CEIX: A Lump Of Coal Or Two Might Be A Good Thing

- Despite coal being written off as dead, global coal consumption remains near all-time highs, making hydrocarbon producers a bullish investment.

- Peabody Energy Corp and the Energy Sector overall are recommended picks for investment.

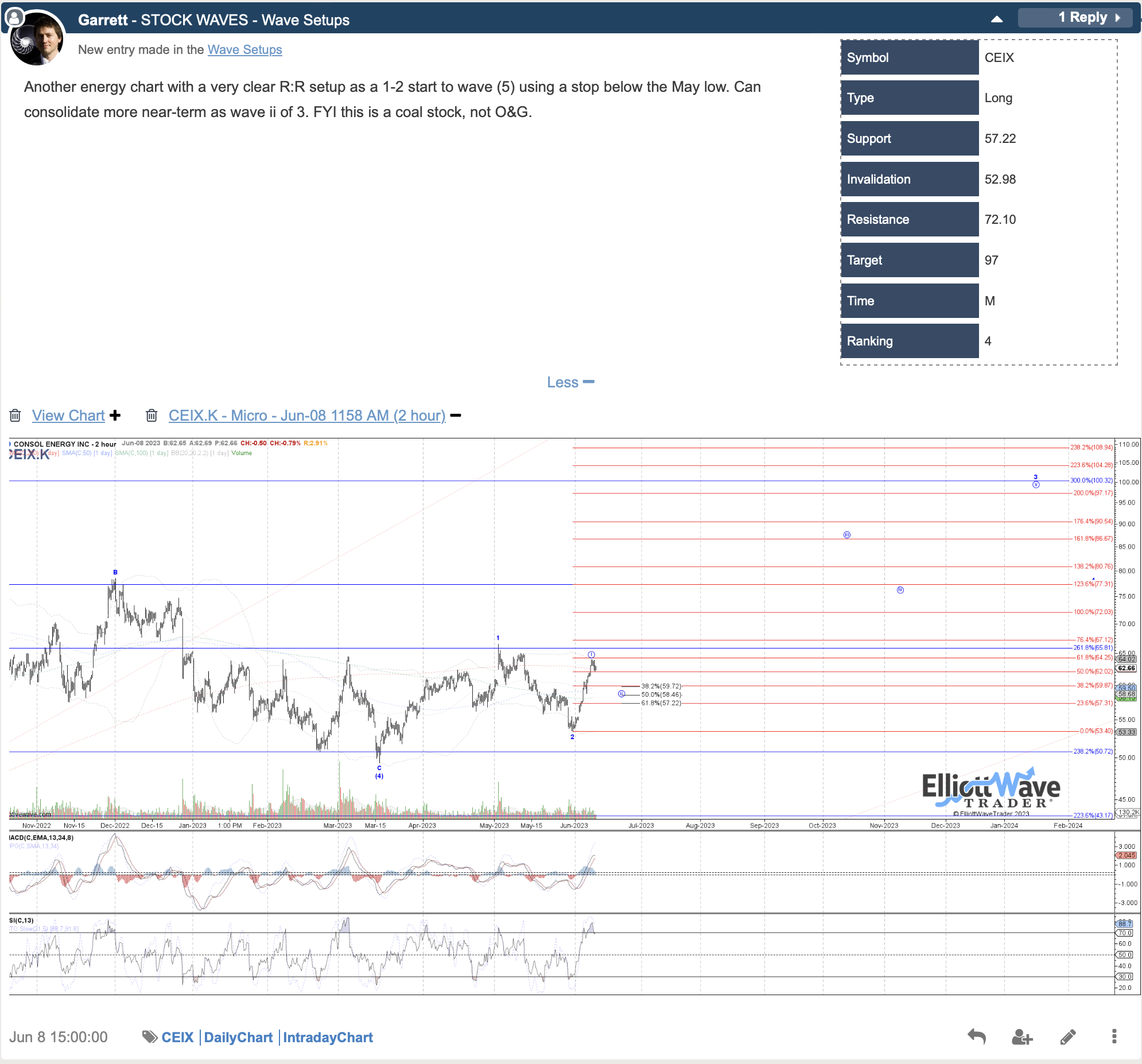

- CEIX was featured as an official Wave Setup in June and is expected to see another surge higher in a fifth wave.

By Levi At Elliott Wave Trader; Produced With Avi Gilburt

Myth has it that if someone received a lump of coal it was some sort of punishment, or worse. Well, in this case, might a lump of coal or two actually be a good thing? Take a look at a Wave Setup with us as we trace its origin from earlier this year to where we now find ourselves. There’s still anticipated upside in (CEIX) as well as clearly defined risk vs reward. Here we go!

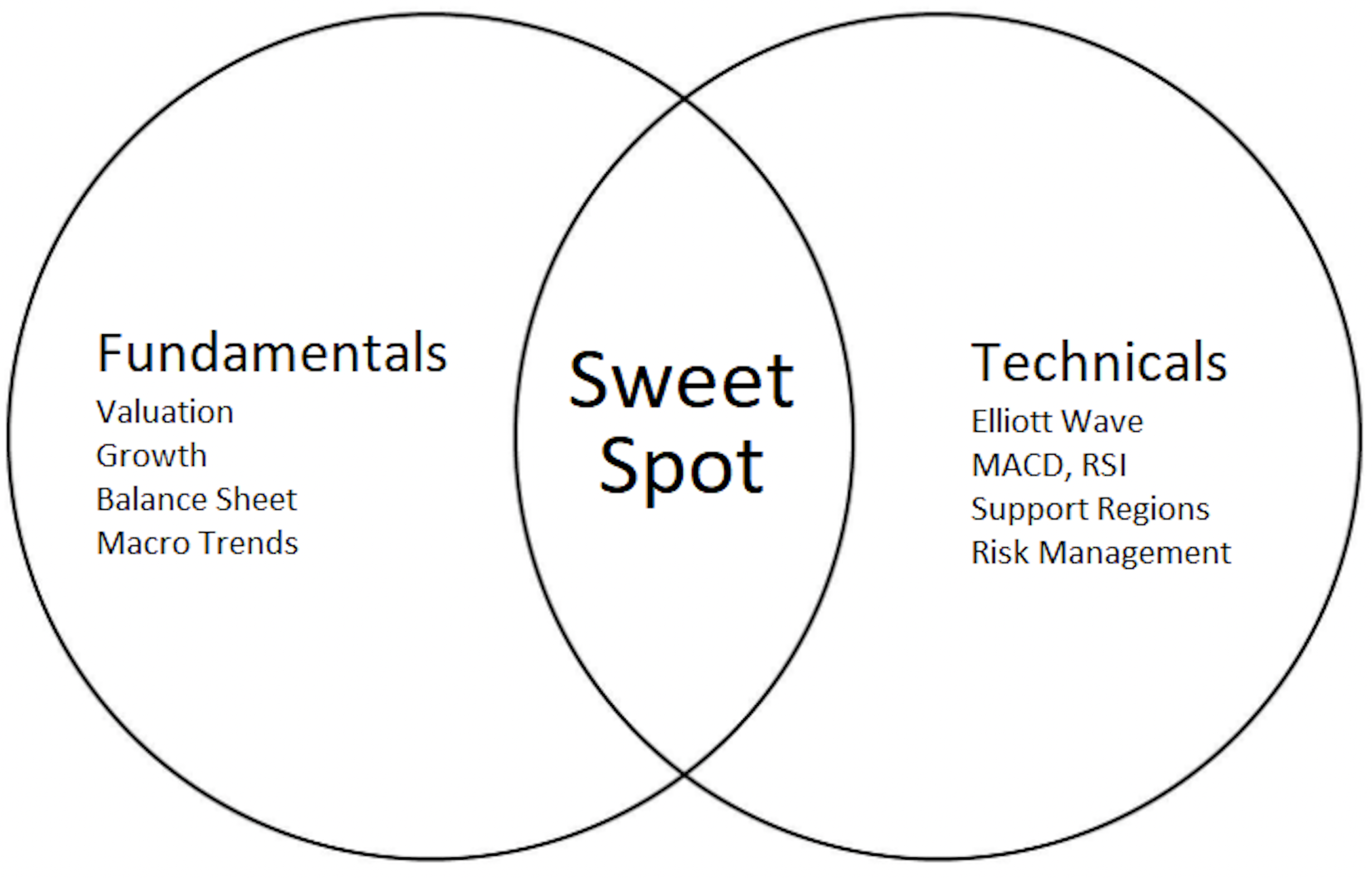

Particularly in individual stocks, we want to have an overview of the fundamental landscape. This is exactly what we do in looking for the synergy between fundamentals and technicals.

As one of our lead analysts, Lyn Alden provides key information and data points for us in sectors across the marketplace. Let’s get her take on the coal industry as a whole.

The Fundamental Terrain

Lyn Alden:

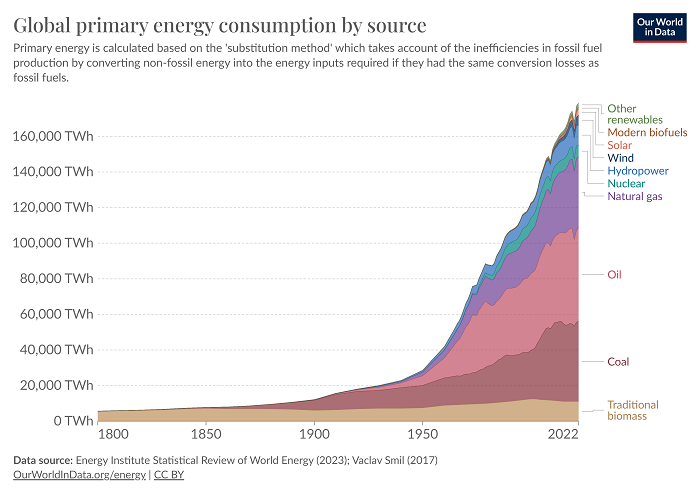

The world still has a rather tight supply side in terms of energy, due to low capex in recent years. Despite coal being written off as dead, and many equities trading at low valuations, global coal consumption continues to be near all-time highs. As shown by the European natural gas crisis last year, coal serves as a backup option for other energy shortages.

For these reasons, I continue to be bullish on hydrocarbon producers across the board with a multi-year view, along economic cycles can affect the timing of that view and individual stocks can deviate to the upside or downside of that baseline expectation.

What Are Some Of Our Current Picks?

First, please allow me to share a few charts that are in the same neighborhood as (CEIX), albeit not the same block.

While (BTU) Peabody Energy Corp is not a current Wave Setup for us, it still has a compelling chart and is closely related to (CEIX).

As well, we continue to be bullish on the Energy Sector overall. Note the charts for (XLE) and (XOP).

In all of the charts we survey and track for our members, we choose some specific setups to be Wave Setups. At the moment we have approximately 50 setups both short and long. Since (CEIX) has fulfilled its upside target for the third wave rally, we no longer have it as a specific Wave Setup. However, if you will, please take a short trip with us from past to present and then we’ll have a brief glance into what may be the future for (CEIX).

The Wave Setups Journey For CEIX

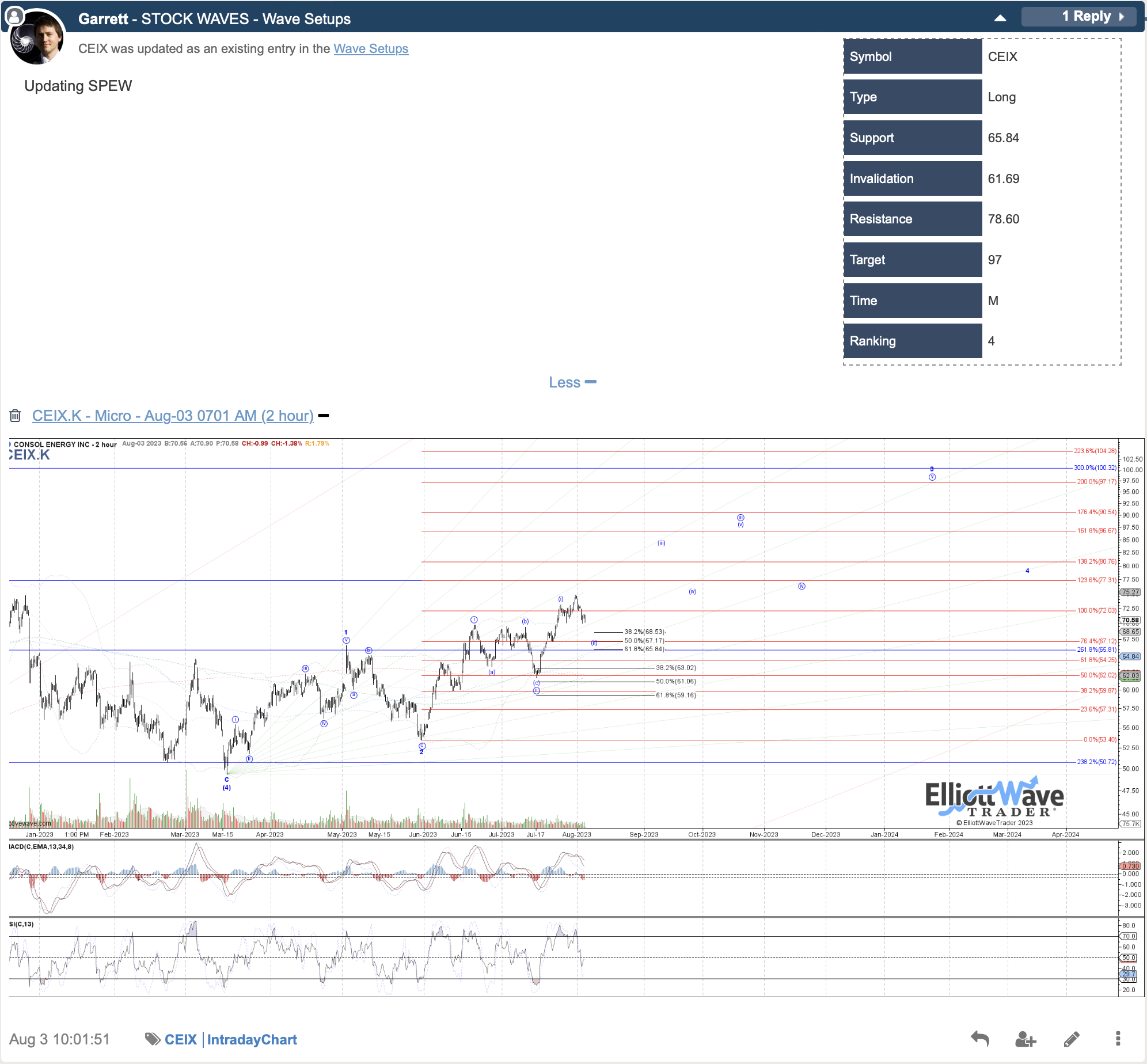

It was back on June 8th that CEIX was first featured to our members as an official Wave Setup. The charts tell their story as you can see the subwave structure fill out over the weeks.

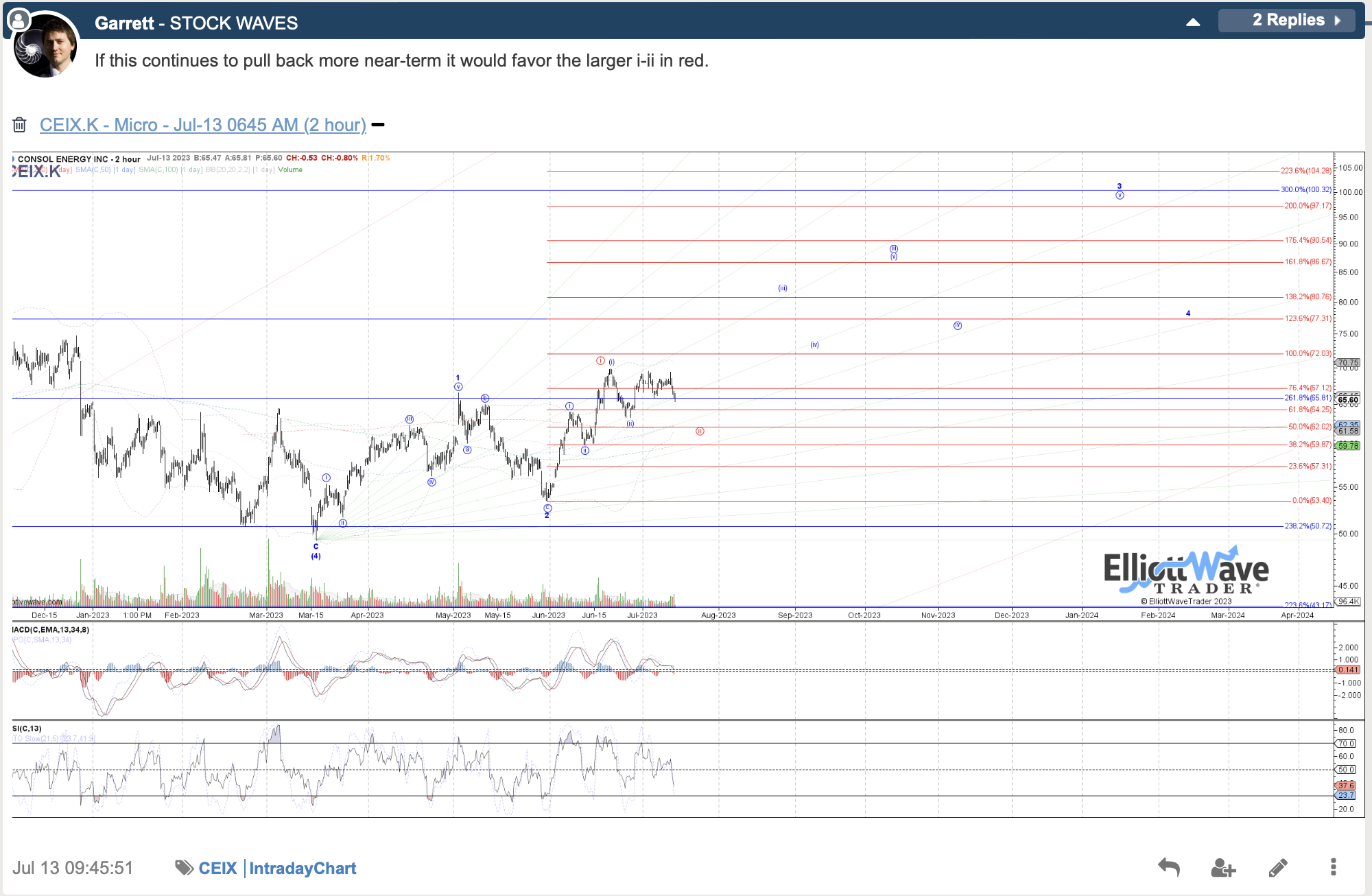

Especially for our on-going Wave Setups but also for literally hundreds of other stocks, we update the charts continually during earnings season. The release of quarterly results and then the forward looking statements can be a catalyst for larger than standard movements. However, since forewarned is forearmed, we prepare members for what is most likely, many times with stunning accuracy.

Especially for our on-going Wave Setups but also for literally hundreds of other stocks, we update the charts continually during earnings season. The release of quarterly results and then the forward looking statements can be a catalyst for larger than standard movements. However, since forewarned is forearmed, we prepare members for what is most likely, many times with stunning accuracy.

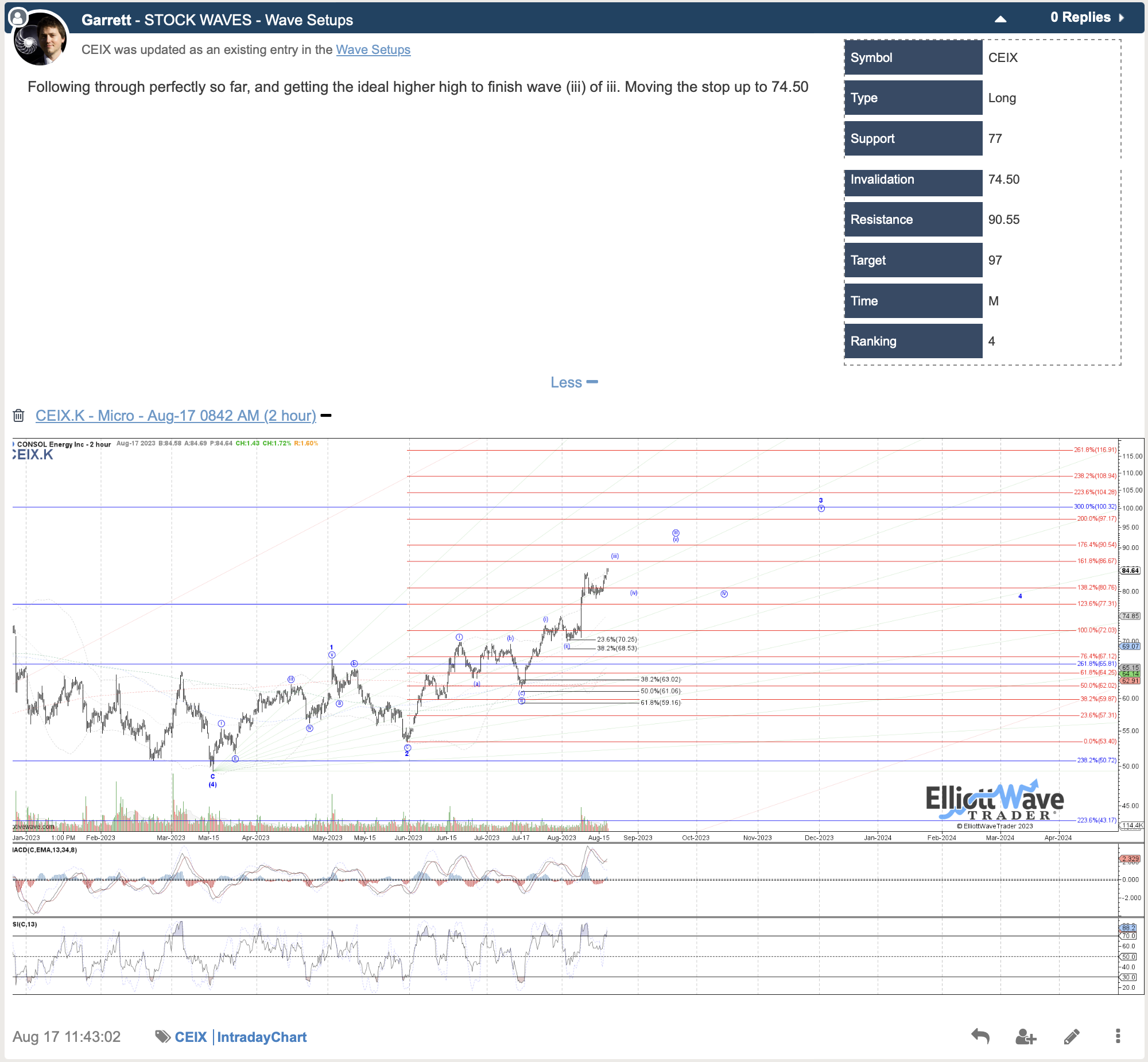

Here is the update that Zac Mannes put out just before (CEIX) reported their latest quarterly results:

Well, fantastic, you may say - thanks for reporting what happened. But, how about helping with some guidance going forward? I’m glad you requested that. Let’s take a look.

As you can see in the latest update, CEIX should see yet another surge higher in a fifth wave of a larger fifth. Once reaching that next target overhead, that should kick off a more prolonged consolidation and corrective phase for the stock.

The risk in the near term would be a move below $80-$82 area. If this happens first then it would indicate something else is playing out instead of our primary path illustrated herein.

What Is Generating These Setups?

How can we possibly project this many different setups across the market? What is the methodology that produces these targets and identifies the risk vs reward? Simply put, what is at work here has always been. However, it needed to be identified and then quantified. If you can do this, then you can open your eyes to an entirely new way of looking at the markets.

Avi Gilburt has written extensively about this way of viewing the markets. You can read this six-part series available to the readership - just start here with part one.

Continuing Education

We have an extensive Education library available at Elliott Wave Trader. As well, we want to teach others this methodology. Three times a week we have beginner and intermediate level videos where we show the exact way we count the waves and give in-depth analysis techniques. This methodology, if you give it the chance, will change the way you invest forever. More on that can be found here.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.