Can Gold and Silver Diverge?

The simple answer is “yes.” In fact, I point it out all the time that, in 2011, silver topped 5 months before gold and only saw a corrective rally while gold went on to its ultimate top during a strong run in the summer of 2011. And, there is no reason we could not see the opposite occur in 2025.

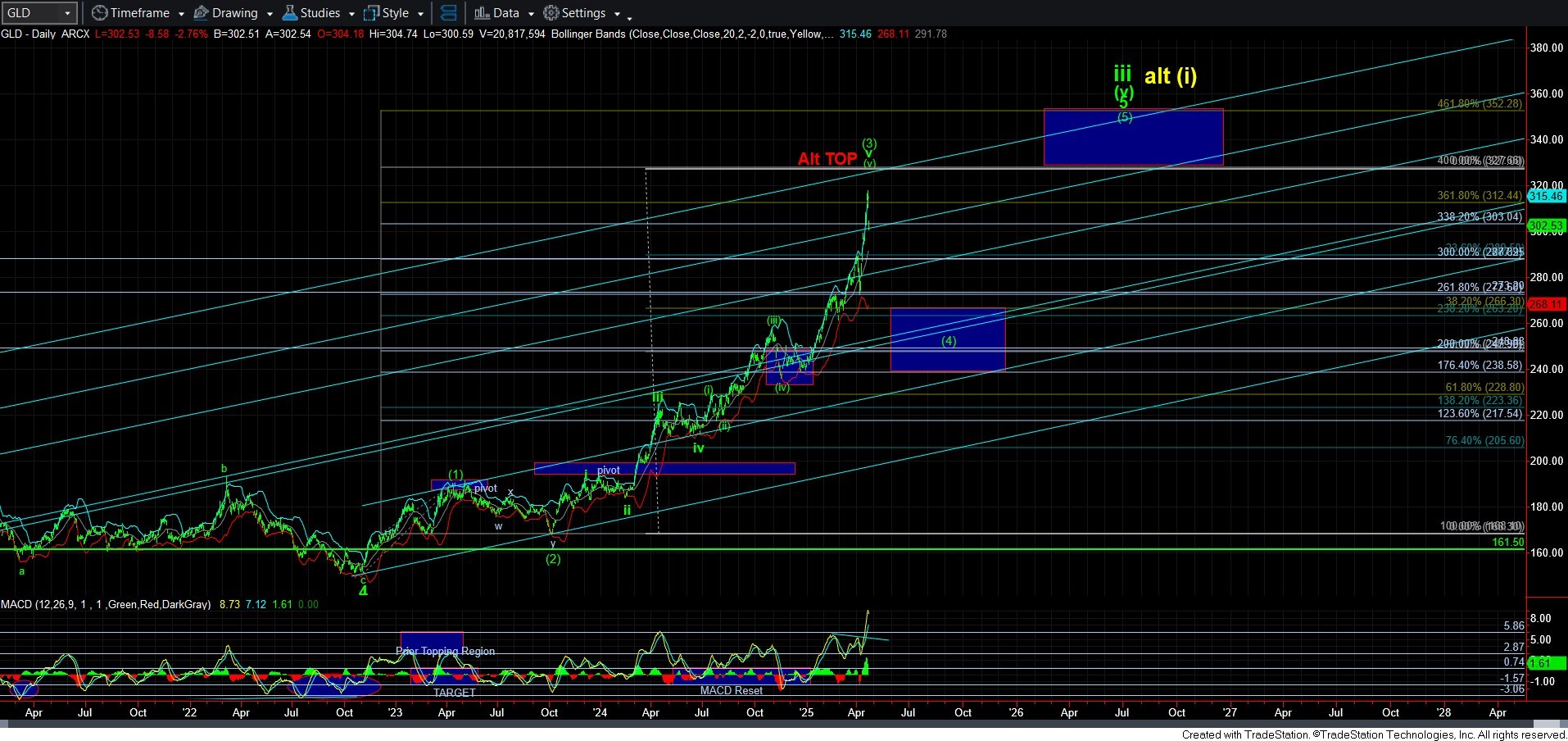

Now, I am not saying that gold has certainly topped. But, it must be a consideration based upon the manner it rallied into the recent high. Yet, my primary count will remain with an expectation of a (4) (5) before this cycle completes. However, if gold should rally correctively and significantly lag silver on the next run, well, I will not hesitate to turn to the alternative “top is in” count.

For now, I think it is reasonable to assume that gold has struck a local top (if not the major top). And, I am viewing us within an a-wave of wave (4) as my primary count. But, I am assuming we still need to complete a (c) wave down before that a-wave is complete. You can see the two paths for this potential on the attached 5-minute GC chart. If we break down below the 1.00 extension in the 3259 region, then it strongly suggests the [c] wave is in progress.

Also, I have to revise the minimum target for this wave (4), as the .382 retracement of wave [3] is now in the 265/266 region, which is presented as the top of my wave (4) box on the daily chart.

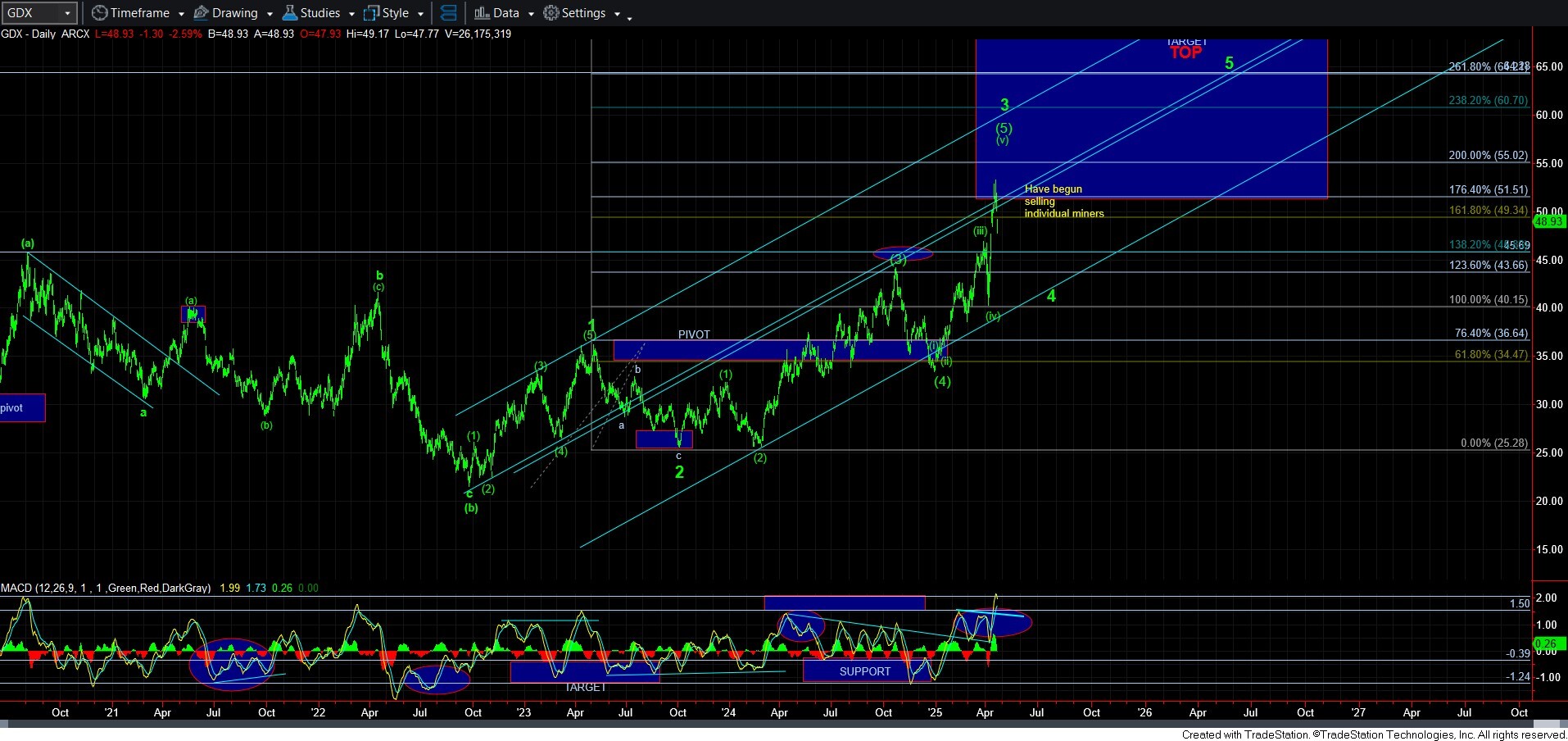

As far as GDX, there is certainly potential that its wave 3 has completed. But, I am still wary of a continuation move in NEM to push it higher still. And, as long as we hold the 49/50 region in NEM, I can reasonably look higher to complete waves 3, 4 and 5.

The alternative for NEM would be that we just struck a b-wave rally high in either a (b) wave triangle, or we get one more drop to fill in a (b) wave flat, as presented in yellow. For now, I am going to look higher more immediately if we hold the 49/50 region as either a standard Fib Pinball structure, or potentially even an ending diagonal for the [c] wave. But, clearly, should that support break in NEM, it increases the probability that GDX has entered its 4th wave pullback.

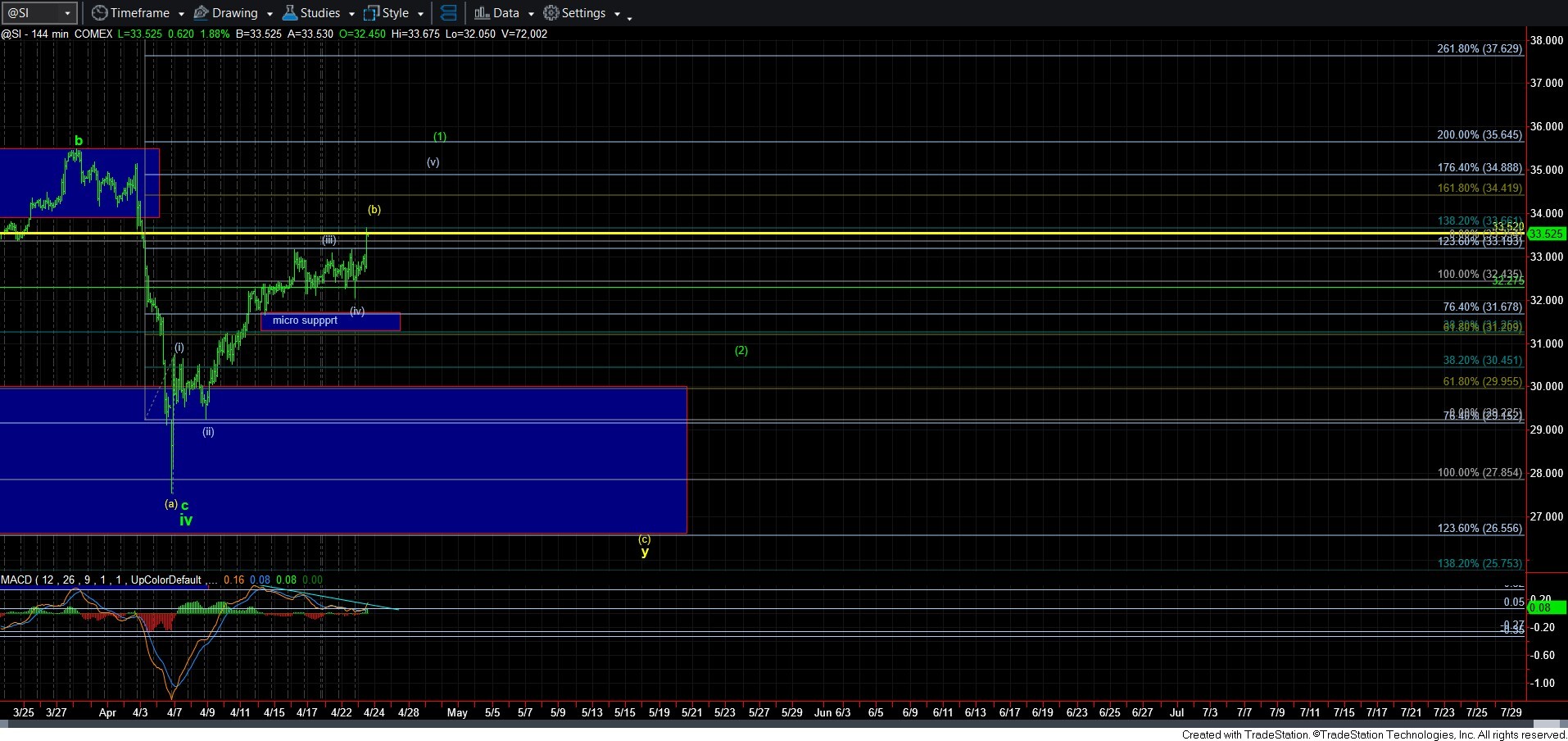

Now, silver remains quite complex. I still cannot get rid of that yellow count. But, this break out today opens the door to the leading diagonal scenario. But, we must rally to at least the 1.618 extension for me to really consider this potential. So, right now, I have to say I am around 50/50 and will remain so until I see how the market begins its next decline in silver.

Overall, whether gold goes on to make higher highs or not, I am still quite confident that we are going to see a strong rally in silver in the coming year. And, my expectation is that GDX will follow along for its 5th wave. For now, I am maintaining the same expectation in gold, but am open to changing that view based upon how it rallies after wave (4) is done.