until a week or so ago…now, we’re long.

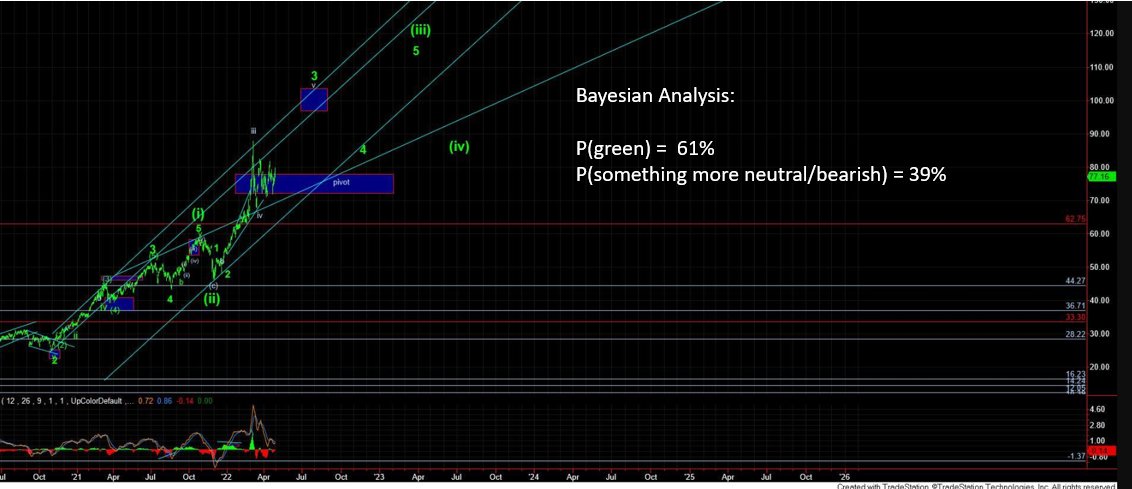

BPs (Bayesian Probabilities) fully support acquiring longer-term long positions after a bearish multi-month down-leg to start the year. I unwound the remainder of my longer-term long hedges last week and for members following me from early-January when I put them on, your longer-term accounts have had modest, if any, drawdown in 2022.

For newer members, here’s a recap so far in 2022: The first week of January 2022 I informed members if they were continuing to acquire long positions, then they were picking up pennies in front of a steamroller; and to expect an intermediate-term top imminently. Over the next two months SPX corrected 15%.

Further, we have remained in a sell-the-rip (STR) environment for several months (as expected and discussed herein) and made the lions’ share of our profits in stocks being correctly positioned net short.

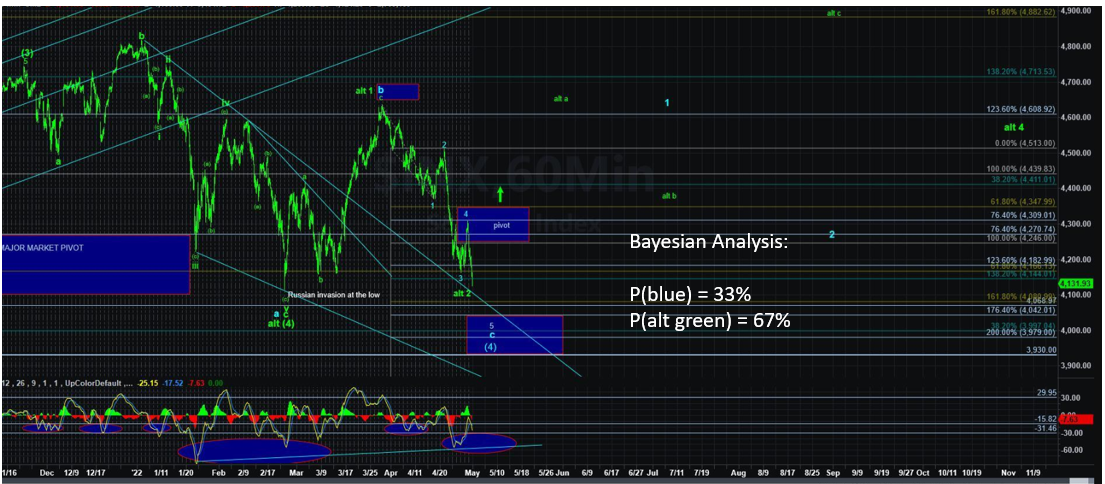

With that said, whenever I see a ROCs move away from a prevailing trend, it gets my attention. Two BP paths to continue to be aware of: (1) the “low is in” with a large basing region (like a sine wave) that will continue for weeks to months longer and then a break higher out of that large basing area will occur sometime into 2H 2022, and (2) The other path I have is OML, and if that were to occur, then there are two BP support areas at SPY 395-405 and at 360-380.