Can Bulls Capitalize On This Setup?

Thus far, the bulls are holding supports on the pullbacks we are seeing in the micro structures in the metals charts. In fact, silver has a very nice bullish potential micro setup on the chart, which can provide us with a really nice rally, and even potentially target the pivot overhead with the type of extensions we often see from silver.

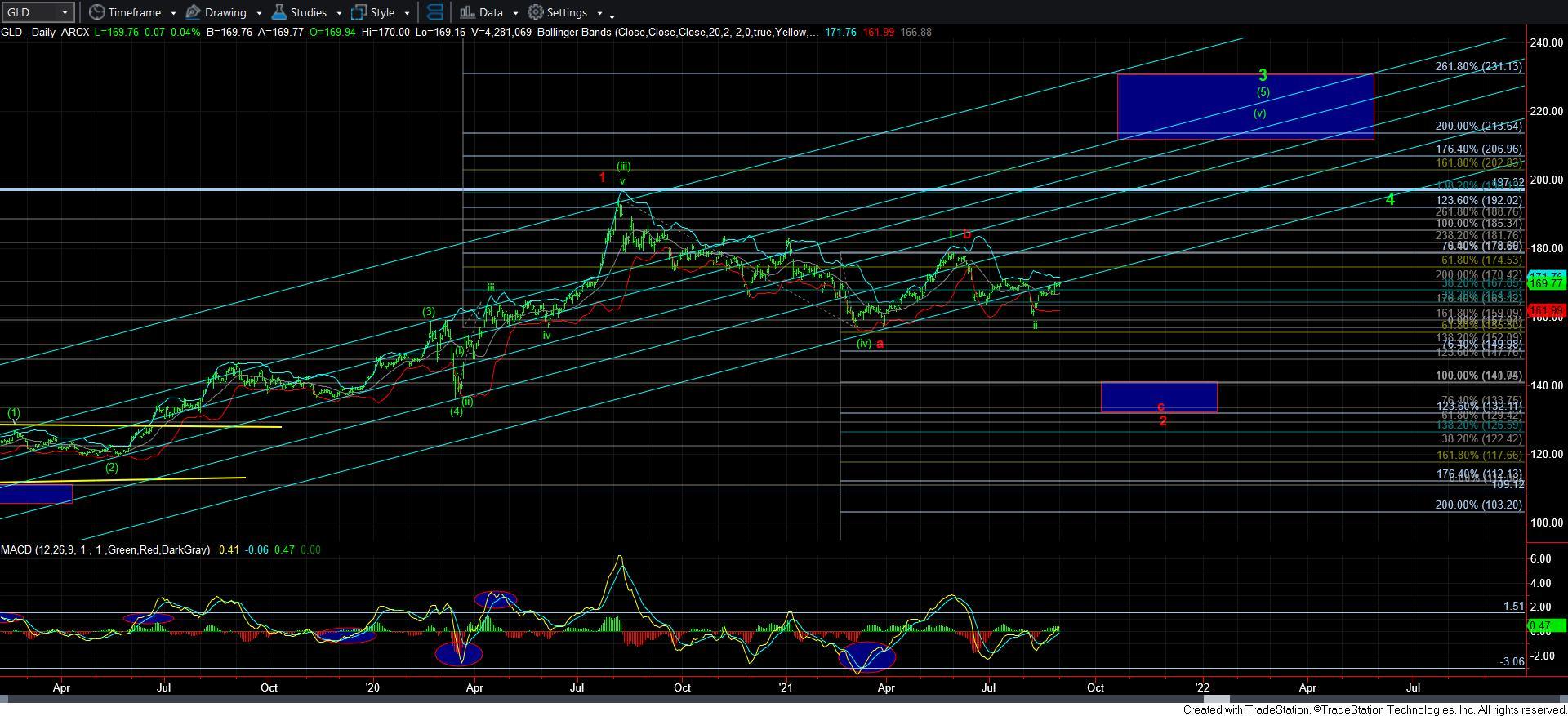

As far as gold is concerned, we still need to break out through the resistance that has been keeping us in check for the better part of the last two weeks. Yet, even if we do break out of the resistance, I want to again note that any 5-wave structure in GC would be an overlapping leading diagonal, and I would need much more confirmation to accept this as a bullish trading cue.

So, not much has yet changed in both GC and silver, as silver really still has the best bullish potential set up on the micro structure.

But, GDX is still my biggest concern, as I have highlighted many times. As of late, we have been hovering below the Negative Nelly Box. And, until we actually complete 5-waves up THROUGH the Negative Nelly Box can the bulls breath a sigh of relief.

You see, if the market is unable to complete all 5-waves up as presented in green, and instead turns down and breaks below 31.29 impulsively, then we have a strong indication that the trap door has opened in the GDX, and if the market steps through it, we have a target down in the 21 region to strike before all is said and done.

So, clearly, we are at a very important juncture in the coming week or two in the metals complex. And, until the bulls can prove themselves, I intend to stay somewhat protective and cautious.