Can Bitcoin Reach $65,000 by 2021?

Greetings From the Crypto Room

I just got back from TraderExpo, where I shared my outlook for cryptos in 2019 and beyond. The presentation was titled, ‘Can Bitcoin Reach $65,000 by 2021’. While this title is meant to catch attention, the point was to explain to the audience what I was looking for to make that likely. I also explained that the next long term top in Bitcoin can come in at $30K to $125K or more. I lean to the higher targets as it has a tendency toward extended 5th, not unlike gold.

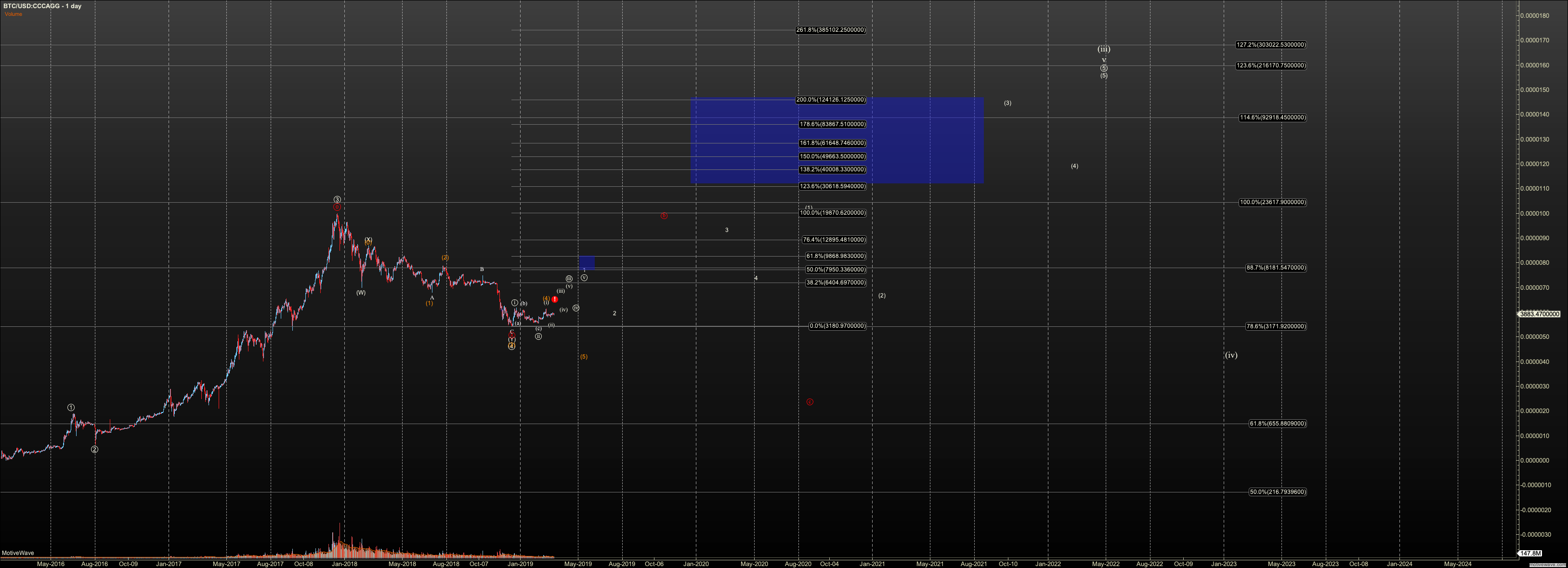

If you’ve been watching at all, you know that Bitcoin has dropped 85% from $19,500 to $3120 over a year. While that sounds awful, and it has been, it is not unique. As you see from my chart, Bitcoin has seen several such drops over its short 10 year life and will experience many more. Bitcoin being the center of liquidity in the crypto space, as most cryptos trade in XXX/BTC, not XXX/USD pairs, most charts came down with it, and many faired much worse. While Bitcoin has held my primary long term count (support was at $3000), a few have not. Ethereum, for example forced consideration of a wave 2 down, rather than a wave 4. Bitcoin itself can be consider wave iv of it’s primary 3, as long as over $3000. Though the level it has reached does make primary 4 already in, or in progress as a reasonable alternate still, and certainly primary below $3000.

One characteristic of Bitcoin is that it tends to show very steep WXY correction on many timeframes from 5m charts to daily. If complete, this correction is a great example. See how I include the alt 4-5 for a ‘traditional’ C wave to $2500. But my experience with Bitcoin is suggests it doesn’t need that lower low.

Further, since, we can count 5up off the $3120 low, and the potential 5up with an expanded flat off the wave 2, we may have a 1-2, i-ii setup in progress. The alternate is we had a low C wave top at $4085 and are on path to $2500. But we have a line in the sand at $3500, which if held, I have a projection to the $6000 region.

I lean bullish on this setup for a couple reasons:

When I look across the Crypto market, we do have the same question about the Feb22 high being a C wave. We were too low. Corrections off that high, have suggested breakouts in the heart of a third seem imminent. Time will tell.

One point of discussion in my presentation, is that Bitcoin has reached a certain level of ‘street cred’ as an asset class despite the bear market. Futures being launched were the start. Do we think the futures were created to give retailers speculation options out of their brokerage accounts? I don’t think so. By 2017, institutions were starting to accumulate Bitcoin, and they need a hedging method because moving large volume of bitcoin is dangerous. It is not transparent.

Further, since the top, the OTC market for Bitcoin, has been quoted by one of the institution prime brokers for cryptos as $200M. And, these prime brokers, or rather ‘liquidity providers’ are sprouting up regularly. There is a growing business in the institutional trade of Bitcoin. Watching the large wallet addresses ‘out there’ shows a large accumulation. There is a concerned groundswell rising that retailers may be forced away from bitcoin as the supply may get a little thin.

Beyond giving Bitcoin some credit as an asset class, It does seem to be changing its characteristics. This may be circumstantial, but Bitcoin has slowed down substantially. Further, I do consider that Bitcoin can be range count for a couple more years, perhaps putting in a B wave later this year, that can show a C wave down below the December low, down the road. I suppose whether it is range bound or not depends on how much retailers engage back in trading it. If liquidity is thinned out by institutions accumulating Bitcoin into wallets, than it won’t take much new interest to ignite Bitcoin price action.

The difference to me is seeing five up to the $13K-16K region in Bitcoin. If we do see that level, I assume it will prep for breakout, provided it holds support for wave 2 down. Until then, Ill prep for a range bound trade. If we do see a bullish 1-2, a move to $65K can happen fairly quickly. We’ve seen Bitcoin move $1800/day near the previous top, so it will not take much time when FOMO sets in.

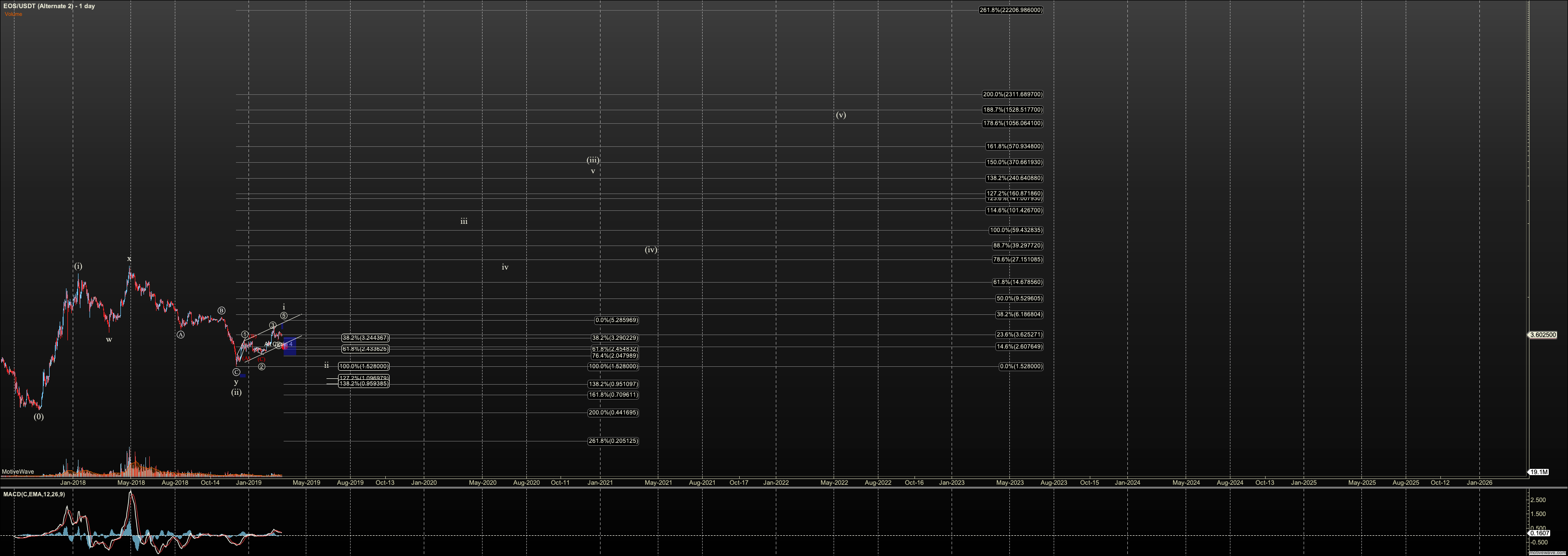

While I can make an easy case for a range bound Bitcoin, we have many coins have are well setup for third waves. Most of these are newer coins, which put five waves up into 2017-2018 high. One example is EOS. EOS actually continued to breakout after the bear started, putting in a high X wave before finally succumbing to a wicked Y wave. That high X wave suggests the long term trend was hard to fight off. Right now, as EOS sits at a lowly $3 and change, the third wave projects into the three digits, and $1059 for the fifth. If you need a fundy reason, EOS is probably the most easy to interact with, has one of the fastest transaction rates and is the driver of a new crop of blockchain gaming platforms, and enterprise applications.

The alternate view is that this rally is a wave 4 as the alt in Bitcoin, and we go deep into the $1’s before another attempt.

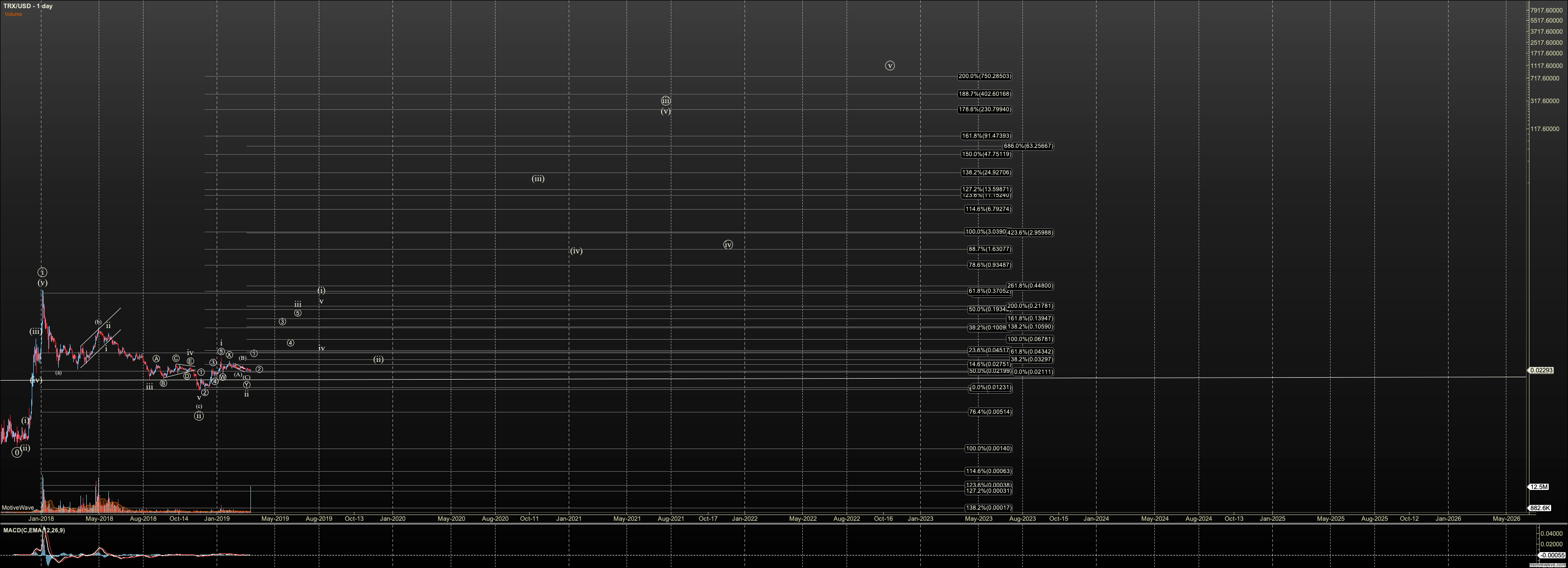

Another example is Tron (TRX)- TRX has been increasing in use, putting in strong transaction counts. Just the swing trade we are following right now projects for a 10X return from 2 cents to 22 cents. As you can see, from the chart, if we see 5up here, it is likely that the bear market for TRX was a quite shallow wave 2. And, a rally to 22 cents would be wave 1 of wave three, which with all of wave three targetting $91 sometime down the road.

Yes, we see a lot of insane targets on the long term in cryptos. But also, long term supports can be quite a long way a part. The difference between a .382 retrace, and a .618 retrace on a daily chart can be very far apart. So, a subscriber can ask me if a long chart is broken, and I may say no, but the support may be 50-80% lower. This is the challenge. For this reason, I prefer to break the crypto market into smaller swing trades, and dedicate much less to long term holds. For the last 15 months, we only had one good solid long swing, in April 2018. And, since the post swing price action did not hold bullish support, the market went into freefall.

Here we are again with some solid long swing trades, with many charts still over long term supports. Wil we see the bear market end with the bulls having more solid footing for a rally. Will we see the market bifurcate, with BTC being range bound between $19K and $3K,while other coins are running in thirds. I don’t know for sure, but I know what clues I’m looking for in price action.

If you are interested in trading cryptos, but have no idea how to get started, I have a video I did early on in the service. You can find it here. It offers all you need to know about exchanges and security. If any questions let me know.

If you'd like a PDF Version of the entire presentation, it is here.