Can The Bottom Be In?

Of course, the answer is "yes" to the question in the title. But, due to the structures of bottoming in both GDX and silver, I am still skeptical. Again, as I noted in my last updates, it does not mean I am going to be aggressively shorting this market, as I think that to be foolish as we are on the cusp of another major rally phase. But, I will really need to see a full 5 waves up to confirm that the rally has begun.

In gold, I have highlighted the general path I want to see for that 5-wave structure. And, as I recently noted, this was the only chart that had a set up for this. As I write this, GC is at the 1.00 extension off the recent lows, with a pivot outlined on the chart between the .618-.764 extensions. IF we break down below that pivot now, then it would suggest this correction may continue.

As far as silver, we would need to take out the 31.25 resistance and complete a more clear 5-wave structure back to the recent highs for me to view its wave 2 as having completed. But, as long as we remain below 31.25, we still have potential for a lower low before this wave 2 completes.

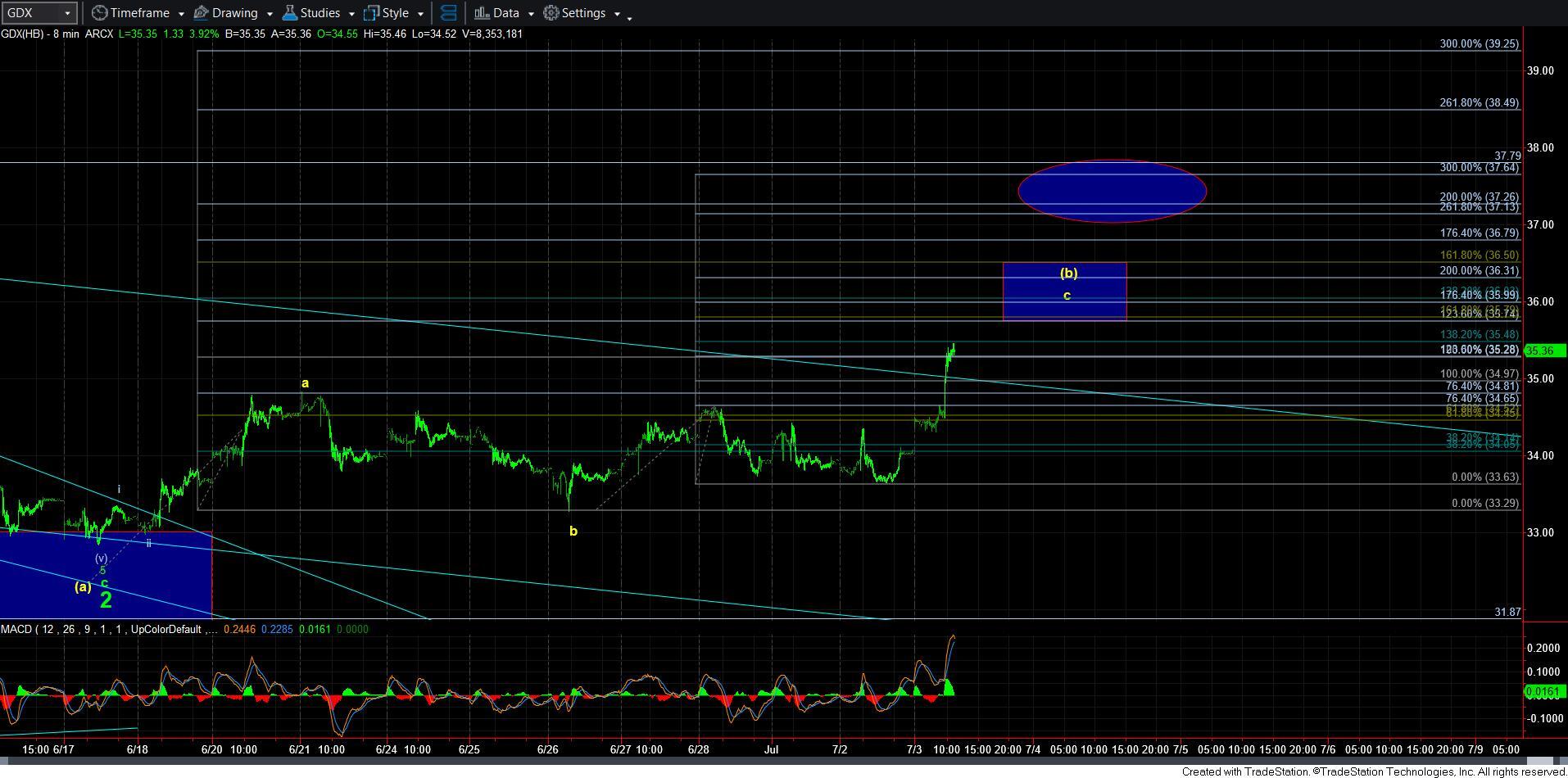

Lastly, GDX has its resistance BOX noted on the chart. And, if we see a 5-wave decline off that resistance, then it would make it likely that we are dropping down to the 30-31 region to complete this correction. But, if we can move through resistance and head to the ellipse overhead, then it makes it more likely that a bottom has been struck. And, if we see a corrective pullback from that ellipse, then I will be looking for more aggressive shorter term long positions.

So, for now, I cannot say that we clearly have seen the lows in this correction. But, it would seem that gold has the best shot of this still.

But, I want to reiterate that I still see the last half of 2024 being a very strong time for the metals complex, especially once we see completion of this correction, if it has not completed already.