Can The Metals Stage One More Breakout?

With silver certainly taking the lead this week, this was the chart which made it rather clear to me of late that the upside was not yet done. And, as silver continued its move higher, it is now coming towards the completion of its wave (v) of (3). As long as it maintains over the 19-19.20 upper support, I can still expect one more push higher to complete this pattern.

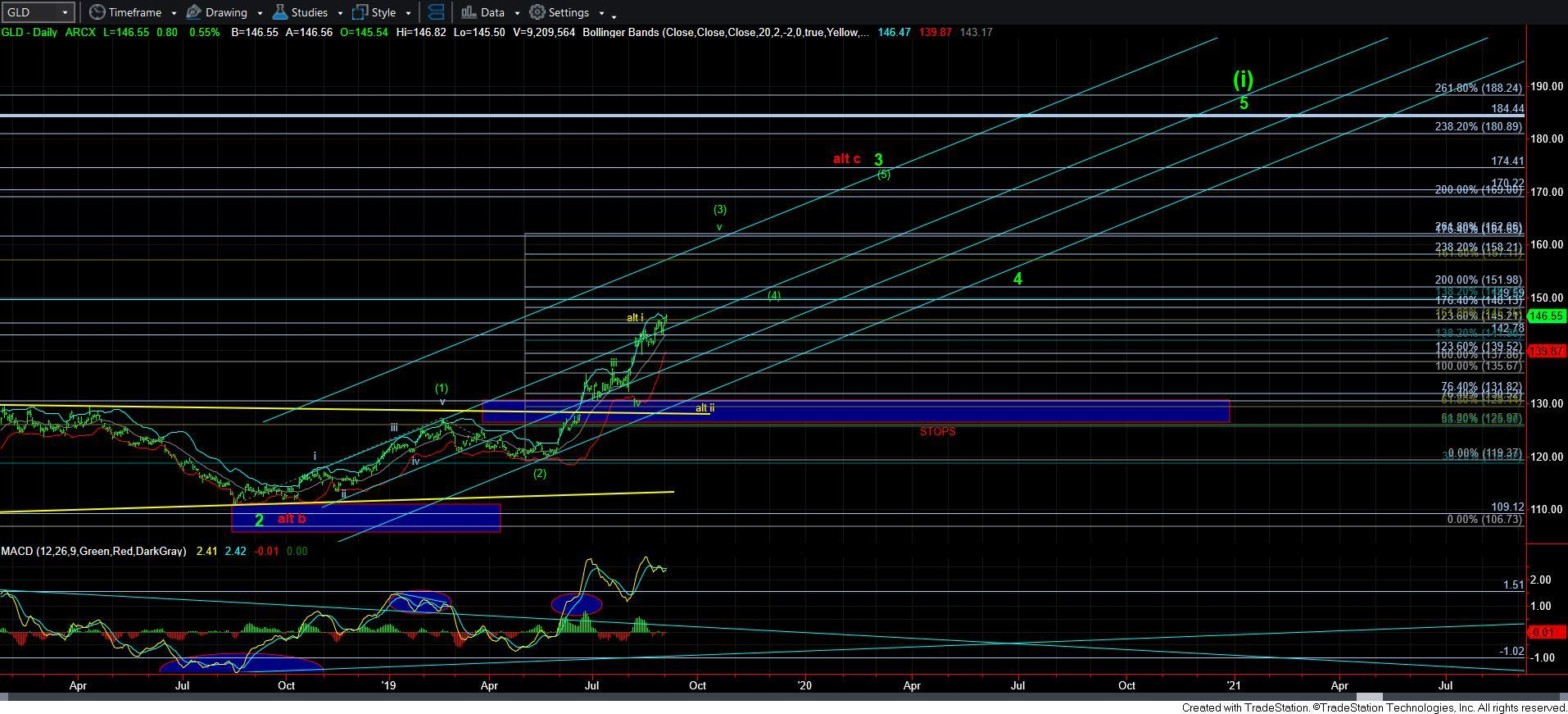

However, GDX and GLD have certainly lagged relative to silver. But, if you recall when this rally initially began, GDX and GLD took the lead, and silver lagged terribly. And, all I heard was complaining from so many about why silver was not moving. Now, I am hearing the same complaining, but it is now directed towards the GDX and GLD action.

This afternoon, the market began peeking over resistance, and most specifically in GDX. To put it simply, as long as we remain over 29.50 GDX and 143 in GLD, I can still maintain an upside bias for a strong extension in the complex. However, should those levels break, that would strongly concern me that this rally has met its local top, and a larger degree pullback may ensue.

To be honest, the market is rather simple at this time, and we can be well guided by the levels I just outlined above. Ideally, I still want to see more of an extension for wave (v) of (3) across the whole complex to take us to the more ideal targets we have for that wave degree on our daily charts.

So, as I have reiterated for months now, I will continue looking higher in wave (v) of (3) until we complete this more extended rally I want to see, or until we break the support levels cited. With us currently being over those levels, I must continue to look higher in the near term, but with the expectation that GDX may have more left to run than silver.