Can Metals See One More Drop?

In all honesty, when it comes to silver, I do not have a whole lot of clarity. While I have this potentially counted as a c-wave of a 4th wave as having completed, it really is VERY deep for a 4th wave, even in a diagonal. It would actually be easier if silver got a lower low to reset the count. But, as long as we remain below the resistance, I have no way of viewing us as rallying to complete the leading diagonal.

As you can see from the GDX chart, we have dropped right down to the bottom of the pivot and have begun a rally. I cannot see a CLEAR 5-wave structure off that low, so I am still in a bit of a wait-and-see posture on GDX.

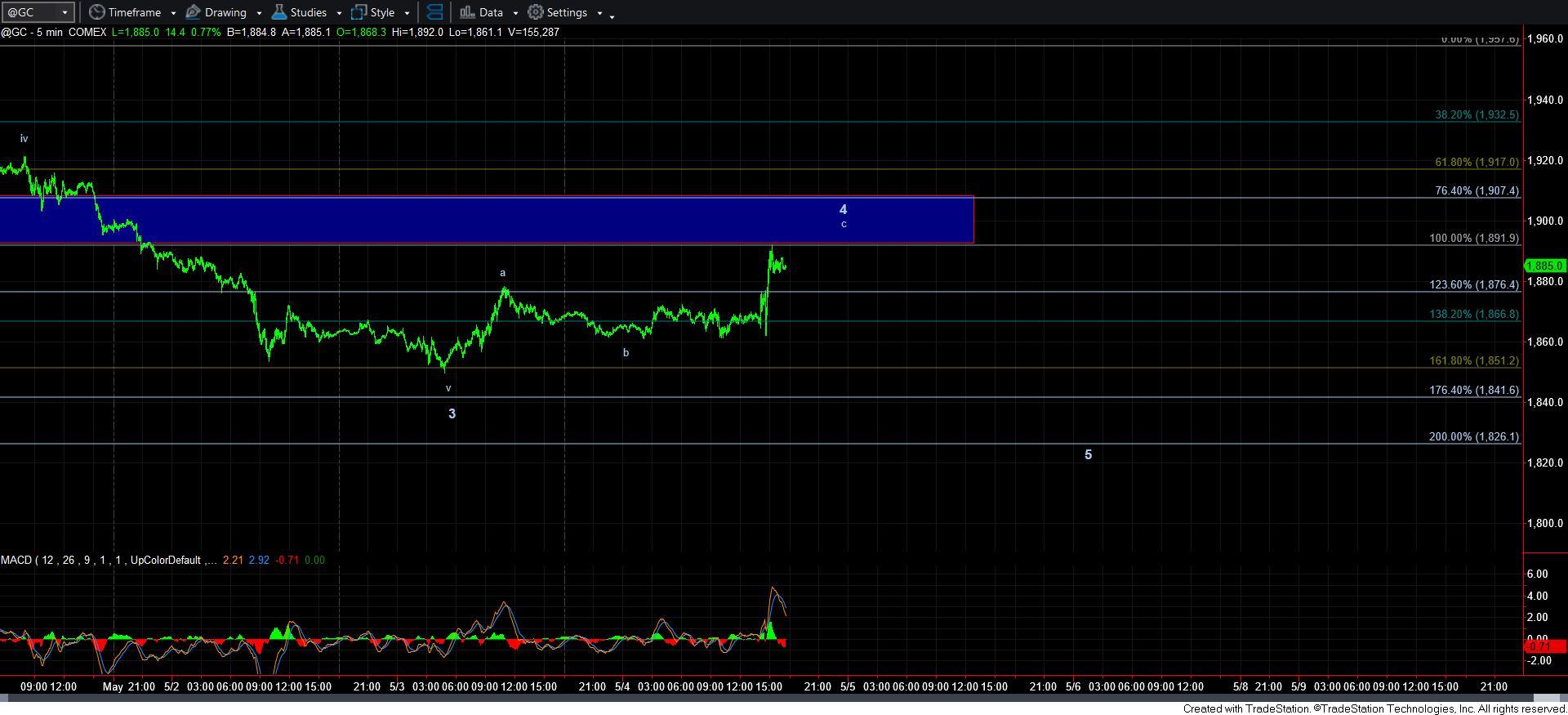

As far as gold, well, I am viewing this as a 4th wave pullback, as you can see from the daily GLD chart. The question is if gold has completed that 4th wave, or if it has one more lower low before it is done. As you can see from the GC chart, we have followed through on that 4th wave bounce I have been outlining over the last two days. And, we have struck the resistance for wave 4. As long as it holds, we can see one more lower low in wave 5 to complete the c-wave of the 4th wave. But, if we break out through that resistance, then wave iv is done, and the next rally phase has likely begun.

So, I still have no reason to take any aggressive long trades. Until I have a clear 5-wave Fib Pinball structure, I do not act aggressively on any chart. The Fib Pinball structure provides me with high confidence in trading, with low-risk, high probability entries and exits. Without that, I am not willing to get aggressive. In the meantime, I still think the market goes much higher, but the question is still a matter of path when it comes to the micro structure. I would imagine this can finally clear up in the coming week or two.