COPA Holdings (CPA): An Airline With A Moat

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

When we talk about a company or a certain technology that has a moat, most will understand this to mean that they possess some sort of an advantage over the competition. This could be patent protection, an advance in the field not held by others or something similar. But in the airlines sector it is rare to encounter a stock where we would affirm that they do indeed have some type of a moat whereas their competitors do not.

We look to Lyn Alden as one of our lead analysts in StockWaves for her keen insights and conclusions regarding the macro economy as well as company specific information. When we queried her about (CPA) the response was though-provoking. Let’s review her comments and observations about this potentially unique situation in COPA Holdings. Then we’ll see what the structure of price is telling us via the charts with Zac and Garrett.

Fundamentally Speaking

Note below Lyn’s commentary regarding COPA:

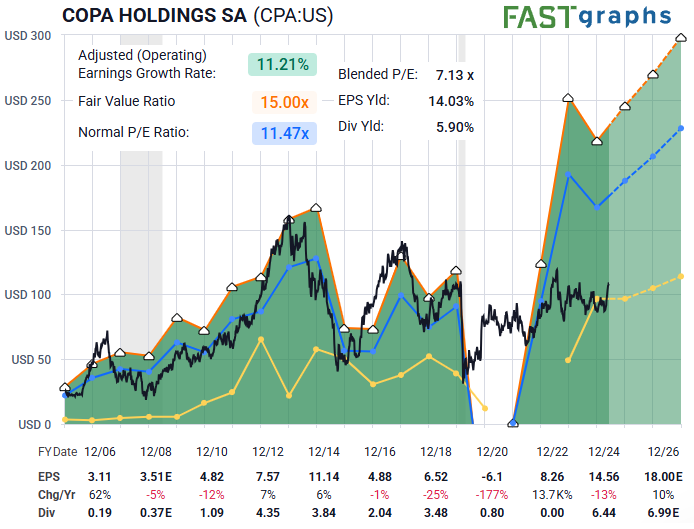

“In terms of fundamentals, CPA is perhaps the only airline I'd consider buying. It looks bullish for the long run, with good numbers and a cheap valuation.

To the extent that I invest in aviation, I prefer airports which can have more of an economic moat. Airlines are usually bad business models. CPA, however, has historically been the exception due to solid execution and a strategic geographic location. In some ways, that gives it certain elements that airports have; a degree of dominance over an important area.” - Lyn Alden

So we have a thesis on which we can build a possible trading/investment strategy. But we next need to determine potential risk versus reward. One could arbitrarily appoint some figures to their plan, however we have long used a methodology that assists us in this matter. Please let us share that with you and we’ll show you exactly how we do this day in and day out for our members.

Sentiment Speaks

For over thirteen years Avi Gilburt has provided his analysis to the public. This is through multiple open articles on varied websites as well as timely posts to our members at Elliott Wave Trader. Many of these missives have “Sentiment Speaks” as an introductory title and then the specific theme discussed that follows. How is it that sentiment “speaks”? You ask a good question and it merits some investigation.

(If you would like to see the entire catalog of these “Sentiment Speaks” articles, they are available to you here)

One of those articles published late last years was entitled, “Why You Misunderstand And Underperform The Market”. The subtitles to that piece were: Narratives, Hope/Inability To Objectively Know When You Are Wrong, Not knowing what time frame is beneficial for you. Here is a brief excerpt from the body of that article:

“An investor will buy into a position (usually based upon some narrative), and continue to ride that position lower and lower while they ‘hope’ they are right and that the price will turn. And, by the time the fundamentals or narrative have shifted to the point the investor finally realizes they were wrong, they often find themselves down 10% or a lot more.

This then causes a change in the investor’s perspective from one of almost certainty regarding this investment to one where he now resigns himself to the foolish belief that it is not a loss until he sells. The main problem is that these investors often have no objective manner in which to determine when they are wrong early enough for them to minimize their losses, which then only leaves them with hope.

For this reason, I have advised the thousands of investors and traders we have taught through the years that you must have an objective plan in place before you enter the trade or investment. You must know where your ideal entry is, where you intend to take profits, and where you exit with a small loss because you are wrong in your assessment. And, we develop these price levels through the use of Fibonacci mathematics. This should be part of every single investor’s risk management plan.” - Avi Gilburt

Yes, sentiment will communicate all this and more to the individual trained to notice it. Here’s how we do it.

A Study Of Sentiment As Expressed Via Price

And more specifically, the structure of price on the chart. Let’s take a look at the findings provided by Zac and Garrett for (CPA) stock.

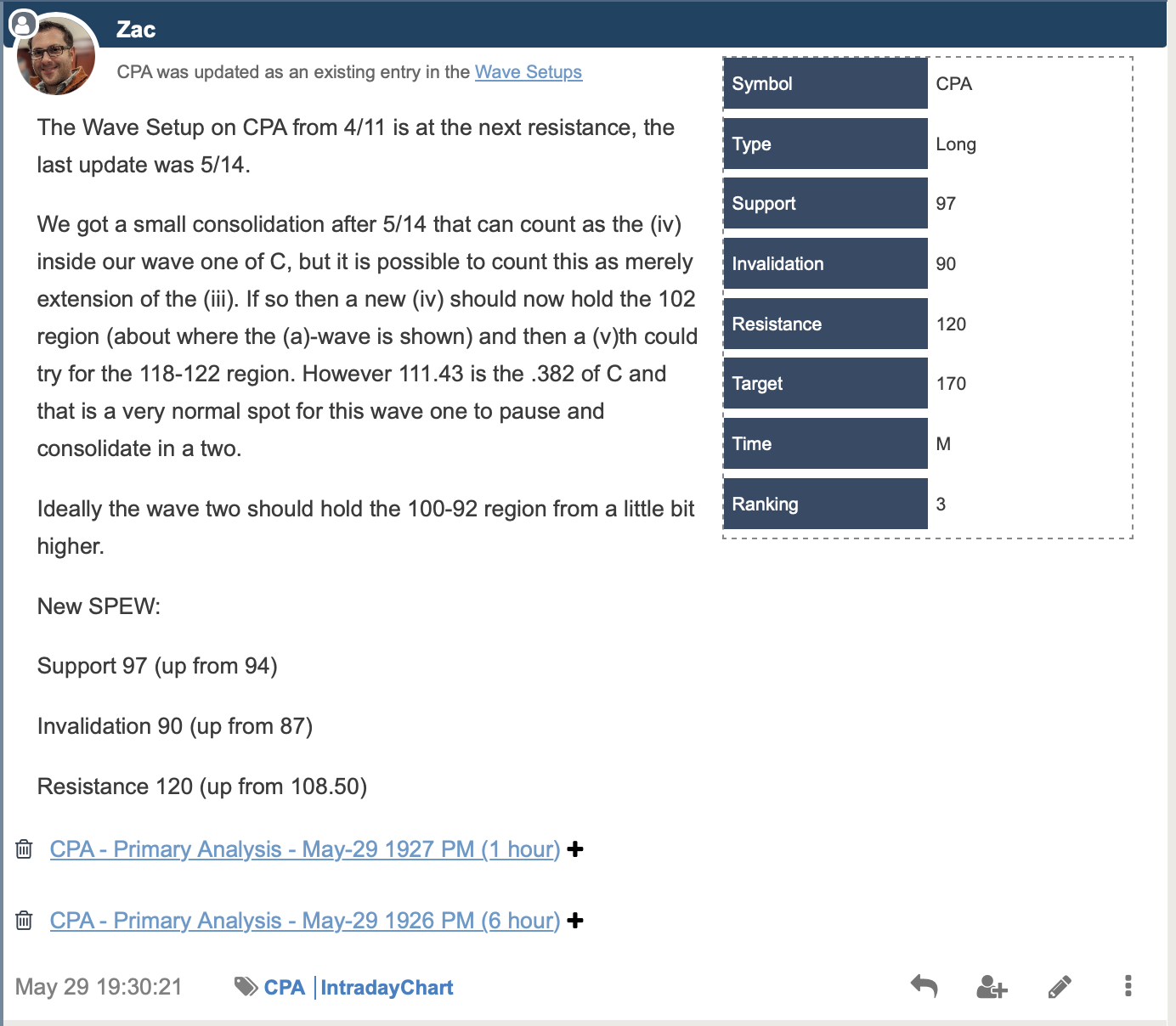

Both of our analysts are showing a bullish setup in the bigger picture for (CPA). Why is this? Note that the structure of price on the chart suggests that an important low is in place as of April of this year. What’s more, we now can identify some key price levels as shared in the table shown here:

As you can see in the table above, this is an ongoing Wave Setup that was first shared with members on April 11 of this year. Specific price levels have just been updated as of the May 29 post and the outlook remains bullish going forward with the parameters shared still being valid.

As you can see in the table above, this is an ongoing Wave Setup that was first shared with members on April 11 of this year. Specific price levels have just been updated as of the May 29 post and the outlook remains bullish going forward with the parameters shared still being valid.

Conclusion

Approach this with an open mind. Open in the sense of being willing to accept that there are ways of viewing the markets that you have not yet considered. We certainly are not suggesting blind credulity. Take your time, review what we have shared with our readership over the past several years. It is probable that you will come to realize the true nature of the markets. Your eyes will be opened to an entirely new viewpoint. Once you see it, you may just question how it has been there all this time, and you are just now coming into the light.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.